The Ins and Outs of Fixer-Upper Loans

Doug Carling is a Senior Mortgage Consultant for Synergy Home Mortgage in Reno, NV who has spent 15 years helping families achieve their homeownership dreams.

If you’ve been feeling like trying your hand at being handy, you may be in the market for a fixer-upper house. But buyer beware, not all fixer-uppers qualify for traditional financing. Regardless, you should still make sure you're covered with an affordable home insurance policy.

But what do you do when you find yourself with a non-qualifying fixer-upper and without a pot of gold? We asked Doug Carling, a mortgage lender with more than 15 years of experience, for some insight into fixer-upper loans and how to find the right one for you. And here’s what we got:

What Is a Fixer-Upper Loan?

Also known as rehabilitation (or ‘rehab’ for short) loans, fixer-upper loans are a special type of funding that’s used specifically for renovations and upgrades to a home.

There’ are several types of fixer-upper loans. Qualifying for them depends on a few factors, including the scale of the renovation you’re planning. Don’t worry, we’ll talk more about that in just a bit, so hold tight.

Can I Get a Traditional Mortgage and a Loan for a Fixer-Upper?

The short answer is no. Typical mortgages don’t cover remodeling. Plus, if your fixer-upper is in poor enough condition, it won’t even qualify for a traditional fixed-rate loan. That’s why you need a loan specifically designed for upgrading a home. Let’s talk about a few options out there for you.

What Are the Different Types of Fixer-Upper Home Loans?

Basically there are four different options for you when it comes to rehab loans. The one that works best for you will depend on the projects you’re facing and how much money you want to donate to the cause.

- Limited 203(k): Best for smaller repairs and upgrades, as it caps at $35,000.

- Standard 203(k): Better for extensive home upgrades and requires that you hire a consultant to oversee the project.

- Fannie Mae HomeStyle Renovation Mortgage: This can be used to purchase or refinance a home, as a primary, secondary or rental property. The price of this loan depends on the renovation plans and the contractor’s bids for the planned work. Also, you cannot live in the home during the renovations. Nor would you want to—ew, sawdust.

- Home equity loan: This is a one-time line of credit with non-flexible payments for the lifetime of the loan, also called a second mortgage. This loan is only beneficial if you have enough equity in your home for the remodel you’re looking to do.

- Cash-out mortgage refinance: Similar to the home equity loan, here you’re also using your home as collateral. You’ll basically refinance your house with a whole new mortgage and the difference will be given to you in cold, hard cash. To qualify for a cash-out mortgage refinance, you need at least 20% equity in your home.

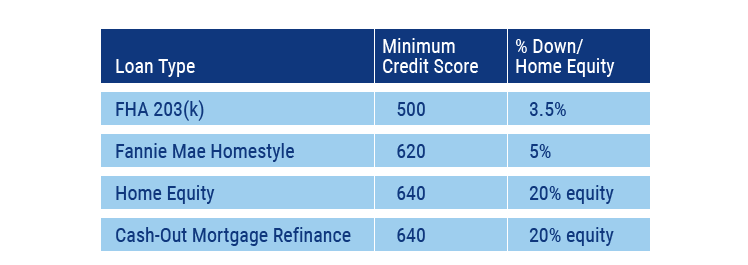

But if words aren’t your thing, here’s a chart. Enjoy!

Choosing Between Fixer-Upper Loans

Now you may be wondering how to choose between all of these options. Don’t worry, you may not have to. Often the decision will be made for you once you know exactly what your remodel looks like.

Getting your hands on a loan like this shouldn’t be too difficult. It’s all just gonna depend on credit scores, loan amount needed and what kind of money you can spare to put down–piece of cake.

What to Know Before Purchasing a Loan

Before you commit to any loan, Doug recommends fully knowing and understanding your budget.

“Be cautious of your expenses so you don’t do a cost overrun,” said Doug. “It’s easy for buyers to not realize how much work they’re doing. The shinier it is, the more expensive, so it’s important to be cognizant of budgeting.”

It’s Loan O’Clock

And there you have it, your fixer-upper loan questions answered. Now, while we may not have answered all of your questions, we hope to have at least helped you understand your options. And don't forget to make sure you're covered with an affordable home insurance policy. Onward you go!

https://www.fanniemae.com/content/fact_sheet/homestyle-renovation-product-matrix.pdf

https://pocketsense.com/203k-vs-conventional-rehab-mortgage-7305659.html