Long Term Care Insurance

(Everything you need to know - and more)

In 1946 the first baby boomers were born. Life expectancy was 65 and 70 for boys and girls born that year. Today life expectancy is 80 with lots of folks living well past that age. Retirement plans have to last longer, and one of the big question marks is how to pay for long-term care. Long-term care insurance is one way to do it.

Contact an independent insurance agent. Learn how to protect yourself and your retirement plan from the cost of long-term care.

What Is Long-Term Care Insurance?

Long-term care (LTC) insurance pays for help with basic activities like eating, bathing, and dressing. Long-term care insurance covers expenses that health insurance, Medicare, and Medicaid don’t pay for.

Long-term care needs aren’t limited to senior citizens either. In fact, 37% of long term care services are provided to people under the age of 65.

How Does Long-Term Care Insurance Work?

Long-term care insurance is usually purchased through an insurance agent or broker. You select the amount of benefit, how long you want it to pay, and when you want it to start.

The insurance company will ask you for some medical and lifestyle information. If you have certain health conditions, long-term care insurance may be more expensive or unavailable.

The insurance company will pay a benefit if you can’t do two of the six activities of daily living by yourself, or are diagnosed with a cognitive disorder.

| Key Terms | |

| Daily benefit | Cash benefit paid per day: usually paid monthly. |

| Benefit period | How long benefits are paid: usually two years, five years, or lifetime. |

| Waiting period | When benefits begin after eligibility: usually 30, 60, 90, or 180 days. |

| Activities of daily living | Activities used to determine eligibility for claims: eating, dressing, bathing, toileting, transferring, continence. |

| Cognitive disorders | Diseases that affect memory, learning, perception, and problem solving such as dementia and Alzheimer's. |

| Indemnity long-term care policy | Benefit is not limited to actual cost of care. |

| Reimbursement long-term care policy |

Benefit is limited to the actual cost of care. |

| Non-forfeiture option | Value of policy if canceled. |

| Guaranteed renewable | Insurance company cannot cancel the coverage if the premium is paid. They can raise the premium under certain conditions. |

| Skilled care | Skilled care is nursing and therapy care provided by medical professionals. |

| Custodial care | Non-medical care assisting activities of daily living. |

What Does Long-Term Care Insurance Cover?

The insurance company will pay for care in your home, at adult daycare, at an assisted living facility, or at a nursing home. You will need to provide a doctor’s report and a plan of care.

What Does Long-Term Care Insurance Not Cover?

Reimbursement long-term care policies will not cover expenses paid by Medicare or Medicaid. They will not cover care provided by family members.

Indemnity style long-term care policies pay a cash benefit as long as you are eligible. There is no restriction on how the money is used.

Why Buy Long-Term Care Insurance?

The chances that you will need some form of long-term care are pretty good. 50% of people age 65 today will need some form of long-term care. Long-term care is expensive no matter what type of service. Here are some national averages:

| Service | |

| Licensed homemaker | $20 per hour |

| Home health aid | $20.50 per hour |

| Adult day care | $2,040 per month |

| Assisted living | $3,628 per month |

| Nursing home semi-private room | $6,844 per month |

Even if you only needed some part-time help from a licensed homemaker service, it’s still $30,000 per year. A semi-private room in a nursing home averages $82,000 per year. For most people, it’s a pretty big hit to their retirement plan.

Medicare, Medicaid, and Long-Term Care

Medicare will partly pay for stays of less than 100 days while you are receiving skilled care. Medicare will not pay any benefits after 100 days.

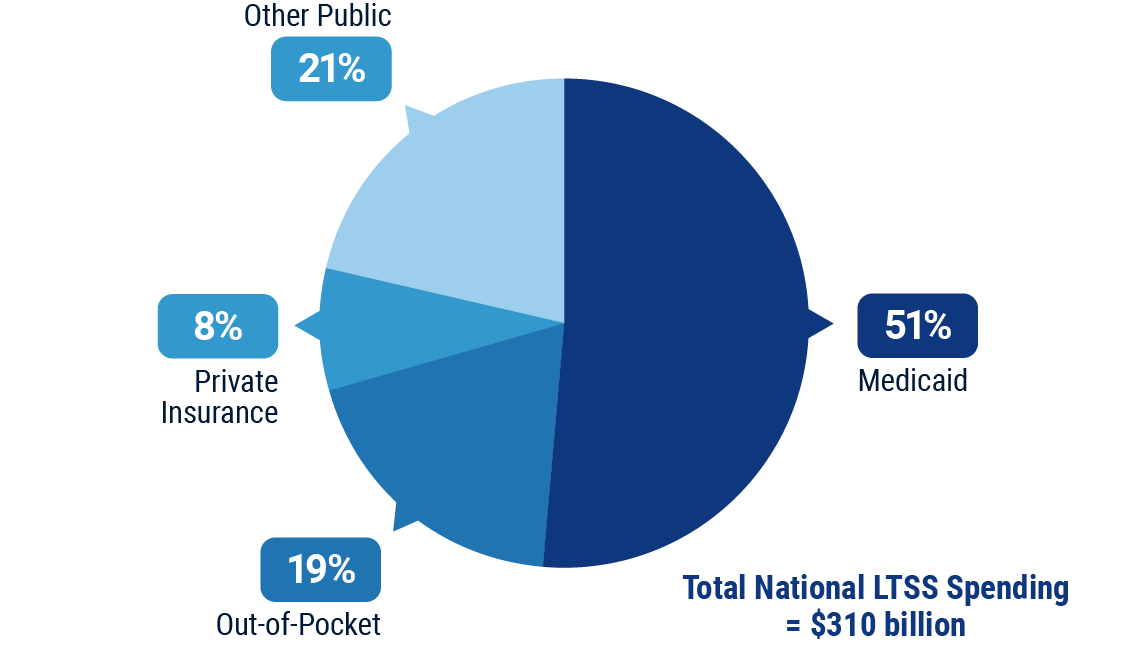

Medicaid pays for 51% of all American long-term care costs. Here’s the problem. Medicaid is a poverty program. To qualify, you can’t have more than $2,000 in assets. And in recent years, Uncle Sam has tightened up on giving away your assets at the last minute to qualify for Medicaid. There is a five-year look back period.

Not all facilities and services accept Medicaid patients. And of course, no one can predict what Medicaid programs will be available twenty years from now.

Types of Long-Term Care Insurance

Traditional long-term care insurance plans only pay a benefit for long-term care services. The insurance company can raise premiums under certain conditions, and there is no refund of premiums for unused benefits. Only a few companies offer traditional long-term care insurance in the market today.

Hybrid long-term care insurance policies are life insurance policies that include a long-term care benefit.

When you buy the life insurance policy, a long-term care benefit is linked to the death benefit. You can pay for the insurance each year or in a lump sum. Whatever you use for long-term care is subtracted from the death benefit when you die.

| Traditional | Hybrid | |

| Benefits | Long-term care only | Long-term care, death benefit for heirs, cash values |

| Premiums tax deductible | Yes | No |

| Tax-free benefits | Yes | Yes |

| Partnership plans available | Yes | No |

| Refund for unused benefits | May be available at an extra cost | Yes |

| Can premiums increase? | Yes | On some policies |

Long-Term Care Insurance vs. Disability Insurance

Some disability insurance policies have provisions for long-term care benefits. Thirty-seven percent of those who needed long-term care in 2017 were under 65. The difference is that disability insurance pays a benefit if you are unable to work. The benefit replaces your income.

Long-term care insurance pays a benefit to pay the expenses of care. It doesn’t matter if you are working.

Is Long-Term Care Insurance Tax Deductible?

If your long-term care policy meets the requirements for tax-qualified, the premiums may be tax deductible. Your long-term care insurance premiums are considered medical expenses. For 2019, you can deduct medical expenses on more than 10% of adjusted gross income.

The IRS limits how much of your long-term care policies can be included in medical expenses.

| Age | Maximum Deduction |

| 40 or less | $420 |

| More than 40 but not more than 50 | $790 |

| More than 50 but not more than 60 | $1,580 |

| More than 60 but not more than 70 | $4,220 |

| More than 70 | $5,270 |

Only traditional long-term care premiums are tax deductible. Hybrid premiums are not. Long-term care insurance benefits are tax-free up to the greater of $370 per day and actual cost of care.

Long-Term Care Medicaid Partnership Program

Medicaid is a Federal poverty program administered by each state. Medicaid pays for long-term care if you qualify financially. The rules are a bit different in each state, but the big picture is this: to qualify for Medicaid, you cannot have more than $2,000 in assets.

Home equity doesn’t count if a dependent lives there. Spouses can also retain as much as $126,000 in some states.

The partnership program works like this: you will purchase a traditional long-term care policy that qualifies for the partnership program. Don’t worry, the insurance company tells you if it does.

When you need long-term care, the policy will pay out the benefits. If the policy benefits run out, you can apply for Medicaid. You can keep $2,000 plus an amount equal to the benefits paid out by the long-term care policy.

If you buy traditional long-term care insurance, there is no downside to buying a partnership plan. Remember, hybrid long-term care does not qualify for the partnership program.

How Much Long-Term Care Insurance Do You Need?

Long-term care should be part of your financial plan. How do you want to fund long-term care if you need it? How much would you be comfortable paying for yourself?

Here are some planning considerations:

Your assets: How long could you pay for long-term care without jeopardizing your retirement plan?

Your budget: How much can you afford to pay for long-term care insurance?

Your legacy plan: How much do you want to leave to your heirs?

Long-term care costs where you retire: Where you live can make a huge difference in the cost of care. $150 per day benefit may be adequate in Ohio, but not in Los Angeles.

Why Go It Alone?

Long-term care insurance is an important part of smart retirement planning. There is a lot to know about the coverage, so contact your local independent insurance agent. They can simplify the process for you.

hhs,irs,cdc,iii