Snowmobile Insurance

(How you can easily get started today)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You know the feeling — the snow starts to fall and you gas up the snowmobiles. But before you lace up your snow boots and throw on those gloves, you need to make sure you have the right protection in place. Because all it takes is one bad accident to keep you off the trails you love.

Now, insurance may not be the first thing on your mind, but that doesn't mean you should rule it out. Working with an independent Insurance agent, you'll understand exactly why snowmobile insurance is so important and how they can help you find it all at the perfect price for you.

But first, you'll want a bit of background on the ins and outs of snowmobile insurance.

What Does Snowmobile Insurance Cover?

Your snowmobile insurance policy should be a direct reflection of how you use your snowmobile. This is why it’s important to talk to your independent insurance agent so they can help customize your snowmobile policy with no more, and no less coverage than you need.

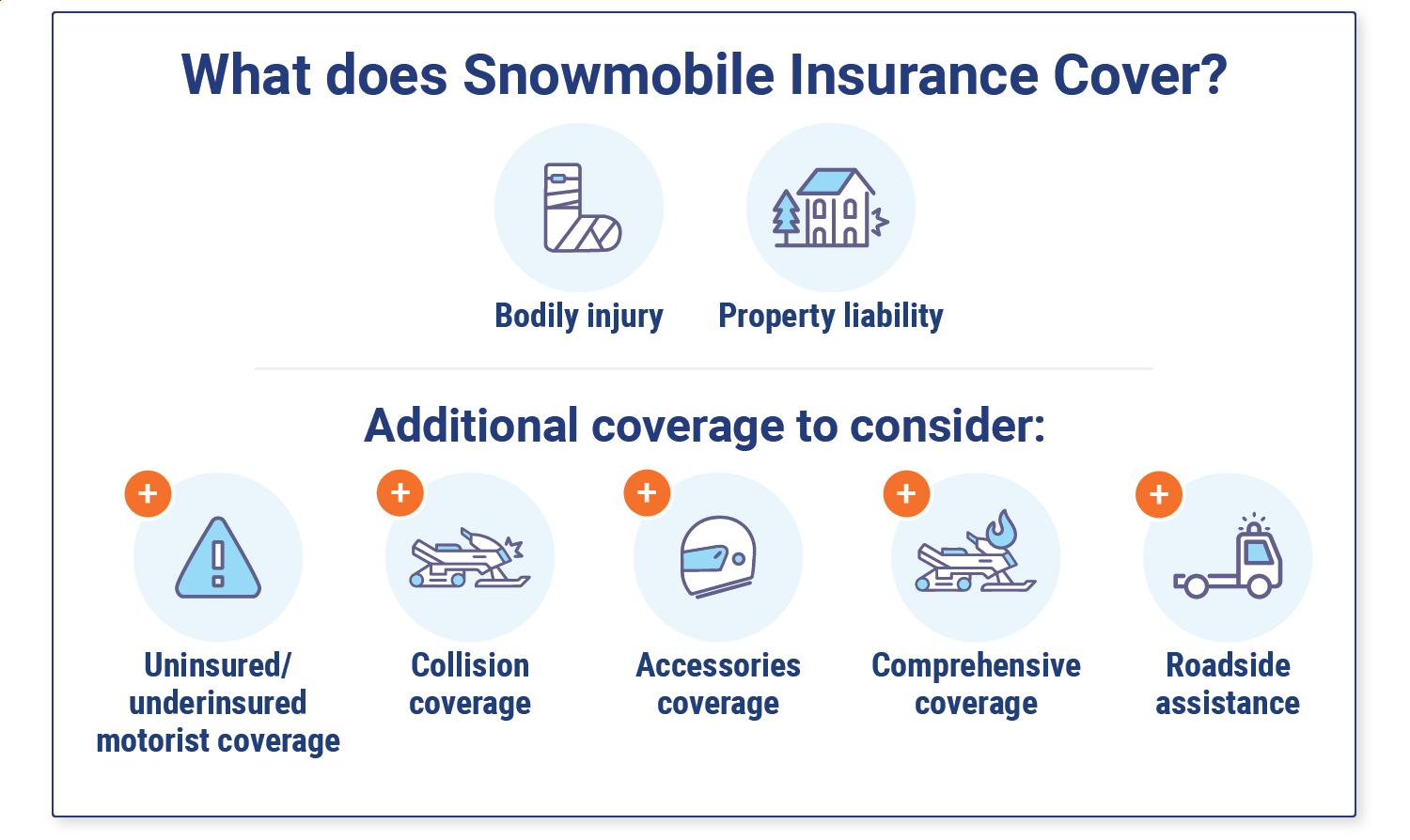

That being said, a basic snowmobile insurance policy will typically include coverage for both bodily injury and property damage liability, broken down like this:

- Bodily injury: This is designed to cover medical bills that may be associated with bodily injuries that occur to someone else during a snowmobile accident.

- Property liability: If you crash your snowmobile into someone's house and damage their property, this will cover the damage done. Property liability may also cover damage as a result of a collision with another snowmobiler.

But a basic policy may not be enough for you. And, in many cases, you may want to consider adding several kinds of coverage for your snowmobile, like:

- Uninsured/underinsured motorist coverage: This coverage protects you if another snowmobiler causes an accident and lacks the proper insurance to cover your costs.

- Collision coverage: This coverage can provide compensation for repairs or replacements if you get in an accident with another snowmobiler.

- Accessories coverage: This option can provide compensation for damages to other items closely related to your snowmobile like your trailer, and can even protect you if someone steals your helmets or other safety equipment.

- Comprehensive coverage: Comprehensive covers you for "other than collision" damages, which may include damage from storms, theft, or vandalism.

- Roadside assistance: If you find yourself stranded with a dead battery, lost keys, empty gas tank, or any other reason, you can call for help and get a lift to the nearest repair facility at no cost to you.

Note: If you have a policy and decide to take your sled across state lines, your coverage will keep you protected regardless of their laws.

Is Snowmobile Insurance Required?

Well, yes and no. In a few states, snowmobile insurance is required, like: Pennsylvania, Vermont, New York, North Dakota, and South Dakota.

If you live and ride in these states, you'll definitely want to work with a local independent insurance agent who can help you understand the laws in your state and guide you toward the protection you need.

None of the other states in the US, though, have any sort of legal requirements when it comes to snowmobile coverage. But be careful, if you don’t have insurance and get in an accident that causes damage or injury, you’ll have to tackle medical expenses, legal fees, and repairs entirely out of pocket. And bills like those can really add up quickly.

Why is Snowmobile Insurance Important?

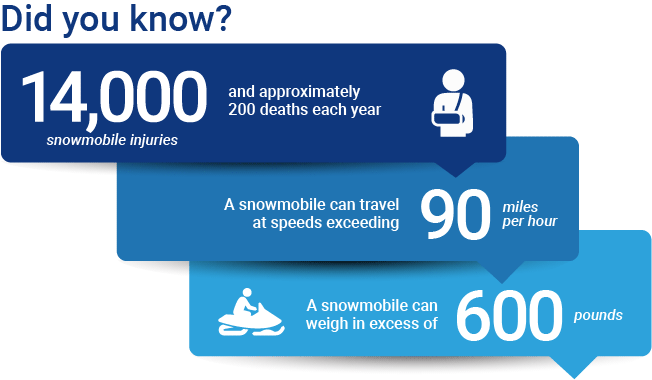

Driving a piece of machinery at 90 mph through snow, ice, and other winter landscapes can be a dangerous adventure. Sure you have a helmet on, but the rest of your body is exposed, and if all the wrong things happen at once you can find yourself, your passengers, and your snowmobile in rough condition.

Just like you wouldn't drive your car around without insurance, protection for you and your snowmobile is important for a number of reasons, like:

- To protect your snowmobile

- To protect yourself if you're injured

- To protect your passengers if they're injured

- To protect someone else who is driving your snowmobile

- To protect yourself if you injure someone else

- To protect yourself if you damage someone's property

- To protect yourself if you damage someone else's snowmobile

When it comes to playing in the snow on a 400+ pound machine, it's better to be safe than sorry.

How Much Does Snowmobile Insurance Cost?

Depends. It all comes down to the types and amount of coverage you need. As you can imagine, a casual rider with pretty lax coverage will pay less than someone who uses their sled all the time with a ton of protective coverage.

On average, your sled insurance should only cost you about $10-$20 a month. And that’s a pretty small price to pay for the incredible peace of mind you’ll have knowing you're financially protected on the trails.

How to Get Cheap Snowmobile Insurance

Insurance for your snowmobile doesn't have to break the wallet. Similar to most insurances, there are a few ways that you can keep your snowmobile insurance cheap.

- Be a safe driver: Like with all insurance, the better your driving record is the less of a risk you are to insurance companies.

- Have experience: You can't control your age, but an older, more experienced driver will be charged less for snowmobile insurance than a young driver.

- Take a safety course: Some insurance companies may offer a discount if you prove you've taken a snowmobile driving safety course.

- Pay your premium in full: Ask your independent agent if paying your premium in full will save you money in the long run.

- Look into automatic payments: An insurance company may offer a discount if you set up your insurance premium payments on automatic withdrawal from your bank account.

- Lower coverage during the summer: Chances are you won't be using that snowmobile over the summer, so you can save some money by lowering your coverage during summer months. However, be cautious of losing discounts from bundled coverage if you choose to lower your coverage during warmer months.

- Combine with home and auto insurance: Bundling insurance packages can help save hundreds of dollars on premiums across the board.

Bundling Snowmobile Insurance

As reasonably priced as snowmobile insurance is, it never hurts to save a few extra bucks a month. Fortunately, bundling with existing policies is one of the easiest ways to get the discounts you deserve on insurance.

You can usually get insurance discounts when you combine your snowmobile insurance policy with others like your homeowners, your auto, your ATV, and your umbrella.

Not only that, but combining your insurance policies under one agency also ensures you’re covered properly and makes handling any claims that may come up all the more simple. And who couldn't use a little extra simplicity in their life?

The Benefits of an Independent Insurance Agent

Insurance policies can be complex. And searching through company after company for the right snowmobile insurance can be extremely time-consuming and overly frustrating.

An independent agent's role is to simplify the process. They work with multiple insurance companies on a daily basis so they know all the pros and cons to each and can help you navigate the playing field.

Plus, they'll break down all the fancy insurance jargon and fine print to make sure you're confident that you've got the right coverage for your unique snowmobiling needs.

Finding and Comparing Snowmobile Insurance Quotes

An independent insurance agent will review your needs and help you evaluate which snowmobile insurance coverages make the most sense for you. Then, they'll start shopping from some of the best companies out there to bring a number of different options to the table.

You'll review them together with your agent, walk through all the fine print, get all your questions answered, and pick which is right for you. It just doesn't get any easier than that.