Personal Injury Protection

So you know you are covered when it matters most

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Every year there are more than six million non-fatal motor crashes in the US. But even most non-fatal crashes result in injury. Should you get injured in an accident without personal injury protection insurance, you will be paying expensive medical bills out of pocket.

An independent insurance agent is the most suitable resource when it comes to obtaining personal injury protection. They have dealt with various insurance companies and have the knowledge of the best carrier to fit all your insurance needs.

What Is Personal Injury Protection Insurance?

Personal injury protection, also known as PIP, is a type of car insurance coverage that is endorsed or included on your auto insurance policy. This coverage is mandatory in some states and offered as an optional add-on in others.

Personal injury protection insurance will help pay for medical bills related to an accident, regardless of who is at fault. It will also cover accidents that occur when you're not driving, such as riding your bike or riding in someone else's car.

Is Personal Injury Protection Insurance Mandatory?

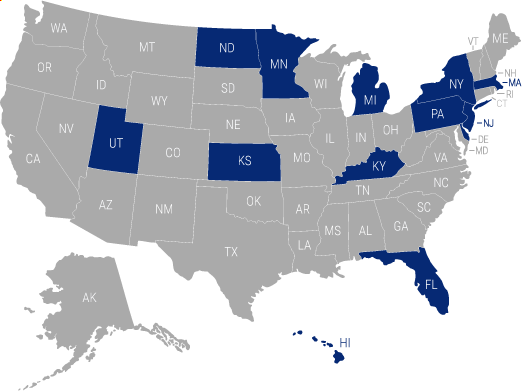

Currently, personal injury protection insurance is only mandatory in twelve states and is referenced below. These are no-fault states, which means you're in charge of your own injuries and damage in the event of an accident.

Typically, if you're in an accident with another person and it's not your fault, their insurance will pay for any damage or injuries. In no-fault states, everyone involved in an accident is required to file a claim with their own insurance, regardless of who is at fault.

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

PIP is automatically included in your auto policy in these states unless you sign a refusal of coverage letter. In the remaining states, personal injury protection insurance can still be available but it is not required.

What Is the Minimum Personal Injury Protection Needed by State?

If you live in a mandatory no-fault state, then you’re required to have the following minimum PIP coverage:

| State | Minimum |

| Florida | $10,000 |

| Hawaii | $10,000 |

| Kansas | $9,000 |

| Kentucky | $10,000 |

| Massachusetts | $8,000 |

| Michigan | $20,000 |

| Minnesota | $40,000 |

| New Jersey | $15,000 |

| New York | $50,000 |

| North Dakota | $30,000 |

| Pennsylvania | $5,000 |

| Utah | $3,000 |

Depending on your personal situation, you may want to purchase more than the minimum required personal injury protection insurance. The average cost of an ER visit after a car accident is $3,300. If the victim needs to be hospitalized, that cost increases to $57,000.

Why Do You Need Personal Injury Protection Insurance?

In the event of an accident, PIP protects you, your family, and anyone in the car from out-of-pocket medical expenses. It will even cover you when you’re riding in other people’s cars or if you’re riding on the back of a motorcycle. The coverage can prove to be very useful, especially if you have a high medical insurance deductible.

Even if you're not located in a no-fault state, PIP can protect you if you're in an accident with an uninsured or underinsured driver. If you spend a lot of time behind the wheel, it can provide an extra layer of protection against the risks you face on the road.

What Does Personal Injury Protection Insurance Cover?

Policies vary from state to state. PIP will typically cover any accidents and injuries involving a moving vehicle of any kind. Whatever the type of vehicle used, coverage will be available.

Most of the time, PIP fills in the gaps so you are not responsible for paying medical bills due to a vehicle accident. It can also provide coverage for lost wages, funeral expenses, and replacement services.

PIP coverage can include the following:

- Medical bills: PIP will cover any medical bills related to hospitalization, operations, and additional medical care.

- Lost wages: If you’re injured to the point of not being able to go back to work, PIP will provide up to six weeks of coverage for your lost wages.

- Funeral services: If someone dies in a vehicle accident, PIP will help pay for funeral costs.

- Replacement services: In the event that your injury makes you unable to continue to do everyday living activities such as mowing the lawn, PIP will provide funds for someone else to come out and perform those functions until you are able.

Your personal injury protection will not cover any damage that is done to your vehicle, vehicle theft, or any damage to someone else's property. It also will not cover any medical expenses not related to the accident or that exceed your policy limits.

How Much Does Personal Injury Protection Insurance Cost?

PIP can cost from as little as fifty dollars per month up to a couple of hundred. It depends on your age, the make and model of your vehicle, and the amount of coverage you desire. It may not be the least expensive coverage on your auto policy, but it is vital to proper protection.

Is Personal Injury Protection the Same as Liability Insurance?

Liability insurance is a required type of coverage in most states. It is designed to help pay for any medical expenses for someone else if you're in an at-fault accident. Under a liability car insurance policy, you do not receive coverage for your own injuries.

A personal injury protection policy covers you in the event of an accident. No matter who is at fault, if you come out with injuries and need to be hospitalized, your PIP policy will help with the financial losses.

DID YOU KNOW?

More than two million people are injured in US motor vehicle crashes every year.

Do You Need Personal Injury Protection If You Have Health Insurance?

If you're injured in a car accident, your health insurance will step in to pay for the medical bills. However, PIP can help meet your health insurance deductible in the event of an accident. The coverage is meant for each individual named insured, and no one else is allowed to file a claim on your PIP coverage.

In addition to providing medical coverage for you, PIP will also include coverage for lost wages and replacement services, which most health insurance plans do not cover.

The Benefits of an Independent Insurance Agent

An independent insurance agent is the best educator when it comes to personal injury protection coverage. They work with a number of different insurance companies and can find not only the best insurance coverage, but also the most competitive pricing.

Since they are knowledgeable about a variety of insurance products, they can help you narrow down which policy is right for your specific circumstances.

Most importantly, they’ll be there to help you file a personal injury protection claim. The outcome of insurance claims can be strongly impacted by how the process is approached and handled.

Finding and Comparing Personal Injury Protection Insurance Quotes

Working with a well-vetted independent insurance agent will ensure that you receive the right coverage from a variety of options. Comparing different insurance policies is to your benefit, and so is your independent insurance agent.