Who's Responsible if Your Mother-in-Law Crashes Your Car into Your Garage?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Responsible homeowners have to worry about not only what they can do to protect family members, guests, and strangers on their property, but also the damage others can cause to their home. So what happens if your mother-in-law borrows your car and ends up crashing it through the back of your garage? Who’s responsible for this mess, anyway?

Luckily, independent insurance agents are familiar with all kinds of scenarios like these. They’ve handled a multitude of obscure claims, so they’re more than equipped to get you set up with all the coverage you could possibly need for these strange circumstances, long before you’d ever need it. Here’s how they’d hook you up with the right coverage to protect against your mother-in-law crashing your car through your garage.

Who’s Responsible if Your Mother-in-Law Crashes Your Car Through Your Garage?

You trusted your mother-in-law with your car, and she wound up driving it right through the other side of your garage. It happens. Fortunately in this situation, you’re covered under either your homeowners insurance or your auto insurance. Your mother-in-law probably already feels terrible enough about causing the accident, but at least she won’t have to go through the added hassle of contacting her insurance company to reimburse you for the damages.

Which Insurance Should I Go Through? Auto or Homeowners?

While you’re likely to be covered under both of these policies, it’ll be a personal decision which one you want to file through. Most folks would probably start with their homeowners insurance. But really, what it comes down to is considering which policy has the lowest deductible. If your auto insurance will reimburse you for the damage and leave you paying less out of pocket than your homeowners policy, you might opt to file through that one.

You’ll also need to consider what was damaged. Obviously, if there’s a new hole in your garage, you’ll want to get that fixed. But you’ll also need to assess the damage to your vehicle. If it’s in bad shape, you’ll have to file a claim through your auto policy to get it repaired, since most vehicles are not covered through homeowners insurance.

How Does Property Coverage Work in This Scenario?

The property damage section of your homeowners insurance would reimburse you for the new hole in the back of your garage thanks to your mother-in-law, as well as any personal property she may have smashed along the way. You’d be covered up to your policy’s limit in the dwelling category of your coverage, after paying your deductible. However, your property damage coverage would not pay for the damage to your car.

How Does Liability Coverage Work in this Scenario?

In the event you wanted to sue your mother-in-law, you would use the liability coverage section of your homeowners insurance. Your liability coverage reimburses for legal expenses such as attorney and court fees, and any settlements you might be ordered to pay. But in the case of an accident caused by a family member, it may not be worth the hassle of starting a legal case. You may wish to resolve the matter in private before going through insurance.

What if Someone Got Injured in the Accident?

If your mother-in-law hurt someone in the accident, including herself, your auto insurance would cover the expenses, as long as you had her listed on your policy. The medical payments section of auto insurance coverage provides reimbursement for fees associated with treating injuries sustained in car accidents. It’s important to list any other drivers you’ll be entrusting with your vehicle on your auto policy in case of a situation like this one.

How Would This Incident Affect My Premiums?

Fortunately, single incidents are typically unlikely to affect your insurance premium, whether it be your homeowners or auto policy. Insurance companies don’t tend to punish policyholders for single or uncommon incidents. However, if your mother-in-law crashing through your garage became a trend or regular occurrence, your insurance company may decide to start hiking your premium or even choose to not renew your policy after its term was up.

Other Common Home Risks Worth Considering Coverage For

Not all homeowners are concerned about their mother-in-law crashing through their garage, but there are plenty of common risks that warrant having the proper coverage. Check out these stats regarding common home insurance claims.

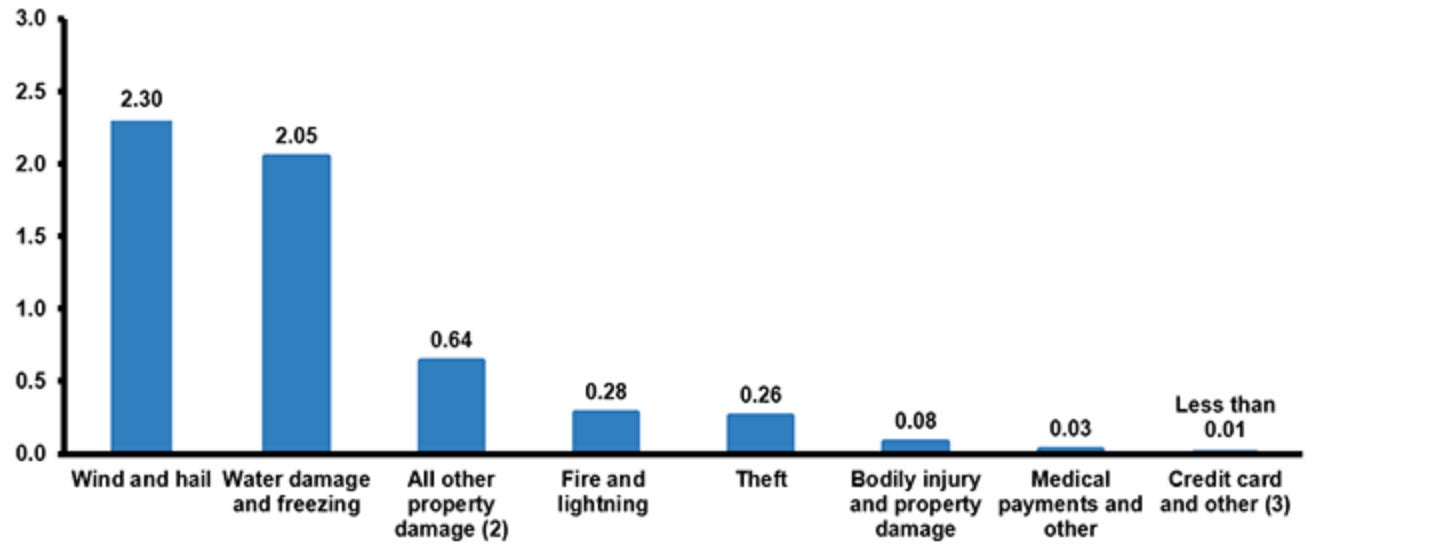

Homeowners Losses Ranked By Claims Frequency, 2014 to 2018

(Weighted average, 2014 to 2018)

The most commonly submitted claims by homeowners in the 2014 to 2018 period were due to wind and hail damage. Following those disasters were claims made due to water damage and freezing. Property damage, fire and lightning, and theft were also commonly reported, as were bodily injury claims, medical payments, and credit card misuse.

Talk with your independent insurance agent about getting your home covered from these common perils. Standard homeowners insurance policies provide protection against things like water damage, fire, and wind/hail damage. However, you may be concerned about your coverage limits. Your independent insurance agent can ensure you walk away with all the protection you need to feel comfortable and secure.

Other Common Auto Risks Worth Considering Coverage For

While a mother-in-law crashing your car through your garage is certainly a possible risk and happens more often than you might think, there are many other common concerns that all drivers should consider having coverage for. Here are a few of the most common auto insurance claims:

- Damaged windshields: Windshields can be chipped or cracked by all kinds of things, including driving behind a truck on the freeway and getting hit by a rock. Having comprehensive auto insurance would protect you in this case.

- Hail damage: Hail can absolutely destroy vehicles in a severe storm. If you live in an area prone to hailstorms, you’ll want to have comprehensive auto insurance to protect you.

- Vandalism: Cars can be vandalized in many ways, including being keyed, tagged, having the tires slashed, or getting broken into. Once again, damage would be covered under comprehensive auto insurance.

- Theft: Whether you’ve left your car unattended at a fancy movie theater or just in your driveway, your car can be stolen at pretty much any time. Comprehensive auto insurance will reimburse the vehicle’s owner for the replacement value of the car.

- Rear-end collisions: The most common car insurance claims, by far, are rear-end collisions. Since you’re not at fault if you get rear-ended, the collision insurance section of your auto policy will reimburse you for your vehicle’s damage.

Talk with your independent insurance agent about these common risks that all drivers face, as well as any other concerns you may have about protecting your vehicle. They’ll make sure you get set up with all the auto insurance coverage you could ever need.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting homeowners against family members crashing through their garage and all other strange incidents, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners and auto insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

iii.org