How to File Motorcycle Insurance Claims

Learn the simple step-by-step process for filing a motorcycle insurance claim the right way.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Motorcycle riders and operators must be aware of how to file claims through their motorcycle insurance after an incident. Unfortunately, motorcyclists are 28 times more likely to die in an accident and four times more likely to be injured than drivers and riders in passenger cars. This makes understanding the claims process even more critical for motorcyclists.

Fortunately, a local independent insurance agent can help file motorcycle insurance claims for you, for motorcycle accidents, theft, vandalism, and more. Your agent can also get you set up with all the coverage you need. But until then, here's an easy step-by-step guide to filing motorcycle insurance claims the right way.

When to File a Motorcycle Insurance Claim

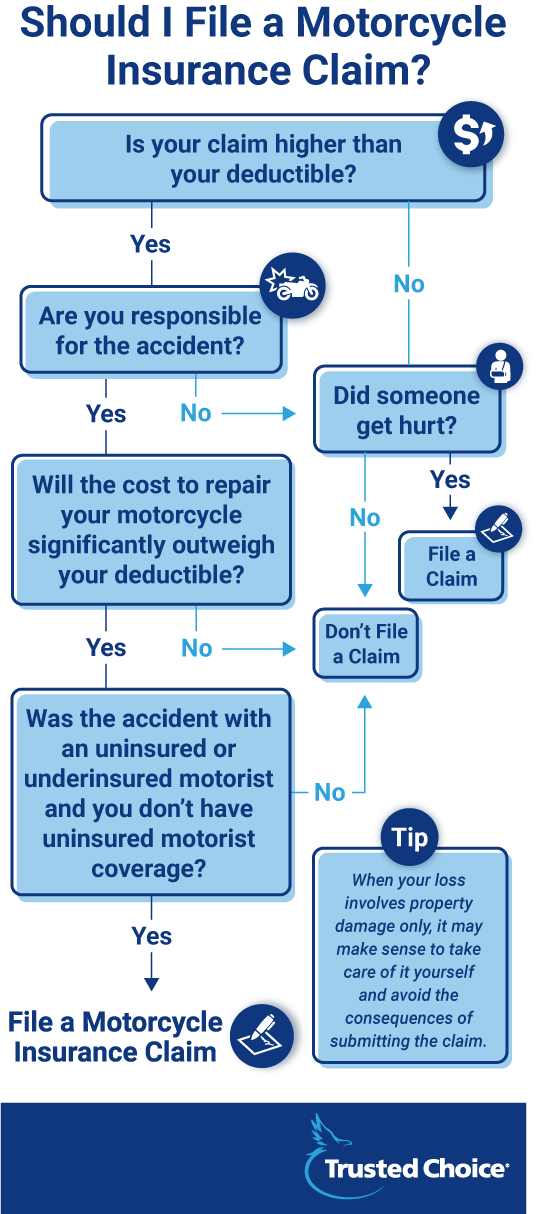

Whether to file a motorcycle insurance claim can be a personal decision. Before filing a claim, you'll want to consider your savings and your policy's deductible in comparison to the extent of the damage.

For example, if an incident occurred with no injuries and only property damage, if the cost of repairing your bike would be $650 and your policy's deductible is $500, filing a claim would definitely not be worth the risk of your premium going up for possible compensation of just $150.

However, there are a few scenarios in which you would most likely want to file a claim:

- If you’re responsible for the accident and can be held liable for third-party property damage or bodily injury

- If you or your passengers were injured in an accident, regardless of fault

- If the cost to repair your motorcycle significantly outweighs your policy's deductible

- If you’re involved in a hit-and-run or an accident with an uninsured or underinsured motorist

Note that you'll need uninsured motorist coverage to reimburse you for the cost of hit-and-run accidents or damage or injuries to yourself, your passengers, or your bike caused by an uninsured or underinsured driver. If the other driver doesn't carry any or adequate insurance of their own, uninsured motorist insurance can compensate you properly.

If you’ve determined you need to file a claim, you’ll want to do so ASAP. Waiting to file a claim can cause the insurance company to issue a denial.

How to File a Motorcycle Insurance Claim: 7 Easy Steps

Maybe you've been in a crash, your bike was stolen, or you just want to prepare yourself. Fortunately, filing a motorcycle claim can be simple when you know the proper steps to take. In fact, filing motorcycle insurance claims is very similar to filing car insurance claims. Follow this process to file a claim through your motorcycle insurance policy.

Step 1: Check for Injuries

The first step after a motorcycle accident or collision is to check all parties for injuries, including the other driver and their passengers. If anyone is injured, call for medical help right from the accident scene. Motorcycle insurance policies can provide reimbursement for medical bills and other medical expenses in the event of personal injury after a crash, so be sure to save all receipts.

Step 2: Report the Accident

If you've been involved in an accident, it's typically mandatory by law to report it to local authorities right away. Call the police and wait for help to arrive. If you can, safely move your bike and the other vehicle to the side of the road and out of the way of oncoming traffic.

Step 3: Gather Important Information

When you file a motorcycle accident claim, you'll need to be prepared with all relevant information about any other parties who were involved. Write down the other driver’s contact information, insurance details, and any witnesses’ contact information.

Take photos and videos of the crash scene that show the driving conditions, location, and any damage to all vehicles involved. The more info you have to present to your insurer, the better your chances may be of having your claim handled in a timely manner.

Step 4: Assess the Damage

Next, thoroughly inspect all damage, including to your bike, other vehicles involved, and any surrounding property that may have been hit. Your insurance coverage may provide compensation for property damage to third parties, including if it's to a signpost or fence. Be sure to take photos and video evidence if possible.

Step 5: Contact Your Insurance Company or Independent Insurance Agent

Your independent insurance agent can contact your motorcycle insurance company for you to initiate the claims process with the information you provide them. They can even keep you updated through each step of the process, including when you can expect to receive reimbursement if your claim is approved. Otherwise, you can contact your insurer directly to file your claim. You'll need to complete a claims form for your carrier.

Step 6: Schedule a Visit from an Adjuster

Your insurance company will likely want to send an insurance adjuster to evaluate the damage and other details of the claim in person. Your independent insurance agent can help schedule this visit for you, or you can work with your carrier directly to do so. The insurance adjuster will provide you with an estimate of how much compensation you can expect to receive for repairs.

In extreme cases, your bike may be considered a total loss. This will occur if the extent of the damage exceeds the costs of necessary repairs. Otherwise, if your claim is approved, your insurance company will issue you a check or directly deposit the amount of reimbursement you're approved for into your online bank account. If you are unsatisfied with your insurance company's decision, you may appeal the claim or negotiate with them.

Step 7: Schedule Repairs

Next, you'll schedule your bike for repairs at a local shop. Your insurance company will provide you with a list of approved repair shops near you.

Keep in mind that your claim may not have been approved for the full cost of repairs, and you may be responsible for certain costs yourself. You'll also have to pay your deductible amount out of pocket before receiving reimbursement.

Once repairs have been made and you've received compensation from your insurer, the claims process is complete. If you have any further questions, your independent insurance agent can also help you navigate the claims process.

Will My Premiums Go Up After a Claim?

A variety of factors can determine whether your premium will be raised after a claim. Your potential premium increase can depend on the severity of your accident, your insurance policy, your personal claims history, and your driving record. In most cases, you can expect your motorcycle insurance premiums to increase, even after filing just one claim.

To save money on your motorcycle insurance policy, work with an independent insurance agent. They can help you find motorcycle insurance discounts you may be eligible for, even if you've filed a claim.

An Independent Insurance Agent Can Help You File Motorcycle Insurance Claims

If you need to file a motorcycle insurance claim, no one's better equipped to help than an independent insurance agent. Your agent can contact your carrier directly to file your claim, walk you through the entire claims process, and provide you with ETAs for every step. And if your coverage needs change, your agent can help update your policy when necessary.

https://www.progressive.com/claims/motorcycle-process/

https://www.forbes.com/advisor/legal/motorcycle-accident-statistics/#motorcycle_riders_are_28_times_more_likely_to_die_and_four_times_more_likely_to_be_injured_in_an_accident_section