Publishers Insurance

(Finding protection for your business has never been easier)

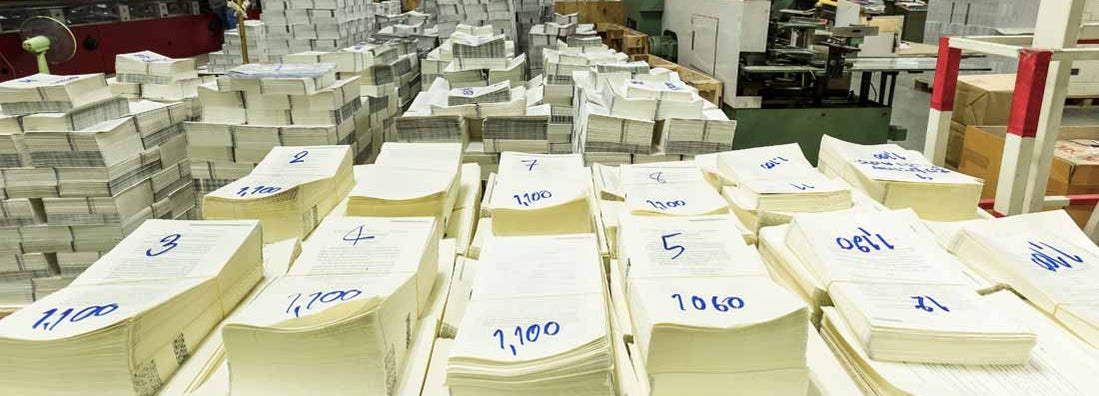

Printing and publishing might seem like a fairly low-risk business endeavor, but in reality, businesses in the printing and publishing industry face serious, potentially costly risks every day. Publishers need a comprehensive business insurance portfolio in place to help mitigate their risks and protect them should the worst happen.

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

The traditional publishing industry consists of a wide variety of small and large businesses that produce these products:

- Newspapers

- Periodicals

- Books

- Directories

- Mailing lists

- Greeting cards

Publishers may also be involved in these activities:

- Bookbinding

- Commercial printing

- Lithography

- Platemaking

- Typesetting

Publishers use dangerous chemicals and high-tech equipment, such as the following, in large printing facilities:

- Printing presses

- Packaging equipment

- Forklifts

A printing facility can be dangerous for workers, delivery persons or any members of the general public that are on the premises. In addition, damage to buildings and machines can delay production and have serious financial consequences. One spark can be disastrous, with paper, glue and other flammables present at all times.

Beyond dangers to people and property, publishers can be sued for a variety of reasons such as errors, omissions, negligence, slander, libel, copyright infringement and a whole host of potential liability claims related to the works that you publish. Defending your business in a lawsuit is devastatingly costly and time-consuming.

You need specialized, tailored publishers insurance to address all of these unique risks.

Publishers Insurance Overview

Publishers should work with an independent insurance agent to assess their risks and determine the types of business insurance that they need. You will likely need the following types of policies, tailored to your unique exposures:

- Business property insurance protects buildings and their contents, including computers, office equipment, printing presses and other publishing equipment, furniture, supplies, and inventory if it is damaged by fire, smoke, theft, vandalism or some other covered peril. Property insurance provides funds to repair or replace lost, stolen, damaged or destroyed property.

- Your business property policy should also include business interruption coverage, which compensates you for lost business income and pays for operating expenses if you must temporarily close or relocate following a covered loss (e.g., a building fire).

- Commercial general liability (CGL) insurance pays for claims of bodily injury and property damage to third parties due to your negligence (e.g., a client's or delivery person's injury at your printing facility). CGL insurance also provides coverage for lawsuits related to claims of slander and libel, and for advertising liability, including attorney fees, court costs and any judgments or settlements that a court orders you to pay.

- Equipment breakdown insurance, often referred to as boiler and machinery coverage, supplements your business property insurance. It covers certain costs associated with accidental breakdown of machinery or equipment (printing presses, packaging equipment, binding equipment etc.) and the resulting property damage or loss.

- Commercial auto insurance covers your vehicle fleet and drivers in the event of an accident or other vehicle damage. Commercial auto insurance provides coverage for property damage and bodily injury liability claims, vehicle damage, and medical bills, as well as any costs related to lawsuits due to auto accidents involving your vehicle fleet.

- Commercial umbrella insurance, or excess liability coverage, provides an extra layer of liability protection to any of several other policies you might have. It is activated when the limits of your other applicable liability policies have been exhausted, protecting you when a covered claim exceeds the amount of coverage available from any other applicable policy.

- Cyber liability insurance provides coverage in the event of a data breach involving your business. It helps pay for the costs of notifying affected clients or business partners and helps pay for public relations and forensic costs.

You may also need directors and officers (D&O) liability insurance. It protects specific decision-makers (e.g., a board of directors or advisory committee) from legal judgments and costs arising from certain behaviors or decisions that they make.

Without this coverage, these individuals’ personal assets could be at stake if they are sued for certain acts:

- Unlawful acts

- Erroneous investment decisions

- Failure to maintain property

- Releasing confidential information

- Hiring and firing decisions

- Conflicts of interest

- Gross negligence

Publishers Liability Insurance and Media Perils Insurance

While publishers can get broad liability protection with a general liability policy, it is likely not sufficient to cover all of the very unique liability exposures that they have. When you produce printed content for mass consumption, you are exposed to numerous liability risks that go far beyond slips and falls at your printing facility.

You need publishers liability insurance and media perils coverage to protect yourself from lawsuits that may arise as a result of the content that you publish.

There are two kinds of publishers liability insurance designed for the specific needs of publishers.

Publishers liability insurance is a form of errors and omissions (E&O) insurance. It provides coverage when a publisher makes a professional mistake that harms a customer or a client.

If the publisher is sued for negligence, it provides coverage for attorney fees, court costs, settlements and judgments related to the lawsuit whether or not you are actually liable for the alleged mistakes.

Media liability coverage, or media perils coverage, is designed for publishers and other media-related firms. It is typically written to cover specific media-related perils such as the following:

- Defamation

- Invasion of privacy

- Copyright and trademark infringement

- Plagiarism

- Advertising injury

- Unfair completion

- Infliction of emotional distress

- Misappropriation of ideas

Most media perils policies cover costs relating to defending a lawsuit, up to the limits of the policy – whether or not the claim is legitimate. Most will exclude coverage for intentional and malicious acts.

Publishers liability and media perils insurance are specialized types of coverage that are not available from every insurance company. In order to find the coverage that is best for your business at a competitive price, you need to work with an independent insurance agent who can work with multiple insurance companies.

If your material will be distributed outside of the U.S., you will have additional coverage complications that need to be addressed with your agent.

Workers’ Compensation Insurance for Publishers

Publishers’ employees often work in a dangerous environment, using heavy equipment, caustic chemicals and other potential health hazards. Your employees are susceptible to slips and falls, loss of fingers or limbs, eye injuries, lung irritation, and even repetitive motion injuries.

What can you do to protect your workers and your business from the costs of work-related injuries and illnesses? How can you prevent injured workers from suing you if they are hurt at work?

The safety of your employees should be one of your highest priorities. Workers’ compensation insurance is an affordable way to protect your business and your employees from the cost of work-related injuries and illnesses.

It provides benefits to injured workers regardless of who is at fault and provides death benefits for a worker’s dependents if he or she is killed as a result of a workplace incident.

Providing workers’ compensation insurance gives peace of mind to your employees and eliminates the possibility that an injured worker will sue you for damages.

Workers’ compensation rates are partially based on your company’s history of workers’ compensation claims. What can you do to keep your employees safe at work and reduce workers’ compensation claims? The best way is to provide workplace in which safety and injury prevention are top priorities.

While every injury or illness cannot be prevented, implementing proper safety and risk management techniques goes a long way toward keeping everyone healthy and happy and keeping the number of workers’ compensation claims down.

Every state requires employers to carry workers’ compensation insurance – with a few exceptions. If you don’t have workers’ compensation insurance as required by your state, you may be subject to significant fines and penalties.

What’s more, without protection from workers’ compensation insurance, injured employees can sue you.

Find Publishers Insurance That Protects Your Business

Publishing is a highly complex business with risk exposures everywhere you look. You need tailored business insurance solutions specifically designed for the publishing industry. And not every insurance company or agent can help you.

An independent agent in our network can work with numerous reputable insurance companies – including those that specialize in publishers insurance – to make sure you find coverage for your unique risks.

If you are looking for a long-term partnership and personal service, and knowledgeable advice and counsel – rather than a one-size-fits-all approach – an independent agent is the best choice for you.