How Long Does Voluntary Short-Term Disability Insurance Last

(It can be, but don't forget to explore your other options.)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

What would happen if you became unable to work? Government benefits aren’t a guarantee and take a long time to kick in. Voluntary disability insurance is there to bridge the gap and keep your family afloat if you become temporarily disabled.

Buying voluntary insurance through your employer has a tax benefit, but it might not be the best deal for you. Once you’re ready to shop, expert independent insurance agents are here to answer your questions and find you the coverage you need at the right price.

What Is Voluntary Disability Insurance?

Voluntary disability insurance covers a percentage of your income if you become disabled. You cover the entire premium of this insurance rather than an employer chipping in part of the money. (And you can opt out of this coverage, hence the “voluntary” part.)

It may feel stingy for your employer to put the total cost on you, but there’s a tax benefit: In return for taking on this cost, you get your benefits tax-free if you ever become disabled and need to access them. That can save you money in the long run.

Group vs. Individual Voluntary Disability Insurance

Disability insurance is sold two ways: in group policies or in individual policies. Voluntary insurance is a type of group insurance.

Group policies are purchased through your employer. You’re placed in a risk pool with the other people at your company, which is to your advantage if you’re at higher risk of disability (for example, if you’re 50 or over) and to your disadvantage if you’re at lower risk.

Group vs. Individual: Which Is Better?

| Type | Benefits Offered | Benefit Period | Pros and Cons |

| Individual | Flat income amount | Short-Term: 1-5 years Long-Term: from 2 years till retirement |

Pros: Full control over the coverage; no loss of coverage when you change jobs; can shop from any company for the best offerings. Cons: Can be expensive if your risks are higher. |

| Group | Percentage of income | Short-Term: less than 1 year Long-Term: from 2 years till retirement |

Pros: If you're at high risk for disability, pooling coverage with others can be cheaper. Cons: Limited options; you lose coverage when you switch jobs. |

Source: Principles of Life and Health Insurance

Both individual and group disability insurance have their pros and cons. With voluntary insurance, since you’re taking on the full cost of the premium anyway, you may decide it’s better to shop on your own rather than stick with your company’s offering.

Whatever you end up choosing, it pays to at least check out your individual options as well as your voluntary group options. There may be unique discounts or perks you qualify for individually that you’d lose out on in a group.

How Long Does Voluntary Long-Term Disability Insurance Last?

Long-term voluntary disability insurance is designed to cover permanent or long-lasting disabilities that either prevent you from working or significantly affect how much and what type of work you can do, forcing you to take a pay cut.

Long-term disability insurance typically kicks in within 2 weeks to 9 months. Once it starts, its benefits can last anywhere from 2 years until retirement (or rarely, until your death).

How Long Does Voluntary Short-Term Disability Insurance Last?

Short-term voluntary disability insurance is designed to cover temporary disabilities lasting a few months to a year or two. This could include situations like a head injury, a severe infection, or a bad flare-up of a chronic condition like migraines.

Short-term disability insurance can kick in instantly. More commonly, it has a short waiting period of 7-90 days. Once it starts, voluntary group policies typically last 6 months to 2 years.

Why Is Voluntary Short Term Disability Insurance Important?

Short-term disabilities can happen at any time—car accidents, disease and freak injuries don’t care how much money you have in savings. What would you do if you lost your job or had to go on unpaid leave because of disability?

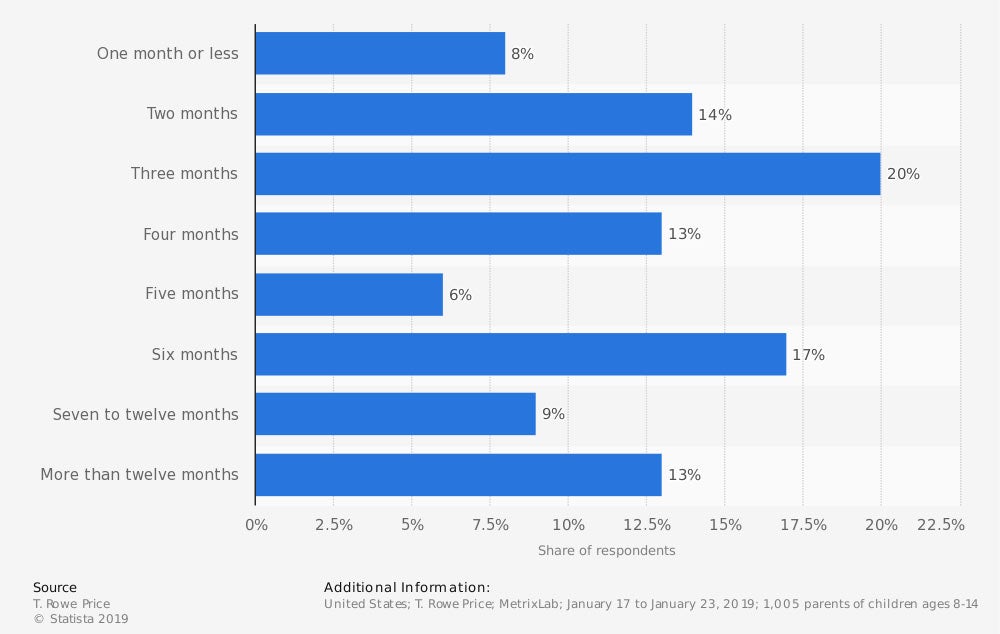

For how many months would your emergency fund cover your family's expenses?

In 2019, fewer than half of Americans had enough in savings to carry them beyond a 6-month emergency. Nearly a quarter of Americans only had enough for less than two months.

Short-term disability insurance kicks in fast to get you the money you need, when you need it.

Do I Lose Voluntary Disability Insurance If I Quit My Job?

The prospect of losing your benefits can be one of the worst parts of changing jobs. That’s why insurance companies almost always offer you the option to continue your coverage after leaving your job.

If your employer is covering part of your premiums, this can end up being a bad deal. You will now be forced to shoulder more of a cost for the same benefit. With voluntary insurance, however, this does not affect the cost, since you were paying the whole premium to begin with.

That said, continuing your workplace’s voluntary disability insurance isn’t always the smartest thing to do. Changing jobs is a good time to reevaluate your insurance needs and find out if you could be getting better discounts elsewhere. Independent insurance agents can help.

What about Government Benefits?

Government disability income programs like Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are designed for long-term disabilities. You may be able to access retroactive SSDI benefits for what’s called a “closed period” (a temporary period of disability that has ended), but that won’t help you during a crisis.

Short-term disability insurance is an important safety net that keeps your family from falling behind on critical expenses like a mortgage or rent, car payments, utilities, food, medications, tuition and more. It fills a unique niche that government benefits are not designed for.

What to Do When Voluntary Short Term Disability Insurance Runs Out

If your disability lasts longer than the duration of your short-term disability insurance policy, you may be able to convert it into a long-term policy. An independent insurance agent can help you figure out if your policy allows that. Better yet, they can help you shop for one that guarantees this option in the first place.

If you can’t convert, then it’s time to try accessing government benefits. There are two main government disability benefit programs: Supplemental Security Income and Social Security Disability Insurance:

- Supplemental Security Income: Anyone with a disability can apply. Benefits are based on federal cost of living estimates. No retroactive benefits.

- Social Security Disability Insurance: Must have a work history to apply. Benefits are based on your income history. Retroactive benefits may be available.

How Life Insurance Can Help

If you’re all out of disability-specific options, take another look at your life insurance policy. Whole life insurance policies gain cash value over time and can eventually be converted into cash value or even monthly payments (annuities) that can function like disability insurance.

If you don’t currently have a whole life insurance policy, this is another reason they’re a great financial planning tool. Whole life insurance can be used to pay for a generous retirement if you stay healthy, or it can be used to cover disability and long-term care costs if you need them.

How an Independent Insurance Agent Can Level Up Your Disability Insurance

Shopping for disability insurance yourself can be a downer. It’s hard to know where to look, how much insurance you need, or how to find a good deal. Luckily, independent insurance agents are here to handle the hard parts for you.

Independent insurance agents are industry experts who aren’t bound to any one company. They can compare quotes from multiple insurers to find you the coverage you want at the right price. Shopping for disability insurance with an independent insurance agent is shopping smart.

iii.org

SSA.gov

The Long Term Care Handbook (3rd edition) by Jeff Sadler

Nolo’s Guide to Social Security Disability: Getting and Keeping Your Benefits (8th edition) by David A. Morton III, M.D.

Principles of Life and Health Insurance (2nd edition) by Dani L. Long and Gene A. Morton