EquiTrust Life Insurance Company Review 2025

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Our EquiTrust Life Insurance Company Score

2 Stars

We award EquiTrust Life Insurance a final rating of two out of five stars. The carrier has a couple of decades of experience in the industry and a high rating from the Better Business Bureau (BBB). However, the insurance company’s rating through AM Best is lower than many other modern carriers’. EquiTrust is also not currently BBB-accredited and has had several customer complaints filed against it through the organization in recent years.

The insurance company’s official website does not provide many modern customer service options, such as online claims reporting or getting matched with an agent. The website also does not provide much information about claims processing.

EquiTrust Life Insurance Company was founded in 1996, originally as a subsidiary of the FBL Financial Group. It began operating in the independent insurance channel in 2003. EquiTrust Life Insurance Company was purchased by Guggenheim Partners in 2011. EquiTrust began working with independent insurance agents and expanded its reach from just 15 states to a nationwide presence in 2003.

Bottom Line: What we’re most concerned with is whether or not an insurance company takes care of its customers and delivers on the coverage promises it makes. Unfortunately, many negative customer reviews can be found across the web. So, if you’re looking for life insurance or annuities from an insurance company that makes its customers a priority, we strongly encourage you to work together with your independent insurance agent to survey all other options before settling on EquiTrust Life Insurance Company as your trusted carrier.

EquiTrust Pros and Cons:

| Pros: | Cons: | ||||

|---|---|---|---|---|---|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

To find insurance in your state, use our national insurance company directory to find the best company to meet your needs. You can locate insurance companies that specialize in your specific coverage needs and get connected to an agent near you.

EquiTrust Insurance Products by Type

EquiTrust is a specialized insurance company with a focus on life insurance. Its coverage offerings include:

Life Insurance:

- Single-premium indexed life insurance

Other:

- Fixed annuities

- Accumulation fixed annuities

- Payout (income) fixed annuities

EquiTrust Life Insurance

EquiTrust specializes in single-premium, indexed life insurance. This type of coverage allows the policyholder to pay a lump-sum premium only once for the entire length of the policy.

The policy also comes with an Accumulation Value over time, which grows according to the market index's performance. However, this value isn't exposed to market risk, as the funds aren't directly tied to an index.

EquiTrust Life Insurance Average Prices

EquiTrust does not make information about its average life insurance premiums readily available. However, an independent insurance agent can help find exact EquiTrust life insurance quotes for you. You can also get a better idea of how much coverage might cost you by using our life insurance calculator.

What Discounts Does EquiTrust Offer?

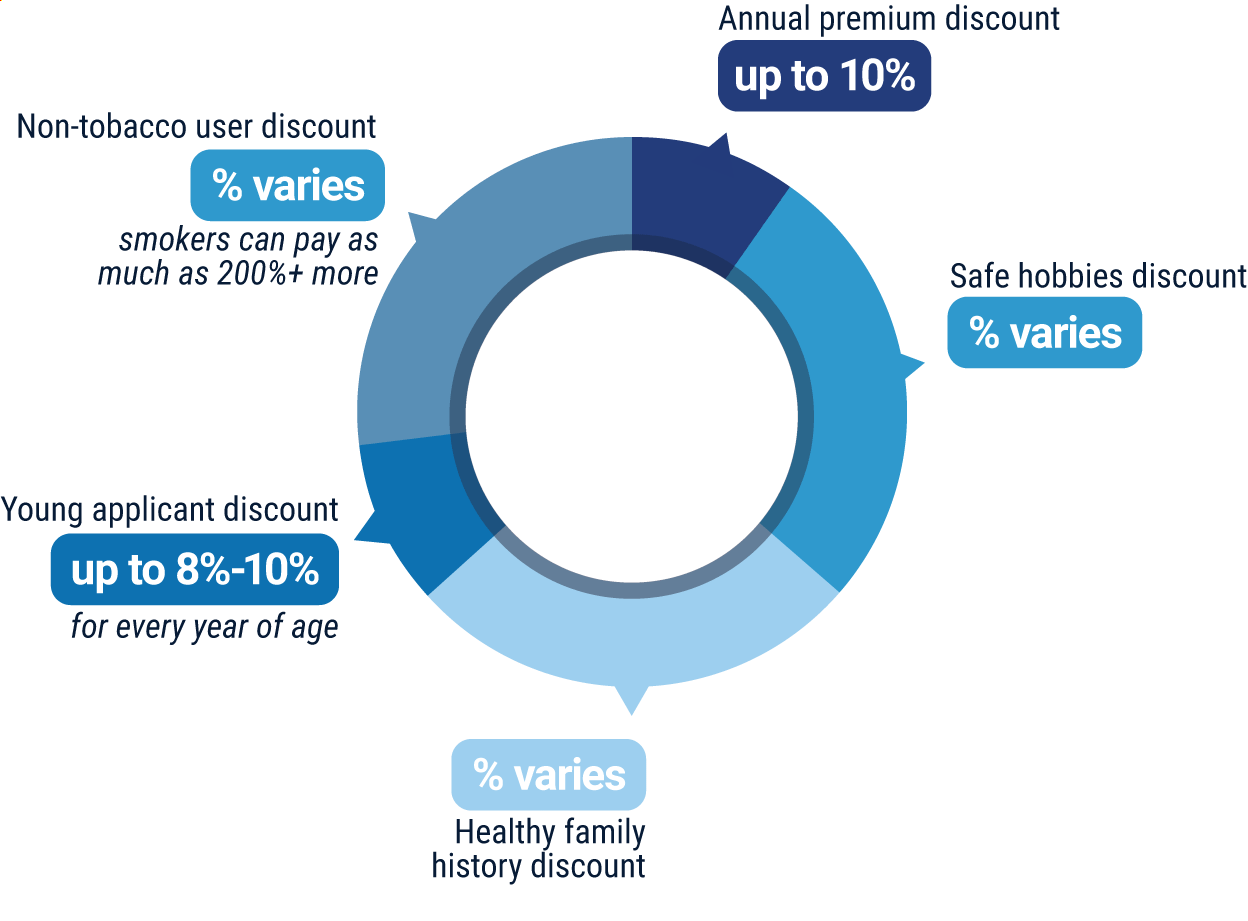

While EquiTrust does not make information about its specific discounts readily available, most life insurance companies today offer several common discounts on comparable coverages. These discounts often include:

- Annual Premium Discount: Insurance companies often award discounts to customers who pay their premiums annually instead of monthly.

- Safe Hobbies Discount: Life insurance companies often award customers who practice safe, non-life threatening habits (e.g., no skydiving) with cheaper premiums.

- Healthy Family History Discount: Life insurance companies also reward applicants with healthy genetics, or a good family health history.

- Young Applicant Discount: When signing up for life insurance, considerable discounts are often awarded to applicants who purchase coverage when they are younger, such as in their 20s or 30s.

- Non-Tobacco User Discount: Life insurance companies tend to reward customers who do not use tobacco products with cheaper premiums.

Your independent insurance agent can help you find more information on exact discounts offered by EquiTrust and additional ways to save money through the insurance company, helping you to get the best value for your coverage.

EquiTrust Life Insurance Company Customer Service

EquiTrust offers just one phone line for all customer inquiries. The carrier provides the following customer service options:

- Phone

- Snail mail

- The main customer service and claims reporting hotline has the following hour restrictions:

| Days | Hours (CST) | ||

| Monday-Thursday | 8 a.m.-5 p.m. | ||

| Friday | 8 a.m.-2 p.m. |

EquiTrust sells its insurance products through a wide network of agents, including independent insurance agents. Independent insurance agents can help make customer service easier for you by handling claims and other concerns.

EquiTrust Life Insurance Company FAQs

EquiTrust allows customers to file claims via phone. However, the carrier does not provide a specific claims response time frame promise. Customers have reported frustration with having claims answered and processed within a reasonable time frame.

EquiTrust has just one phone line for customer service and all other inquiries. The phone contact option is available during restricted hours, Monday-Friday. The insurance company also has a social media presence on Facebook, LinkedIn, Instagram, and X, which makes it more accessible to customers.

EquiTrust provides phone claims reporting for its customers. The insurance company does not list its official claims process on the website beyond how to file. Customers can call the carrier or contact their independent insurance agent if they have questions about how to file. Forms are available on the website to make claim filing easier.

Compared to many modern insurance companies, EquiTrust’s official website leaves much to be desired. Many pages could stand to be fleshed out quite a bit more, and a disturbing amount of pertinent information seems to be lacking entirely. For example, there is no outline of an official claims process or claims response time frame.

The insurance company also does not offer online claims reporting through the official website, which puts it far behind many other modern carriers. The official website is also lacking common customer service options, such as getting matched with an agent or requesting quotes.

EquiTrust specializes in life insurance and annuities. The carrier's annuities come with the following perks:

- Tax-deferred growth

- Guarantees

- Access to all or a portion of funds

- Flexibility in the event of certain needs or circumstances

Your independent insurance agent can help you find out more about EquiTrust’s annuities and life insurance policies.

EquiTrust has a good rating through AM Best, but it’s not as highly rated as many other modern insurance companies. Its “A+” rating through the BBB is impressive, though. However, the insurance company is not accredited by the BBB.

Also, there are many dismal customer reviews across multiple sites detailing frustrating encounters with the insurance company and disappointment in its coverage. Because of this, we're hesitant to call EquiTrust Life a good insurance company.

EquiTrust Life's products may be right for customers seeking life insurance policies or annuities.

https://www.equitrust.com/

https://news.ambest.com/PR/PressContent.aspx?refnum=34872&altsrc=9

https://www.bbb.org/us/ia/west-des-moines/profile/insurance-companies/equitrust-life-insurance-company-0664-32049387