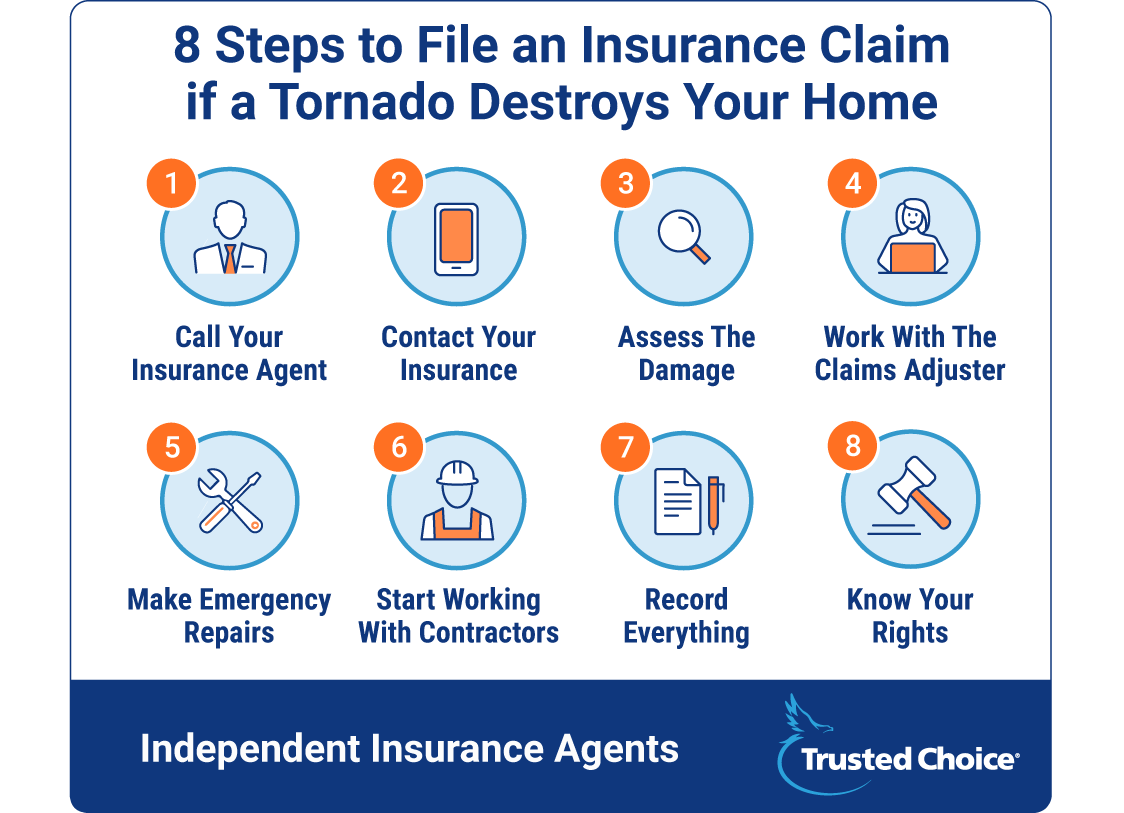

8 Steps to File an Insurance Claim If a Tornado Destroys Your Home

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

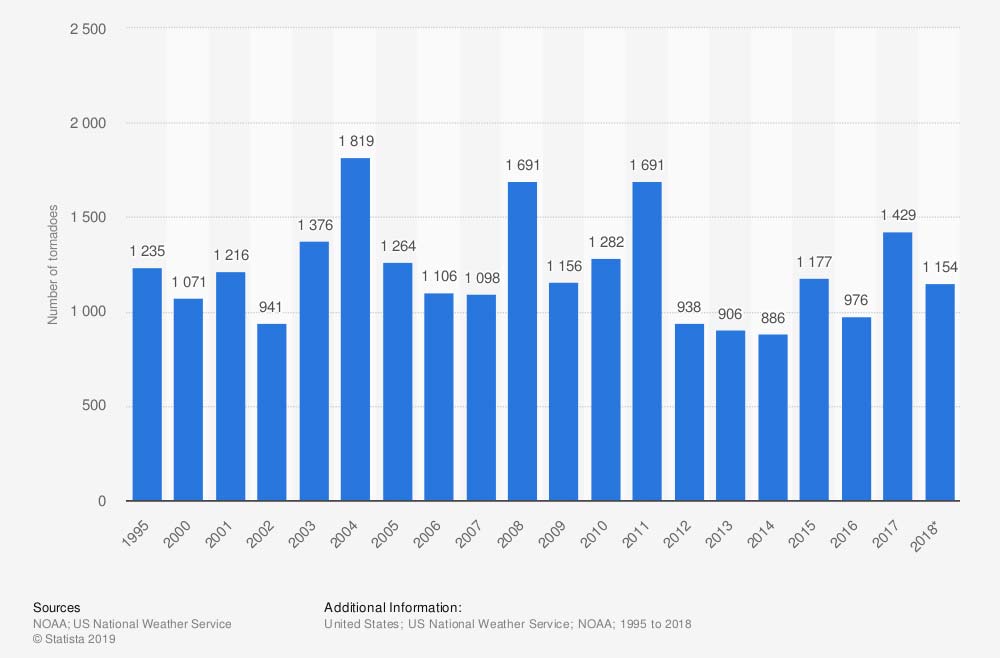

No one expects to have their house taken out by a tornado, but every year more than 800 tornadoes blow across the US, showing mercy to no one and no home in their way.

Number of tornadoes in the US, 1995 to 2018

Once the dust has settled, only the lucky will be left with no damage to their homes. And it’s more likely that you’ll be displaced from your house for some time.

At this point, it’s time to make an insurance claim. But where do you start? When your house is in shambles, it’s easy to feel like your life is following suit. That is why we spoke with insurance expert, Paul Martin, to help lay out the exact steps you should take if your home is destroyed or damaged by a tornado.

Step 1. Call Your Insurance Agent

Once you’ve taken inventory of all your loved ones and determined that you have no medical emergencies, take a deep breath and call your insurance agent.

The sooner you call your agent, the sooner the insurance process can begin. At this time you can also ask your agent to educate you on the timeline and process for filing a claim. Some questions you can ask include:

- What is the next step I should take?

- How long will it take for me to hear from the insurance company?

- How long will the claim process take?

- Is there any information I should start gathering now?

Step 2. Contact Your Insurance Company

The first thing your insurance agent should do is call your insurance company. If you don’t have an insurance agent, you can contact your insurance company yourself.

Let your insurance company know your house has been damaged by a tornado and you’d like to make a claim. Most likely you’re not the only person who has been affected by the tornado, so your insurance company should already be starting the process of taking care of claims.

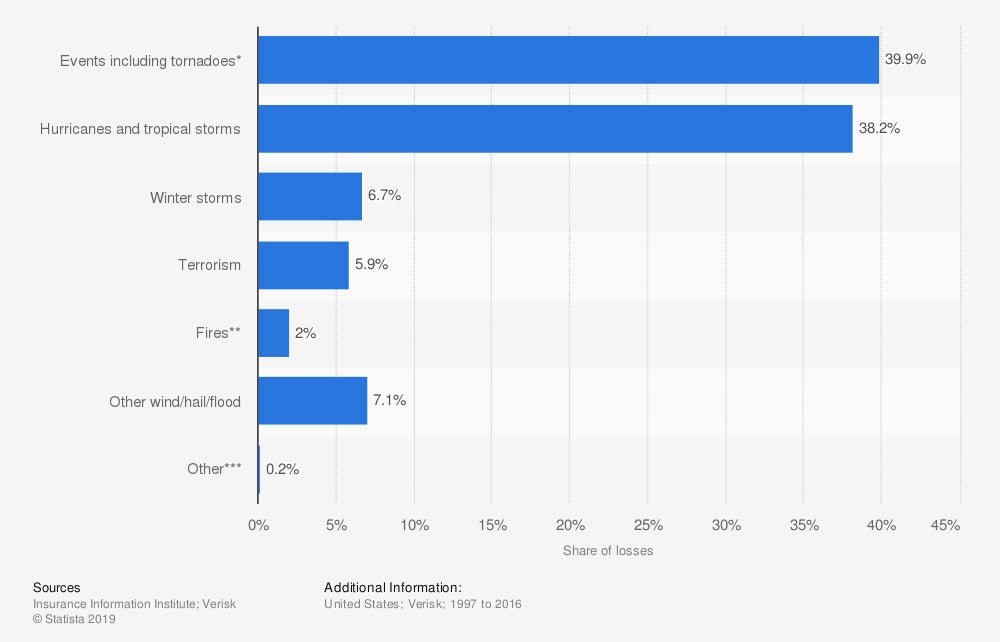

Distribution of insured catastrophe losses in the United States from 1997 to 2016, by type

Step 3. Assess the Damage

If you’re able to access your home, you can immediately begin to assess the damage that has been done. Use a video camera or your phone to take photos and videos of all of the damage.

If you happen to be immediately displaced from your home, start making a written list of all of your possessions that you can remember. Your insurance company may get access back into your property before you do, and will be able to calculate the damage, but they won’t know all of your possessions.

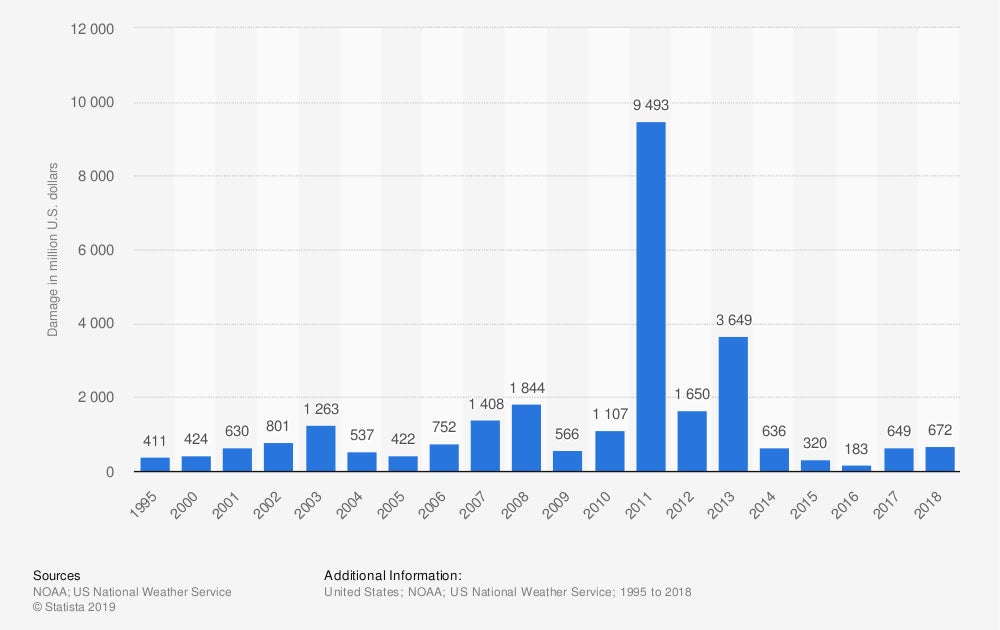

Economic damage caused by tornadoes in the US from 1995 to 2018 (in million US dollars)

Step 4. Work with the Claims Adjuster

Once your insurance company is aware of the claim, they’ll have a claims adjuster contact you and come to your home. In most cases you should hear from an adjuster within a couple of weeks, but in the event that the tornado was a major catastrophe, it could take longer.

If your home is no longer inhabitable, your adjuster will ask where you’re living. Your homeowners insurance will cover any temporary living expenses while the event is being investigated.

Any information that your claim adjuster requests should be completed as quickly as possible.

At this point it’s likely that your insurance company will ask you to fill out a Proof of Loss. This is where you list everything you believe you’ve lost. People often feel like the Proof of Loss is a say-all for items destroyed in a tornado, but if you think of items after you’ve turned in your Proof of Loss, you can still claim it with your insurance company.

The sooner you can provide your adjuster with the information they need, the faster they can move through the next steps of the claim.

Step 5. Make Emergency Repairs

If you’re able to stay in your home, you may have some immediate emergency repairs to make. You can make these repairs before you start working with your insurance company, just make sure to keep your receipts.

It’s important to not move too much of your stuff before the adjuster has a chance to come out and assess the damage. Only make emergency repairs like exposed electrical wires or leaky pipes.

Step 6. Start Working with Contractors

After the adjuster comes to your home, you’ll know what kind of damage you’re looking at and you’ll be ready to start repairing and rebuilding.

At this point you’ll start working with different contractors. You can choose them yourself, or take suggestions from your insurance company.

Unfortunately, it’s common for fraudulent contractors to contact people who have recently been through a catastrophe. Be cautious, and only work with licensed contractors. When working with contractors, be sure to ask for all the details, costs, and materials for the work you need.

Step 7. Record Everything

In natural disasters like a tornado, insurance companies will often work with a variety of extra staff. You’re going to have a lot of conversations with a lot of people, so keep track of all conversations, all the information you hand over to the insurance company, and everything they ask of you.

It’s also important to keep the receipts for anything you purchase, as well as any hotel stays, rentals, cars, etc.

Chances are you’ll be purchasing things at different times, so keep a copy of everything you purchase and all costs related to the loss of your home so your insurance company can properly reimburse you.

Step 8. Know Your Rights

While the majority of homeowners have home insurance, they hardly expect to have to use it for a large catastrophe. Be sure to work with your insurance agent to understand your rights and what coverage you should get from your insurance company.

Navigating an insurance claim after a catastrophic event can be complicated, emotional, and confusing. That’s why your independent insurance agent can help you focus on the end goal of getting you back into a livable space.

Rebuild, Repair, Restart

Once the claim has been handled, you’ll begin the repair process. This could take months to years depending on whether you’re doing simple repairs or a complete rebuild.

From the first day you speak to your insurance agent, ask questions so you understand the process and timing for filing a claim. Get a good understanding of your policy and what it pays in a situation like this so you know your insurance is working as it should.

Keeping a professional attitude and being cooperative will make for a smooth claim process. If you believe your insurance company is treating you unfairly, get your insurance agent involved. They’re there to have your back and make sure that your insurance is working for you. Then you can begin the process of rebuilding, repairing and restarting your life in your home.