Collision Insurance

(And how you can get started today)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

We do our best to avoid bumping into things while driving, but most of the time a fender bender comes out of nowhere. No one likes running into something they're not supposed to, but fortunately, collision insurance will help you cover the cost of an accident.

An independent Insurance agent is around to find the perfect collision insurance policy for you — they’ll also help you navigate the claims process so you can get back on the road, fast.

There are lots of insurance options when it comes to driving, so what are the benefits of collision insurance?

What Is Collision Insurance?

In short, it’s an agreement between you and an insurance company, where the insurer will help pay to repair or replace your vehicle in the event of collisions with other cars or inanimate objects.

Collision insurance will not cover damage to your vehicle not related to driving, like hail or theft, damage to another person's vehicle, or medical bills. There are different car insurance policies for that.

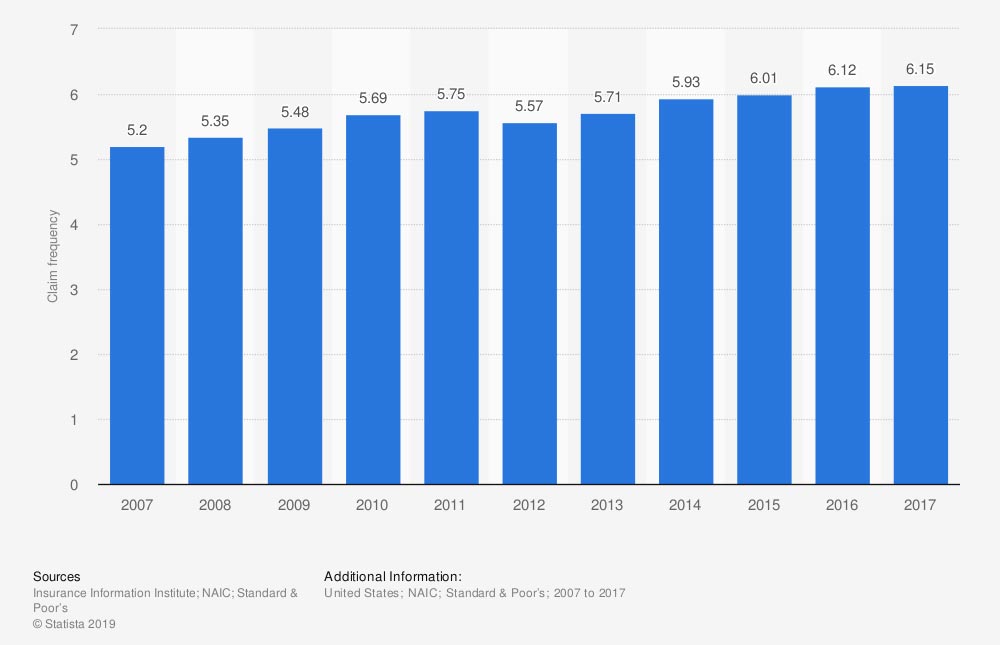

Number of Collision Claims with Physical Damage

For every 100 cars on the road, there are roughly six claims of collision with physical damage.

Is Collision Insurance Mandatory?

Not technically. The only car insurance that’s legally required is liability insurance which covers other drivers and pedestrians in case of an accident. However, car dealerships and banks often require you to have collision insurance if you’re leasing or still making payments.

Why Should I Get Collision Insurance?

A car accident has a major ripple effect on your job, family, and free time — after all, unless you’re an extreme hobbyist or collector, you’re likely to have a car so you can get from place to place. Collision insurance minimizes the time you’ll spend carless and maximizes the time you’ll spend living normally.

There are a few scenarios where it doesn’t make sense: When you’re driving a car whose replacement cost would be cheaper than your annual premiums, or when you have enough disposable income that you could easily pay out of pocket in an accident. For everyone else, we highly recommend it.

What Does Collision Insurance Cover?

Like the name suggests, it covers costs related to collisions with other vehicles or objects like lamp posts and parking meters. It’s there to help you pay for repairs or a replacement, and if you’re leasing your car or still paying it off, it also helps cover that debt if it’s totaled.

How Much Does Collision Insurance Cost?

There’s no one cost for collision insurance since your policy and premiums will be personalized for you and your vehicle. The final price tag will be based mainly on these factors:

- Car value: Expensive cars are more expensive to insure because replacement and repair costs are higher. The opposite is true for cheaper vehicles.

- Safety record: One or two fender benders won’t hurt you too much, but major offenses like DUIs will cause your costs to skyrocket.

- Experience and age: The longer you’ve had your license, the less you’re likely to pay. Age is also a factor — most drivers see a big drop-off in costs after age 25.

- Location: Different regions (called “rating territories”) have different risks that affect costs. For example, drivers in congested cities will likely pay more for insurance because heavy traffic is a risk factor for accidents, even if you’re a good driver otherwise.

An experienced driver with a perfect safety record and a low- to mid-range vehicle will likely pay only a few hundred dollars a year for collision coverage. New drivers with bad records, especially ones with expensive cars, could pay thousands for the same coverage.

Benefits of an Independent Insurance Agent

Your car is one of your most important assets — don’t let mistakes and misunderstandings get between you and the coverage you need.

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. Find an independent insurance agent in your community here.

Comparing Collision Insurance Quotes

Instant online insurance quotes are nice, but algorithms are designed for the lowest common denominator and can miss important details. Independent insurance agents do the hard work behind the scenes so you can enjoy a policy that strikes the perfect balance of meeting your needs and saving you money.