Earthquake Insurance

Separate coverage is often required to protect homes and businesses against losses due to earthquake damage.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Keeping your home or business safe means anticipating all disasters, even those caused by Mother Nature. But if you’re unsure of which natural disaster coverages are required, trying to establish the right combination of protection for your home or business can be confusing. You might not know whether to get additional coverages, like earthquake insurance.

Fortunately, independent insurance agents can help you determine if adding earthquake insurance is the right move for your home or business. They can get you set up with the right policy for your needs. But first, here’s a closer look at earthquake insurance and whether it’s required in your area.

How Common Are Earthquakes?

When considering the importance of earthquake insurance, it's helpful to know just how prevalent these disasters are. Check out some earthquake stats below.

- Between 1974 and 2003, there were more than 21,000 earthquakes of magnitude 3.5 or greater recorded in the U.S.

- Alaska has the most frequent and strongest seismic activity in the U.S.

- Between 12,000 and 14,000 earthquakes occur globally each year, which translates to about 35 per day.

- Each year, California experiences two or three earthquakes of a magnitude 5.5 or higher, meaning they are strong enough to cause moderate structural damage.

Knowing that thousands of earthquakes occur around the world each year, it's easier to see just how critical earthquake insurance is, especially for those who live in high-risk areas.

What Does Earthquake Insurance Cover?

Earthquake insurance provides crucial protection for your home or business in the event of an earth movement disaster. These perils are not covered under standard homeowners insurance or business insurance policies, so additional coverage is required. While policies can vary, earthquake insurance typically includes coverage for the following:

- Your home/business’s structure

- Your home/business’s foundation

- Your home/business’s interior

- External or detached structures, such as sheds

- Disastrous events resulting from an earthquake, such as cliffs collapsing onto a business or a home sliding down a hill

- Additional living expenses if you're forced to live elsewhere temporarily while repairs are made to your home

Optional coverages can include:

- Building code upgrades

- Land restoration costs

- Emergency repairs

Not all policies include coverage for external structures. To qualify for insurance reimbursement, your home or business must have been damaged due to activity from earth movement. Note that if an earthquake has recently occurred in your area, it might not be possible to get a new earthquake insurance policy for up to two months.

An independent insurance agent can help explain even more about the importance of earthquake insurance and how it could protect your home or business. They'll be able to get you set up with the right coverage ASAP.

Does Earthquake Insurance Cover Landslides?

Earthquakes are caused by seismic activity, while landslides are caused by water accumulation that leads to land destabilization. Landslides are also often caused by erosion. However, sometimes landslides occur as a direct result of an earthquake. In such cases, earthquake insurance may provide coverage for landslide damage as well.

Preparedness is critical to protect homeowners, business owners, and condo unit owners against financial losses resulting from these natural disasters. Be sure to review your earthquake insurance policy with your independent insurance agent to determine if it includes coverage for landslides or if you need to purchase a stand-alone policy to cover these disasters.

Is Earthquake Insurance Mandatory?

If you live in an area at high risk for earthquakes, such as near a fault, your mortgage lender for your house, condominium, or business may actually require you to have earthquake insurance. Otherwise, earthquake insurance is typically optional.

If you live in an area prone to these disasters, having earthquake insurance can save you a lot of money in the long run. The damage from just one earthquake can be devastating, and literally shake a building to its core. Having to pay rebuilding fees out of pocket could lead to bankruptcy for a home or business owner.

Who Sells Earthquake Insurance?

Earthquake insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. These agents know which insurance companies to recommend to match your individual needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies might offer earthquake insurance, finding coverage could also depend on the area you live in. Here are a few of our top picks for earthquake coverage.

Top Earthquake Insurance Companies

| Top Earthquake Insurance Company | Company Rating | |

| Best coverage for renters | Liberty Mutual |

|

| Best commercial coverage | ICW Group |

|

| Best bundled coverage | American Family Insurance |

|

| Best customer service | Country Financial |

|

| Best for California residents | Amica |

|

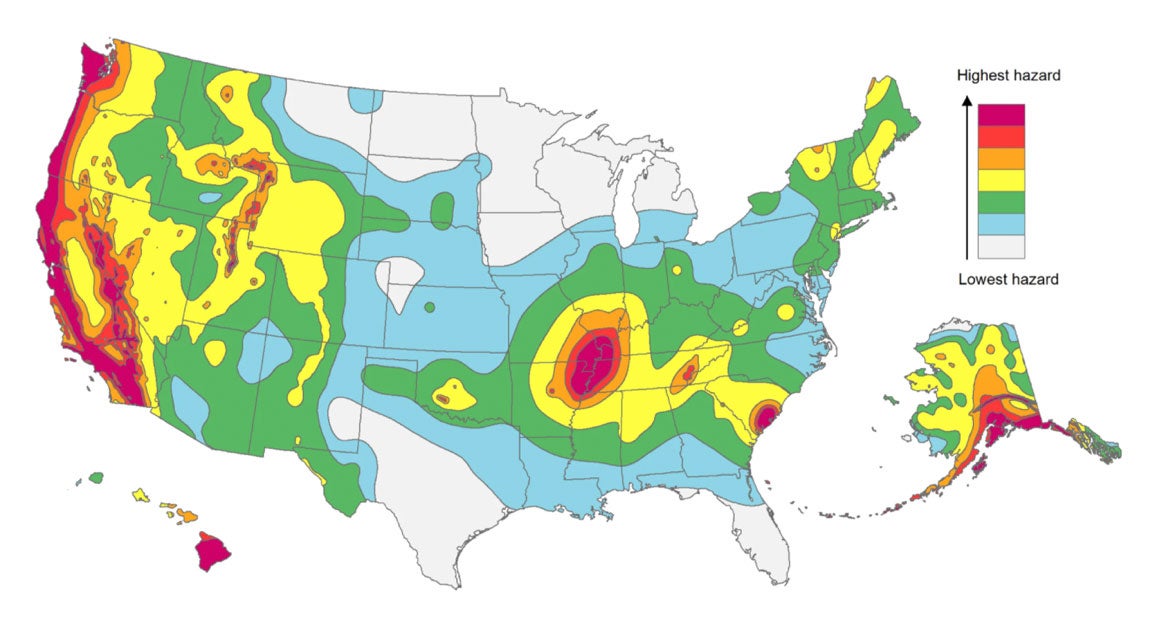

Who Needs Earthquake Insurance?

While earthquake insurance is optional in many areas, those who live in high-risk zones absolutely need to have coverage to avoid huge financial consequences. That includes folks who own a home or business or rent in the following areas:

The highest risk areas for earthquakes are:

- Alaska

- California

- Hawaii

- Idaho

- Kentucky

- Missouri

- Montana

- Oregon

- South Carolina

- Tennessee

- Washington

- Wyoming

If you're a homeowner, renter, or business owner in any of these states, contact an independent insurance agent to get equipped with the proper earthquake insurance to protect your property.

What to Look for in an Earthquake Insurance Policy

You'll know an earthquake policy is right for you when it provides all the basic coverages necessary to repair your house and belongings, as well as temporary living expenses coverage. In a business's case, you'll look for adequate coverage for the building and inventory. Here's a breakdown of an earthquake insurance policy for better reference.

An Inside Look at an Earthquake Insurance Policy

| Pays for: |

| Repairs to the home/business and attached or sometimes detached structures. |

| Repairs to personal belongings like clothes and furniture, or business inventory and products. |

| Additional living expenses for staying in a temporary residence while undergoing repairs to the home. |

| Doesn't pay for: |

| Fire damage after an earthquake: This is covered by homeowners or business insurance already. |

| Vehicle damage: You'd need a personal or commercial comprehensive auto insurance policy for this. |

| Flood damage: You'd need a flood insurance policy to cover this, even if the flooding resulted from an earthquake. |

| Sinkholes: This coverage can be purchased separately or as an endorsement to homeowners insurance. |

An independent insurance agent can greatly assist you in selecting a legitimate earthquake insurance policy that meets your needs.

How Much Earthquake Coverage Do I Need?

When determining how much coverage is right for you, your independent insurance agent can certainly suggest ideal coverage limits for your policy. Your policy's limits might be the same as your homeowners insurance policy's at first, such as 10% of your dwelling's overall coverage for your personal property. This amount can be increased, however.

Earthquake policies can also come with higher deductibles compared to home insurance, sometimes at 10% to 20% of the dwelling coverage limit. These policies also often come with separate deductibles for dwelling coverage and personal property coverage. An independent insurance agent can help review your policy and break this down further for you.

Is Earthquake Insurance Expensive?

Earthquake insurance may seem costly at first, but because your home or business is probably your biggest investment, protection from all natural disasters is necessary. Homes located directly over or near a fault line have the highest risk of damage, so policies for these homeowners often come with the highest premiums.

However, homeowners can reduce their costs. Homes made of wood generally cost less to insure than those made of brick. This is because wood-constructed homes are more flexible than those made of concrete masonry and can better withstand the jarring motions caused by an earthquake.

Also, homeowners can often receive lower premiums by practicing certain earthquake safety measures, such as retrofitting their homes to make them better able to withstand an earthquake. This can be done by securing the structure to the foundation via bolting and installing a sprinkler system in the home.

How Are Earthquake Insurance Rates Determined?

Like many types of coverage out there, earthquake insurance policies consider several factors to determine their cost. These factors often include:

- Your exact location

- Your home or business structure's age

- How big your home or business is

- The value of the property

- The type of soil on the property

- Building materials used in the property

- Your proximity to fault lines and historical seismic activity

The average cost of an earthquake policy in the U.S. is $800 annually. Renters, however, might pay much less annually for a policy with a 5% deductible, $50,000 in personal property coverage, and $1,500 in loss of use coverage, if they live in a low-risk area. However, homeowners in active regions like San Francisco may pay upwards of $2,000-$5,000 annually.

Earthquake insurance may be well worth the cost for many individuals, especially those who live in high-risk areas. Long-term, having this coverage could pay off many times over if a disaster occurs that badly damages or destroys your home or business. An independent insurance agent can help find quotes and provide exact figures for the cost of earthquake insurance in your area.

How Do Earthquake Insurance Claims Work?

If an earthquake destroys your home or business, your insurance company will reimburse you up to the amount of your policy's coverage limit, minus the cost of the deductible. Here's an example:

| Earthquake policy coverage limit: | $150,000 |

| Earthquake policy deductible amount: | 15% |

| Claim amount submitted to insurance company: | $150,000 |

| What you'd pay: | $22,500, or 15% of the overall coverage |

| What the insurance company would pay: | $127,500, or the remaining 85% |

If your home is destroyed by an earthquake, start by contacting your independent insurance agent or insurance company. Document the damage thoroughly before making the call. Your agent can walk you through the entire claims process and provide you with estimates for each step, including when you'll likely receive reimbursement.

An Independent Insurance Agent Can Help You Get Earthquake Insurance

When it's time to find the right earthquake insurance for your home or business, no one's better equipped to help than a local independent insurance agent. These agents have access to multiple insurance companies in your area, so they're free to shop and compare policies and rates for you. They'll get you set up with the best blend of coverage and cost.

FAQs About Earthquake Insurance

Standard earthquake policies provide coverage for your home or business's dwelling as well as limited coverage for the property inside, and additional living expenses.

Comprehensive earthquake policies cover your home or business's structure, your personal property or inventory, additional structures, and additional living expenses.

To determine how much coverage you need, work with an independent insurance agent to figure out how much it would cost to rebuild your home or business. You'll also figure out the cost to replace the property inside and for coverage for additional living expenses.

Yes, though it might be offered as optional coverage depending on the policy. Emergency repairs up to 5% of the insured value of the home or business can be included, as well as the same amount for debris removal.

Yes, optionally. Typically up to $10,000 in building code upgrade coverage is available.

In part. Earthquake insurance typically offers up to $10,000 in coverage for the land that supports your insured home to restore or replace it. No additional coverage for landscaping is usually offered.

https://www.conservation.ca.gov/cgs/earthquakes

https://www.iii.org/article/insurance-for-landslides-and-mudflow#:~:text=Q.-,Will%20an%20earthquake%20insurance%20policy%20cover%20my%20home%20or%20business,of%20the%20movement%20are%20different.

https://www.amfam.com/insurance/home/coverages/earthquake-coverage

https://www.insurance.wa.gov/earthquake-insurance