Fixed Annuities Pros & Cons

Here's why you might want to consider getting a fixed annuity.

Jeff Green has held several positions at life insurance companies, Wall Street firms, and distribution organizations over his 40-year career.

One way to avoid serious financial injury is to use the right "financial tools" to accomplish your goals. There are plenty of investment choices to accumulate wealth and create retirement income. Depending on your specific goals, you might choose to get a fixed annuity.

Independent insurance agents are experts when it comes to helping you pick the right tool for the job. They can help advise on whether a fixed annuity is right for you. But for starters, here's more about fixed annuities and why you might want one.

What Is a Fixed Annuity?

Fixed annuities are one option you have for a financial product that guarantees a specific rate of return. So, the answer to the common question, "Are fixed annuities guaranteed?" is yes. A fixed annuity provides a steady, guaranteed income stream during retirement. The rate of return can vary depending on the annuity, but it might be 2%.

Fixed interest rates allow the annuitant (i.e., the person with the annuity) to have an exact idea of how much interest the annuity will accumulate and pay out over time. That makes it easier for folks to plan for their retirement expenses along the way.

Are Fixed Indexed Annuities a Good Investment?

Fixed annuities are insurance products designed to accumulate money. Some fixed annuities can accept regular contributions, while others accept only one. Fixed annuities have guaranteed rates of interest and guaranteed principal. These are features that are similar to bank products like CDs but may be a smarter choice for many.

Fixed annuities often pay higher rates of interest than CDs. That's because the way the insurance company can offer a rate tends to be more favorable than what the bank can do.

The big difference is that your CD money is guaranteed by the FDIC, an agency of the federal government. Annuities are guaranteed by the insurance company. If the insurance company fails, your money may be at risk.

How Are Fixed Annuities Taxed?

Fixed annuities are tax-deferred. The interest that is paid by the insurance company is not taxable until the money is withdrawn. That means the money you would have paid stays in the annuity and grows until you take it out. The interest on CDs is taxed every year.

By the way, both fixed annuities and CDs are taxed at ordinary rates, not the more favorable capital gains rate. The higher your tax bracket, the bigger benefit you get from tax deferral.

Fixed Annuities and Retirement Income

There are a number of ways to create retirement income. Some people have pension benefits that pay income for the rest of their lives.

These days, however, traditional pension benefits are mainly available to public employees. Social Security represents an important source of retirement income for most people, but even at the maximum, it’s not enough.

Retirement income can be created using stock dividends and interest payments from bonds, either individually or using mutual funds, exchange-traded funds, and real estate investment trusts. The value of these investment options and the income they produce can change based on market conditions.

Fixed annuities create a guaranteed income for life. It's similar to having a traditional pension benefit. The income can be structured for a single lifetime or as joint and survivor for two lives.

However, there is a downside to fixed annuities. The purchasing power of fixed annuity payments declines with inflation, and the guarantee is only as good as the financials of the insurance company.

Do Fixed Annuities Have Fees?

If you need access to your money for emergencies or other short-term needs, fixed annuities are not a good choice. There are fees associated with withdrawing money from a fixed annuity. These include:

- Surrender penalties: Fixed annuities have surrender penalties, typically for three to 10 years. And they can be significant, as much as 10% of the money withdrawn. Fixed annuities allow a penalty-free withdrawal, usually 10% of the account value.

- Tax penalties: If you withdraw money before age 59-1/2, you may be subject to a 10% penalty on the taxable portion.

An independent insurance agent can further explain the fees associated with withdrawing money from a fixed annuity and if it's a wise financial decision for you to have one.

How Much Time Do You Have to Grow Your Wealth?

The length of time you have to accumulate wealth should be a consideration for what tools you use. Investments that have a higher risk of loss also have a higher potential for gain. Over the long term, they tend to perform better than lower-risk investments.

In the short term, higher-risk investments can be very painful. Just remember the crisis from 2008 to 2009, when stocks lost 50% of their value.

Financial Rewards or Capital Gains vs. Risk by Financial Asset Type

| Reward Interest, Dividend, Capital Gain | Financial Asset | Risk Default, Capital Loss, Inflation Liquidity |

|---|---|---|

| Interest | Treasury Bonds, Bills, Notes | Inflation (if not indexed) |

| Interest | Certificates of Deposit | Inflation |

| Interest | Fixed Annuities | Inflation, Liquidity, Default |

| Interest, Capital Gains | Corporate Bonds | Inflation, Liquidity, Capital Loss |

| Dividends, Capital Gains | Real Estate Investment Trusts (REITs) | Inflation, Capital Loss |

| Capital Gains, Dividends | Mutual Funds, Exchange-Traded Funds | Inflation, Capital Loss |

| Capital Gains, Dividends | Stocks | Inflation, Capital Loss |

| Capital Gains | Collectibles | Liquidity, Capital Loss |

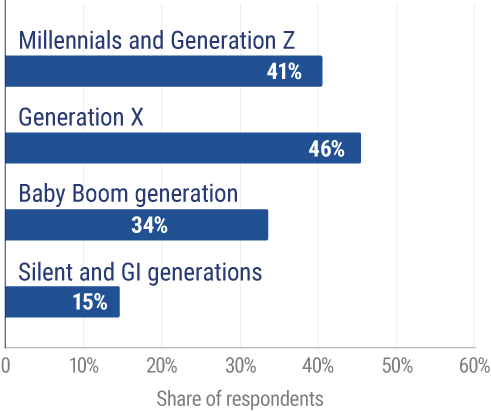

If your allotted time to accumulate wealth is 10 years, you may be willing to take more risks to get more return. The chart below illustrates attitudes toward investments as people age.

Willingness to take above-average or substantial investment risks in the United States in 2021, by age of household's head

In recent years, Generation X demonstrated the highest willingness to take investment risks by far. Fixed annuities can make sense for pre-retirees who want low-risk investments.

What Other Options Are Available to You?

Consider all the alternatives available, especially if your goal is to accumulate retirement money. Employer-sponsored plans are often the most effective choice. IRAs and Roth IRAs are good options as well, but there are limits on the tax deductions and contribution levels based on your income.

Fixed annuities can be used in IRAs and some types of qualified plans, but they don't provide any additional tax benefits. Fixed annuities can be a good choice for people who have maxed out their retirement plan contributions and want a predictable, low-risk investment.

Protecting Your Money

Fixed annuities can protect your money in several ways that most investment options don't. The first is the guarantees of the insurance company. Life insurance companies are regulated and monitored by the state insurance department of each state they do business in. Life insurance companies have to maintain sufficient reserves to meet policyholder obligations.

They also have to meet other financial standards the state insurance commissioner sets. Most states use the standards recommended by the National Association of Insurance Commissioners. Each state has a guarantee fund to reimburse policyholders if the life insurance company fails. The limits are different for each state.

The guarantees, of course, are only as good as the insurance company's ability to make good on them. Financial strength ratings of insurance companies are available from AM Best, Fitch, Moody’s, and Standard & Poor.

Fixed annuities can be protected from lawsuit judgments or bankruptcy. For some people who may be more likely to be sued (e.g., doctors, corporate executives, etc.), protecting their assets from creditors can be a very important reason to buy an annuity.

Most states offer annuities some form of creditor protection. Some states protect all of the annuity proceeds from creditors, whereas others just protect the beneficiary's interest.

Should You Buy a Fixed Annuity?

Fixed annuities are a predictable, low-risk way to accumulate money and create guaranteed income you can't outlive. They can work especially well for people in higher tax brackets with time limits of three to five years. But they don't work for everyone.

Financial goals and preferences are as individual as you are. Also, there are many ways to get to where you want to go. An independent insurance agent can always advise you on whether investing in a fixed annuity is the right choice for you or if it makes more sense to opt for another financial tool to grow your wealth and provide a steady retirement income stream down the line.

How to Invest in a Fixed Annuity

There are a couple of options for investing in a fixed annuity. You can buy a fixed annuity by paying a lump sum of money upfront, or you can choose to make multiple payments over time. Afterward, your insurance company will guarantee the interest rate that your account will accumulate over time.

Frequently Asked Questions about Fixed Annuities

Fixed-rate annuities or fixed annuities offer guaranteed interest rates based on your initial premium deposit. Indexed annuities come with interest rates determined by their market index's performance (e.g., Standard & Poor's 500 or the Dow Jones Industrial Average). Indexed annuities offer a potentially higher rate of returns than fixed annuities do.

The insurance company bears the risk with a fixed annuity contract.

Though there's always some risk with any financial product, fixed annuities are among the safest options available. A fixed annuity offers one of the safest retirement investments thanks to its guaranteed rate of return.

The risk falls on the insurance company with a fixed annuity.

A fixed annuity guarantees a rate of return and/or a guaranteed income.

RMD refers to Required Minimum Distributions. Fixed annuities are subject to RMD only if they are held by an IRA or qualified plan.

Fixed annuity rates have been increasing quite a bit in recent years, and the trend is expected to continue.

Here are some sample fixed annuity interest rates today:

- 2-year fixed annuity: 4.50%

- 3-year fixed annuity: 5.65%

- 5-year fixed annuity: 5.40%

- 7-year fixed annuity: 5.45%

- 10-year fixed annuity: 5:45%

The Benefits of an Independent Insurance Agent

When it comes to fixed annuities and other retirement investment options, browsing for the right choice for you can be exhausting and time-consuming. Independent insurance agents simplify the process for you by shopping and comparing your options and presenting you with only the best. They'll be able to help you get set up with a fixed annuity at the best possible rate.

https://www.annuity.org/annuities/rates/

https://canvasannuity.com/blog/are-annuities-safe

https://www.statista.com/statistics/255780/willingness-to-take-above-average-or-substantial-investment-risks-by-age/