Delaware Long Term Care Insurance

(Because it's never too early to start planning ahead)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Nearly one-third of Delaware’s population is projected to be made up of senior citizens by the year 2030. While the state continues to gray, concerns about the availability of affordable long-term healthcare only increase.

Though it may seem like nursing homes and assisted living facilities are far off in the distant future, it’s never too early to start setting aside some funds, just in case. You may thank yourself for it later.

Long-term care is expensive, so many folks plan for it far in advance. For those wishing to take charge of the financial aspect of their future, fortunately there are plenty of long-term care insurance options in Delaware.

Independent insurance agents are absolute experts in long-term care insurance and can help you find exactly what you need. But first, a briefing on long-term care insurance.

What Is Long-Term Care Insurance?

Basically a different angle on life insurance, long-term care insurance is a type of policy designed to help you prepare for the financial side of assisted living services and other medical fees when you get older.

Of course, you might not end up needing this coverage if you remain in good health as you age, so unless you’re already in poor health, it’s more of a “just in case” method of preparation. Setting money aside while you’re young and healthy can make a huge difference.

No one wants to think about the possibility of their health declining in the future or one day needing extra medical care, but if it does happen, having a financial cushion in place can at least help to soften the blow.

Having to pay out of pocket for increased medical costs after retirement can be extremely stressful, especially if you haven’t planned for it in advance. Long-term care insurance aims to help make this phase of life easier for the elderly.

How Does Delaware’s Long-Term Care Insurance Work?

It all starts with paying a regular premium. Long-term care insurance is often purchased by adults in their 40s who have watched their parents go through assisted living or paying other excessive medical fees, and in turn became inspired to start setting money aside for themselves to use later in life.

Once you purchase a policy, you’ll pay a monthly premium for a long period towards an eventual benefit payout if and when you need it.

Benefits kick in once you’re in need of long-term care. In other words, you’ll get your policy’s payout when you actually go into a nursing home or assisted living facility, or are diagnosed with an ailment that requires another form of long-term care, such as continuous treatment and doctor visits.

Depending on your specific policy, you may receive a certain amount of your benefits daily, weekly, or monthly.

Long-term care insurance is very similar to a life insurance policy, the difference being that you’re the one who gets the benefit payout—to use while you’re still alive. Working with an experienced independent insurance agent is the best way to find a policy that’s set up in a way that benefits you as much as possible.

What Does Delaware’s Long-Term Care Insurance Cover?

Pretty much all forms of long-term care that may be necessary in old age or following a particularly severe health diagnosis. Long-term care insurance is set up to help in the event that you outlive the money you’ve saved up or find that maintaining your self-care becomes more expensive in your advanced years.

You can use your benefit payout to help with all kinds of medical costs. Check out a handful of the most common services and fees to apply coverage to.

Long-term care insurance benefits can help provide coverage for costs associated with the following:

- Nursing homes

- Assisted living facilities

- Extended hospital stays

- Recurring doctor visits

- Multiple surgeries

- Testing and diagnostic processes

- Prescription medications

- Physical therapy or other rehabilitation following surgery

- Chemotherapy and radiation treatments

- Fees associated with treating and recovering from long-term illnesses like stroke, dementia or Alzheimer’s disease

It’s often said that life gets more expensive as you age. Unfortunately this is often the case, especially if increased medical care is required. Luckily those who plan ahead by purchasing a long-term care insurance policy can seriously help themselves with potential extra costs in their golden years.

Why Would I Need Delaware Long-Term Care Insurance?

Mainly to help pay for long-term medical costs once you’ve retired, because Medicare won’t pay for everything. But really there are tons of reasons that might inspire you to look into long-term care insurance. Here’s a look at just a handful.

You might want to get a long-term care policy for one or more of the following reasons:

- You don’t want to put a financial burden on your kids when you’re older by asking for their help with your medical payments.

- You won’t have enough money set aside in savings after retirement to cover your living expenses and increased medical costs.

- You’ll be financially strained post-retirement, but not so much so that you’ll qualify for Medicaid.

In addition, the costs of nursing homes, assisted living facilities, and other long-term treatment can be staggering.

Here are just a few examples of average expenses for Delaware seniors requiring long-term care:

- The national median cost of assisted living is $4,000/month, or $48,000/year.

- On average, a private room in a nursing home costs about $8,365/month, or $100,380/year.

- Home health aides typically charge $20.50/hour for their services. Seniors often spend $50,668/year on home health aides.

- The average daily cost of adult day health care centers is $68.

- The average cost of cancer treatment is around $150,000 in total.

- Additional treatment for Alzheimer’s disease can increase assisted living center costs by as much as $1,000/month.

Though more than half of surveyed American adults plan to rely on Medicare for their medical costs if necessary, sadly Medicare typically doesn’t cover assisted living expenses.

It’s important to keep this in mind when deciding whether to invest in a long-term care insurance policy, as well as the high costs of other long-term medical treatments and services.

What Factors Influence the Cost of Delaware Long-Term Care Insurance?

Well, there are a lot of them, and they’ll depend on your specific health insurance company. But in general, you’re likely to be asked several lifestyle questions, personal profile questions, and whatever other information your insurance company feels is important for calculating your insurance benefits and premium.

Here are a few of the most common.

Your insurance company may base your premium rates on the following factors:

- Age

- Race

- Gender

- Weight

- Lifestyle habits (smoker vs. non-smoker, etc.)

- Health history

- Location of residence

As with other forms of life insurance and even health insurance, premiums tend to be on the pricier side for folks who are generally considered to be less healthy and lead riskier lifestyles. Although it depends on many things, in general, the younger and more fit and careful you are, the lower your premium is likely to be.

How Much Does Long-Term Care Insurance Cost in Delaware?

Several factors influence the cost of long-term care insurance, including where you live. The cost of treatment and service rates in your area also influences insurance premiums. Unfortunately, Delaware ranked as the fifth-most expensive state for assisted living facility care and the ninth-most expensive state for nursing home care in 2018.

Here’s a look at a few average costs for common long-term care services in the state.

Average costs of long-term care in Delaware:

- Home health aide daily rates: $147

- Nursing home care daily rates: $326 for a semi-private room, $315 for a private room

- Assisted living facility monthly rates: $5,368 for a private room

Delaware Long-Term Care Costs – 2018 (Annual)

| Region | Nursing Home (private room) |

Nursing Home (semi-private room) |

Assisted Living (private room) |

Home Health Aide (44 hours/wk) |

| Delaware State Median | $131,400 | $125,925 | $64,200 | $52,624 |

| Dover | $132,860 | $129,210 | $65,010 | $54,912 |

Source: https://www.ltcinsuranceconsultants.com/delaware-long-term-care-insurance/

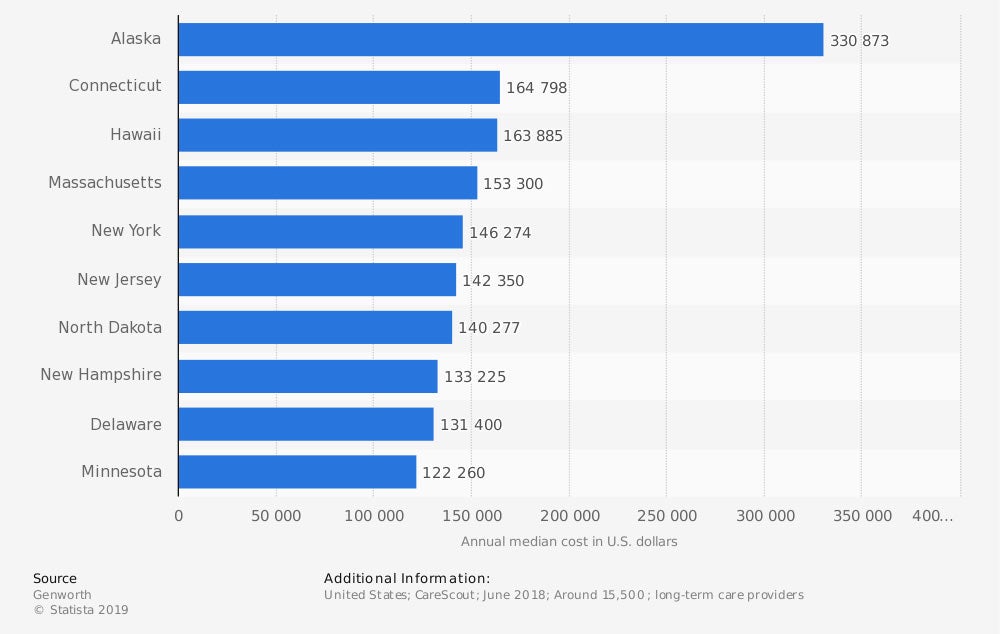

US States with highest annual cost for a private room in nursing homes as of 2018 (in US dollars)

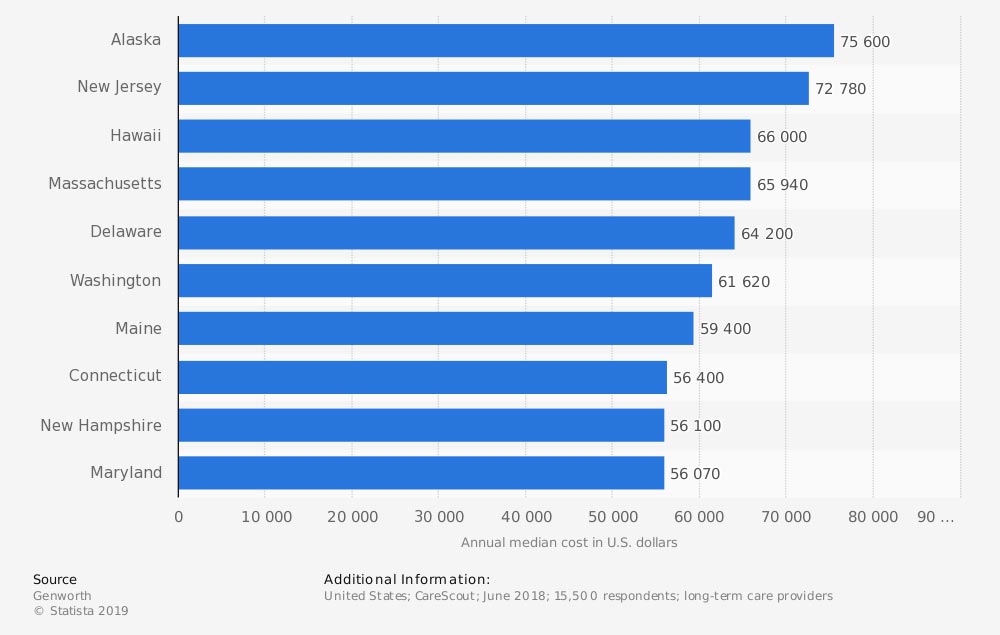

Selected US states with high annual costs of assisted living facilities as of 2018 (in US dollars)

As for the cost of long-term care insurance, that depends on several factors. The national average for singles aged 55 is $2,007/year, while married 55-year-olds pay an annual combined average of $2,466. Here are some average long-term insurance rates for Delaware’s capital, Dover.

Average costs of long-term care insurance for Dover, Delaware:

| Dover, Delaware | ||

| Single male, age 40: | ||

| $68/month for a benefit amount of $2,500 | $95/month for a benefit amount of $3,500 | $122/month for a benefit amount of $4,500 |

| Single female, age 40: | ||

| $105/month for a benefit amount of $2,500 | $147/month for a benefit amount of $3,500 | $189/month for a benefit amount of $4,500 |

| Single male, age 55: | ||

| $90/month for a benefit amount of $2,500 | $126/month for a benefit amount of $3,500 | $162/month for a benefit amount of $4,500 |

| Single female, age 55: | ||

| $146/month for a benefit amount of $2,500 | $204/month for a benefit amount of $3,500 | $262/month for a benefit amount of $4,500 |

| Single male, age 70: | ||

| $171/month for a benefit amount of $2,500 | $239/month for a benefit amount of $3,500 | $307/month for a benefit amount of $4,500 |

| Single female, age 70: | ||

| $265/month for a benefit amount of $2,500 | $371/month for a benefit amount of $3,500 | $477/month for a benefit amount of $4,500 |

Clearly the cost of monthly premiums increases significantly with age, which is a big reason why many long-term care policyholders first purchase coverage in their 40s, to lock themselves into a much lower premium.

Married individuals also get a price break of up to $100 on monthly premiums, and possibly even more than that if their partner is already a policyholder or looking into their own policy.

What Are the Best Long-Term Care Insurance Partnership Options and Insurance Companies in Delaware?

So now that you’ve learned all about what long-term care insurance is, who needs it, and what it costs, you might be wondering where to get it. Delaware started its own partnership program, the Delaware Long-Term Care Partnership Program, in 2011.

The partnership program aids long-term care policyholders if their insurance benefits don’t fully cover their medical costs. Through this program, policyholders are able to protect their assets and still qualify for Medicaid.

As for the top companies to purchase your long-term care insurance from, fortunately for Delawareans there are several to choose from in your state.

Here are several of the top long-term care insurance companies in Delaware:

- Bankers Life & Casualty

- Genworth Financial

- LifeSecure

- MassMutual Financial Group

- Mutual of Omaha

- National Guardian Life

- New York Life

- State Farm

- Thrivent Financial

- Transamerica

An independent insurance agent can help you get set up with the best insurance company for your unique needs. An experienced agent can also help you determine if you might benefit from joining the Delaware Long-Term Care Partnership Program.

Be prepared with a list of your questions and concerns about long-term care insurance policies before you connect with an agent, to help the process run as smoothly as possible.

How to Find the Best Long-Term Care Insurance in Delaware

In order to get the protection you need (and deserve), you’ll want to work with a trusted expert. Independent insurance agents will not only know where to find the best coverage and price, but also help to make sense of the fine print.

Consider your unique needs, then connect with an agent to help you take it from there. Have a list of your specific concerns and desires ready before reaching out, to help the process run even more smoothly.

Why Independent Insurance Agents?

Insurance policies can be complex and searching through options can be confusing, time-consuming, and frustrating. An independent insurance agent's role is to simplify the process.

They’ll make sure you get the right coverage that meets your unique needs. Not only that, they’ll break down all the jargon and explain the nitty-gritty, so you understand exactly what you’re getting.

And when it comes time to file a claim, you’re not alone. Your agent will be right there to help guide you through every last step and get your life back to where it was. How great is that?

www.iii.org

www.aaltci.org

www.whereyoulivematters.org

www.altcp.org