Everything You Need To Know About Kidnap and Ransom Insurance

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When thinking about insurance, the last thing you might expect to need is coverage for kidnapping and ransom payments. While it might be shocking, kidnapping crimes are actually on the rise, as are their correlating ransom payouts. For those folks who are famous, wealthy, or otherwise just kind of a big deal, it might be a good idea to look into getting kidnap and ransom insurance.

What Is Kidnap and Ransom Insurance?

Kidnap and ransom insurance is a type of coverage designed to protect against the financial harm suffered in the event of a kidnapping. Coverage provides reimbursements for things like ransom fees, medical fees, lost wages, and for professional help in solving the crime and getting the victim home again. Kidnap and ransom insurance might even pay out a benefit if the victim is killed.

What Does Kidnap and Ransom Insurance Cover?

Pretty much all aspects of solving a kidnapping case can be funded by kidnap and ransom insurance. Coverage not only applies to the kidnap victim, but also to their family. If an employer purchases the policy, coverage will protect them in the event one of their employees is abducted.

Here are the most common coverages offered by kidnap and ransom insurance:

- Ransom payments: Coverage will pay reimbursements up to a specified limit, dictated by your policy, towards a ransom payment demanded by the criminal to get the victim released to safety. Typically, a victim’s family will first either have to pay the ransom out of pocket or take out a loan to cover the fee, rather than the insurance company providing the money up front.

- Medical fees for the victim: If a victim suffers physical injury during the kidnapping, kidnap and ransom insurance will reimburse them for medical fees. Coverage also applies to costs of psychiatric help, such as if the victim should require therapy after the traumatic incident.

- Medical fees for the victim’s family: If the victim’s family becomes physically injured or traumatized during the kidnapping, coverage will reimburse for medical fees including therapy costs and psychiatric care.

- Professional assistance fees: Crisis management teams who are responsible for solving kidnapping crimes may be called on for assistance during an incident. Crisis management teams handle things like hostage negotiations, conducting investigative research to figure out the criminal’s identity, and the development of a strategy to bring the victim home as quickly and safely as possible. These professionals may also cooperate with authorities.

- Home relocation costs: Kidnap and ransom insurance provides coverage for all aspects of the crime up until it’s fully solved, or the point at which the victim returns home safely. Transportation and other costs associated with bringing the victim home are covered.

- Salary replacement: Any loss of salary the victim suffers while being out of work may be reimbursed by kidnap and ransom coverage.

- Death benefits: In certain kidnap and ransom insurance policies, there may be coverage offered if the victim is killed. A death benefit may be paid out to the victim’s family in the event of the worst-case scenario, but this doesn’t apply to all policies.

- Public relations fees: If necessary (and depending on the policy), kidnap and ransom insurance may provide coverage for keeping news media quiet about the incident in order to protect the safety and privacy of the individual or their employer.

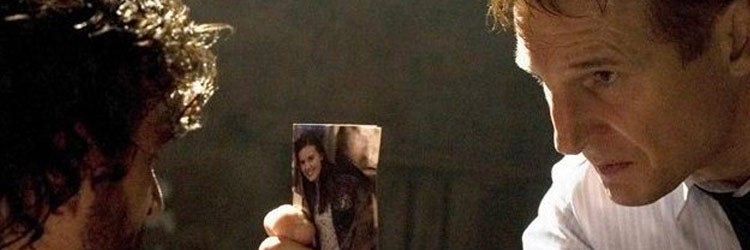

- Legal fees: When an employer purchases a kidnap and ransom policy, it typically includes coverage for fees resulting from lawsuits the victimized employee may file, should their business trip turn into a scene from Taken.

The coverage offered by a specific kidnap and ransom policy will vary from person to person, depending on the amount purchased. Coverage will also vary slightly for policies purchased by individuals versus companies. Kidnap and ransom insurance is in the crime insurance family, but can be available as part of a business insurance package, as part of homeowners insurance for the wealthy, or as a separate coverage.

Who Needs Kidnap and Ransom Insurance?

Anyone who may be a target of kidnapping. If you’re famous or wealthy, unfortunately criminals might have their eye on you or your family for a big payday. We’ll take a closer look at a few specific examples of who might need this coverage.

The following individuals might need kidnap and ransom insurance:

- Celebrities

- Other famous/notorious individuals

- The extremely wealthy

- High-profile employees such as executives

- International travelers

High-profile and/or high net worth individuals, who might have something to offer a kidnapper, are at a much higher risk of being targeted than your Average Joe. Those who frequently travel to high-risk countries for business purposes are perhaps most in danger of being abducted. If you fall into one of the above categories, you might want to seriously consider getting coverage.

How Much Does Kidnap and Ransom Insurance Cost?

Well, that depends on quite a few things. For an individual purchasing coverage for themselves, premium costs might only be $500 annually if they’re not among the more high-risk categories. However, employers purchasing $5 million coverage for high-profile employees that frequently travel to risky countries might pay closer to $2,000+/year.

Coverage costs depend on a number of factors, like:

- Who purchases the coverage (i.e., a business or an individual)

- The amount of coverage needed

- The risk level of the individual(s) being insured

- The insured’s profession

- The insured’s fame/notoriety level

- The destinations the insured travel(s) to

- The insured’s home location

Basically, as with any other type of insurance, the more of a risk someone is to insure, the higher the premium they’ll have to pay. For those folks who may be at risk of being targeted, higher coverage limits could be worth the extra expense paid in the premium. Talk with your independent insurance agent about the right amount of coverage for you.

How To Find the Best Kidnap and Ransom Insurance

For the more obscure/less common types of insurance coverage out there, you might not be able to find what you’re looking for just anywhere. While our independent insurance agents may not be able to provide you with this kind of coverage directly, we’ll happily provide a list of agents in your neighborhood who have access to multiple insurance companies. You’ll walk away with the most options to find the absolute best coverage for your insurance needs.

Statista

https://www.iii.org/article/insuring-against-employee-kidnapping-and-ransom