Present Value Annuity Formula

(The quick and easy recipe is right here)

There are all sorts of different ways to pinpoint the present value of an annuity. That includes everything from talking to an independent insurance agent, reviewing an annuity table, or even just busting out the old pen and paper and tackling it high school math style.

But no matter what you do, it's important to understand how the present value is established, so you know how your annuity is working for you. And once you've got it down backward and forward, an independent insurance agent can help answer any questions you have and take it to the next step.

An independent insurance agent is a great asset to have in your pocket because they know annuities from every direction — after all, they deal with them every single day. They'll walk you through all your options, simplify all the fancy financial jargon, and make sure you're set up with the right financial protection for your retirement. And you just can't beat that kind of special attention.

But first, it's time to talk about that special formula.

Defining the Present Value of an Annuity

As you probably already know, the present value of an annuity is the amount of cash needed to invest today in order to get a specific payout later. In other words, first, imagine the amount of cash you’d like to get regularly during your retirement.

Second, you'll need to find out how much you’ll need to invest today to make that happen. So it's like working backward. The present value will be your initial investment. Pretty simple, right? But, there is more to it, like math.

What is the Present Value of an Annuity Formula?

Before cooking up the present value of your annuity, you’re going to need to know the ingredients, like:

- Regular payment: This is the regular amount of money you plan on receiving/paying during each period (monthly, quarterly, semi-annually, or annually).

- Interest rate per period: Your annuity’s fixed interest rate (normally an annual percent).

- Number of time periods: The time period used to calculate your interest rate is what you use here.

- Annuity type: Either you have an ordinary annuity that pays at the end of the period (i.e., payments at the end of the month) or you have an annuity due which pays at the beginning of the period (i.e., first of the month).

Present Value of Annuity Factor Formula

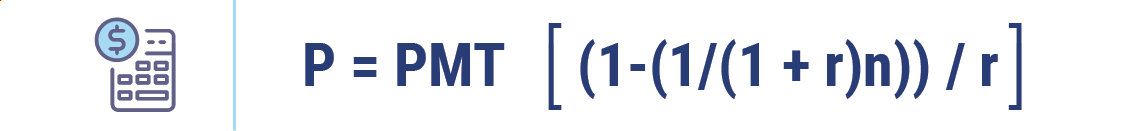

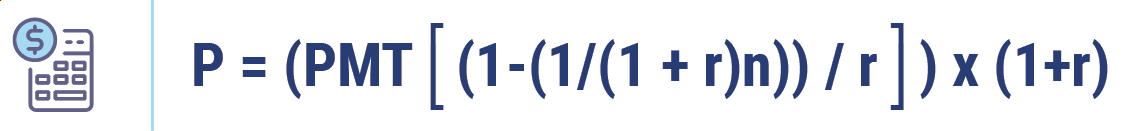

There are all types of different annuities out there, and no two are exactly alike. So when it comes to ordinary annuities versus annuities due, you'll see there are two different ways to calculate the present value, since the payments occur at different points in each period, as shown here:

Where:

P = Present value of the annuity to be paid

PMT = Total of each annuity payment

r = Interest rate (%)

n = Total number of periods during which payments are made

Present Value of an Ordinary Annuity Formula Example

Let’s say Sally has an ordinary annuity and she invested $5,000 at an interest rate of 5% for 10 periods. In this case, Sally would use this formula:

So:

P = 5,000 [(1 - (1 / (1 + .05)10)) / .05]

The Present Value of Sally’s Ordinary Annuity: $38,608.67

Present Value of an Annuity Due Formula Example:

Let’s say Jim has an annuity due and he invested $5,000 at an interest rate of 5% for 10 periods. In this case, he would use this formula:

So:

P = (5,000 [(1 - (1 / (1 + .05)10)) / .05]) x (1+.05)

The Present Value of Jim’s Ordinary Annuity: $40,539.11

Using Excel to Calculate the Present Value of an Annuity

If pencils and scrap paper aren't your thing, you could make life easier by entering your present value of annuity formula into an Excel spreadsheet. There are two different types, one for each annuity. Present Value of Annuity Excel formula can be set up by clicking the fx button then picking the “Finance” category and the “PV” or present value function.

Generic Excel Formula for the Present Value of an Ordinary Annuity

=PV(rate,periods,payment,0,0)

Generic Excel Formula for the Present Value of an Annuity Due

=PV(rate,periods,payments,0,1)

Note: Make sure you enter the “payment” amount as a negative (-) so that the result comes out positive.

So What's Next?

Now that you’ve learned more about the present value of annuity formula than you ever thought you would, it’s time to take that next step. Of course, if you ever have questions or need more info, an independent insurance agent will always be around to have your back and help guide you toward the perfect annuity option for you.