Foresters Financial Insurance Company Review 2025

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Our Foresters Financial Insurance Company Score

2.5 Stars

We award Foresters Financial a final rating of 2.5 out of 5 stars. The insurance company has been around for more than a century and a half now, which is certainly noteworthy and respectable. The carrier has also received high ratings through both AM Best and the Better Business Bureau (BBB).

However, it is not accredited through the latter organization and has had several complaints filed against it in recent years. Further, a lack of 24/7 claims reporting or even an online claims reporting option puts Foresters Financial behind most modern insurance companies.

Foresters Financial was founded in 1874 and is a division of the Foresters family of companies, which includes Foresters Canada, Foresters Life, Foresters Investment Management Company, Inc., Foresters Investor Services, Inc., and more. The Foresters family of companies’ total assets currently reach nearly $13 billion.

Foresters Financial serves customers in the U.S., Canada, and the U.K. The Foresters group of companies offers all types of life insurance products, as well as many different annuities, mutual funds, and savings and retirement planning services. Foresters Financial focuses its efforts on term, universal, and whole life insurance coverages.

While Foresters Financial offers high official ratings and coverage in all states except New York, we can't ignore the customer complaints and slow claims processing. Overall, we recommend looking into several different life insurance carriers before deciding where to get your coverage. An independent insurance agent can assist you in looking into Foresters Financial and other life insurance companies.

Foresters Financial Pros and Cons:

| Pros: | Cons: | ||||

|---|---|---|---|---|---|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

To find insurance in your state, use our national insurance company directory to find the best company to meet your needs. You can locate insurance companies that specialize in your specific coverage needs and get connected to an agent near you.

Foresters Financial Insurance Products by Type

Foresters Financial is a specialized insurance company that focuses on life insurance. Its coverage offerings include:

Foresters Financial Term Life Insurance

Foresters Financial offers two types of term life insurance for customers to choose from.

Coverage types, features, and benefits:

Your Term Level Term Life Insurance

Foresters Financial offers this option for customers to choose term life insurance coverage for a specific time period, with choices ranging from 10 to 30 years.

Strong Foundation Non-Medical Term Life Insurance

Foresters Financial also offers term life insurance that can be extended, renewed, or converted into a permanent life insurance policy. However, interested customers must pass a medical exam to be approved.

Foresters Financial Life Insurance Average Prices

Foresters Financial does not make its average life insurance rates readily available online without requesting a quote. However, an independent insurance agent can help you find specific quotes for the exact amount of Foresters Financial life insurance you need and also compare quotes from multiple carriers for you. You can get a better idea of how much a life insurance policy might cost you by using our life insurance calculator.

What Discounts Does Foresters Financial Offer?

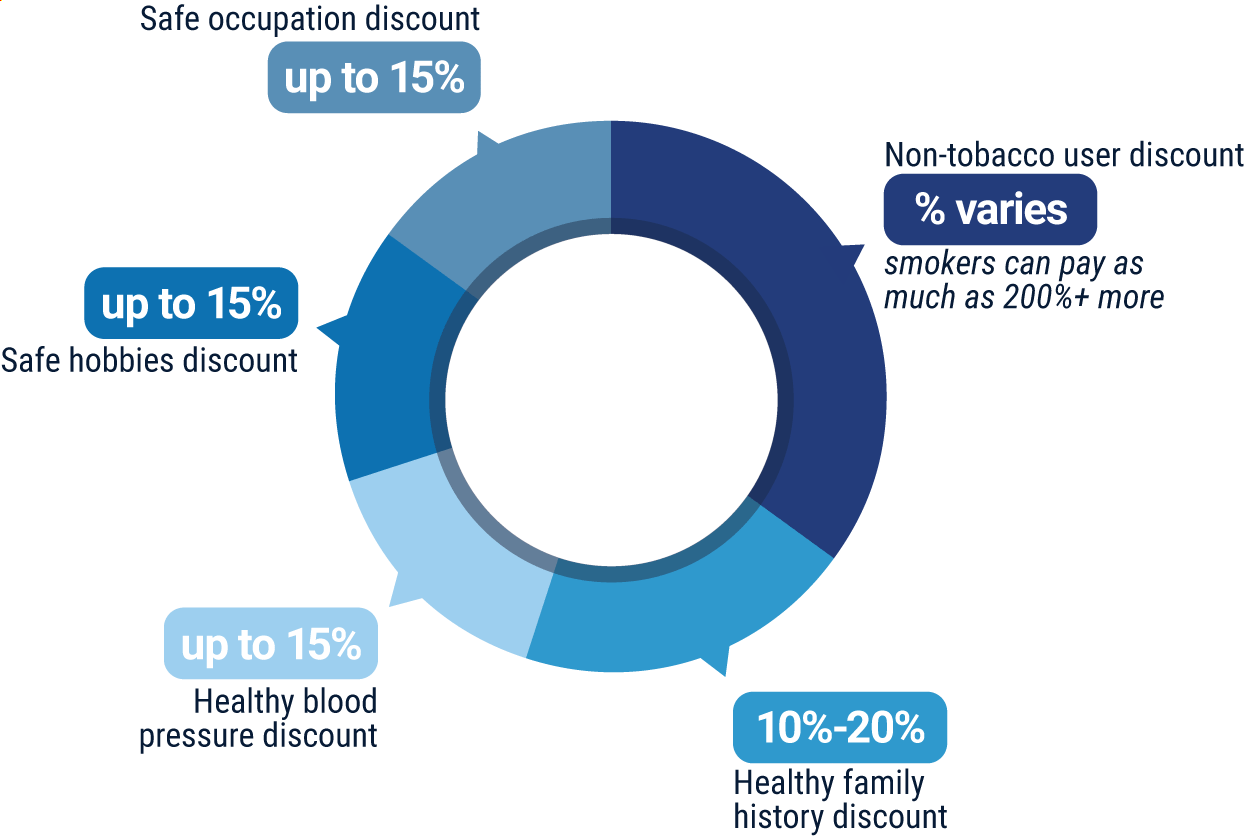

While Foresters Financial does not make information about its specific discounts readily available, many life insurance companies today offer several common discounts on comparable coverages. These discounts often include:

- Non-Tobacco User Discount: Life insurance companies tend to reward customers who do not use tobacco products with cheaper premiums.

- Healthy Family History Discount: Life insurance companies also reward applicants with healthy genetics, or a good family health history.

- Healthy blood pressure discount: Offered to life insurance customers who have what’s considered to be a healthy blood pressure upon evaluation.

- Safe Hobbies Discount: Life insurance companies often award customers who practice safe, non-life threatening habits (e.g., no skydiving) with cheaper premiums.

- Safe occupation discount: Offered to life insurance customers who work in safer occupations that are not typically life-threatening.

Your independent insurance agent can help you find more information on exact discounts offered by Foresters Financial and other ways to save money through the insurance company, helping you to find the coverage you need at the rate you deserve.

Foresters Financial Customer Service

Foresters Financial allows customers to report claims via phone during restricted hours during the week. The carrier also provides the following customer service options:

- Phone

- Mobile app

- Online contact form

- Snail mail claims reporting

The main customer service hotline has the following hour restrictions:

| Days | Hours (ET) | ||

| Monday-Friday | 9 a.m.-5 p.m. |

The best way to ensure a smooth customer service experience is to work with an independent insurance agent. Independent insurance agents can help handle claims and other concerns for you, so you can relax and enjoy your coverage.

Foresters Financial Insurance FAQs

Foresters Financial allows customers to file claims through snail mail. The insurance company does not offer 24/7 claims reporting. The carrier’s official website states that claims will be processed within 15 business days, and a decision about approval will be made within 30 business days.

Foresters Financial does not provide 24/7 contact options for customers. The main customer service hotline is available during typical hours, Monday-Friday. The carrier also has a social media presence on Facebook, Pinterest, Instagram, and LinkedIn, making it a bit more accessible to customers.

Foresters Financial only allows claims reporting via snail mail, though customers can call the carrier to initiate the claims process and receive the forms they need. Customers must complete all claims forms and mail them to the carrier. It can take between 15 and 30 business days after the forms are received for the policyholder to receive a decision from Foresters Financial.

Foresters Financial’s official website is polished and visually appealing, and it’s also intuitive and easy to navigate. Prospective and current customers alike can easily locate important information, and pages are detailed enough to be satisfying in their responses.

The carrier also provides an FAQ for customers with questions. The official website allows customers to connect with an agent; however, it does not offer phone or online claims reporting, which can delay the process and potentially cause frustration for many customers.

Foresters Financial may be a bit behind other insurance companies with its claims reporting processes, but overall, the carrier's official website, mobile app, and social media presence provide a fairly user-friendly experience.

Foresters Financial specializes in life insurance. The insurance company offers the following coverage options and benefits through its whole life insurance policies:

- Coverage that lasts for the policyholder's entire life

- Premiums that typically remain level throughout the life of the policy

- Fixed death benefits

- Cash value

Your independent insurance agent can help you find out more about Foresters Financial’s whole life insurance coverage.

Foresters Financial has received high ratings from both AM Best and the BBB and has solid financial strength. However, the insurance company does not offer 24/7 claims reporting or online quote options.

The carrier has also had several complaints filed against it through the BBB in recent years, and is not currently accredited through the organization. Customer feedback also appears to lean heavily towards the negative side. So, we're hesitant to call Foresters Financial a good insurance company.

Foresters Financial's insurance products may be right for individuals seeking various types of life insurance coverage, including term, whole, or universal life insurance, or accidental death insurance. Coverage is available in all states except New York.

https://www.foresters.com/

https://news.ambest.com/newscontent.aspx?refnum=158606&altsrc=23

https://www.bbb.org/ca/on/north-york/profile/insurance-companies/foresters-financial-0107-1166355