Deciding Whether You Should Rent or Buy a Condo

Congrats - you’re finally feeling adult enough to consider a switch from an apartment to a shiny new condo. However, you still need to decide if buying a condo vs. renting fits your lifestyle.

Actually, renting or buying a condo can look eerily similar to renting or buying a house, but don’t be fooled. Choosing to move into a condo and deciding whether to buy or rent has its own set of considerations, including where to find affordable condo insurance.

We spoke with Crystal Colburn from Real Estate Excel about what goes into the decision-making process when it comes to whether to buy or rent a condo. Her expert knowledge should help nudge you closer to the right choice and save some headaches later on.

Is Renting or Buying Cheaper in Your Area?

Some agents will insist that renting is cheaper than buying, but there’s a little trick called the “price-to-rent ratio,” which may sound like a total snooze fest, but it’s one of the best ways to solve this problem… Or come fairly close to an answer.

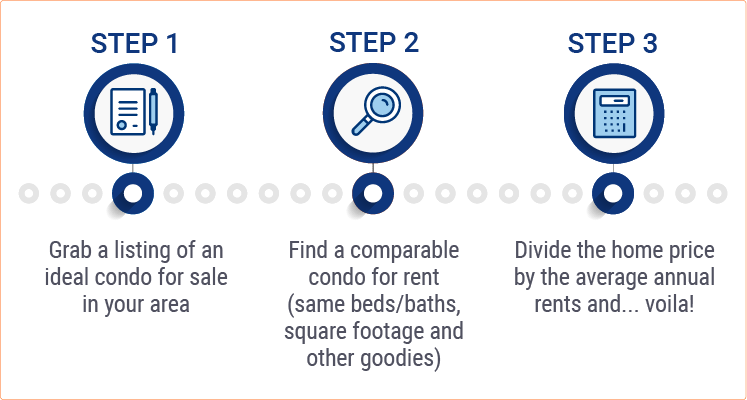

Here’s how it works:

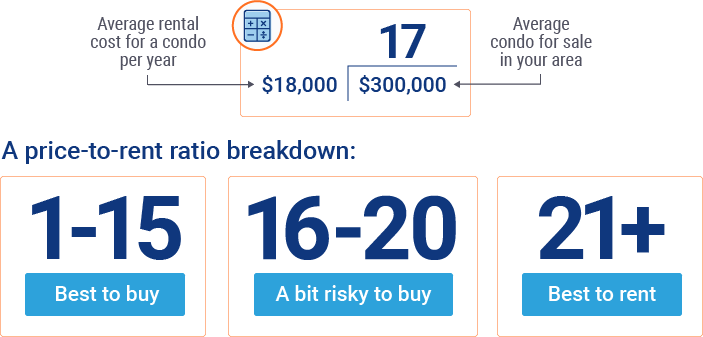

For example:

Let’s say the average rental cost for a condo in your area is $1,500 per month or $18,000 per year, and an average condo for sale in your area is $300,000. Divide $300,000 by $18,000 and you have 17.

While this isn’t a foolproof way to find your answer, it can at least give you a general idea. Then when budgeting, remember to consider up-front costs of buying a condo vs. renting, and also future costs of renovations, utilities, etc.

Up-Front Costs with Buying or Renting

Whether you’re on a tight budget or flying private jets, your budget could dictate your decision. Buying comes with up-front expenses like closing costs, a down payment and bank and title fees, which add up quickly. If you don’t have enough stacks of dough to cover those costs, you might be better off postponing a purchase until you do.

Now, renting kind of looks like a steal since you’d only be responsible for first and last month's rent and, depending on the rental agreement, maybe a security deposit.

Which Costs You More in the Long Run?

The long-term cost of renting is basically your monthly rental price. In other words, it’s like betting money on a retired race horse, you won’t win, and you’ll never see that money again. For some this might be a pretty tough pill to swallow, but it's still tough deciding between buying a condo or renting an apartment or condo of similar value.

- Buying is a bit more complicated because of the unexpected costs like emergency repairs, in addition to other expenses like taxes and insurance.

- Renting, on the other hand, means most of those extra costs, like maintenance and repairs, are not your problem.

It’s difficult to tell which one costs more in the long run because it pretty much boils down to preference. If you’re not prepared for the added and ongoing responsibilities of buying, renting might be worth the cost. But if you’re hoping to build equity and see a return on your investment, buying could be your best bet.

Added Responsibility with Owning a Condo

Most condo owners are only responsible for what’s inside their walls. The monthly association fees you pay will go towards fixing and maintaining everything else including the exterior, entryways and common areas. It’s less responsibility but more out-of-pocket costs.

While condo owners will most definitely have to pay any applicable HOA fees, renters may not have the same obligation. If renting, establish in the lease who is responsible for what fees and expenses and take those costs into account before deciding.

Life-Altering Plans in the Future?

Future plans or lack thereof should be a major factor in your decision-making. If you’re considering a career change, going back to school, or maybe adding a few extra humans, renting gives you more freedom to move on to bigger and better things and places.

When you own a condo, it’s more difficult to up and move and can be costly. However, the benefit of owning is being able to stay put while still being able to make changes like adding another room or office.

Are You Ready To Move Forward?

There are a lot of numbers to crunch, info to digest, and things to consider, but it will come down to budget, future plans and the level of responsibility and effort you’re comfortable with.

So bookmark, screenshot, copy and paste or memorize this article and reference it accordingly. Maybe even bust out an old-school spiral notebook and fill it with all your hopes, dreams and mathematical equations. Just make sure you're covered with an affordable condo insurance policy.

We believe in you.