Brighthouse Financial Insurance Company Review

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Our Brighthouse Financial Insurance Score

2.5 Stars

We award Brighthouse Financial Insurance Group a final rating of 2.5 out of 5 stars. While the carrier has high ratings through AM Best and the Better Business Bureau (BBB), it is not accredited through the latter organization, and has had a concerning volume of complaints filed against it in recent years.

The carrier also does not provide 24/7 claims reporting or even online claims filing, which is something insurance customers have come to expect from most carriers in the industry today. Claims processing times seem to be rather slow, as well.

Brighthouse Financial was founded in 2016, making it one of the younger insurance carriers on the market today. Though the carrier is a specialty company with a focus on life insurance and annuities, its coverage is available in all 50 states, helping it to reach more prospective customers throughout the U.S.

Brighthouse Financial celebrated making the Fortune 500 list in 2020, at number 457. It's also one of the largest life insurance and annuity providers in the U.S. today.

Bottom Line: While Brighthouse Financial has reputable financial strength, what we’re most concerned about is whether a carrier prioritizes its customers. Reliable coverage is critical, and if a customer can’t count on their insurance company to meet their needs or deliver on its coverage promises, no amount of financial strength can make up for that. Many customers report frustration in not only having claims approved, but even being able to get hold of the carrier at all. So, if you’re in the market for affordable life insurance or annuities, we recommend working together with your independent insurance agent to survey other options before settling on Brighthouse Financial to be your next trusted carrier.

Brighthouse Finanscial Pros and Cons:

| Pros: | Cons: | ||||

|---|---|---|---|---|---|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

To find insurance in your state, use our national insurance company directory to find the best company to meet your needs. You can locate insurance companies that specialize in your specific coverage needs and get connected to an agent near you.

Brighthouse Financial Insurance Products by Type

Brighthouse Financial is a specialty insurance company with a focus on life insurance. Its products include:

Life Insurance & Annuities:

Brighthouse Financial Life Insurance

Brighthouse Financial offers three types of life insurance for customers to choose from.

Coverage types, features, and benefits:

Brighthouse SmartGuard Plus

This is an index-linked universal life insurance policy with a Guaranteed Distribution Rider included for an additional charge.

Brighthouse SmartCare

This is a hybrid life insurance and long-term care (LTC) insurance policy that comes with a death benefit and LTC coverage.

Brighthouse One-Year Term

This is a term life insurance policy that offers coverage for one year.

Brighthouse Financial Life Insurance Average Prices

Brighthouse Financial does not make its average life insurance rates readily available online without requesting a quote. However, an independent insurance agent can help you find specific quotes for the exact amount of Brighthouse Financial life insurance you need and also compare quotes from multiple carriers for you. You can get a better idea of how much a life insurance policy might cost you by using our life insurance calculator.

What Discounts Does Brighthouse Financial Offer?

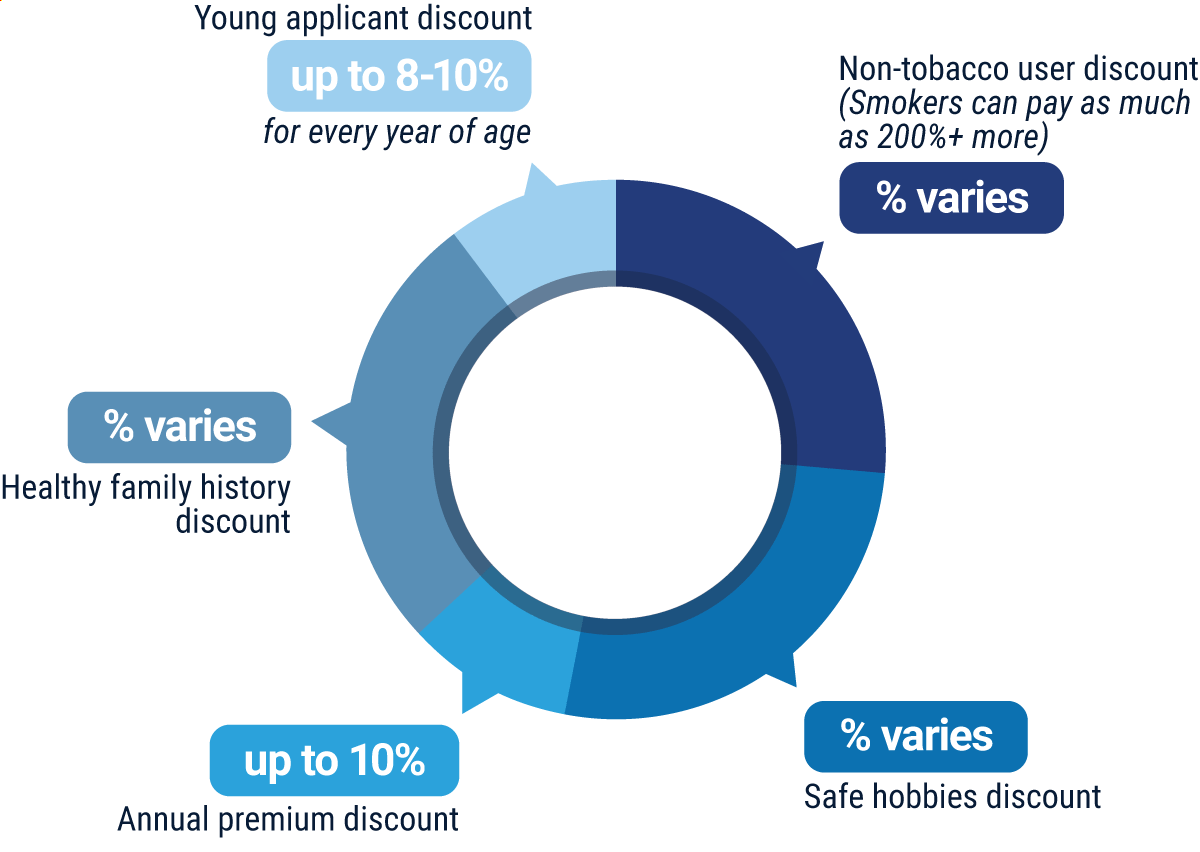

While Brighthouse Financial does not make information about its specific discounts readily available, many modern carriers offer common discounts on life insurance. These discounts may include:

- Non-tobacco user discount: Life insurance companies tend to reward customers who do not use tobacco products with cheaper premiums.

- Safe hobbies discount: Life insurance companies often award customers who practice safe, non-life-threatening hobbies (e.g., no skydiving) with cheaper premiums.

- Annual premium discount: Life insurance companies often award discounts to customers who pay their premiums annually instead of monthly.

- Healthy family history discount: Life insurance companies also reward applicants with healthy genetics or a good family health history.

- Young applicant discount: Life insurance companies often award significant discounts to applicants who purchase coverage for the first time when they are younger, such as in their 20s or 30s.

Your independent insurance agent can help you find more information on exact discounts offered by Brighthouse Financial, helping you get the most bang for your buck on coverage.

Brighthouse Financial Customer Service

Brighthouse Financial conducts most of its customer service over the phone. The carrier provides the following customer service options:

- Phone

- Fax

- Snail mail

- Online contact form

The customer service phone department has the following hour restrictions:

| Day(s) | Hours (EST) | ||

| Monday-Friday | 8:30 am-6:30 pm | ||

| Saturday | CLOSED | ||

| Sunday | CLOSED |

For further customer assistance, reach out to an independent insurance agent. These agents can help make customer service much easier for you by handling claims and other concerns.

Brighthouse Financial Insurance FAQs

Brighthouse Financial states that once a claim has been reported, the carrier will send the customer a claims packet within 15 days. Once a completed claim has been submitted, the carrier states that the customer will receive their official response (approval or denial) within 30 days.

Brighthouse Financial does not provide 24/7 claims-filing or customer service options. Its customer service hotlines are available during extended hours on weekdays. The carrier also has a social media presence on Facebook, X, YouTube, and LinkedIn, which makes it more accessible to customers.

Brighthouse Financial encourages customers to file claims via phone. The carrier’s official website does not detail a step-by-step claims process beyond how to file.

Brighthouse Financial’s official website is fairly easy to navigate, but some users may find it frustrating. Information is overall easy enough to find, but there are also some areas that are sorely lacking. For example, the carrier does not provide a few options that many other modern insurance companies do, such as allowing customers to get matched with an agent.

Online claims filing is also not available, which automatically makes the carrier feel dated in terms of what insurance customers have come to expect from their providers today. Overall, Brighthouse Financial has some catching up to do to other carriers in terms of user-friendliness.

Brighthouse Financial offers a few options for customers seeking life insurance, including hybrid life insurance and long-term care policies, term life insurance, and universal life insurance. However, the carrier's term life policies are limited to one-year terms, which may not provide nearly enough coverage for many individuals.

Brighthouse Financial has excellent official ratings from AM Best and the BBB. However, the carrier is not BBB-accredited and has had nearly 175 customer complaints filed against it through the BBB in the past three years. With such a high volume of negative customer feedback, we're hesitant to call Brighthouse Financial a good insurance company.

Brighthouse Financial's insurance products may be right for individuals seeking life insurance, long-term care insurance, or annuities. Coverage is available in all 50 states.

https://www.brighthousefinancial.com/

https://www.bbb.org/us/nc/charlotte/profile/financial-planning-consultants/brighthouse-financial-0473-575478

https://news.ambest.com/newscontent.aspx?refnum=263412&altsrc=23