Assurity Life Insurance Company Review

Assurity Insurance at a Glance

- Founded in 1890

- Specializes in life insurance

- Coverage available to individuals and businesses

- Offers annuities

- Coverage available in 49 states

- “A-” (excellent) rating by A.M. Best

- “A+” (excellent) rating by the Better Business Bureau

- Offers term and permanent life insurance policies

- Offers coverage options with no medical exam

- Strong financial stability

Assurity Life Pros: Long-standing carrier with more than a century and a quarter of experience in the insurance industry. Offers coverage to individuals and businesses. Offers life insurance coverage with no medical exam. High ratings through both A.M. Best and the Better Business Bureau (BBB). Coverage offered in most states. Impressive financial strength.

Assurity Life Cons: No 24/7 claims reporting option. No online claims reporting. Hard to find customer reviews of the carrier. No official claims response time frame promise. Discount information not readily available.

What Type of Insurance Does Assurity Life Offer?

Assurity Life is a specialized insurance company that focuses on life insurance. They have several coverage options available, including:

- Term life insurance

- Whole life insurance

- Universal life insurance

- Disability insurance

- Critical illness insurance

- Accidental death insurance

- Hospital indemnity insurance

- Disability income insurance

For individuals or businesses, Assurity Life offers several coverage options. If you’re in the market for quality life insurance, Assurity Life may just be the right insurance company for you.

What to Know about Assurity Life

Assurity Life was founded in 1890. With more than a century and a quarter’ of experience in the insurance industry, Assurity Life is certainly a well-established carrier. Offering coverage to both individuals and businesses helps Assurity Life to reach even more customers across the country. Coverage is currently offered in 49 out of 50 states, excluding only New York. The official website states that as of 2019, the carrier had $2.6 billion in total assets.

Having been in business for more than 130 years, Assurity Life’s extensive history has aided its reputation as a stable insurance provider. In 2015, the carrier became a Certified B Corporation, and was the world’s largest insurance company to ever achieve such a title. Businesses that have been identified as meeting the highest standards of social and environmental performance, legal accountability, and public transparency are eligible to be named Certified B Corporations.

Assurity Life’s long-standing status and nationwide coverage further aids the carrier’s reputation as being both financially stable in the present and as having a strong projected outlook for the future. A.M. Best, the leading global credit rating agency monitoring the insurance industry, gives Assurity Life an “A-” rating, indicating the carrier is an excellent choice for insurance customers. The “A-” rating assures customers that Assurity Life is capable of offering guaranteed, secure coverage from a trustworthy carrier. A.M. Best also places Assurity Life in the $250-$500 million financial size category, which paints a clearer picture of the carrier’s strength and stability.

Established in 1899, A.M. Best is one of the oldest rating companies in the world. Reviews from A.M. Best indicate an insurance company’s financial strength and creditworthiness, and are based on comprehensive evaluations of the company’s operating performance, business profile, and balance sheet. For customers who aren’t as familiar with insurance companies’ reputations, A.M. Best’s rating system allows them to make an informed decision about who they can trust to meet their needs in the short term, and also to remain a strong, financially sound company in the long term.

What Discounts Does Assurity Life Offer?

While Assurity Life does not make information about their discounts readily available to prospective customers through their website or direct inquiries, there are several standard discounts commonly offered by many life insurance companies. These discounts include:

- Non-tobacco user discount: Life insurance companies tend to reward customers who do not use tobacco products with cheaper premiums.

- Safe hobbies discount: Life insurance companies often award customers who practice safe, non-life threatening hobbies (e.g., no skydiving) with cheaper premiums.

- Young applicant discount: When signing up for life insurance, considerable discounts are often awarded to applicants who purchase coverage when they are younger, such as in their 20s or 30s.

- Healthy blood pressure discount: Insurance companies tend to award premium discounts to applicants with proven healthy blood pressure.

- Healthy family history discount: Insurance companies also reward applicants with healthy genetics, or a good family health history.

An independent insurance agent can provide more exact discount information and premium quotes for coverage through Assurity Life. When it comes to coverage, independent insurance agents work hard to help to get you the most bang out of your buck.

Assurity Life Customer Service

Assurity Life handles most customer service and claims inquiries over the phone. The carrier provides the following customer service options:

- Claims reporting options available via email, mail, or fax.

- Email options also available for customer service inquiries.

- Main hotline for customer service has the following hour restrictions:

| Hours (CT) | |||

| Monday-Thursday | 7:00 am - 6:30 pm | ||

| Friday | 7:00 am - 5:00 pm |

Though you can contact Assurity Life directly, working with an independent insurance agent is by far the easiest way to get set up with the right coverage for you. These agents also help handle claims and insurance concerns for you, making customer service even easier.

Assurity Life FAQ

What is Assurity Life's average claims response time frame?

While Assurity Life does outline their claims process in simple step-by-step instructions for its customers, unfortunately the official website does not list a claims response time frame promise. However, the fact that the carrier does not offer 24/7 claims reporting, nor an online claims reporting option, already slows down the process considerably for customers when compared to other insurance providers.

What is Assurity Life's customer service availability?

Assurity Life provides phone lines for prospective and current customers to get in touch with them during restricted hours, Monday-Friday. The carrier does not offer a 24/7 hotline for claims reporting, but they do provide an email address for additional customer service and claims inquiries. Customers can also call to check on the status of their existing claim during business hours.

What is Assurity Life's claims process?

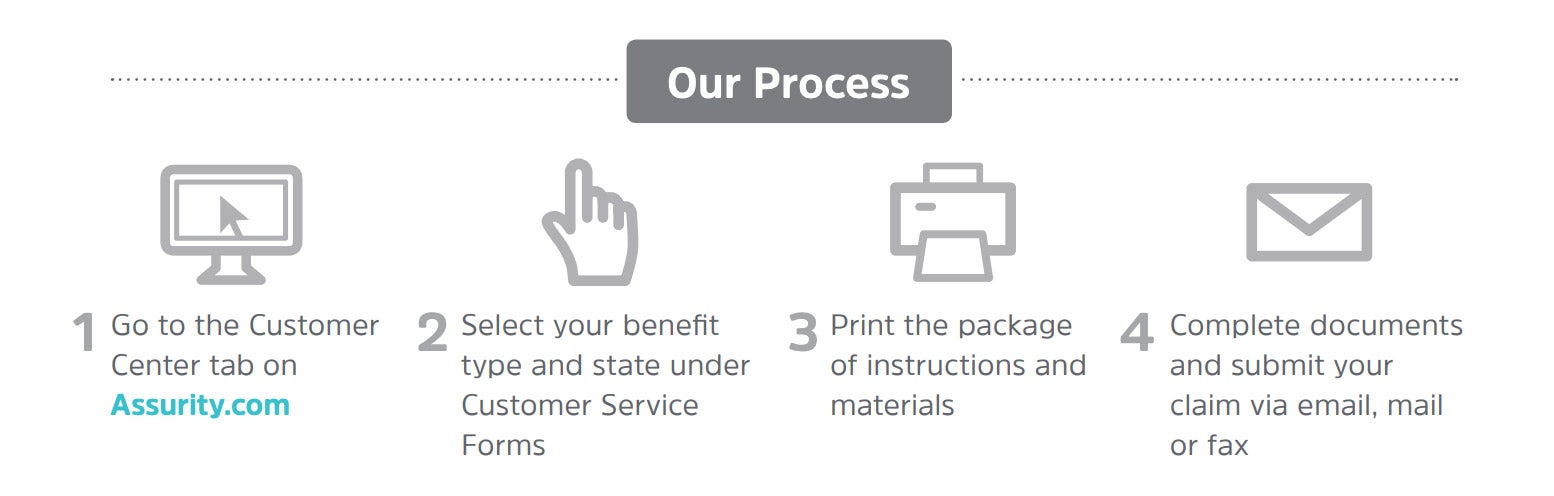

Assurity Life accepts claims submitted via phone, email, fax, or mail. The carrier’s official website breaks down the claims process clearly for customers, as follows:

While Assurity Life does not offer 24/7 claims reporting, their simple four-step process for filing claims allows customers in need to obtain their coverage benefits easily.

Does Assurity Life create a user-friendly experience for customers?

The design of Assurity Life’s official website is a bit restrictive and difficult to navigate. As a result, the official website feels dated when compared to those of other modern carriers. While some pertinent information is easily found, other details which could solidify a prospective customer’s decision to select Assurity Life over other carriers is not present. For example, no official claims response time frame is provided on the website. Further, customers cannot request quotes or file claims online. Assurity Life also has restricted customer service hours, with no contact options available on Saturdays. However, the carrier does have a presence on both Faceook and Twitter, which helps make them more accessible to customers.

Assurity Life Customer Reviews

| Free Advice |

|

| “Very happy with Assurity." |

| Free Advice |

|

| “I have never had an issue with this company. They are always very helpful when I call.” |

| BirdEye |

|

| “I have never had an issue with this company. They are always very helpful when I call.” |

| BirdEye |

|

| “Great company, fast claims process, professional service, and always there when I needed someone to explain my claim and benefits, thanks Assurity!” |

| Consumers Advocate |

|

| “Assurity is a great choice for life insurance mainly because of the company's reputation and longevity, but also because of the flexibility of policy options available. Term policies have several features and riders that can be added to customize coverage so it is maximally effective.” |

| Glassdoor |

|

| “Excellent management and a great environment.” |

TrustedChoice.com's Final Review

We award Assurity Life a final rating of 4 out of 5 stars. A rich history and strong financial strength immediately make the carrier a respectable choice among prospective customers, as well as a top contender within the industry. Assurity Life offers several insurance options for both individuals and businesses, and coverage is available practically nationwide, allowing the carrier to reach many customers in need. No-medical-exam coverage also greatly increases their potential customer base. High ratings through both A.M. Best and the BBB further promote Assurity Life as an excellent option for prospective customers. However, the carrier’s somewhat restrictive and dated website could be a deterrent to many, along with the fact that there is no option to obtain quotes online.

Bottom Line: Though Assurity Life loses points for not offering online claims filing and a couple of other factors, there’s no question that the carrier has a wealth of experience in offering quality coverage, which makes them a noteworthy option to explore with your independent insurance agent in our books.

assurity.com

ambest.com

bbb.org

glassdoor.com

birdeye.com

insurance.freeadvice.com

consumersadvocate.org