Total & Permanent Disability Insurance

(How long-term disability insurance can make a painful time much easier on you and your family)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Have you ever wondered what might happen if you suffered a life-changing injury or illness? The answer could be devastating. Suddenly losing your income could leave you and your family scrambling at a time that should be fully focused on your recovery.

Luckily, total and permanent disability insurance (also called long term disability) is there to replace your income if you ever become unable to work. Here’s everything you need to know about total and permanent disability insurance: what it covers, why it’s important and how to shop around with savvy.

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

What Is Total and Permanent Disability Insurance?

“Total and permanent disability” is a term with a long history that started as workers' compensation jargon. It was a way to distinguish serious injuries so severe that the employee would never be able to return to work (for example, total paralysis) from more temporary disabilities like a broken leg.

Today, total and permanent disability insurance is a type of insurance that covers all or part of your income if you become permanently disabled. It can be supplemental to workers' compensation if you’re injured on the job, or it can cover off-the-job situations like chronic and mental illness.

Total and permanent disability insurance can sometimes be part of your benefits package at work. Otherwise you can buy it yourself, often through life insurance companies. You can also choose to supplement a policy through your workplace with your own coverage.

Total and permanent disability insurance is also often called long term disability insurance. It’s related to short term disability insurance. In fact, short term disability insurance may be converted into long term disability insurance if your disability worsens and becomes permanent.

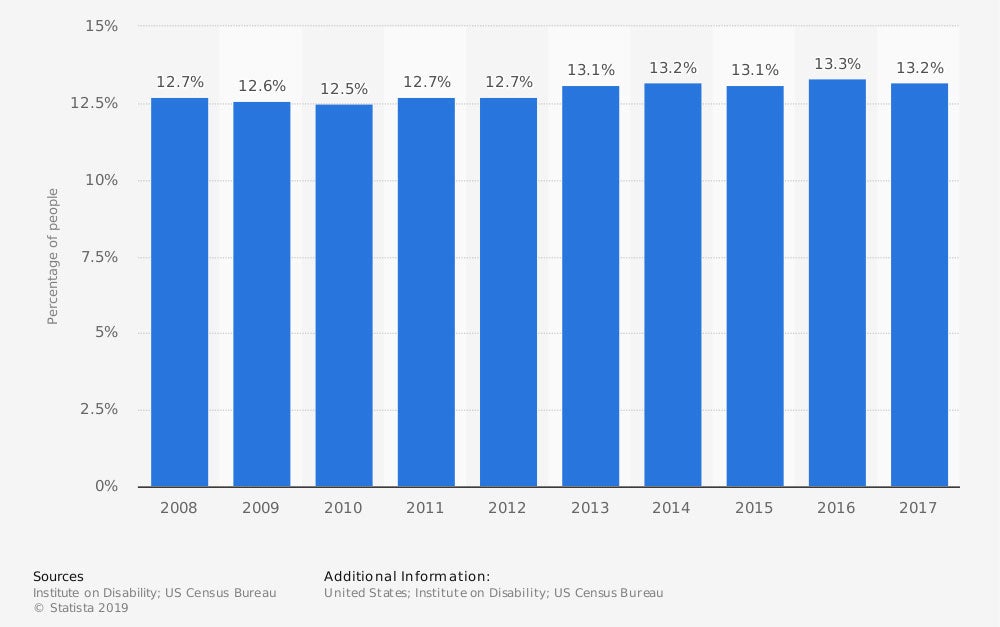

Share of people in the U.S. who had a disability from 2008 to 2017

As of 2017, over 13% of Americans were disabled.

What Does Total and Permanent Disability Insurance Cover?

Total and permanent disability insurance is designed to cover disabilities so severe that you can never return to work—or at least, never return to your old job. It’s especially designed to cover disabilities that happen outside of work, for example, autoimmune illnesses.

It’s designed to replace the income you would have made at work had you been able to continue your job. The insurance company pays it out slowly like a paycheck. It may pay the entire amount of your previous salary. More commonly, it pays you a percentage of that salary, such as 75%.

As opposed to short term disability which covers your income during shorter absences of weeks or months, long term disability usually covers you for years. It begins when you leave the workforce due to disability and lasts until an agreed-upon retirement age, such as 65, or even until death.

Examples of when you might use total and permanent disability insurance:

- Onset of a permanent and life-altering mental illness such as schizophrenia

- Permanent paralysis caused by a car accident or other accident outside work

- Permanent chronic illness and/or autoimmune illness that worsens to the point where you cannot work

Permanent is the key word in total and permanent disability. The condition needs to be something that you are not expected to fully recover from.

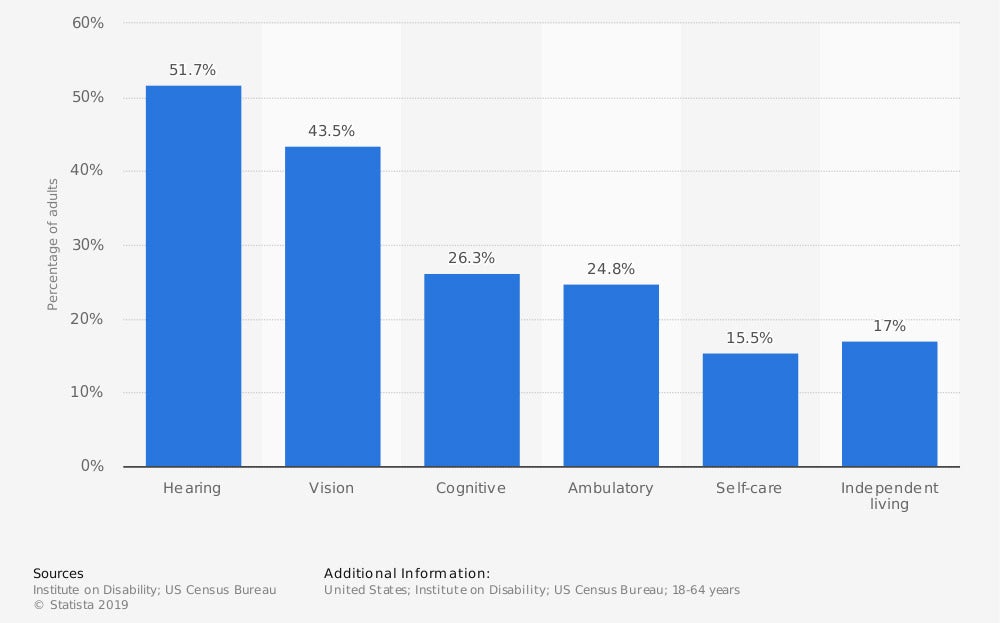

Percentage of adults in the U.S. with a disability who were employed in 2016, by disability type

It’s important to note that people’s ability to work after becoming disabled varies widely. A condition may not alter your ability to work at all, or it may mean you can still work but in a different career. (If it’s a lower-paying career, total and permanent disability insurance may make up the difference in income.)

These complexities are why total and permanent disability insurance doesn’t simply rely on a list of allowed injuries or conditions to determine coverage. They look at your case and needs individually.

How Much Does Total and Permanent Disability Insurance Cost?

The cost of total and permanent disability insurance varies depending on your age and health when you buy the policy as well as on the amount of salary the policy will be insuring.

The higher your risk of disability and your salary, the higher your premiums will be. This type of insurance can cost thousands of dollars per year.

That cost can sting up front, but when you consider what suddenly losing your income could mean for you and your family, it feels like a more reasonable expense.

Do I Need Total and Permanent Disability Insurance?

Whether or not you should buy total and permanent disability insurance depends on your unique situation.

- Are you supporting children or other dependents with your income?

- Do you have a mortgage or other significant debts you would struggle to pay if you could not work?

- Do you have enough savings to cover the months or years it could take before receiving disability benefits through Social Security? (Keep in mind that these benefits are in amounts far below the average salary and likely will not fully replace your income.)

- What is your current age and health status?

- Are there disabilities that run in your family?

There’s no way to fully predict whether or not you will become disabled. It can be frustrating to spend money on premiums when you don’t know whether or not you’ll ever need the benefit.

But for many people, total and permanent disability insurance is well worth the money. It provides peace of mind and ensures that big purchases like a home or paying for a child’s college tuition will remain within reach even if you suddenly become disabled.

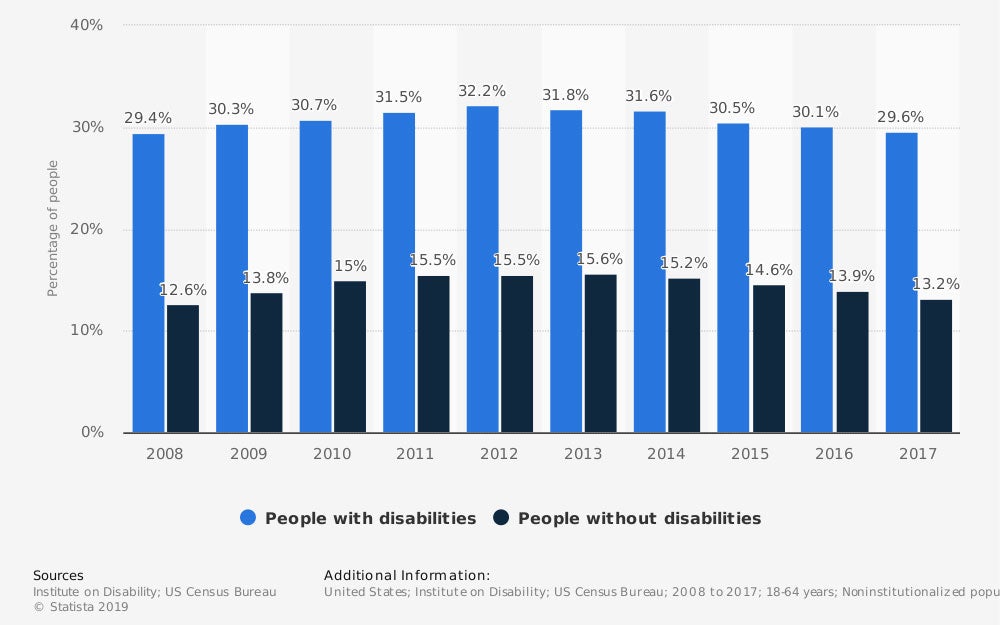

Poverty rate among people with and without disabilities in the U.S. from 2008 to 2017

People with disabilities live in poverty at twice the rate of people without. Total and permanent disability insurance can help bridge this gap in income.

Are There Ways to Get Total and Permanent Disability Insurance Discounts?

Insurance discounts don’t work like 10% off coupons at a grocery store, but believe it or not there is such a thing as total and permanent disability insurance discounts.

Here are a few ways to lower the cost of total and permanent disability insurance if the cost of premiums feels out of reach:

- Insure a lower percentage of your income: Instead of insuring a high percentage, like 100% or 80% of your salary, insure a lower number like 50% or 60% instead. This lowers your premiums and will still provide a significant benefit.

- Buy through work or another group policy: There are significant downsides to buying disability insurance through work. It can leave you majorly in the lurch if you become disabled while changing jobs, but it can be cheaper and easier especially if you have preexisting health conditions.

- Bundle disability insurance with life insurance: Disability insurance is often sold by life insurance companies. If you’re also in the market for life insurance, life insurance companies may offer you a discount if you buy both policies together.

Independent insurance agents are great at sniffing out insurance discounts. They’re not tied to any one insurance company so they can shop around for the deal that makes the most sense for you. They can help if you’re struggling to find affordable total and permanent disability coverage.

How Do I Get a Total and Permanent Disability Insurance Quote?

If you buy total and permanent disability insurance through work or another group policy, it’s usually just a matter of signing up. However, you’re not getting the most thorough coverage that way, and you may be missing out on certain discounts.

To get total and permanent disability insurance that can meet your needs throughout your career, it’s best to contact an expert independent insurance agent. Before you call or email, think about what you want out of your coverage:

- What percentage of your income you want covered

- How long you want it to last (what age you plan to retire)

- Any policies you might be willing to buy at the same time (bundle), such as life insurance or short term disability insurance

Then, your independent insurance agent can help walk you through the application process. These are often quick and easy online questionnaires. They can also help you schedule a medical exam that’s as convenient as possible if one is required.

Shopping for total and permanent disability insurance can feel overwhelming, but it’s easier when you’ve got an advocate on your team. Best of all, an independent insurance agent can even help you file for benefits if you ever need them.

It’s not fun to think ahead to a serious illness or injury, but once a life-changing event happens, it’s too late to get covered by total and permanent disability insurance.

A little advance planning now can mean smoother sailing down the road, so you can fully focus on the important stuff: healing, happiness, and time with the people you love.