Individual Disability Insurance

How to find the coverage you need and more

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

If you're out of work even temporarily due to a disability, the financial consequences could take an extra toll on you. That's why it's so important to be equipped with the proper coverage before an incident ever happens. That means having the right disability insurance.

An independent insurance agent can help you get set up with the disability insurance that best meets your needs. Even better, they'll make sure you're covered long before you ever need to file a claim. But before we jump too far ahead, here's a closer look at this critical coverage.

What Is Disability Insurance?

A disability is defined as "a physical or mental condition that limits a person's movements, senses, or activities" by the Oxford dictionary. Individual disability insurance is bought by you and covers all or some of your income if you become disabled and can’t work for a period of time. Group disability insurance is purchased by your employer and often covers the entire workforce.

An individual disability insurance policy can follow you throughout your career and has many advantages over group disability insurance. Your disability doesn’t need to have been caused by your job for it to be covered by individual or group disability insurance.

What Is Group Disability Insurance?

Group disability plans often cover disabled employees up to 60% of their normal take-home pay while recovering. Maximum amounts for coverage are often around $10,000 per month. Group plans are available for both short-term and long-term coverage periods.

Group plans allows businesses to retain their top employees even in the event of a severe disability. Coverage is also tax-deductible for businesses.

What Is Short-Term Disability Insurance?

Individual short-term disability insurance covers disabilities that last for weeks or months. These can include severe injuries, like traumatic brain injuries, or serious illnesses like meningitis. It can also cover a flare-up of a preexisting disability if it becomes temporarily more difficult to live with and treat.

Short-term disability insurance typically has a short waiting period before it kicks in, as little as a couple of weeks. Payouts typically replace between 40-60% of your normal take-home income. Coverage periods are often between three and six months.

DID YOU KNOW?

Short-term disability insurance also covers pregnancy, which is not covered by long-term disability insurance.

Long-Term Disability Insurance

Individual long-term disability insurance covers disabilities that last for years, or even become permanent. Sometimes long-term disabilities can put you out of work indefinitely, or cause you to have to switch to a lower-paying career. Luckily, long-term disability insurance can cover both situations.

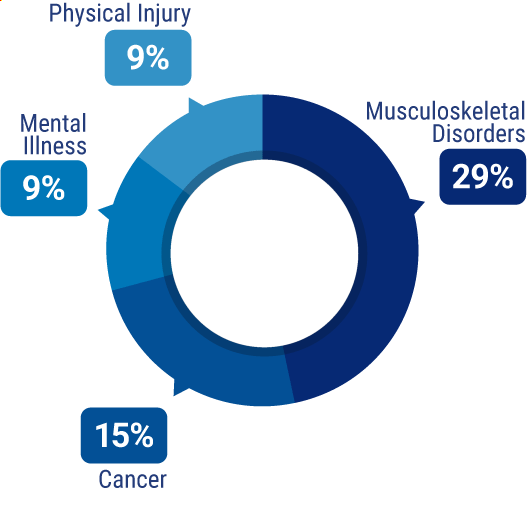

Source: disabilitycanhappen.org

The waiting period before long-term disability benefits kick in can be much longer than that of short-term disability insurance's. This period, also called the "elimination period," is often around 90 days but may be longer. Payouts typically replace between 40-70% of your normal take-home income.

DID YOU KNOW?

Important: Long-term disability is different from long-term care insurance, which helps cover the costs of care facilities if you are unable to perform several of the activities of daily living (bathing, dressing, eating, walking, using the bathroom).

Benefits from long-term disability insurance continue until the coverage period ends, or once you've recovered from that disability — whichever comes first. Policies that cover you up to age 65 are also available, and you can even purchase riders to extend this coverage further. Between 60-80% of your income is often covered by long-term disability insurance.

How Does a Disability Affect Earning Potential?

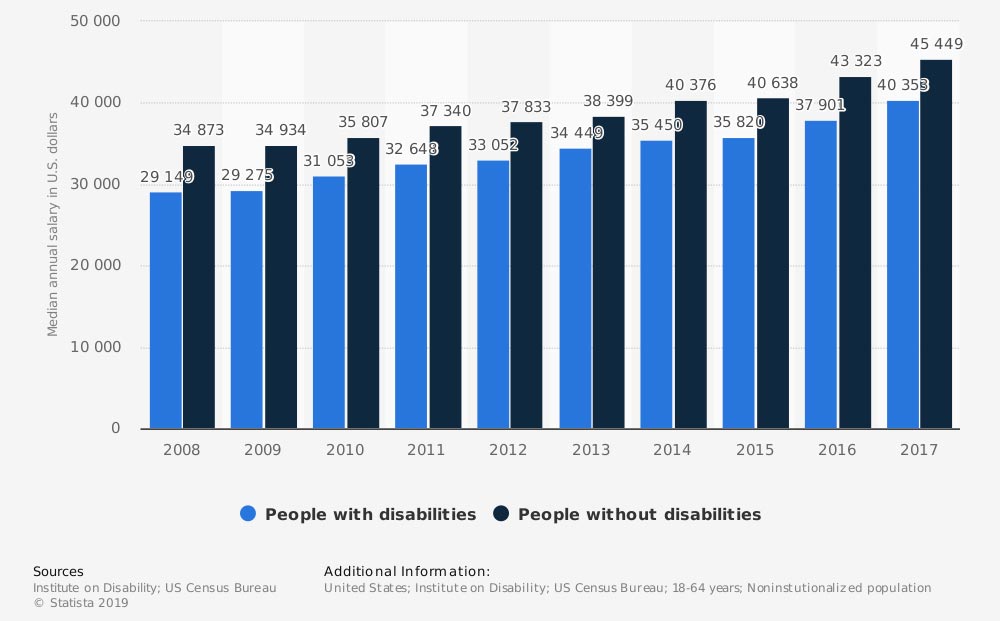

Annual median earnings for people with and without disabilities in the US in a recent decade (in US dollars)

The annual median income of people with disabilities is, on average, $5,000 lower than the median income of people without disabilities. Long-term disability may cover part or all of this income gap.

Who Sells Disability Insurance?

Disability insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. They know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could create a disability insurance policy for you, finding coverage could also depend on the area you live in. Here are a few of the top companies for disability coverage.

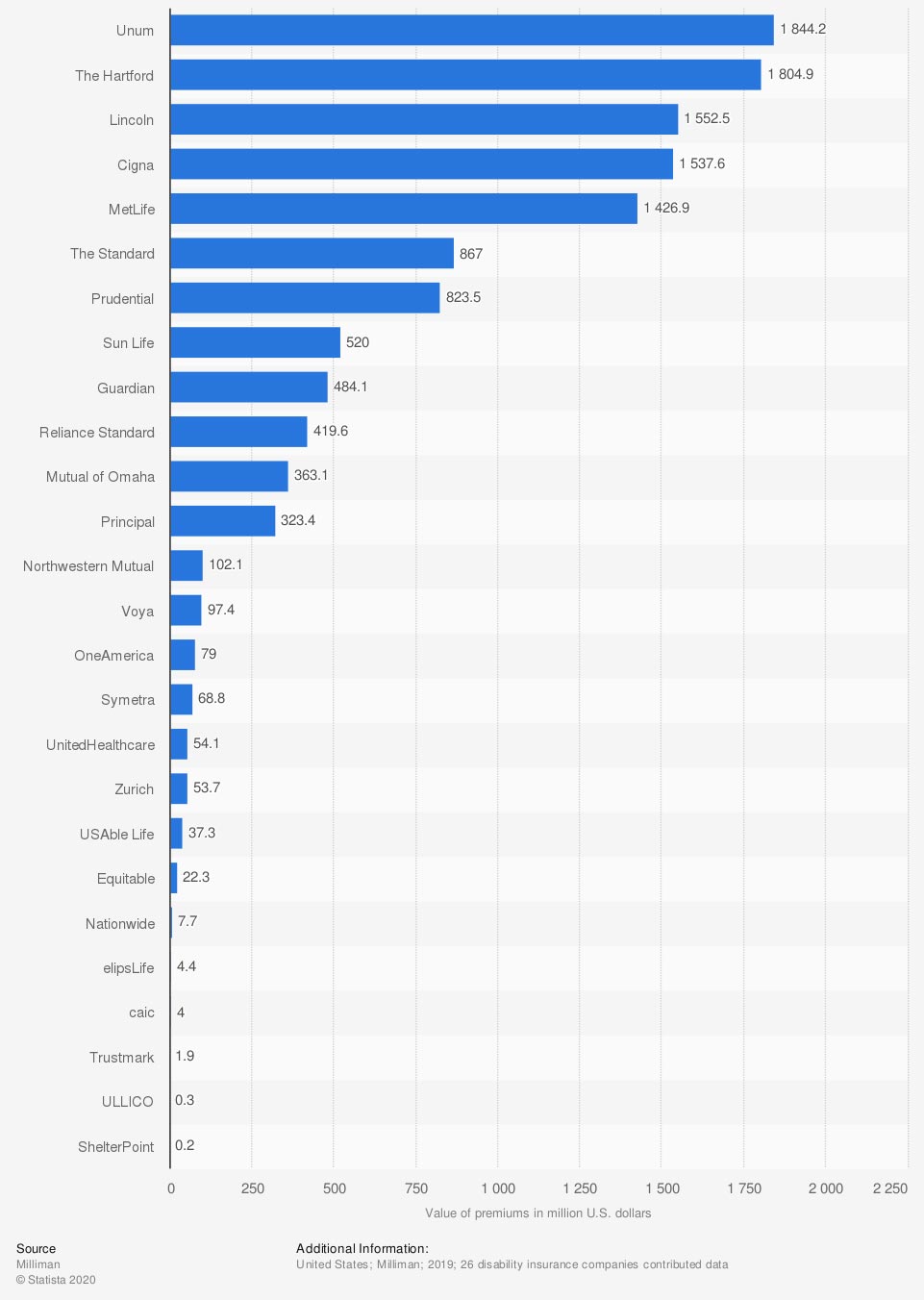

Leading group long-term disability insurers in a recent year in the US, by premiums

Recently, the leading group long-term disability insurance companies are Unum, The Hartford, Lincoln Financial Group, Cigna, and MetLife.

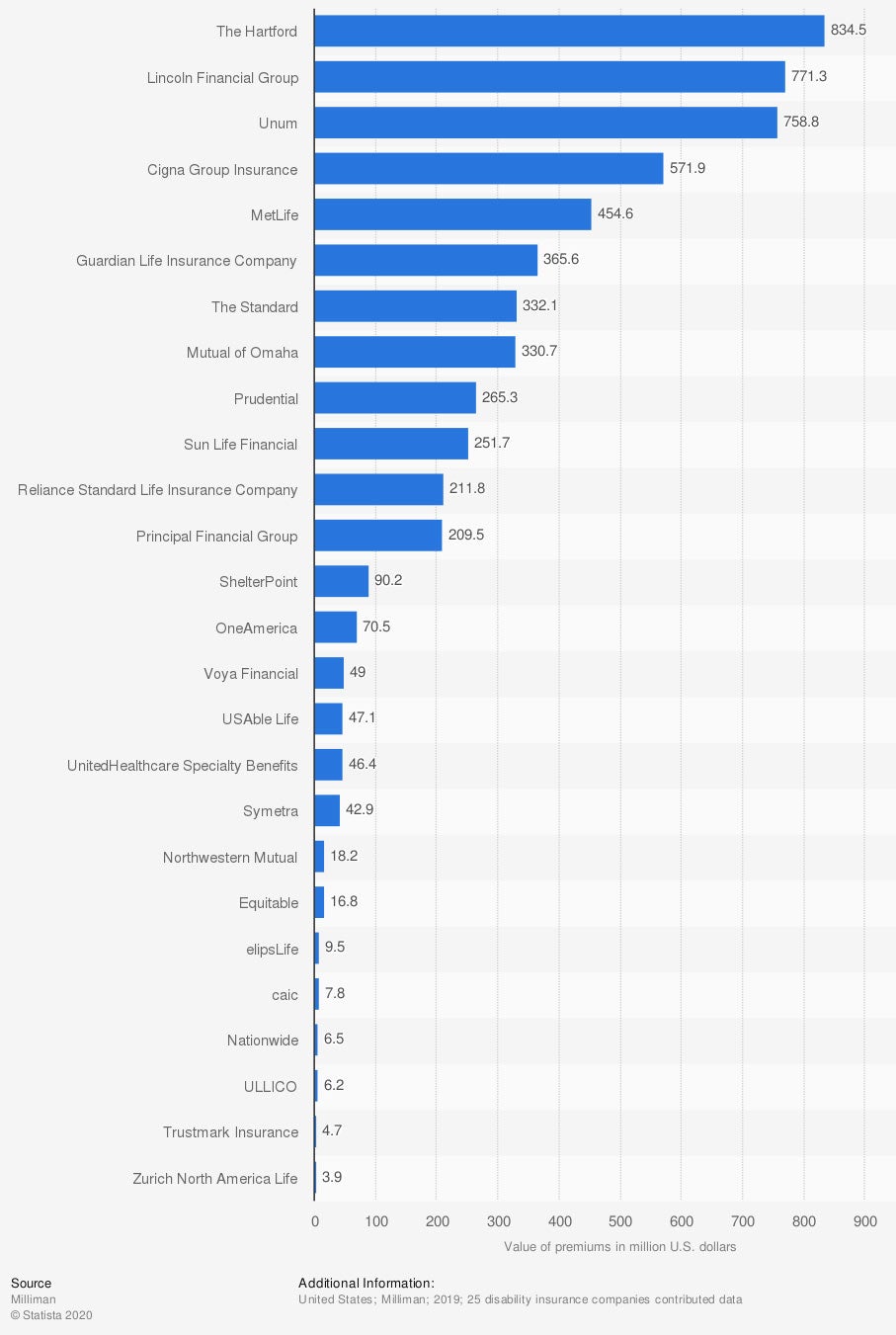

Leading group short-term disability insurance companies in the United States in a recent year, by in-force premiums (in million US dollars)

As of 2019, the leading group short-term disability insurance companies are The Hartford, Lincoln Financial Group, Unum, Cigna, and MetLife.

Who Needs Disability Insurance?

Really, anyone who depends on a source of income. Those with others who depend on them need coverage even more to be able to continue to provide for their families should disaster strike. Disability insurance can be considered a wise investment for younger, healthier individuals to plan ahead for their future.

Why Is Individual Disability Insurance Important?

Individual disability insurance is important because your chance of disability rises sharply with age, and disabilities can happen to anyone. Many individuals with disabilities are unable to work at all, which could lead to bankruptcy without the right insurance. Fortunately, disability insurance helps cover the cost of living for many individuals who are out of work.

What Does Individual Disability Insurance Cover?

Individual disability insurance can pay your mortgage or rent. It can also cover the cost of food, medicine, toiletries, and other necessities. It keeps you from defaulting on debt or running up high-interest credit card debts while you scramble for income during a disability.

In short, it makes a hard time easier, at least financially. Becoming disabled can be an emotional and frustrating process. Money troubles compound that stress for you and your family. Luckily, disability insurance is there to help.

What Is Total Disability Coverage?

Total disability coverage pays out benefits monthly until either you recover from your disability and are able to work again, or your policy expires. You'll want to work with an independent insurance agent to get a policy that provides benefits of about 60% of your pre-tax income, or your usual take-home amount. If needed, more coverage can often be added later.

What Is Presumptive Disability Coverage?

Presumptive disability coverage is designed to cover individuals with such severe disabilities that they're presumed by the insurance company to never be able to work again. Coverage amounts and time periods are often higher for presumptive disability coverage than total disability coverage. Catastrophic disability riders are also available to increase your coverage even further.

What Are Partial Disability Benefits?

Partial disability coverage is designed for individuals who can still physically go to work, but their disability causes them to have to work less or differently than before, resulting in a partial loss of income. Partial disability benefits are only available while you're still being treated by a doctor. Once you no longer require medical care, often partial disability benefits expire.

What's Not Covered by Disability Insurance?

Disability insurance provides a lot of critical benefits for many individuals, but it can't benefit everyone. Disability insurance comes with various exclusions, such as the following.

- Disabilities caused by war

- Disabilities caused by committing crimes or rioting

- Disabilities caused by self-inflicted or intentional injuries

- Many preexisting conditions that later cause disability

Those over the age of 65 may not be able to get disability insurance at all. If you're concerned about finding coverage or the exclusions that may be listed in your policy, work with an independent insurance agent.

When's the Best Time to Apply for Disability Insurance?

It's best to apply for disability insurance long before you ever end up needing the coverage. Applying while young and healthy allows you to pass required medical screenings and gets you started with a lower premium rate. Overall, before age 50 is considered the best time to apply for disability coverage.

What Is Social Security Disability Insurance?

The Social Security Administration (SSA) offers a government program called Social Security Disability Insurance (SSDI) which pays out benefits if a disability affects an individual's ability to work. Several qualifications must be met to obtain SSDI.

- Your employer or job must be covered by Social Security.

- Your qualifying work must be recent and for at least a specified amount of time.

- You must have a disability as defined by the SSA.

- Your disability must cause you to be out of work for a year or longer.

- You must earn less than $1,220 per month with your disability.

If the SSA determines that you can work, you won't qualify for SSDI, regardless of if you can't have the same type of job you did before. Your medical condition, age, education, work history, and skills will be factored into the SSA's review and ultimate decision on if you qualify for benefits.

As of 2020, only about 35% of applicants were approved for coverage by the SSA. In one recent year, the average monthly disability benefit was $1,234. Most people receive less than $1,400 monthly, with the maximum benefit amount often being $3,000.

What about State Disability Insurance?

If you live and work in one of these five states, you might already be covered by disability insurance.

- California

- Hawaii

- New Jersey

- New York

- Rhode Island

The above states make it mandatory for employers to offer their workers disability insurance for injuries and illnesses that are caused outside of the work environment. State disability coverage also comes with a set of drawbacks that make it less reliable than individual or group disability insurance.

How Much Does Disability Insurance Cost?

Long-term disability insurance costs, on average, 1% to 3% of your annual salary. If you make $100,000 per year, you can expect to pay between $1,000 and $3,000 towards a long-term disability insurance policy. The chart below breaks down the cost of this coverage even further.

| Annual Salary | Yearly Cost | Monthly Payment |

| $30,000 | $300 - $900 | $25 - $75 |

| $50,000 | $500 - $1,500 | $60 - $125 |

| $100,000 | $1,000 - $3,000 | $83 - $250 |

| $150,000 | $1,500 - $4,500 | $125 - $375 |

| $200,000 | $2,000 - $6,000 | $166 - $500 |

Several factors will influence the cost of your disability insurance, including your age, health, occupation, location, and more. An independent insurance agent can help you find more exact disability insurance quotes for your area.

Frequently Asked Questions about Disability Insurance

Short-term disability coverage periods are often between three and six months. Benefits from long-term disability insurance continue until the coverage period ends, or once you've recovered from that disability — whichever comes first.

To qualify for disability through the SSA, you must meet a list of criteria, including working for an employer covered by Social Security. To qualify for coverage through your employer, your ability to work must be altered by your medical condition, causing you to work less or not at all, or earn less than normal.

It's recommended to get enough coverage to replace about 60% of your normal pre-tax income, or an amount equal to your usual take-home pay.

To qualify for a mental health disability through the SSA, you must meet a list of criteria, including working for an employer covered by Social Security. To qualify for coverage through your employer, your ability to work must be altered by your medical condition, causing you to work less or not at all, or earn less than normal.

No, workers' comp is not technically a type of disability insurance. It's essentially a form of accident insurance purchased by an employer to protect themselves against employee injury, illness, or death on the job.

Why Are Independent Insurance Agents Awesome?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best disability coverage, accessibility, and competitive pricing while working for you.

chart 1 - https://www.statista.com/forecasts/866401/group-long-term-disability-insurers-usa-by-premiums

chart 2 - https://www.statista.com/forecasts/866366/group-short-term-disability-insurers-usa-by-premiums

https://www.ssa.gov/oact/STATS/dibStat.html

How Much Does Disability Insurance Cost? Chart: PolicyGenius