Rebuilding After Hurricane Harvey

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When disaster strikes, insurance is there to provide essential coverage, even in the case of record-breaking natural disasters. When Hurricane Harvey struck Texas in 2017, it left in its wake billions of dollars in damages, and dozens of tragic deaths. Fortunately for victims of this merciless storm, coverages like property and business insurance were able to help them get back to their lives.

An independent insurance agent can help you find the right coverage for your own worst disasters, even if they’re not quite as tragic, destructive, or deadly as this one. But first, here’s a closer look at Hurricane Harvey and all the ways insurance was able to help victims recover.

What Was the Impact of Hurricane Harvey?

Hurricane Harvey’s arrival began a catastrophic storm season for the southern US and the Caribbean, with total destruction from this single disaster reaching historical levels. Ranking as the second-costliest hurricane to strike the US mainland since 1900, Harvey’s impact is still felt to this day.

Quick stats about Hurricane Harvey:

- 68 deaths were reported

- $125 billion in damage was reported by the National Hurricane Center

- 13 million people were affected by the storm

- Harvey impacted the states of Texas, Louisiana, Mississippi, Tennessee, and Kentucky

- One third of Houston was under water at the storm’s peak on September 1, 2017

- 24 inches of rain, or two feet, fell within the first 24 hours

- 39,000 people were left temporarily homeless due to flooding

- 204,000 homes were damaged

- 3,900 homes were still without power three weeks after the storm

- One million vehicles in the Gulf area were totaled

- Harvey had a diameter of 280 miles

- Windspeeds of 130 MPH were reported during Harvey’s first landfall

- Parts of Texas got 51 inches of rain, a record for the most rainfall in the US from a single storm

Though Hurricane Harvey was certainly devastating, fortunately the victims were able to receive financial aid through insurance and relief packages.

Hurricane Harvey's Toll on the US Economy and Insurance Industry

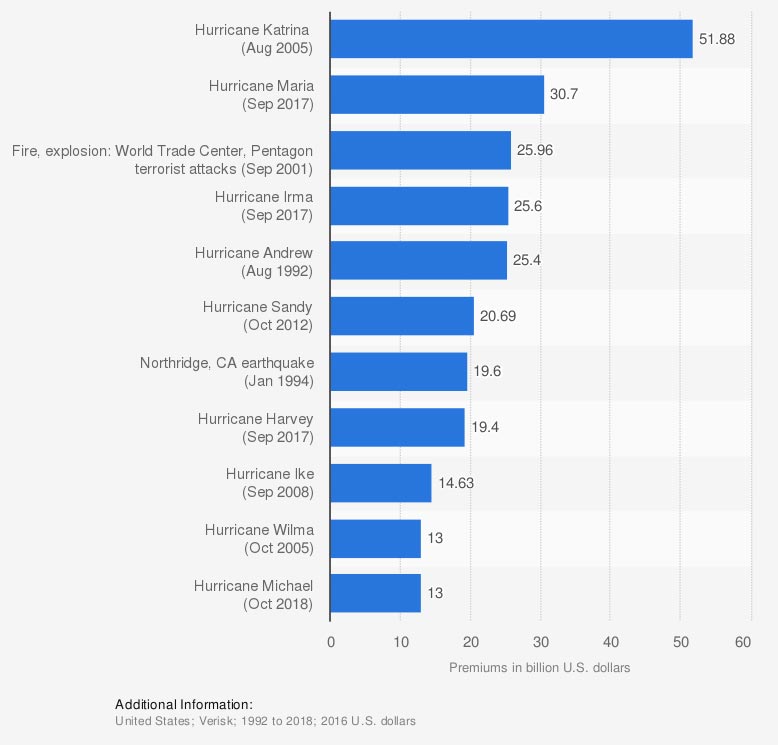

Most Expensive Catastrophes in the United States from 1992 to 2018, by Property Loss (in billion US dollars)

Insurance Information Institute: Verisk

©Statista 2020

In a nearly 30-year period, Hurricane Harvey ranked as the eighth-most expensive catastrophe to strike the US, costing $19.4 billion in property damages alone. Twelve years prior to Hurricane Harvey, Hurricane Katrina, which primarily impacted New Orleans, ranked as the costliest catastrophe in US history, costing a reported $51.88 billion in property damages alone.

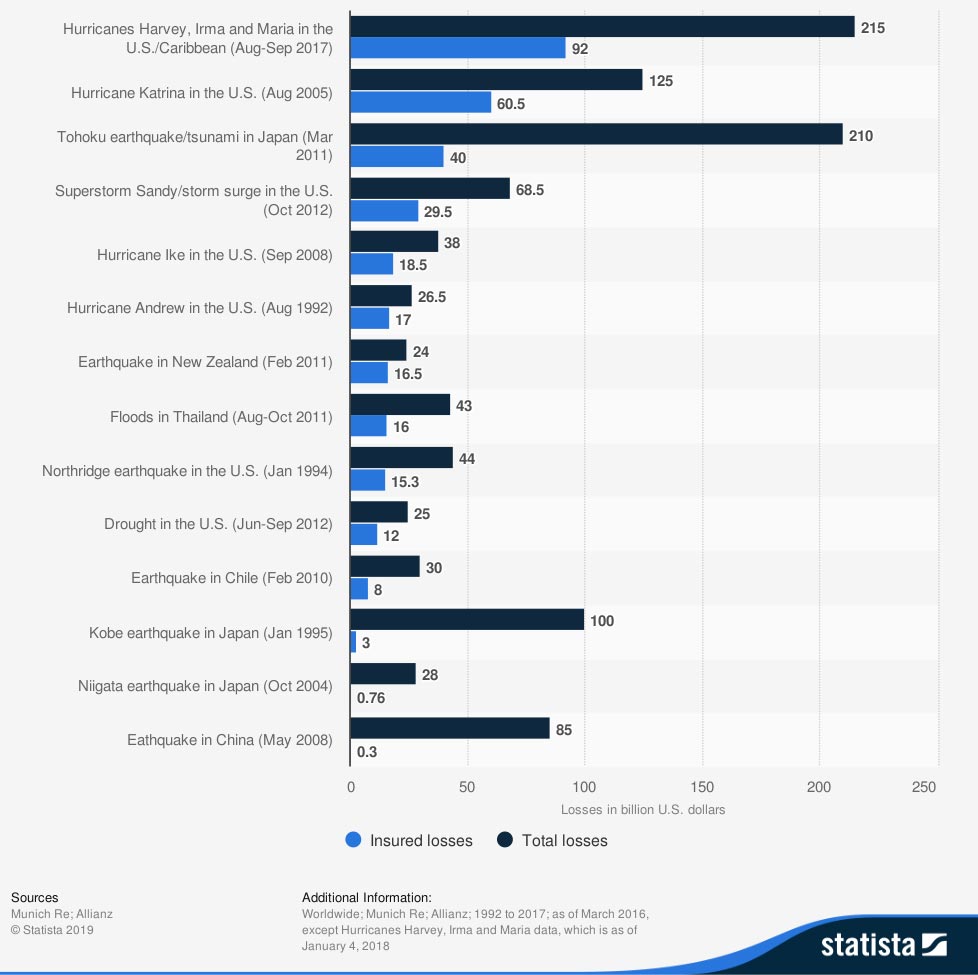

Most Expensive Natural Disasters for the Insurance Industry Worldwide from 1992 to 2017 (in billion US dollars)

As for the impact on the insurance industry, Hurricane Harvey ranks first, along with Hurricanes Irma and Maria, for financial losses due to natural disasters worldwide. A total of $92 billion in insured losses was reported for Hurricanes Harvey, Irma, and Maria, along with a total of $215 billion in overall losses from the three storms combined.

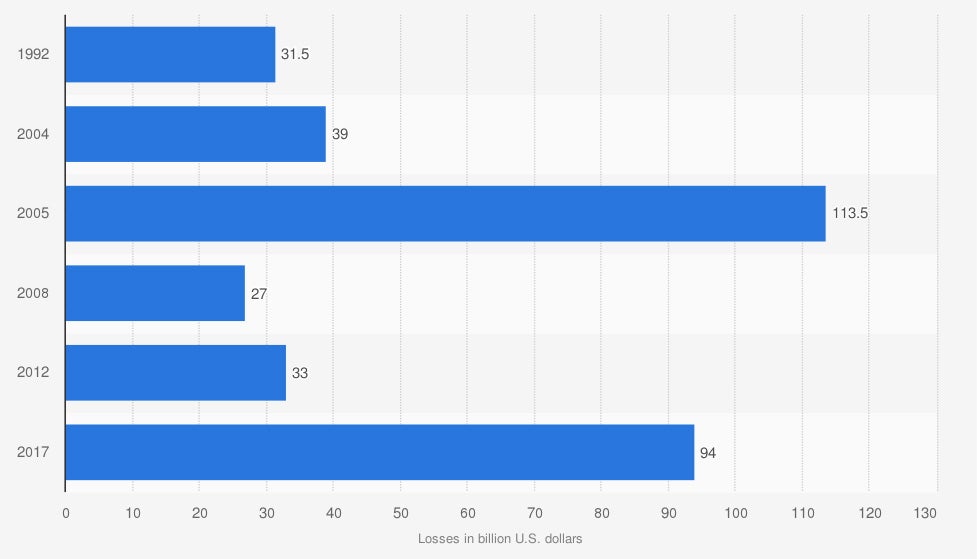

Insured Losses from Selected Hurricane Seasons in North America from 1992 to 2017 (in billion US dollars)

Swiss Re: Statista estimates

©Statista 2019

The hurricane season that brought Harvey, Irma, and Maria to the US ranks as the second-costliest season for the insurance industry overall. Only Hurricane Katrina, which struck in 2005, led to a costlier season, with $113.5 billion in insured losses reported.

Who Provided Help to the Victims of Hurricane Harvey?

One week after the hurricane first hit Texas, President Trump approved a $15.25 billion bill to supply relief for the storm. Of this disaster aid package, $7.4 billion was allocated to the Federal Emergency Management Agency (FEMA) and another $7.4 billion to Housing and Urban Development (HUD) housing assistance. The Small Business Authority disaster loan program received $450 million.

The Red Cross provided more than $115 million in recovery assistance to 46,000 households over the following year and a half, as well as $230 million in immediate financial assistance to 575,000 households within the first few months of Harvey’s appearance. Grants totaling more than $59 million have also been awarded by the Red Cross to community-based recovery services in the Gulf Coast region to aid communities damaged by hurricanes.

Texas Senator John Cornyn approved a bill in late September of 2017 to provide tax relief for Texans who were financially impacted by Hurricane Harvey. The bill provided more than $5.5 billion in tax breaks to hurricane victims.

Two additional disaster aid packages were awarded in the following months. The first provided $36.5 billion in relief for Texans hit by Hurricane Harvey and victims of the nation’s wildfires. The next package provided $89.3 billion for areas hit by Harvey and other natural disasters. About half of this package was allocated to FEMA and the other half to HUD.

How Did Car Insurance Help Victims Get Back to Their Lives?

Fortunately for victims of Hurricane Harvey, having auto insurance allowed them further assistance in resuming their lives. Auto insurance helped Hurricane Harvey victims in the following ways:

- Repairs: For victims whose cars were badly damaged by the storm, auto insurance covered repairs to their vehicles under the collision section of their policies.

- Replacement: Those victims whose cars were completely totaled by the hurricane were able to obtain new vehicles through the help of their auto insurance.

- Rental cars: While victims awaited repairs on their vehicles, auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: The victims who sustained injuries during Hurricane Harvey were able to be compensated by their auto insurance policy for medical payments while receiving treatment.

Though not all car insurance claims stem from damage caused by major hurricanes, it’s helpful to see just how auto insurance provided relief for victims of this huge tragedy in a myriad of ways.

How Did Property Insurance Help Victims Get Back to Their Lives?

Property insurance also helped Hurricane Harvey victims to rebuild and restructure their lives. For Hurricane Harvey victims, property insurance coverage provided protection in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered peril, such as a hurricane. Hurricane Harvey victims were able to rebuild homes that were destroyed by Hurricane Harvey’s harsh winds thanks to property insurance.

- Ending homelessness: Many of Harvey’s victims were left temporarily homeless following the storm. Fortunately, their property insurance coverage provided the financial assistance necessary to rebuild their homes.

- Replacing personal property: Hurricane Harvey victims were largely able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. following the storm. Property insurance typically covers personal property up to 50% to 70% of the insured value of the structure of the home if it’s lost/damaged/destroyed by a hurricane.

- Replacing property stored elsewhere: Property insurance also covered Hurricane Harvey victims’ personal belongings stored off premises, such as in storage units, following the disaster. Limits on off premises stored property are sometimes 10% of the total value of personal property coverage, but additional coverage can be added.

- Mending foliage around homes: Property coverage also includes reimbursement for foliage around the home, including trees, plants, and shrubs if they are damaged or destroyed by a hurricane. Limits typically cap at $500 per plant, but coverage amounts can be increased. Hurricane Harvey victims were able to repair their gardens and general appearance surrounding their homes thanks to property insurance.

While you may never have to submit property insurance claims for major hurricane damage, it’s still helpful to learn all the relief this coverage provided to victims of Hurricane Harvey.

Is Hurricane Coverage Part of Every Homeowners Policy?

While windstorm damage is often included in standard homeowners insurance policies, there are some exceptions, such as for victims of Hurricane Harvey. Additionally, Hurricane Harvey brought a lot of heavy rainfall along with it, leading to severe flooding. Sadly, flood damage is not a covered peril under homeowners insurance, meaning victims would have needed an additional flood insurance policy.

Hurricane Harvey victims needed the following coverages in addition to their homeowners insurance:

- Flood insurance: For those who live in areas known to be at high risk for flooding, mortgage lenders often require them to purchase flood insurance, so many of Hurricane Harvey’s victims may have already had adequate coverage. Flood insurance covers damage to homes and personal property due to flood waters, and is only available through the National Flood Insurance Program (NFIP), which is a part of FEMA.

- Windstorm insurance: Certain states that are prone to heavy winds require homeowners to purchase an additional windstorm insurance policy to protect against hurricanes, cyclones, etc. Unfortunately for victims of Hurricane Harvey, Texas is one of 19 states required to place mandatory windstorm deductibles on homeowners insurance. Windstorm insurance protects against damage due to heavy winds beyond the limit available in a standard homeowners policy, so Hurricane Harvey absolutely needed to rely on this coverage.

Without adequate flood and windstorm insurance, victims of Hurricane Harvey would have been forced to rely on the limitations of their homeowners insurance policies. Homeowners insurance would not have covered victims whose homes were destroyed or damaged by flood waters, nor homes affected by heavy winds up to the amount of the mandatory windstorm deductible. Victims would have had to pay these damages out of pocket.

How Did Business Insurance Help Owners Get Back to Work?

Not all Hurricane Harvey victims were just homeowners, many were business owners as well. Luckily, business insurance provided additional coverage that allowed business owners to reopen their doors and get back to work.

Business insurance helped Hurricane Harvey victims in the following ways:

- Loss of income: Business insurance includes coverage for lost income suffered during temporary closings due to covered disasters, including hurricanes. Business owners who were victims of Hurricane Harvey were able to recover lost income thanks to business insurance.

- Property repairs: Business insurance covers damage to or loss of your business’s physical property, including the structure of the building and often the inventory inside of it, due to a covered disaster like a hurricane. Hurricane Harvey victims were able to rely on their business insurance to help them rebuild their businesses from the ground up, repair less major damages, and to recover lost property such as inventory.

- Lost employee wages: Business insurance also helps pay employee wages that are lost while a business is closed due to covered perils like hurricanes. Victims of Hurricane Harvey were able to compensate their employees during long shutdowns thanks to business insurance coverage.

Businesses close for all kinds of reasons, not just due to catastrophes like Hurricane Harvey. That being said, knowing all the ways business insurance provided relief to business owners following this disaster proves just how important coverage is to have for all potential disasters.

Are Hurricane Harvey Victims and the State of Texas Back to Normal Now?

Fortunately for many of Hurricane Harvey’s victims, life has largely returned to normal. Payouts from homeowners, windstorm, and flood insurance claims allowed victims to repair or rebuild their homes and end homelessness. Car insurance allowed victims to repair or replace lost or damaged vehicles, and business insurance allowed professionals to recover lost income and wages and get back to work.

As of 2019, FEMA reported that victims and their communities had made commendable progress in recovering from Harvey. Texas gained generous assistance in the form of funding from federal, state, and local agencies, as well as nonprofit and volunteer worker efforts to rebuild.

While recovery efforts are far from complete, victims have billions of dollars in assistance to repair and replace homes and belongings and remove debris from communities. Victims continue to relocate to new or repaired homes and schools continue to reopen. Beach repairs are underway and construction on infrastructures is in progress and nearing completion.

Here’s How an Independent Insurance Agent Can Help Protect You from Your Own Disasters

You’ll hopefully never encounter a natural disaster as destructive as Hurricane Harvey, but independent insurance agents can certainly help protect you from your own disasters. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

fema.gov

redcross.org

cornyn.senate.gov

cnn.com

thebalance.com