Long-Term Care Insurance and Additional Benefits

(What they are and why you might need them)

Do you know if your long-term care insurance policy has additional benefits? If you’re anything like most people, we bet you may have a hard time answering this.

That’s okay, because that’s what your independent insurance agent is for. Your independent agent will be able to provide education on what additional benefits are, if your long-term care policy offers them, and if there is an extra premium tied to said benefits.

First things first. Let’s have a little chat about what long-term care insurance is, how and when additional benefits may come into play, and who you should talk to about it. Don’t worry, we know some people.

What is Long-Term Care Insurance?

If you have a long-term care policy you probably already have an idea about what it covers. However, if you’re new to the whole long-term care game you may be wondering just that. Long-term care insurance is, simply put, for your long-term care expenses. Easy right? Where might this apply, you ask? That’s exactly why we're here. See below:

- Nursing home care

- Adult daycare

- Respite care

- Hospice care

- In-home care

- Alzheimer's facilities care

Each policy varies and each carrier offers different benefits for you to choose from. A good independent insurance agent will know the ins-and-outs of the multiple carrier offerings and be able to guide you in your pursuit.

Additional Benefits: What Are They and Why Do You Need Them?

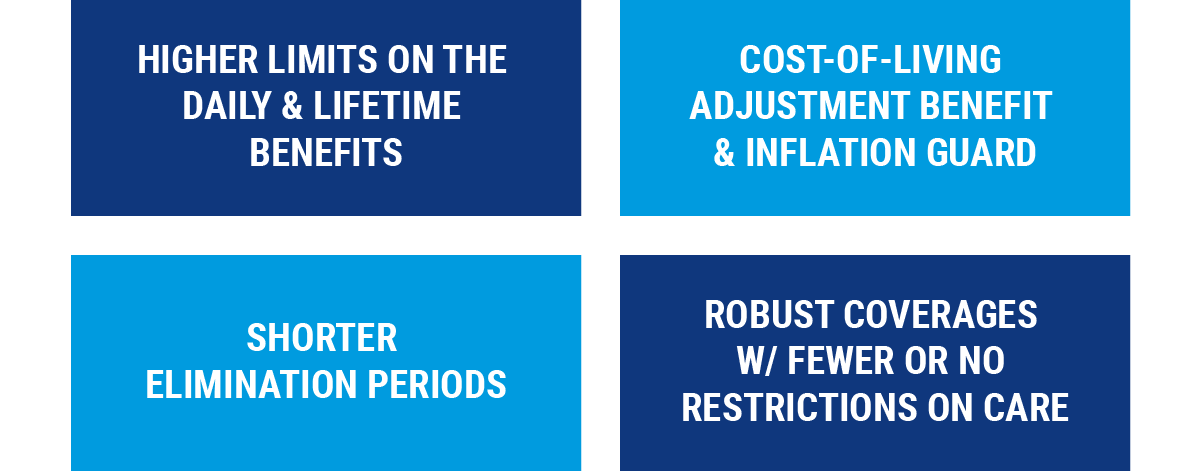

There are a few options when it comes to your long-term care insurance. Additional benefits in a long-term care policy are items such as higher limits on your daily benefit. The lifetime benefit of your policy can also be increased to your liking.

There’s this thing called inflation that is inevitable, and your policy can even have additional benefits to respond to cost-of-living adjustments. Some carriers may have an option for shorter elimination periods as well.

Depending on the type of policy you have purchased, you can have restrictions on the types of care that are afforded to you once you need them. We don’t know about you, but we don’t want to be yelling “Help, we’ve fallen and we can’t get up.” for a 90-day waiting period before someone will come to our rescue.

Additional benefits on your long-term care policy can really protect your retirement savings and provide you with all the care that you could ever need. For some policies, if you don’t add care outside of licensed care facilities such as a nursing home, then the day may come where you have to take what you can get.

We never want you to be in that situation. We want you to have all the coverage you need for any possible outcome the future may hold.

Since we don’t know exactly what the future may hold, we find it best to be comprehensive in our approach to long-term care coverage. Original, and more basic benefits for a long-term care policy really depend on the carrier.

In most cases, a long-term care policy will provide coverage for what we refer to in the business as “activities of daily living” a.k.a. ADL. ADLs are as follows:

- Bathing

- Dressing

- Eating

- Caring for incontinence

- Transferring in and out of bed

- Toileting (assistance for getting off and on the toilet)

Sounds pretty, right? Yeah, no one really likes to think about having to use “activities of daily living” but, alas, here we are.

Are There Different Additional Benefits from State to State?

In a sense, yes. Some states offer what they call “partnership” programs. This is basically the state's way of incentivizing you for being a good steward of your resources and planning ahead with a “partnership” long-term care policy.

These “partnership policies” have to meet certain quality standards set by the state and insurer, taking into account inflation or assisted living expenses, for example. The goal is for you to use your long-term care policy benefits first, then use your Medicaid.

In most states, Medicaid requires you to have a very low dollar amount in assets before you can even tap into the benefits. If you get a “partnership policy,” however, you can typically keep every dollar you would normally have to spend in order to even qualify for Medicaid for every dollar your “partnership policy” paid out.

Make sense? If not, you’re in a good spot because we know the perfect independent agent to introduce you to.

Why Are Additional Benefits So Important and When Will You Need Them?

Additional benefits could mean having enough coverage for as long a time as you need it, period. If you go cheap on your long-term care benefits, it can mean the difference in the Taj Mahal of nursing facilities or the hole-in-the-wall that you don’t feel comfortable in.

Here at TrustedChoice.com, we wouldn’t want you to spend what could be your remaining days in a place like the latter, would you?

We're willing to bet not. Since we know you will likely be needing the additional benefits right when you are in need of care, then we would make sure you not only choose the right advisor, but also the right coverage.

There are so many factors, but a few important ones to look out for are:

Who Can You Speak with about Additional Benefits?

Why, your trusted independent insurance agent, that's who. Don’t have one? No problem, we can make the introduction. Independent insurance agents are really more like advisors than salespeople. They are knowledgeable in the ways of insurance and you can learn a lot from them. So go on, give one a call and learn away.

The independent insurance agent can help with a plethora of items with your long-term care planning. Think of them as a gateway to the town, because that's what they are.

The independent insurance agent has your back and not just on insurance. They also know and work with all the other advisors in town that you need in your corner. This is a relationship that if you don't already have we would suggest getting one ASAP.

Long Term Care. Gov. October, 10th, 2017. Glossary. https://longtermcare.acl.gov/the-basics/glossary.html