Who's Responsible if Your Work Computer Is Stolen from Your Home?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Not everyone gets to leave their work at the office when they head home for the day. Sometimes work equipment gets brought home, and it still needs to be protected. So, what happens if you’ve brought your work computer home and then your house gets broken into and the computer gets stolen? Who’s responsible for this mess, anyway?

Fortunately, independent insurance agents can help you answer these important questions. With their experience in handling all kinds of interesting claims, they know exactly what kind of coverage would protect you in even the strangest scenarios. They’ll help you get set up with all the protection you need, long before you ever need it. Here’s how they’d hook you up with the right coverage in case your work computer gets stolen from your home.

Who’s Responsible if My Work Computer Is Stolen from My House?

Well, since you were the one looking after the equipment, you’d be held responsible for its disappearance. The real question is whether you’d need to file a claim through your business or homeowners insurance, and really, you could choose either one. Both policies would cover you in this scenario, but you’d want to consider the following:

- Deductibles: Since both your business insurance and homeowners insurance would cover your work computer getting stolen from your house, you’ll probably want to choose the policy with the lowest deductible so you could be reimbursed for more of the loss.

- Coverage limits: Standard homeowners policies often come with a $2,500 limit for business property, which would most likely be enough to cover your work computer. You’ll want to double-check your specific policy to be sure, though.

If you’re unsure of which policy to go through or what your deductibles or coverage limits are, your independent insurance agent can help review your policies with you and help you decide which one to file a claim through.

How Does Property Coverage Work in This Scenario?

The property damage section of your homeowners insurance would reimburse you for not only the stolen work computer, but also damage done to your home in the intrusion, and other personal property that may have been stolen as well. After paying your deductible, you’d be covered up to the personal property and dwelling limits in your policy. If you’re concerned about having enough coverage, you can always increase your policy’s limits.

What if It Was My Work Computer for My Own Small Business?

In the event the stolen computer was actually used for your own small business, your small business insurance would possibly cover you. You’d need to review your specific policy with your independent insurance agent to be sure it includes coverage for business property stored off premises, since not all policies do. If you’re a small business owner and concerned about this situation happening to you, make sure to add this coverage to your insurance policy.

How Would This Incident Affect My Premiums?

Fortunately, single incidents are often unlikely to affect your insurance premium, whether it be your homeowners or small business policy. Insurance companies don’t tend to punish policyholders for single, uncommon incidents. However, if your business property getting stolen from your home became a trend or regular occurrence, your insurance company may decide to hike your premium or even choose to not renew your policy after its term was up.

How Could This Situation Be Avoided?

Though break-ins and robberies are traumatic, fortunately there are several ways they can be easily avoided. Especially if you’re planning to store valuable business property in your home, you may want to consider taking one or more of the following proactive measures to prevent break-ins and theft.

The following tips can keep burglars out of your home:

- Install a burglar alarm: Or even just the signage that states you have one. Homes with obvious alarm systems are automatically less enticing to robbers.

- Set up automatic timers for your lights: This one doesn’t just work in the movies. If you set the lights in various parts of your home on random timers, it’ll give the illusion that someone is not only home, but awake, for a much larger portion of the day and night.

- Trim all bushes and shrubs: Though overgrown foliage may make the exterior of your home more visually pleasing, it also provides ample hiding places for burglars. Keep all plants neatly trimmed to offer less coverage for burglars to sneak or lurk behind.

- Turn a TV or radio on: If you can get past the idea of wasting electricity, leaving a TV or radio on with the volume turned up can also dissuade burglars from wanting to break into your house.

- Get a safe: If you’re going to be storing expensive business property in your home, you might want to protect it even further by investing in a safe.

No one wants their home to be broken into, or for any of their property, business or personal, to get stolen. Luckily there are several ways this can easily be prevented, and some of them don’t even require spending any money.

Other Common Home Risks Worth Considering Coverage For

Not all homeowners are concerned about business property getting stolen from their home, but there are plenty of common risks all homeowners face that warrant having the proper coverage. Check out these stats regarding common home insurance claims.

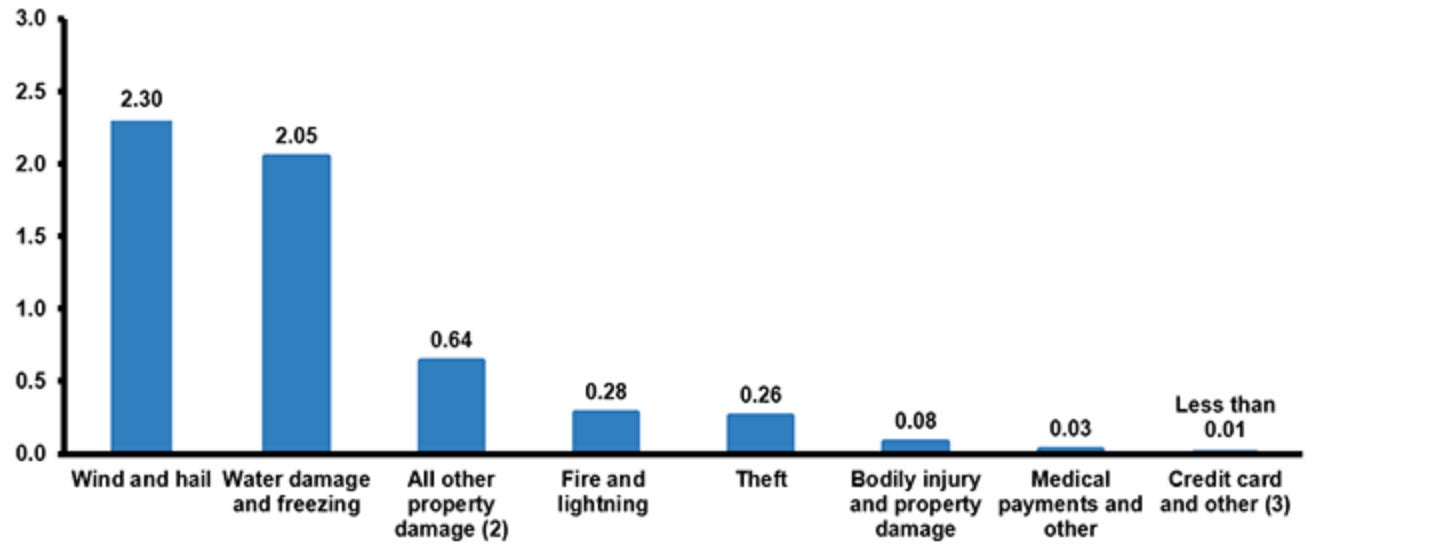

Homeowners Losses Ranked By Claims Frequency, 2014 to 2018

(Weighted average, 2014 to 2018)

The most commonly submitted claims by homeowners in the 2014 to 2018 period were due to wind and hail damage. Following those disasters were claims made due to water damage and freezing. Property damage, fire and lightning, and theft were also commonly reported, as were bodily injury claims, medical payments, and credit card misuse.

Talk with your independent insurance agent about getting your home covered from these common perils. Standard homeowners insurance policies provide protection against things like water damage, fire, and wind/hail damage. However, you may be concerned about your coverage limits. Your independent insurance agent can ensure that you walk away with all the protection you need to feel comfortable and secure.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting against business property being stolen from your home and all other unique incidents, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners and small business insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

iii.org