Erie Insurance Company Review 2025

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Our Erie Insurance Company Score

3 Stars

We award Erie Insurance a final rating of three out of five stars. The insurance company has recently surpassed its century mark in the insurance industry, and its level of experience shows through its ratings. Erie’s high ratings of an “A+” through both AM Best and the Better Business Bureau (BBB) are noteworthy and respectable. The carrier does lose some points for not being BBB-accredited, however, and for having had quite a few customer complaints filed against it in recent years.

Erie Insurance was founded in 1925 under the name the Erie Insurance Exchange. The insurance company has grown from humble roots to now having more than 5,000 employees. Erie’s official website states that the insurance company now has more than five million insurance policies in force.

Erie began its venture in the insurance industry by focusing its efforts on auto insurance. Today, the insurance company offers tons of different products, ranging from boat insurance to personal umbrella insurance and life insurance. Though their coverage is currently only available in 12 states and D.C., millions of customers have chosen to rely on Erie for their insurance needs.

The insurance company holds a few impressive rankings. In recent years, Erie has taken the titles of the 12th largest auto insurer in the U.S., the 11th largest home insurer in the U.S., and the 12th largest business insurer in the U.S.

Erie is also a Fortune 500 Company and has been recognized on the list since 2003. In 2016 and 2017, Erie won the Achievement in Customer Excellence Awards by Confirmit for its claims service. Overall, if you live in an area where coverage is available, we recommend looking into Erie Insurance to be your next trusted carrier with the help of your independent insurance agent.

Erie Insurance Pros and Cons:

| Pros: | Cons: | ||||

|---|---|---|---|---|---|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|||||

|

To find insurance in your state, use our national insurance company directory to find the best company to meet your needs. You can locate insurance companies that specialize in your specific coverage needs and get connected to an agent near you.

Erie Insurance Products by Type

Erie provides a range of insurance products for individuals. The carrier's coverage offerings include:

Vehicle & Auto Insurance:

- Auto insurance

- Boat insurance

- Motorcycle insurance

- Recreational vehicle insurance

- Antique and classic car insurance

- Off-road insurance

Home & Property Insurance:

- Homeowners insurance

- Renters insurance

- Condo insurance

- Mobile home insurance

- Landlord insurance

Life & Medical Insurance:

- Whole life insurance

- Medicare supplement insurance

Erie Insurance Auto Insurance

Erie allows customers to assemble a full coverage auto insurance policy with property damage liability, bodily injury liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection (PIP) coverage. The carrier also offers a few optional coverage enhancements and additional options for increased protection.

Coverage types, features, and benefits:

Auto glass repair

Erie offers optional auto glass repair coverage, which allows policyholders to waive their deductible for windshield repairs. For an extra fee, customers can also add Full Window Glass coverage, which can waive the deductible for windshield replacements. Wiper blades are also included in windshield repairs or replacements.

Pet

Erie offers optional pet coverage, which can reimburse policyholders for up to $500 per pet or $1,000 total if their animals get hurt in a car accident while riding as your passengers.

Personal item

Erie offers optional coverage for personal items, such as luggage and clothing, that are damaged inside an insured vehicle.

Locksmith services

Erie also offers optional coverage of up to $75 for locksmith services if you accidentally lock your keys in your vehicle.

Erie Insurance Car Insurance Average Prices

Here's an overview of the average cost of car insurance from Erie.

| Annual Full Coverage Car Insurance Premium | Annual Minimum Coverage Car Insurance Premium |

|---|---|

| $2,206 | $728 |

Erie Insurance Homeowners Insurance

Erie offers all the standard protection needed in a home insurance policy, including personal liability, dwelling coverage, and contents coverage. The carrier also offers special coverage and a few optional coverage enhancements, such as the following.

Coverage types, features, and benefits:

Valuables

Erie offers higher coverage limits for valuable personal items, such as watches, jewelry, precious stones, and more.

Gift cards

Erie offers coverage for gift cards bought for a business that has since permanently closed.

Animals, birds, and fish

Erie offers up to $500 in coverage for animals, birds, and fish.

Cash and precious metals

Erie offers up to $500 for cash and precious metals.

Hard-to-replace items

Erie also offers coverage for bills, passports, deeds, and other hard-to-replace personal property.

Erie Insurance Home Insurance Average Prices

Here's a look at Erie's average homeowners insurance policy rates.

| Annual Premium for Home Insurance with $300k in Dwelling Coverage: |

|---|

| $1,887 |

What Discounts Does Erie Offer?

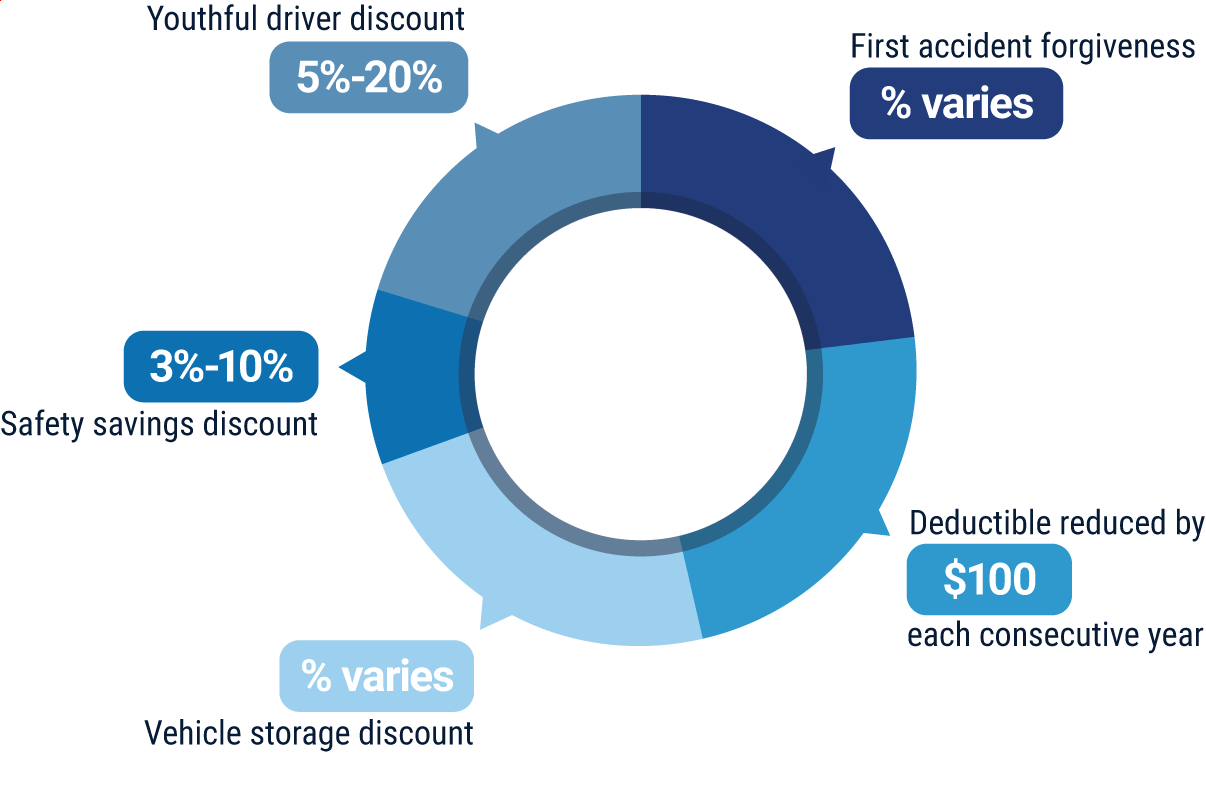

Erie offers several competitive discounts and money-saving options for customers, especially on auto insurance. The carrier's discounts include:

- First accident forgiveness: Auto insurance customers who have been with Erie for three or more years (in certain states) will not be charged for their first at-fault accident.

- Diminishing deductible option: Awarded to auto insurance customers who have not filed any claims.

- Vehicle storage discount: Awarded to customers who plan to store their vehicle for at least 90 consecutive days.

- Safety savings discount: Awarded to customers with vehicles that have factory-installed airbags, anti-theft devices, and/or anti-lock brakes (ABS).

- Youthful driver discount: Awarded to customers who insure another driver in their household who is unmarried and under the age of 21.

Your independent insurance agent can help you find even more information on discounts offered by Erie and other ways to save money through the insurance company, helping you find the best value for your money.

Erie Insurance Customer Service

Here's an overview of Erie Insurance's customer service options and availability.

- Phone

- Snail mail

- Online bill pay and claims reporting

- Extended hours phone claims reporting

- Fax

The customer service phone line has the following hour restrictions:

| Day(s) | Hours (EST) | ||

| Monday-Friday | 8 a.m.-7 p.m. | ||

| Saturday | 9 a.m.-4:30 p.m. | ||

| Sunday | CLOSED |

Erie sells insurance through a wide network of agents, including independent insurance agents. Independent insurance agents can help make customer service easier for you by handling claims and other concerns.

Erie Insurance FAQs

Erie allows customers to file claims over the phone at any time. The carrier's official website states that it will respond ASAP to customers after a new claim is filed to expedite the process.

For certain types of claims, Erie allows customers to contact them via phone during extended hours, daily. The carrier's main customer service hotline is also available during generous hours Monday-Friday, and during restricted hours on Saturday. The carrier also has a social media presence on Facebook, Instagram, YouTube, and LinkedIn, making it even more accessible to customers.

Erie allows customers to file claims via phone during extended hours, daily. The carrier breaks down the insurance company’s process for auto insurance claims in a few simple steps:

- Start the claim: The customer contacts Erie or their independent insurance agent.

- The customer is contacted: A claims handler will contact the customer "right away" to get more details about the claim.

- Schedule repairs: The claims adjuster will help the customer schedule repairs for their damaged vehicle at an approved body shop.

- Claim settlement: Erie states that how long a claim takes to settle depends on the specific claim and its severity.

Customers can stay updated on their claim’s progress by keeping in touch with their independent insurance agent or by calling the carrier.

Erie’s official website is intuitive and easy to navigate, but it seems to have some performance issues. However, pertinent information can be located easily for prospective and current customers, and what's provided on the website is detailed and thorough.

The insurance company’s discounts and its claims process, for example, are prominently displayed on the website, which is a courtesy not offered by all insurance companies. Overall, Erie provides an excellent, user-friendly experience for customers.

While Erie offers many types of coverages, the carrier has its roots in auto insurance. The insurance company provides the following benefits under its auto policies:

- Pet coverage

- Personal item coverage

- Auto glass repair

- Locksmith services

- Roadside assistance

- Rental car coverage

One of the most unique features about Erie’s auto insurance is the “rate lock” endorsement, which allows customers to keep their same premium rate throughout the life of their policy, unless they make changes such as adding or removing a driver, or moving the address of their vehicle.

With extremely high ratings through both AM Best and the BBB, as well as several impressive nationwide rankings, Erie has certainly made quite a name for itself over the years. Many glowing customer reviews can be found across the web, too, suggesting that Erie delivers on its coverage promises. Topped off with a polished modern official website, Erie Insurance can arguably be considered a good insurance company.

Erie's insurance products may be right for customers seeking several types of personal insurance, including home and property insurance, vehicle and auto insurance, or life insurance. However, Erie Insurance only sells its coverage in 12 states currently, so you'll have to check your eligibility.

https://www.erieinsurance.com/

https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=4272

https://www.bbb.org/us/pa/erie/profile/insurance-companies/erie-insurance-group-0141-20000052

https://www.bankrate.com/insurance/reviews/erie/