What Is Short-Term Rental Insurance?

Why you might need short-term rental insurance, where to find it, and more.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

You may already have a rental property that you can't wait to host tenants in. But there's always a risk of a number of different incidents when you invite the public to rent from you. Unfortunately, your guests may not leave your place in the same condition they found it, which could create huge potential losses for you without the right coverage.

If you're renting out your home or other property for any length of time, you'll need to make sure you’re protected. An independent insurance agent can help you find the right short-term rental insurance coverage to protect your property from damage or destruction caused by your tenants.

What Is Short-Term Rental Insurance?

Short-term rental insurance is a specialty coverage or endorsement that’s added to a homeowners insurance policy to protect you and your personal belongings from damage due to a number of causes. Short-term rental insurance only applies if you'll be renting out a property for a term that your insurance company considers to fall within that category.

If you're renting out your property for six months or more, you'll need a different kind of coverage like landlord insurance or rental dwelling coverage. Further, if you plan to turn your property into a short-term rental on a regular basis, this would constitute a business requiring a different policy entirely, such as hotel insurance, or bed and breakfast insurance.

What Does Short-Term Rental Insurance Cover?

Short-term rental insurance covers potential disasters that may extend beyond obvious examples. Your paying guests may even cause an insect infestation or attempt identity theft. Luckily, short-term rental insurance can cover many different types of risks.

What short-term rental insurance covers:

- Your personal belongings: Coverage includes property damage to, destruction, or theft of your personal belongings stored on the premises by your renters.

- Liability costs: Coverage includes reimbursement for legal costs if you get sued by your renters for claims of bodily injury or personal property damage while they're staying at your residence.

- Dwelling damage: Coverage includes property damage to the dwelling or structure of your home or other rental property caused by fire, vandalism, etc.

These are just the basic coverages provided by many short-term rental endorsements. An independent insurance agent can help you add any extra coverages you may need.

How Popular Are Short-Term Property Rentals?

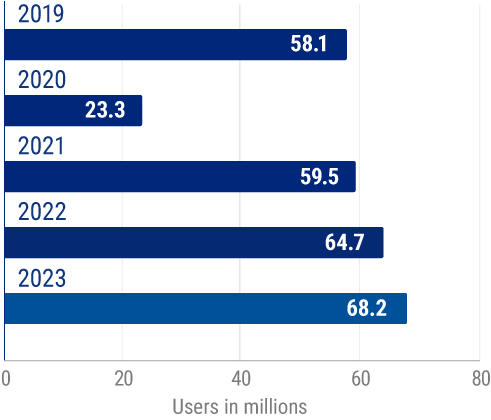

You might be surprised by just how many folks choose to rent out their property on a short-term basis. Check out the chart below and see for yourself.

Number of short-term rental home-sharing users in the U.S. (in millions)

Over the past five years, the number of short-term rental home-sharing users has increased significantly. At the beginning of the observed period, 58.1 million folks reportedly stayed in home-sharing rentals.

With short-term rentals in shared homes being an ever-growing economy, it's crucial for all participants to have the proper coverage secured from the start. An independent insurance agent can help you accomplish just that.

Is Short-Term Rental Insurance Mandatory?

Short-term rental insurance isn't mandatory by law, but it's crucial coverage to have if you'll be allowing renters to stay on your property. Without the right extra coverage or endorsement, you could be stuck paying repair or replacement costs out of your own pocket if your guests cause damage. You might also find yourself on the wrong side of a lawsuit filed against you by your guests if they claim to have been harmed by or on your property.

Does Homeowners Insurance Cover Short-Term Rentals?

Your homeowners insurance most likely will not cover property damage or liabilities arising from a short-term rental situation. Standard homeowners policies often have exclusions about renting in general. That's why it's important to work with an independent insurance agent to find the right coverage to protect yourself and your property if you decide to rent it out.

Why Do You Need Short-Term Rental Insurance?

Short-term rental insurance is required to protect your home or other property if you choose to rent it out for what your insurance company considers a short amount of time. If you rent your home through a service like Airbnb, the coverage provided by that platform isn't enough to protect you. Your home insurance also doesn't provide enough coverage to protect you from renters' damage.

DID YOU KNOW?

This year, there are more than 4 million hosts on Airbnb worldwide.

Airbnb is growing in popularity as time goes on, and experienced about a 32% revenue growth within the past year. Further, Airbnb accounts for just a percentage of short-term rental properties. Short-term rental coverage is important to protect hosts from fires, theft, guest injuries, plumbing breaks, and more.

Who Needs Short-Term Rental Insurance?

Property owners who choose to rent out all or part of their property to paying guests use short-term rental coverage to protect themselves in a myriad of ways.

Here are just a few common uses for short-term rental insurance:

- Reimbursement for renter-caused property damage: Whether it's accidental or malicious vandalism, short-term rental insurance can cover the costs of property damage caused by your renters.

- Reimbursement for theft by renters: If your renters steal your belongings, other property, cash, etc., short-term rental insurance can help recover the cost.

- Reimbursement for renter injuries caused by your pet: In case your renters get injured or have their belongings damaged by a pet on your property, fortunately, short-term rental coverage often includes pet liability.

- Reimbursement for bed bugs brought by renters: If you have the unfortunate experience of renting to folks who bring bed bugs into your home or other property, luckily, short-term rental insurance can help cover the costs of treatment. Note: This coverage is typically excluded from most insurance policies. However, there are a few companies that offer endorsements to cover this type of exposure

These are just a few examples of how short-term rental insurance can protect you after a disaster. An independent insurance agent can provide many more.

How Much Does Short-Term Rental Insurance Cost?

The cost of short-term rental coverage will depend on a number of factors. For starters, it will depend on if you need separate coverage or can add it to your home insurance as an endorsement.

Short-term rental insurance can range from $1,500 to $3,500, but the cost will depend on which carrier you go through and other factors. An independent insurance agent can help you find exact quotes for short-term rental coverage in your area.

Companies That Sell Short-Term Rental Insurance

Short-term rental insurance is available from many different insurance companies, and the best way to find the right carrier for you is by working with an independent insurance agent.

Though many insurance companies could offer short-term rental coverage for you, finding it could also depend on the area you live in. Here are a few of the top companies for short-term rental coverage.

| Top companies for short-term rental coverage | Star Rating |

| Progressive |

|

| Nationwide |

|

| American Family |

|

| Farmers |

|

| Allstate |

|

Why Work Together with an Independent Insurance Agent?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best short-term rental coverage, accessibility, and competitive pricing while working for you.

https://www.statista.com/statistics/1191533/home-sharing-economy-users-us/

https://www.iii.org/article/coverage-for-renting-out-your-home

https://www.stratosjets.com/blog/airbnb-statistics/

https://www.macrotrends.net/stocks/charts/ABNB/airbnb/revenue#:~:text=Airbnb%20revenue%20for%20the%20twelve,a%2077.38%25%20increase%20from%202020.