Annuity Future Value Formula

(Discover how to easily calculate the future value of your annuity)

Maybe you’re thinking about investing in an annuity for retirement someday. You’re probably trying to decide the terms of your annuity, like whether you should deposit a lump sum or make a series of smaller payments.

You may also be trying to guess what you might receive in future annuity payments during your golden years. Well, there’s no need to guess when you have a crystal ball known as a future value annuity formula.

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

What’s the Future Value of an Annuity?

Basically the future value of an annuity estimates how much cash you would have in the future at a defined rate of return (aka interest rate or discount rate). In other words, you can use a special formula to anticipate how the money you invest today will grow over time. The higher your annuity’s discount rate then the higher your annuity’s future value (and subsequent payments) will be.

How to Calculate Future Value of Annuity?

Since the value of money is fluid, it adjusts over time. That’s why the money you save today can increase over time through your investments. Obviously this is one of the reasons 401ks are so popular. A little of today’s money deposited into your 401k account can, over time, make more money for your future.

Think about it. Getting $10,000 today is more valuable than $1,000 each year for 10 years. The $10,000 invested right now will be more valuable at the end of the 10 years then receiving the $1,000 each year. Even if you invest the amounts at the same interest rate, today’s money is a larger sum and will have a longer amount of time to accrue additional funds through your investments.

It is possible to anticipate how today’s money can expand through your annuity. Like most anything in the finance world, there’s a formula for that!

Future Value of Annuity Due Sample Problems

Our future value annuity formula example is going to take you back to those fun word problems during 4th-grade math class. Back then you thought word problems were useless, but your future self is thankful you paid attention.

Let’s imagine you decide to save by depositing $2,000 in an account each year for five years. The annual rate on the account is 2%. The initial deposit happens at the end of the first year. If a deposit was made right away then the future value of annuity formula would be used.

If you want to determine the account’s balance after the 5th year, you’d use the future value of an annuity formula to get the answer $10,408.08.

The Nitty Gritty: Future Value of Annuity Formula Derivation

Behind our above example, there is an actual future value of an annuity calculation.

Let’s break down the future value of an ordinary annuity. Remember, an ordinary annuity is when payments are made at the end of the period in question, like at the end of each calendar year.

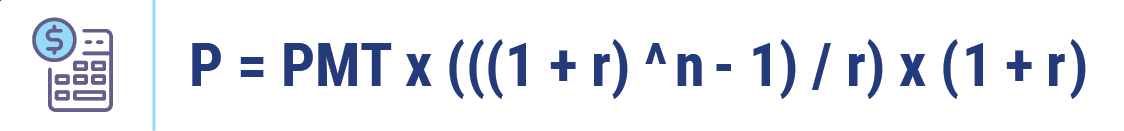

Below is the future value annuity factor formula:

| Where: | ||

| P | = | Future annuity payments |

| PMT | = | Amount of each annuity payment |

| r | = | Interest rate |

| n | = | Total number of periods during which payments are made |

For example, an individual decides to invest $125,000 each year over the next five years. The annuity is expected to pay 8% compounded interest per year. The future value of this payment stream based on the above formula is:

Future value of annuity = $125,000 x (((1 + 0.08) ^ 5 - 1) / 0.08) = $733,325

Future Value Annuity Excel Formula

To make life easier, you may want to calculate the future value annuity using an Excel formula. Let’s say an individual wants to calculate her future balance after 15 years. The rate being offered is 6% and so far $5,000 has been deposited in the account.

Other Future Value Annuity Formulas

As you may know, there are plenty of different formulas and calculations that can be done when you are trying to guesstimate the future value of an annuity. Check out a few more formulas that we dissected for you below.

Future Value Annuity Formula Compounded Monthly

Annuity due payments are made at the beginning of the period. So the calculation is a bit different than an ordinary annuity.

Below is the future value annuity factor formula:

For example, let’s say the individual from our example above has an annuity due rather than an ordinary annuity. This is how the individual’s formula would look.

Future value of annuity due = $125,000 x (((1 + 0.08) ^ 5 - 1) / 0.08) x (1 + 0.08) = $791,991.

Future Value of Growing Annuity Due Formula

A growing annuity is also known as an increasing annuity. The calculation for the future value of a growing annuity tells you the future amount of a series of payments (aka cash flows) that grow at a proportional rate.

| Where: | ||

| P | = | First Payment |

| r | = | rate per period |

| g | = | growth rate |

| n | = | number of periods |

Example: Future Value of Growing Annuity

An individual is paid biweekly and decides to save one of his paychecks per year for retirement. One of his paychecks is $2,000 for the first year and he expects to earn a 5% raise on his net pay each year thereafter. The annuity account has a 3% per year yield. After finishing this calculation, we find his amount after the 5th cash flow would be $11,700.75.

No Crystal Ball Needed

If you’re curious about your future value annuity, then don’t rely on a crystal ball. Instead, simply use one of our formulas to determine how your today’s cash can grow into tomorrow’s income.

Give your neighborhood independent insurance agent a call today about annuities. Experienced agents are always available and ready to help when it comes to your financial future.