Annuity Values

(Because you should know what to expect from your retirement investments.)

As you know, annuities are a great, and fairly common, way to invest your money for your retirement years. And depending on the type of annuity you choose to invest in, your return will vary. So how are you supposed to know which to choose, and what the value of your annuity is?

That's where having an independent insurance agent in your corner is always a good idea. Independent insurance agents are experts in the field of annuities and all insurances who can answer all your questions to help pair your goals, needs, and budget with the right annuity option for you.

They'll help find the best rates and companies for your situation and walk you through every step of the way. It just doesn't get any easier than that. But first, here's a bit of background on all types of annuities and their values to help get you started.

First Things First — What’s an Annuity?

Annuities are policies issued by insurance companies. They pay a regular guaranteed income for life or a period of years. You buy an annuity policy by making a single payment or a series of payments.

- Deferred annuities accumulate money for a period of time before the policy pays income.

- Immediate annuities start paying income right away.

- Qualified annuities are part of a pension plan or IRA. They are purchased with before-tax dollars. Qualified Roth annuities are part of a Roth IRA or pension plan. They are purchased with after-tax dollars. Non-qualified annuities are personally owned and paid for with after-tax dollars.

Deferred Fixed Annuity Values

Fixed deferred annuities accumulate money at a stated rate of interest. The values of a fixed annuity are guaranteed by the insurance company. The guarantees apply to:

- The cash value: The payments accumulated at the interest rates applied. The cash value is the total money at work.

- The surrender value: The cash value minus any charges for cashing in the policy. The surrender value is the money available to you.

- Death benefit: This is the minimum value your beneficiaries receive.

Deferred Fixed-Indexed Annuity Values

Fixed-indexed annuities offer growth potential without stock market risk. Index accounts credit some of the gains of a market index like the S&P 500 and none of the losses. The portion of gains credited is measured by a formula. The values of a fixed-indexed annuity are guaranteed by the insurance company. The guarantees apply to:

- The cash value: The payments and interest credits applied. The cash value is the total money at work.

- The surrender value: The cash value minus any charges for cashing in the policy. The surrender value is the money available to you.

- The minimum surrender value: The lowest amount you will receive if you surrender the policy.

- Death benefit: The minimum value your beneficiaries receive.

Deferred Variable Annuities

Deferred variable annuities accumulate money in investments selected by the owner called subaccounts. Like mutual funds or other investments, the value of the subaccounts is based on market performance. They aren’t guaranteed.

- The account value: This is the purchase payments and investment growth. The account value is the total money at work.

- The surrender value: This is the account value minus any surrender charges. The surrender value is the money available to you.

- Death benefit: This is the minimum value your beneficiaries receive.

Immediate Annuity Values

Immediate annuities and deferred annuities make regular payments in the income phase to the owner for a period of time. Some insurance companies will allow an owner or beneficiary to stop the payments in exchange for a lump sum of money. The amount of the lump sum is called the commuted value. It's the present value of all the future payments at an assumed rate of interest called the discount rate.

There are also factoring companies that buy annuity payments and they use the same process. The price that they offer is determined by the discount rate that they use. The higher the discount rate, the lower the price offered.

Annuity Rates And Immediate Annuities

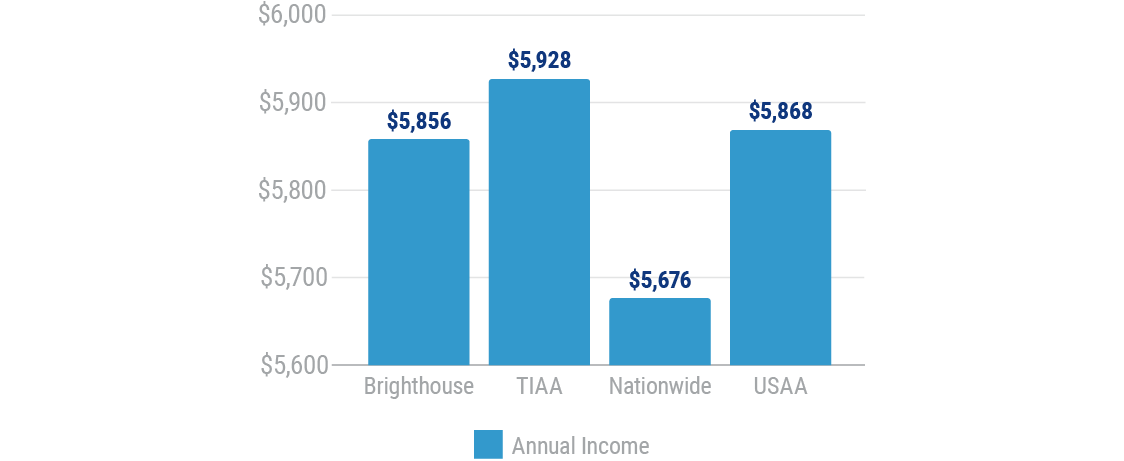

Fixed immediate annuities start to pay income 30 days to 1 year after the purchase payment is made. The annuity rate is applied to the purchase payment to calculate the guaranteed income. Fixed immediate annuity rates are based on age, sex, and interest rates. Some insurance companies offer more competitive rates than others. Here’s an example:

Variable immediate annuity income options are based on how the market performs. So the income in some years could be higher than in others. The assumed rate of interest is what insurance companies use to calculate the initial variable income payments from an annuity. The initial payment is calculated based on your age, sex, the assumed rate of interest, and the purchase payment.

If the investments that you selected perform better than the assumed interest rate, your payment will be higher. If the performance of investments that you selected are lower than the assumed interest rate, your payments will be lower.

The advantage of a fixed immediate annuity is there are no surprises. The downside? Inflation can eat away at the purchasing power of a fixed annuity payment. In fact, if you retired in 2009 on $100,000 you need $119,000 today to buy the same things.

The advantage of a variable annuity payment is the potential for an increasing income to keep pace with inflation. However, if the value of the underlying investment decreases, well, so does the income.

What Next?

If you're considering purchasing an annuity, it pays to shop around. But if you're looking to simplify the whole process, talk to your independent insurance agent, they can help.

Why Choose An Independent Insurance Agent?

Independent insurance agents are experts at helping make sense of the ins and outs of all types of annuities and other financial tools. They have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working entirely for you.

SPIA rates available as of October 28th 2019 From:

Brighthouse Financial

Nationwide

TIAA

USAA