ATV Liability Insurance

Sometimes a required coverage, ATV liability insurance can reimburse you for lawsuit expenses in the event of third-party injuries or property damage caused by your vehicle.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Incidents can happen out on the trail or in the backwoods at any time. Many drivers of off-road vehicles have experienced a mishap or injury at some point. ATV liability insurance is designed to help you pay for the expenses associated with an accident, whether people, property, or both are involved.

Contact a local independent insurance agent today to get set up with the right policy. Whether you’re looking for 3-wheeler insurance or coverage for your UTV, an independent insurance agent can help you find the appropriate amount of protection. Until then, here's a breakdown of ATV liability insurance, what it covers, and more.

What Is ATV Liability Insurance?

Liability is defined as legal responsibility for your acts or omissions. You can be held responsible for causing harm to another person or their property due to an accident or another incident involving your vehicle.

ATV liability insurance protects you from high costs associated with lawsuits due to accidents and injuries. Having coverage can help you recover financially after you're faced with a lawsuit. Otherwise, you could have to pay potentially hefty costs out of your own pocket.

Does Homeowners Insurance or Car Insurance Cover ATV Liability?

Though both homeowners insurance and car insurance include liability coverage, most likely, your ATV isn't covered by either policy. In some cases, home insurance might provide limited liability protection for your ATV, but not always.

You may also lack enough coverage to fully recuperate from an incident if you rely on your home insurance to protect your ATV. Review your coverage with your independent insurance agent to determine if a separate ATV liability insurance policy is necessary.

What Does ATV Liability Insurance Cover?

Understanding what ATV liability insurance covers is critical in case an incident occurs. Note that ATV liability insurance doesn't cover damage to your personal ATV. Though policies can vary slightly, in general, the coverage provided includes:

- Property damage: This coverage pays for repairs up to your defined limits in the event of collisions and damage to third-party property.

- Bodily injury: This coverage pays for the associated bodily injury costs, up to your limit, if an accident occurs and the other rider needs to seek medical attention.

- Legal fees: Liability insurance often covers your legal defense should a lawsuit be filed against you after a collision.

ATV liability insurance is designed to offer financial reimbursement in case a third party files a claim against you for bodily injury or personal property damage. It can cover court costs, attorney, and other legal expenses, including any settlements you're ordered to pay.

Is ATV Liability Insurance Required?

You may be required to carry ATV liability insurance by law. Certain states require ATV owners to have liability coverage if they ride their vehicles on public or state-owned property. You might also find that you're required to carry this coverage if you finance your ATV.

What Are the Limits on ATV Liability Coverage?

Depending on the policy you select, your ATV liability insurance comes with certain limits that are important to be aware of. ATV liability policies have three primary limits:

- Bodily injury for one person

- Bodily injury for all persons involved

- Property damage

You choose limits in these areas when you purchase your quad or 3-wheeler insurance plan. If your policy has a 30/60/15 limit and you get into an accident, your insurance plan will pay up to $30,000 for one person’s injuries, up to $60,000 for all injuries in the accident, and up to $15,000 for property damage.

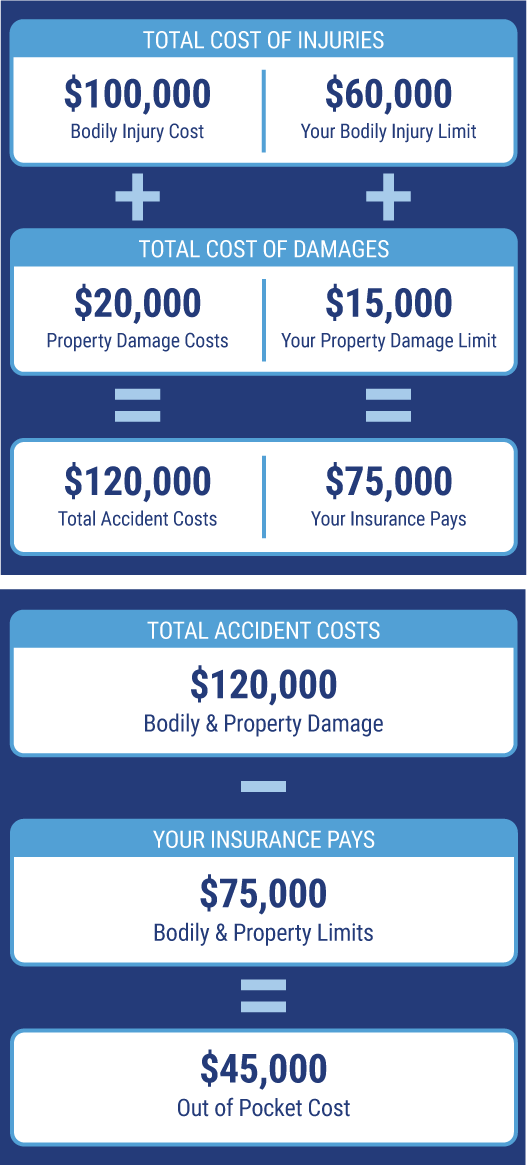

In a scenario where you cause an accident that results in $100,000 in injuries to the other rider and a passenger and $20,000 in property damage, altogether, the cost of the accident is $120,000. This is illustrated in the following example:

How ATV Liability Limits Work

Because the cost of bodily injury exceeds your coverage limit by $40,000, and the cost of property damage is $5,000 higher than your limit, you would owe $45,000 out-of-pocket to cover this claim.

Get Extra Protection with an ATV Umbrella Policy

The costs associated with injury, property damage, and legal fees can add up fast, and can quickly exceed the limits you have set on your policy after an accident. To protect yourself from incurring costs that surpass the limits of your ATV liability coverage, you may want to consider purchasing umbrella insurance.

Umbrella insurance kicks in once your existing policy's liability coverage limit has been exhausted. These policies can stack on top of home insurance, auto insurance, ATV insurance, and other policies. In the example claim illustrated above, umbrella insurance could cover the remaining $45,000 you owe.

How Much Does ATV Liability Insurance Cost?

The cost of ATV liability insurance can depend on several factors, including the limits you set and your deductibles. To save money on off-road vehicle insurance, consider choosing a quad or 3-wheeler with a less powerful engine because this can have a dramatic impact on the affordability of your insurance. You can also choose higher deductibles, maintain a good driving record, and ask your agent about ATV insurance discounts you might qualify for to make your coverage more affordable.

An Independent Insurance Agent Can Help You Find ATV Liability Insurance

Find an independent insurance agent today to learn more about ATV liability insurance. Because these agents are independent, they can compare rates from multiple providers and help you choose a plan that meets your needs and budget. Your agent will learn about your unique ATV and its uses before selecting your policy. And down the road, your agent will still be there to help you file ATV insurance claims or update your coverage as necessary.

https://www.allstate.com/resources/powersports/atv-liability-insurance