How Pandemics Impact Your Insurance

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Pandemics and communicable disease outbreaks impact not only the population as a whole, but also the insurance industry and its consumers. While some forms of coverage are built to cover pandemics and disease, unfortunately not all of them are. As an insurance consumer, it's important to know how pandemics impact your specific coverage, if at all.

An independent insurance agent can help by reviewing your current coverages with you to double-check if you're protected during unforeseen pandemics, as well as other local or even global disasters. But first, here's a deep dive into how pandemics impact different forms of insurance.

How Business Interruption Insurance Responds to Pandemics

The COVID-19 pandemic brought up a lot of questions and frustrations about business interruption insurance and its exclusions for communicable disease outbreaks. Understandably, many business owners filed claims through their business interruption coverage during shutdowns due to the pandemic. Unfortunately, the vast majority of these claims were denied due to the nature of business interruption insurance's limitations.

- Business interruption claims must stem from a covered loss relating to commercial property damage. In the case of pandemics or communicable disease outbreaks, there's usually no physical damage to the business that can be proven to an insurance company.

- Even if you could prove that your specific business suffered from the disease outbreak internally, your insurance company would likely argue that it might take you a day at most to suspend operations and scrub down your interior.

It's important to review your specific business interruption policy, preferably with the help of your independent insurance agent. Unless your policy specifically lists pandemics or communicable diseases, they won't be covered.

In fact, many insurance policies have begun listing pandemics as a coverage exclusion that hadn't been listed previously. However, some states are considering passing legislation to afford retroactive business insurance coverage to affected businesses during a pandemic. But in most cases, this legislation has yet to be finalized.

How Car Insurance Responds to Pandemics

During lockdowns and other restrictions of the COVID-19 pandemic, car owners have been driving significantly less than usual. A quarter of auto insurance policyholders were worried that their premiums would not change to reflect less time spent on the road. Standard auto insurance policies do not have premium reductions built in for pandemics or communicable disease outbreaks.

Fortunately, many bigger insurance companies offered their customers a return on their premiums during the COVID-19 pandemic. The vast majority of customers received about 15% of their annual premium back. However, this was a voluntary action made by many larger insurance companies, so not all participated. Further, there's no guarantee that insurance companies would offer a return on premiums in a future pandemic.

Pandemics and the Insurance Industry

Not only are insurance customers strongly impacted by pandemics and communicable disease outbreaks, but the insurance industry itself is majorly impacted. Here's a glimpse at how the COVID-19 pandemic affected the insurance industry across the globe.

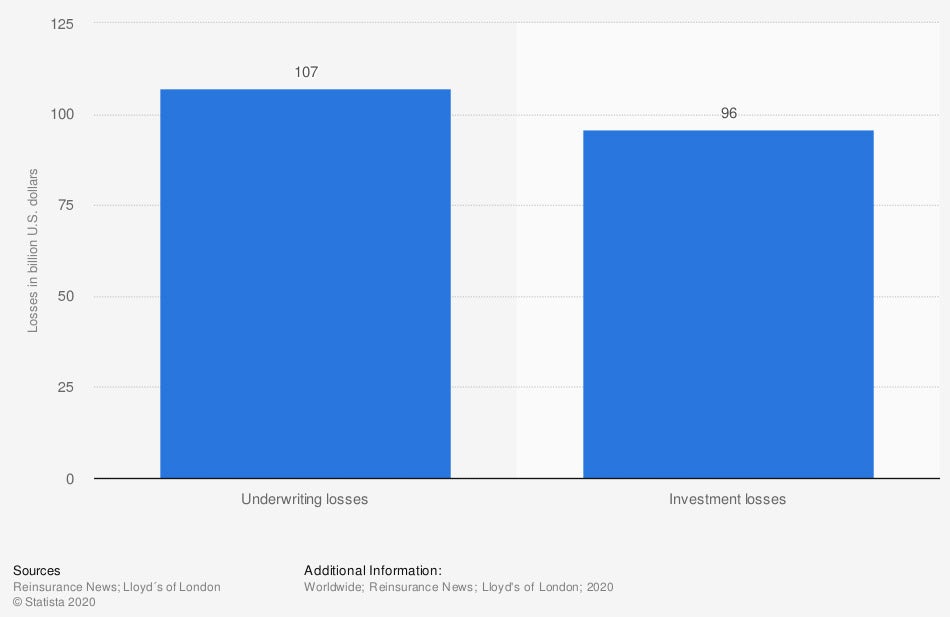

Forecasted losses from COVID-19 for insurance industry worldwide 2020, by type (in billion US dollars)

The US insurance industry is forecasted to lose at least $203 billion overall due to the COVID-19 pandemic. There is an expected $107 billion in underwriting losses, and another $96 billion in investment losses.

Insurance customers worldwide are impacted financially by pandemics and communicable diseases, but so is the insurance industry itself. The COVID-19 pandemic has had a huge estimated impact on the US insurance industry, and potential future pandemics could cause a similar hit.

Pandemics Increase Consumer Interest in Life Insurance

Life insurance customers also question their coverage during pandemics and communicable disease outbreaks. And those who aren't currently covered are more likely to sign up for a new policy. Here's are a couple of influences COVID-19 has had on the life insurance market.

- When asked, life insurance consumers reported that unsatisfactory coverage options as well as complex underwriting conditions were most likely to cause them to switch their policies or carriers.

- However, longer call wait times were less likely to influence carrier switches, possibly because customers understood the increased demand for remote staffing.

Life insurance became more attractive to consumers who formerly did not have coverage after the onset of the COVID-19 pandemic. In most cases, life insurance covers deaths due to communicable disease outbreaks. Also, the increased focus on early, unexpected deaths due to a pandemic sparked an increased interest in obtaining life insurance for the first time among many consumers.

Pandemics Increase Consumer Demand for Annuities

Annuities have also become more attractive to consumers thanks to the COVID-19 pandemic, mainly among older policyholders who seek to preserve their wealth. Annuities offer guaranteed returns and afford numerous investment and other advantages.

- Life insurance payouts can be converted into annuities.

- Annuities can help with uncertainty of future income.

- Annuities are extremely flexible and offer many payout options and schedules.

As folks outlive others in the wake of a pandemic or communicable disease outbreak, it's natural for them to consider the security of their finances. Getting an annuity is a smart way to secure continuous future income.

Pandemics Inspire Rapid Digital Transition

The COVID-19 pandemic forced many consumers to connect with their insurance carriers in new ways, particularly through digital methods such as online or via a mobile app. One positive impact of pandemics is that they can lead to shifts in the way the insurance industry operates. Insurance companies are currently going through rapid technological updates to keep up with demands and increase customer satisfaction.

The digital transition of the insurance world has the potential to unlock greater levels of customer experience and personalization. Granting customers easier and faster access to their policy information, as well as increased accessibility to customer service representatives, provides for an overall more comprehensive and reliable insurance experience.

Additional Impacts on Insurance by Pandemics

With more and more folks working at home and especially online thanks to the COVID-19 pandemic, the cyber liability insurance market has experienced huge increased demands. Unfortunately, cyberattacks have also been trending upwards. As a result, the costs of coverage are also increasing.

The commercial property insurance market is also changing as a result of the recent pandemic. With many businesses permanently closing their physical locations and shifting to an entirely virtual setup, there isn't nearly as much need for coverage for office buildings, etc. The commercial property insurance market will continue to shift its coverage over time to keep up with current trends, not just stemming from pandemics and communicable disease outbreaks.

The Benefits of an Independent Insurance Agent

When it comes to helping insurance customers get the most out of their coverage during a pandemic and all other disasters, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in any type of insurance, deliver quotes from several sources and help you walk through them all to find the best blend of coverage and cost.

https://www.statista.com/statistics/1117220/covid-19-global-insurance-losses/

https://www.pwc.com/us/en/industries/insurance/library/insurance-consumer-survey.htmlhttps://www.investopedia.com/study-reveals-pandemic-to-continue-affecting-consumer-insurance-through-2021-5111994