21st Century Insurance Company Review 2025

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Trusted Choice's 21st Century Insurance Score

2 Stars

We award 21st Century Insurance a final rating of 2 out of 5 stars. 21st Century has an excellent rating by the Better Business Bureau (BBB). However, many customer complaints have been filed through the BBB in recent years. Further, AM Best withdrew the carrier's financial strength rating in 2019.

21st Century was founded in 1958 and belongs to the Farmers Insurance family. 21st Century primarily conducts business virtually, through its website or email, or over the phone. This makes the company ideal for customers who aren’t interested in in-person meetings with their insurance agents.

While offering 24/7 roadside assistance is a nice perk, a concerning number of customer complaints clearly demonstrates that 21st Century still has plenty of room to grow in certain areas. Additionally, 21st Century offers fewer discounts than other comparable auto insurance companies and now only caters to customers in California.

Customers have also reported expensive premiums, and our research found that 21st Century's auto insurance rates are mostly higher than average. Overall, we recommend looking into other auto insurance carriers with the help of your independent insurance agent.

21st Century Insurance Pros and Cons:

| Pros: | Cons: | ||||

|---|---|---|---|---|---|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

To find insurance in your state, use our national insurance company directory to find the best company to meet your needs. You can locate insurance companies that specialize in your specific coverage needs and get connected to an agent near you.

21st Century Insurance Products by Type

A specialty insurance company, 21st Century only offers car insurance at the present time. Additionally, the carrier now only sells policies to residents of the state of California.

21st Century Insurance Car Insurance

You can buy full coverage and liability-only car insurance policies from 21st Century Insurance. While the carrier also advertises antique auto insurance, motorcycle insurance, ATV insurance, personal watercraft insurance, and boat insurance, customers are redirected to Foremost and Farmers Insurance to view coverage details and purchase those policies.

Coverage types, features, and benefits:

Roadside assistance

21st Century Insurance's auto insurance policies include complimentary roadside assistance coverage, depending on customer eligibility.

21st Century Insurance Car Insurance Average Prices

21st Century Insurance's average full coverage auto insurance rates are more expensive than average. A full coverage car insurance policy from 21st Century costs an average of $3,020, and a minimum coverage policy averages $558. California's current average cost of full coverage car insurance is $2,835 annually, while minimum coverage policies average $670.

Here are some average car insurance rates from 21st Century by driver age in comparison to the current national average premium:

21st Century Insurance Annual Full Coverage Car Insurance Rates

| Driver Age | 21st Century Average Premium | National Average Premium |

|---|---|---|

| 16 | $12,314 | $5,229 |

| 18 | $10,382 | $4,501 |

| 20 | $6,671 | $4,972 |

| 25 | $4,177 | $3,031 |

| 30 | $3,408 | $2,622 |

21st Century Insurance's average car insurance premiums were considerably higher than the current national average rates across every driver age category we studied. Many 21st Century Insurance customers have detailed frustration with expensive premiums and unexpected increases over time.

Methodology

Average rates for car insurance were based on a sample driver who is 40 years old and has a clean driving record. The sample customer was quoted for an auto insurance policy with bodily injury liability coverage of $300,000 per accident and $100,000 per person, property damage liability coverage of $50,000 per accident, personal injury protection coverage of $100,000 per accident, and uninsured motorist bodily injury coverage of $300,000 per accident and $100,000 per person. The driver's collision and comprehensive coverages each had a $500 deductible.

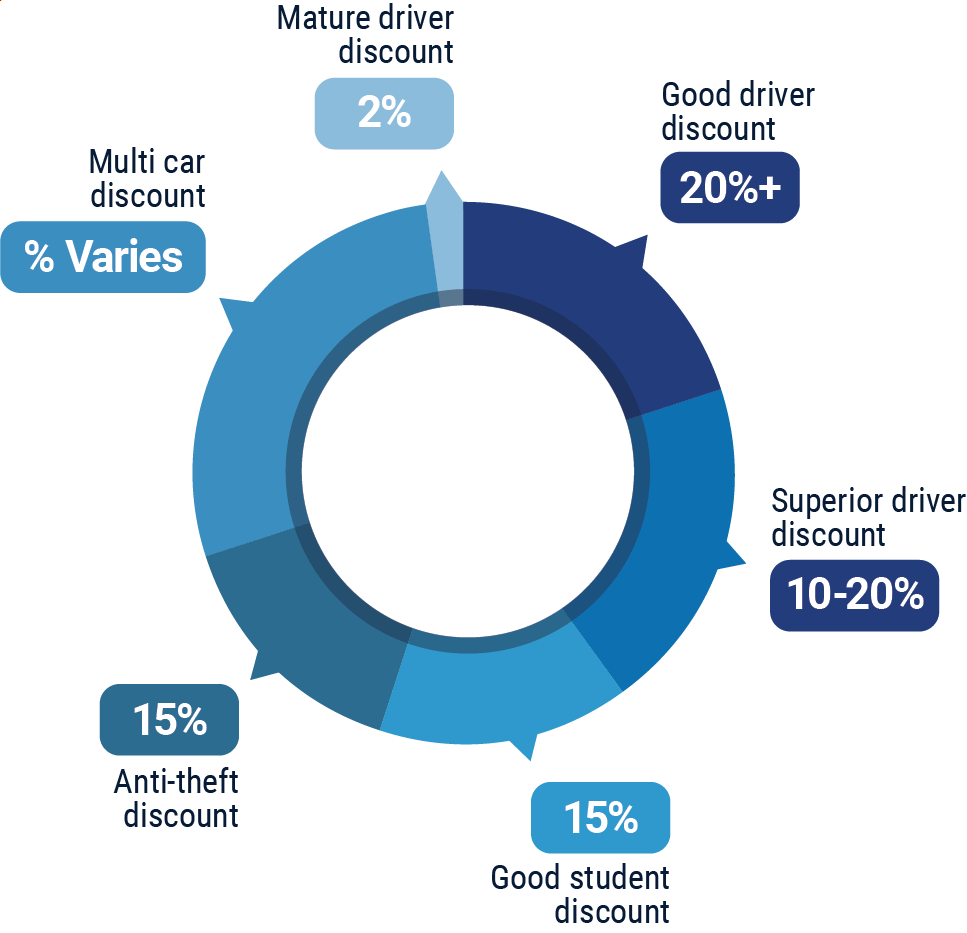

What Discounts Does 21st Century Insurance Offer?

21st Century offers a handful of competitive discount programs for new and loyal auto insurance customers. These discounts include:

- Good driver discount: Available to customers with a clean driving history for at least the last three years. Drivers with one point or less for moving violations within the three-year period qualify for this discount.

- Superior driver discount: Those who qualify for the good driver discount may also qualify for this one, which requires a clean driving record for at least four consecutive years. Greater savings are available to customers with more than five years of clean driving history.

- Good student discount: Available to students under the age of 25 who maintain a “B” average or higher.

- Mature driver discount: Available to customers 55 years old or older after completing a state-recognized defensive driving course.

- Multi-car discount: Available to customers who own multiple cars or insure multiple drivers under the same policy.

- Anti-theft discount: Available to customers whose vehicles are equipped with anti-theft systems that are up to date.

Your independent insurance agent can help you find even more information on discounts offered by 21st Century Insurance and other ways to save money through the insurance company, helping you find the coverage you need at the rate you deserve.

21st Century Insurance Customer Service

21st Century allows customers to handle customer service issues over the phone or online, any time of the week. The following services are available to assist customers with questions, concerns, or claims:

- Claim/fraud report representatives available 24/7

- Complimentary roadside assistance available 24/7

- Live chat on website

- Mobile app

- Customer service phone assistance is available during the following times:

| Days | Hours (EST) | ||

| Monday-Friday | 9 a.m. - 10 p.m. | ||

| Saturday | 10 a.m. - 9 p.m. | ||

| Sunday | CLOSED |

21st Century sells insurance primarily through independent insurance agents. These agents are also available to handle claims and insurance concerns for you, making customer service even easier.

21st Century Insurance FAQs

21st Century’s Claims Reporting Hotline is available for customers in need 24/7 via a toll-free phone number. Customers can also submit claims and file appropriate reports online. The carrier promises to contact customers within one business day of filing a claim. Should a visit from an adjuster be necessary, 21st Century states that one will be assigned to assist you within 48-72 hours.

21st Century offers an Interactive Voice Response system and its website for customers 24/7, but live phone and online chat representatives are only available during scheduled business hours. The carrier provides extended phone hours Monday through Saturday.

21st Century Insurance does not outline a specific step-by-step claims process. However, the carrier states that after customers are assigned a claims representative, they will be assisted in making arrangements for a rental vehicle. Afterward, an inspection will be conducted and an appraiser will provide an estimate of the damages.

For current and prospective insurance customers who are fans of virtual interactions and claims filing processes, it can be argued that 21st Century Insurance provides a highly user-friendly experience. 21st Century handles the vast majority of customer concerns through its website or over the phone.

Customers can also request quotes, pay their bills, manage their policies, and make changes to their account preferences through the official website, which is fairly easy to navigate. The carrier also has a presence on Facebook, LinkedIn, Instagram, and X, allowing greater customer access. The insurance company also has a mobile app available for smartphone users.

21st Century offers both full coverage and minimum coverage auto insurance policies for residents of California. While the carrier has a perk of offering complimentary 24/7 roadside assistance, it's also known for offering higher-than-average premiums.

21st Century Insurance has an excellent official rating by the BBB. However, AM Best withdrew the carrier's financial strength rating a few years ago. Further, many customer complaints have been filed against the carrier through the BBB in recent years.

21st Century's insurance products may be right for drivers who live in the state of California. The carrier currently only sells auto insurance in one state.

https://www.21st.com/

https://news.ambest.com/PR/PressContent.aspx?altsrc=10&RefNum=28728&URatingId=3270628

https://www.bbb.org/us/de/wilmington/profile/auto-insurance/21st-century-insurance-0251-22000073

https://www.bankrate.com/insurance/reviews/21st-century/