Home Buying Programs for First-Time Buyers

The fact is, there are plenty of people who could use a bit of financial assistance when it comes to the biggest investment of their lives, which is why home buying programs exist. They're available to help ease some of the stress and turn the dream of owning a home into a reality.

If you’re a first-time buyer, it will be important to understand the most commonly used home buying programs, how they work, and if you’re eligible. To get this insight, we enlisted experts Keith Gumbinger, vice president of HSH, and Alex Nunemaker, mortgage consultant for Mlend. You can also find out more about affordable home insurance by contacting an insurance agent in your area.

USDA Loans

The US Department of Agriculture offers assistance programs to those looking to buy in a rural area. What constitutes a "rural" area, you ask? Well, it's defined by the USDA; but, as Alex said, their definitions are "pretty lenient." Instead of Googling the definition, you'll need to check with a lender to see what areas near you qualify for this specific program.

The USDA loan program "allows 0% down but is geographically limited," said Keith. Alex added that there’s a limit on the amount of income your family generates (and this will vary based on family size) to qualify. You must also demonstrate that you maintain a steady source of cash flow and can handle the monthly payments like nothing less than an absolute champ.

"There's a sweet spot of not making so much that it disqualifies you from the program, but not so little that it keeps you from the house you want to buy," said Alex.

Additionally, there are two different types of programs within the USDA: direct loans and guaranteed loans.

- USDA direct loans: These are meant for very-low-income families; those eligible for a direct loan must make between 50% and 80% of the median income for the area.

- USDA guaranteed loans: These cater to the average-income borrower, who can have an income of up to 115% of the median income for the area.

So if you're excited about the possibility of buying a home for the first time with no money down, check with a local lender to see if there are any properties nearby that would qualify for a USDA loan.

Conventional Loans: HomeReady and Home Possible

Mortgages that are not guaranteed or insured by any government agency qualify as conventional loans. These loans typically have fixed terms and rates and leave little wiggle room for haggling. Alex said these loans typically offer 3% down payments for first-time buyers, and a minimum of 5% down for non-first-timers.

Fannie Mae's HomeReady* and Freddie Mac's Home Possible* are such programs, allowing for "reduced mortgage insurance premiums and lower (if any) risk-based pricing adjustments that raise costs for more marginal borrowers," said Keith. He also added that a FICO credit score of 620 is the minimum to be eligible.

Fannie Mae and Freddie Mac work with local lenders in order to offer affordable mortgage options for low-to-moderate-income families. These are great program options for a low down payment (with a low-ish credit score), especially for first-time buyers. Feelin’ more confident yet?

VA Loans

The US Department of Veterans Affairs offers their own home buying program to active-duty military members, honorably discharged military members, veterans and surviving spouses. While not exclusively available to first-time home buyers, this program is still popular, since it's another 0% down program.

"This is a fantastic program for those that have earned the right to use it," said Alex. He also said that there’s a lot of misinformation regarding this program being on the shady side, but he assured us that it's legit. He added that first-timers are fond of it because of the one-time, up-front fee with no additional monthly fees.

There's also no minimum credit score requirement. So if you meet the program requirements, but are worried about the several credit cards you opened, fear not, this could still be the program for you.

Federal Housing Administration (FHA) Loans

FHA loans are a great alternative to USDA loans if the buyer is not looking in an eligible area. Keith said, “They’re available to everyone, but happen to be more popular with first-time buyers.”

"Arguably, for the widest number of borrowers, the FHA program is the best all-around offer - it is well-understood by lenders, has no cost penalty for borrowers with a low credit score, allows for as little as 3.5% down, and sellers can contribute up to 6% of the loan amount to help cover buyers' closing costs," said Keith.

"However, for most borrowers, the required mortgage insurance cannot be cancelled, so the lower barriers to access do come at a price," he added. So while there may be no completely perfect and totally risk-free program in existence, the FHA loan program seems to be what comes the closest.

State-Specific Loans and Grants

Specific state-backed programs that offer loans and grants to cover down payments and closing costs for first-time homebuyers also exist. "These are aimed at low-to-moderate-income buyers or buyers in targeted areas," said Keith. "Most use the FHA program as a base, so it is technically possible for some potential homebuyers to get a mortgage with poor credit and little, if anything, out of pocket (i.e., grant) or little cash up front (i.e., down payment loan)," he said.

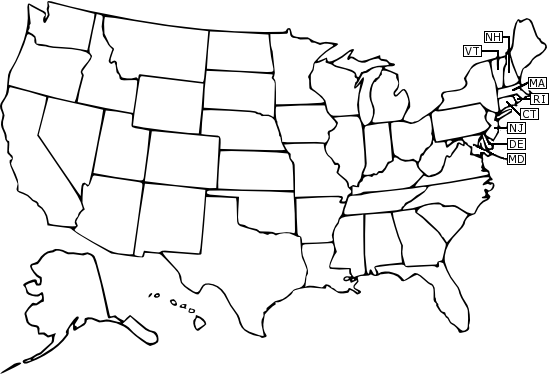

Click your state to find a list of state-backed loan programs:

HOPE Program

The HOPE Program is an example of a local assistance offerings. A number of variations of this program has been run by the US Department of Housing and Urban Development. However, Keith stated that some "seem to be defunct" now. The program aims to help very-low-income families, or those with a low credit score of even below 500, to qualify for down payment assistance.

According to operationhope.org, the HOPE Program offers a counseling program that helps clients overcome a variety of barriers to home ownership, including bad credit, lack of down payment, existing debt and money management issues.

Be sure to speak with a local lender if you are interested in this program, to make sure you get set up with a variation that is still alive and well in your area.

A Word about Credit Scores and Savings from the Experts

As far as credit scores are concerned, when it comes to getting loans or other financial assistance, Alex said that "really, anything is possible for a score of 580 and above." But he added that it is "disingenuous" for lenders to advertise that number, since they may ultimately turn a prospective client down for a score in that ballpark.

"In general, you want to aim for at least a 620 credit score to buy a house," said Alex.

He added that lenders urge prospective home buyers to start saving as early as possible. Part of their job is to educate buyers about the fact that, while a program may offer "no money down," there may be closing costs. So they always recommend having plenty saved - just in case.

Alex further noted that if you start paying yourself now as if you're already paying the mortgage, it'll create the habit of budgeting - and will allow a nice cushion of savings to build up. "No one's ever regretted saving up," he said. So choose a few (dozen) of those crazy-patterned leggings to sell off, and turn the profits right over to your savings account.

If You Still Have Financial Concerns...

Despite the generous amount of financial assistance available through home buying programs, it's understandable if the thought of spending so much money still leaves you gulping audibly like a Looney Tunes character. That's why there are experts around to help you get to where you need to be.

"A lender will always look for what (first-time buyers) can be approved for, and work with clients - we want to put them into the best situation possible," said Alex.

Lenders also offer credit counseling, to help clients rebuild poor credit. As far as the oft-asked question of "Can I buy a house with bad credit and no money down?" is concerned, however, Keith said that many lenders will write FHA-backed loans for people with credit scores as low as 600.

"Technically, the FHA program is available to borrowers with scores as low as 580 with just a 3.5% down payment - but most lenders are still imposing overlays (additional requirements so as to protect themselves against future loan failures). You can get a loan with a score as low as 500 (minimum 10% down, though). So poor credit, yes - but usually not with no money down," Keith said.

That's just one more example of why, our experts stressed, it's so important to have savings built up when going into home buying mode, even if you have your heart set on one of these programs. So do whatever you have to do - perform on the street corner with an open guitar case, call up your relatives and beg, cancel your weekly Taco Tuesday - to grow that savings account.

Now You're Ready To Become a Buyer

So there you have it. It's nice to know that there are several programs out there to help you get your first new home. We hope that this list has allowed you to worry less about down payments and credit scores, and more about wall colors and what kind of ambiance you want to create in your new place.

Good luck and happy home-hunting, first-timers.

Huge thanks to Keith Gumbinger, vice president of HSH, and Alex Nunemaker, mortgage consultant for Mlend, for all the insights and answers. You can also find out more about affordable home insurance by contacting an insurance agent in your area.