Cheap Car Insurance

(So you can stop grinding your gears over finding a cheap policy)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Whether you roll around in a luxury coupe or that same old ..vehicle that has been in the family for centuries, you need car insurance for it. And no matter what you’ve got parked in your garage, you don’t want to be spending a ton of money on car insurance coverages you don’t even need. But we can help.

Our network of independent insurance agents stretches far and wide and. They’ll shop multiple carriers to bring you the coverage options you need at a price you can feel good about. Nice, right? So let’s get the savings rolling.

Cheapest Car Insurance Companies

| Company | Full Coverage |

| Erie | $771 |

| Mapfre | $949 |

| Country Financial | $1,248 |

| Travelers | $1,279 |

| MetLife | $1,293 |

| Amica | $1,360 |

| NJM | $1,418 |

| Nationwide | $1,509 |

| 21st Century | $1,510 |

| Auto-Owners | $1,545 |

| Shelter | $1,653 |

| CSAA | $1,809 |

The best way to get in touch with these companies is through an independent insurance agent.

Why Cheaper Insurance Could Cost You More

Saving a buck or two always sounds like a good idea at first, but it’s like they say, “You get what you pay for.” If you pay a little, you’re going to get a little. And when it comes to car insurance, a little isn’t going to cut it.

All it takes is one fender bender to show you that those premiums were all just a waste, giving you next to no coverage.

But What About Those 'Name Your Price' Deals?

Some companies have a ‘name your price’ option or some sort of sliding scale where you start with the amount you want to pay and the coverages will increase and decrease to meet it. Not a good idea.

Some of the more important coverages are the first to go when it comes time to cut the fat, and you’re gonna want them when an emergency comes.

But the Late Night Ad Said $18 / Month?

Some companies run ads late at night for $18/month insurance policies. Well sure, those are real, but the list of coverages is a pretty short one. And your deductible would be so high that pretty much any damage costs that would occur would be entirely out of pocket.

And if you hurt someone and they came after you for medical expenses and legal fees, forget about it. This is why it’s important to have the right coverages in place.

But having the right coverage doesn’t mean you can’t save money on your premiums. But there’s a right way and a wrong way to find cheap car insurance, just like there’s a right way and a wrong way to drive.

The wrong way includes a few of the examples we just went through. The right way includes working with an independent insurance agent to make sure you end up with a policy that suits your needs.

How Can I Cut My Car Insurance Costs?

A lot of factors will go into your car insurance premiums, including the state you live in, your age, the number of drivers, and your driving history.

Highest and lowest car insurance premiums by state: The national average is $1,365

| Highest | Lowest | |||

| Michigan | $2,239 | Vermont | $932 | |

| Louisiana | $2,126 | Ohio | $989 | |

| Florida | $2,050 | Idaho | $944 | |

| Rhode Island | $1,852 | Virginia | $1,013 | |

| Connecticut | $1,831 | Iowa | $1,025 | |

| DC | $1,827 | New Hampshire | $1,039 | |

| California | $1,731 | Wisconsin | $1,084 | |

| Georgia | $1,668 | North Dakota | $1,086 | |

| Delaware | $1,646 | Indiana | $1,091 | |

| Texas | $1,589 | North Carolina | $1,104 |

A standard car insurance policy includes liability, collision, and comprehensive coverage. If liability is the only required coverage, couldn’t you just cut your comprehensive and collision coverage? Not so fast.

That’ll leave you unprotected if you hit another vehicle, and car parts are pretty expensive these days. Plus, with more people on the road than ever before, collision accidents have become more and more common.

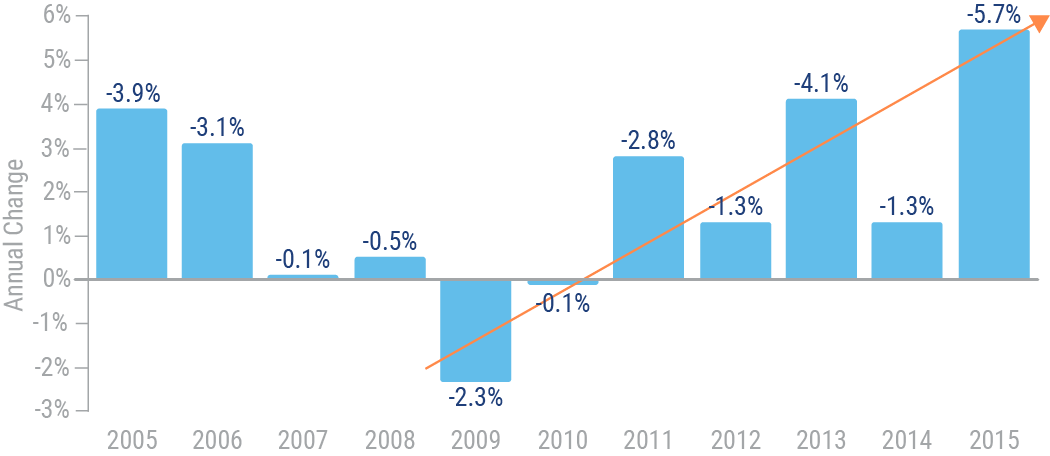

Collision Claims: Severity Trending Higher in 2009-2015

Source: Fast Track Monitoring System, Insurance Information Institute.

But how else can you lower your payments? You can’t change your age, you probably don’t want to move, and we definitely don’t recommend cutting back on your liability or collision coverage. But there are a number of tips and tricks worth considering, like:

- Use an independent insurance agent in your state: We can set you up with an agent who has experience with different companies and isn’t afraid to talk to you about which companies they represent.

- Spill the beans: The more your agent knows about you and your driving habits, the better they can shop around for cheap car insurance.

- Combine policies: You can save between 5% and 25% on your premiums by bundling your home, auto, and life insurance policies.

- Take your limits to the maximum: Sometimes opting for the maximum liability limits will actually lower your premium. In an insurance company’s eyes, someone who purchases the max insurance coverage is a less risky driver.

- Consider the age of your car: If your car isn’t worth very much money, consider dropping physical damage coverage.

- Drop the extras: Some common extras you may be able to do without, based on your lifestyle, include medical payments — covered by your health insurance — towing and labor, rental insurance, and glass breakage.

- Consider company kickbacks: Many companies will reward you for driving safely, being loyal, and your age. Work with your agent to explore all your options for extra discounts.

Average Car Insurance Premiums by Age

| Age group | Average rate |

| 16-19 | $2,999 |

| 20-24 | $2,040 |

| 25-29 | $1,707 |

| 30-34 | $1,591 |

| 35-39 | $1,610 |

| 40-44 | $1,603 |

| 45-49 | $1,478 |

| 50-54 | $1,284 |

| 55-59 | $1,214 |

| 60-64 | $1,169 |

| 65-69 | $1,244 |

| 70-74 | $1,187 |

| 75 and up | $1,203 |

What’s So Great about Independent Insurance Agents?

You want your car insurance to pay off in money, quality of service, and speed of filing a claim. There are more than 6,000 insurance companies in the United States. Independent insurance agents exist so that you don’t have to wrap your head around that number.

When you’re looking at your two lowest quotes from Company A and Company B, you’re most likely looking at the numbers, but your independent agent will be looking at the whole picture. On top of that, your agent will be located in your city, so if the going gets tough you have face-to-face assistance.

The Lowdown on Online Quotes

If you’re staring at an $18/month car insurance ad on Google, look away. We understand that time is of the essence, and you want cheap car insurance and you want it now. Most carriers offer same-day car insurance coverage these days, whether you buy online or with an agent. But take the 30 minutes you would spend banging your head against the wall and connect with an independent insurance agent.

Our independent insurance agents will review your needs and help you evaluate which coverages make the most sense and which cost-saving tactics apply to you.

They'll also compare policies and quotes from multiple insurance companies to make sure you have the best protection out there at the perfect price. They'll hook you up — in a comprehensive and affordable way.

https://cars.usnews.com/cars-trucks/car-insurance/cheapest-car-insurance-companies

https://money.cnn.com/pf/money-essentials-car-insurance/index.html