Market Value Adjusted Annuity

(All of the whats, the hows, and the whys that you've been looking for)

Annuities are a great way to save for the future. And really, investing in one isn't that hard. But when it comes to knowing all the little details that can raise and lower your return, it can be confusing. Like market value adjustments, do you know about that?

No worries, an independent insurance agent can help you out. Independent insurance agents live and work all over your community and are always ready to answer all your annuity questions and help set your financial future on the right path.

And when it comes time to shop for your annuity, an independent agent can help simplify the whole process by pricing out different options and walking you through your best choices. But first, here's more on market value adjusted annuities and what all of that means to you.

What is a Market Value Adjustment?

The definition of a market value adjustment (MVA), put simply, is a feature associated with annuities that lay out interest rate guarantees along with an interest rate adjustment factor. Usually, the MVA is applied to what the industry calls a modified guaranteed annuity (MGA).

The market value adjustment normally kicks in when it comes time to cash in your modified guaranteed annuity. And when you cash in your market value adjusted annuity, you will be charged a surrender penalty.

You might also hear the term “fair market value annuity,” which is just another way to say your annuity’s worth will change as the market interest rates change. The cash amount you get at the time of surrender might be higher or lower than what was estimated at the time you got the annuity account.

Don't worry, though. You’ll never get less money back than what you put into your annuity.

How Does the Market Value Annuity Work?

Basically, with a market value adjusted (MVA) annuity, you’re assuming the risks that come with fluctuating interest rates. But the good news is that the insurance carrier will pay you a slightly higher rate than it pays on book value annuities (non-MVA accounts).

The whole "timeline" of a market value annuity looks like this:

- You’ll go through an independent insurance agent or company to find an annuity option you like.

- Then you put money into the annuity account which earns a fixed rate of interest.

- Next, the insurance company holds onto your annuity's money for a guaranteed rate period.

- At the end of the guaranteed rate period, there’s usually a small window of about 30 days where you can withdraw money without penalties.

- If you don’t do anything with your annuity, the insurance carrier will give you a new rate. This new rate will be based on the current market and a new market value adjusted annuity surrender penalty and MVA period will begin.

After the guaranteed rate period, the insurer will give you a new interest rate (aka renewal rate) based on the current market. That means your new rate can be higher or lower than the percentage you were getting before. Typically the interest rate won’t be lower than two percent.

If you notice an annuity with a higher rate, you really aren’t supposed to break the MVA contract and take out money before the withdrawal window. If you do, you may have to pay a hefty penalty.

How does a market value adjustment work?

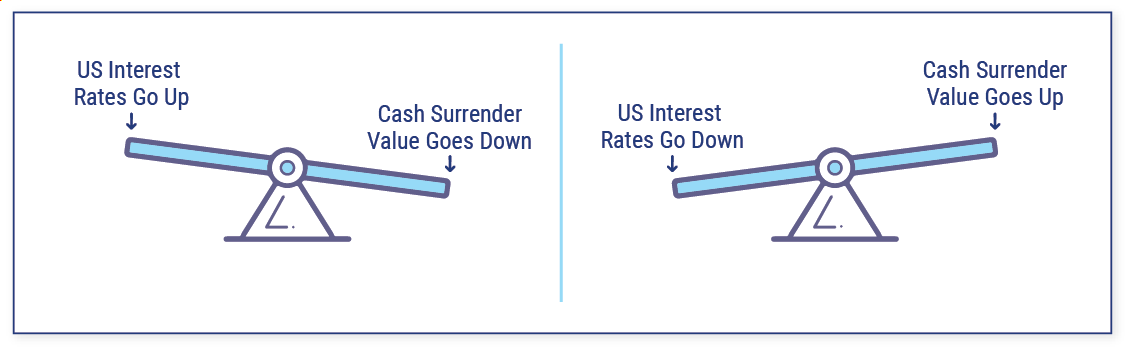

Remember playing on a seesaw when you were a kid? Well, that's a good way to picture how an MVA works.

Market Value Annuity Example

If you like examples, here's one that helps illustrate just how an MVA works:

When Christina created her modified guaranteed annuity, she had a 3% interest rate. Now, with a few years left in her current annuity period, she decides to take the money out.

Now:

- If the current bond interest rate for new accounts is more than three percent, she'll have a negative adjustment to her total cash value.

- On the other hand, if the current market rate is less than the rate she's been getting, her value will be adjusted higher.

Why Is There a Market Value Adjustment Anyway?

The short answer is because insurance companies need a way to protect themselves from taking a loss on your annuity account.

The long answer goes something like this: when you put money into a modified guaranteed annuity or a fixed annuity, the insurer guarantees a fixed interest rate. The carrier will invest your money into things like mortgages or bonds that earn interest and match your annuity’s guaranteed rate period.

So if you buy a 5-year modified guaranteed annuity, the insurer will put your money into a matching 5-year bond. Think about it, if you cash in your annuity before the rate guarantee period, the insurance company may have to then cash out their bond at a loss (should the interest rate have increased in the meantime).

Obviously the insurance carrier won’t like that very much. That’s why they have terms in place to pass along all or some of the loss. If you decide to cash in your annuity, but the market interest rate is lower than what the carrier was committed to paying you, then you may receive a market value adjustment bonus.

What Next?

Fixed annuities can be an important part of your retirement plan. While they have many features and benefits, they are not for everyone, and there are a lot more details that you should definitely know about including market value adjustments.

Talk to your independent insurance agent. They can help you decide if a fixed annuity is right for you and find the perfect options for your financial needs.