Fixed Annuity Income Inflation

(Because what goes up doesn't always come down)

In 1972, Texas Instruments introduced its first calculator for $149.95, about $900 in today's dollars. Today you can buy an 8-function calculator for $4.95, which was about 82 cents in 1972 dollars. There aren't many things that have decreased in price over the years, though. In fact, if you retired in 2009 on $100,000, you need $119,000 today to buy the same things. The impact of inflation is the number one financial concern of pre-retirees and retirees, according to the Society of Actuaries 2017 retirement risk survey. One financial tool that's available is a fixed income annuity with an inflation rider. But is it worth the cost?

Independent insurance agents are experts when it comes to annuities, and their job is to simplify the process. They’ll help guide you through all your options, weigh the good and the bad, and even see you through it all from start to signature. See? Easy, isn’t it?

How Do Fixed Income Annuities Work?

Fixed income annuities are also known as immediate annuities. That's because the insurance company begins to pay an income immediately after receiving a purchase payment, or premium. Immediate annuities have several options for income:

Life only: A payment is guaranteed for the lifetime of the annuitant. No payments are made after the annuitant's death. Life only options will pay out a higher monthly or annual income than the other options. Joint and survivor life only is available for the longer of two lives, usually spouses.

Life & period certain: A payment is guaranteed for the lifetime of the annuitant. The payments are made for at least a "certain" number of years regardless of when the annuitant dies. The certain year options are usually 10 and 20. Joint and survivor options are available for life and period certain.

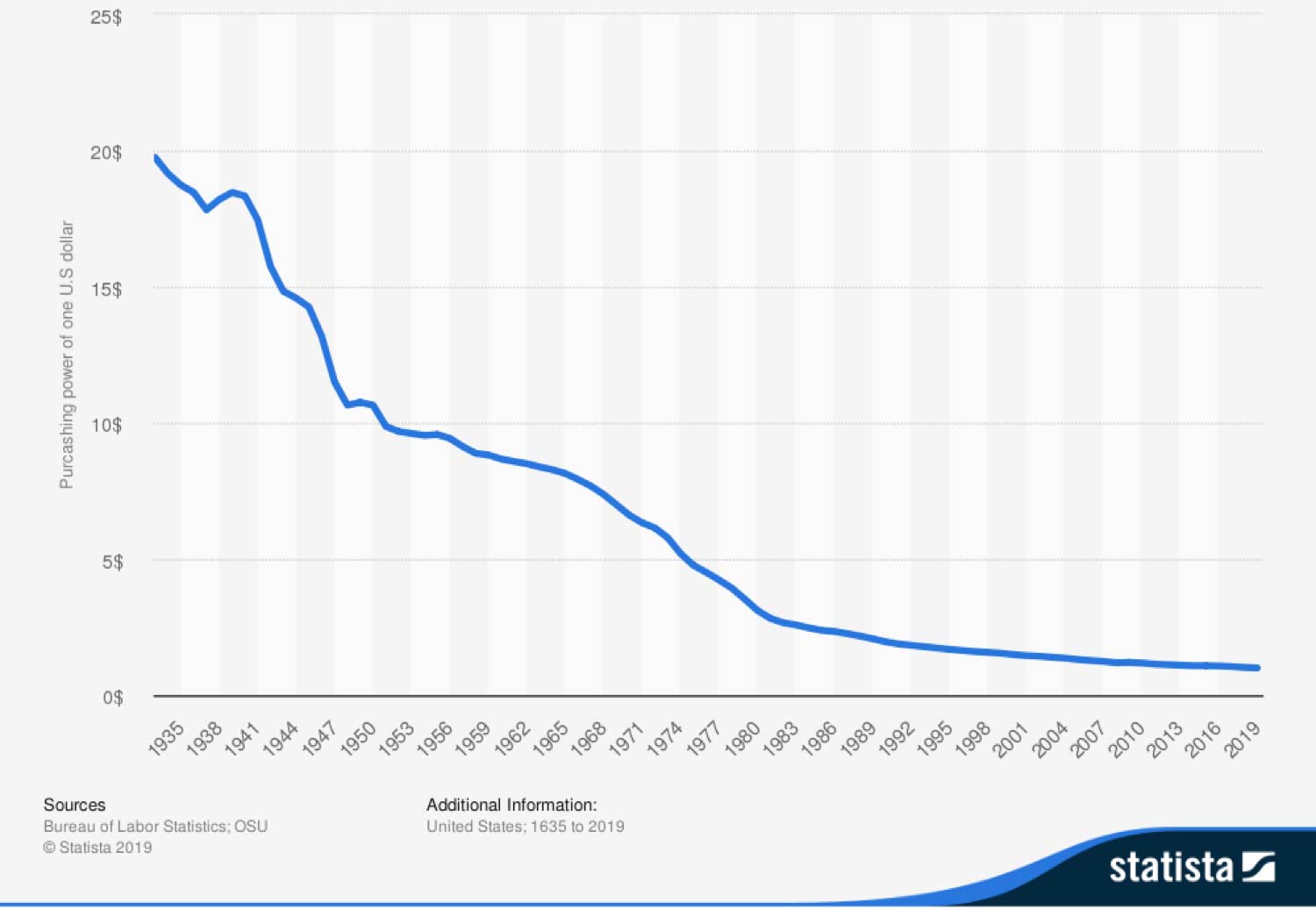

Immediate annuities are a solution for creating a retirement income that can't be outlived. But the purchasing power of that income will decrease with inflation. And the longer you live, the bigger the problem. The chart below shows the purchasing power of $1.00 from 1935 to 2019.

Purchasing Power of One US Dollar 1935-2019

Today's retirees face the very real prospect of 25 years or more of retirement. Even at a very modest 2%, that means a 64% loss in purchasing power.

Fixed Income Annuities with Inflation Riders

There are two types of inflation riders, consumer price index (CPI) and cost-of-living adjustment (C.O.L.A.) Both riders increase the annuity payment each year, but they are calculated differently. CPI riders are based on the consumer price index, much like Social Security benefits. CPI inflation riders, however, are not widely available, if at all. C.O.L.A. riders increase the annuity payment by a fixed percentage. The options are usually 2%, 3%, or 4%.

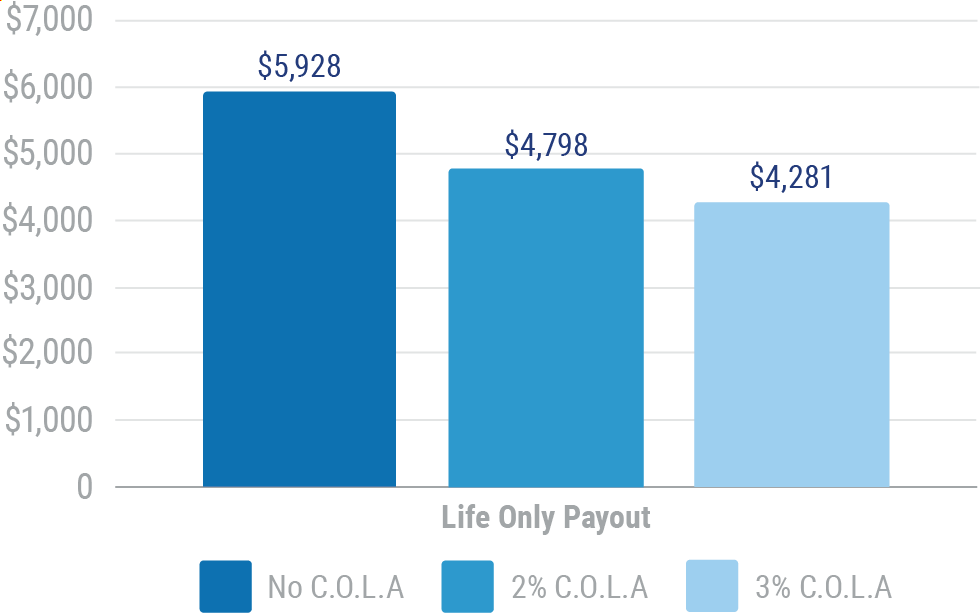

The chart below shows the income from a representative $100,000 fixed income annuity, including a 2% and 3% C.O.L.A.

Representative Life Only Payouts - Male, Aged 65, $100,000 Purchase Payment

What Happens to the Money When You Die?

The insurance company calculates annuity payments based on a certain number of people dying. While it's unfortunate if you happen to be "the statistic," it’s good news for the rest of the annuitants. The "mortality credits" result in higher payments to everyone else.

The income option you selected determines what your beneficiary receives. Certain options guarantee that a minimum number of payments will be made. Joint and survivor options continue to pay the survivor for the rest of their life. Life only options pay nothing to beneficiaries.

The Pros of Income Annuities and Inflation Riders

These days fewer people have traditional pensions that pay an income every year for life. Buying an income annuity is like buying a pension for yourself. Income annuities can also help you plan for lifetime income for two people. Joint and survivor life expectancy can be much longer than for each individual.

Income annuities produce a higher income than you would get for a similar low-risk investment. A portion of the income is excluded from taxes because it is considered principal. Finally, as people get older it becomes more difficult to manage day-to-day finances. Income annuities offer a predictable long-term alternative that doesn't require hands-on attention.

The Cons of Income Annuities

When you purchase an immediate, or income, annuity you give up access to the principal. In doing so you give up the opportunity for other investments in the future. Here's why that can be a problem. Interest and inflation rates change. In January 2000 you could get a 6-month CD at 6.15%. Today? A 6-month CD pays 0.60%. In 1980 inflation was running at 12%, today it is 2%. The point is that income annuities are long-term arrangements. Changes in the economic environment can make them more or less effective.

While fixed income annuities do produce a higher rate of income, it takes a long time to get your principal back. In the chart above, our 65-year-old is 81 before he recaptures his original $100,000 without the C.O.L.A. rider.

The Cost Of C.O.L.A.

Have you ever noticed that the cereal boxes in the supermarket always seem to be getting smaller but the price stays the same? Clever devils, it's a pretty stealthy way to raise prices. Income annuity inflation riders work in a similar fashion. There is no specific cost to them, like other riders.

Instead, the purchase payment buys less income. In our example, the income annuity with a 3% C.O.L.A. rider pays 28% less than the income annuity without the C.O.L.A. rider. Even though the income increases by 3% every year, it takes 22 years for the C.O.L.A. rider to catch up in total payments. So our 65-year-old has to live to age 87 just to break even.

What to Look for in an Income Annuity

Income annuities are a long-term arrangement. The insurance company's financial strength and reputation are the most important considerations. Financial strength ratings are available from A.M. Best, S&P, Moody's, and Fitch.

Shop around, there can be a big difference in what the insurance companies are offering. If you are in less-than-perfect health, some insurance companies sell medically underwritten income annuities with higher payouts.

Is an Income Annuity with an Inflation Rider Right for Me?

Fixed-income annuities are a way to guarantee retirement income, just like a traditional pension does. They are simple and predictable. If you are concerned about living into your 90s and beyond, fixed income annuities and inflation riders might be a way to create income for your basic expenses along with Social Security.

Most importantly, make sure that an income annuity fits into your financial/retirement plan. An independent insurance agent can help you make smart decisions.

What's So Great about an Independent Insurance Agent?

Annuities are complex, and searching through options can be confusing, time-consuming, and frustrating. An independent insurance agent's role is to simplify the process. They will make sure you get the right coverage that meets your unique needs and will break down all the jargon so that you understand exactly what you're getting.

National Museum Of American History Handheld Calculators

Statista

St Louis Fed 6 month cd secondary market

Advisor’s guide to annuities John Olsen

Fundamentals of Investments Wilson & Hopkins

Fitch Ratings Definitions

Moody’s Moody’s rating scale and definition

S&P Global Understanding Ratings

A.M. Best Why An A.M. Best Financial Rating Is Important