If Someone Gets Sick at Your Summer BBQ, Can They Sue You?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Homeowners have to consider all kinds of potential hazards that could happen on their property, including third party injuries and illnesses. So what happens if a guest who attended your summer BBQ ends up getting sick afterwards? We’ll tell you. We’ll also tell you if you’re covered.

Fortunately, an independent insurance agent can help you consider any risks before they ever happen, from the common to the obscure. They’ve seen and handled all kinds of claims, and they know how to hook you up with the exact protection you need, long before you ever need it. Here’s how they’d help you get covered in the event that someone got sick because of your BBQ.

What Happens if Someone Gets Sick after My BBQ?

Well for starters, you could get sued. Whether you would actually end up being held liable for the illness is the real question. But for any event that involves you serving food to guests, you’re taking their safety into your own hands. You can end up causing illness to your guests in the following ways:

- Food poisoning: Maybe you just left the potato salad out in the sun for too long by accident, but guests can easily get sick this way.

- Disease transfer: Another possible method of spreading illness is if you or anyone in your home has a virus or disease which gets transmitted to guests through unhygienic food preparation.

No matter how your BBQ guest ends up getting sick, they still have grounds to sue you. Fortunately, in the event you’re held liable in court, insurance can help protect you.

How Often Do Guests Get Sick at Private Events Like BBQs?

Where Food Preparation Leads to Food Poisoning

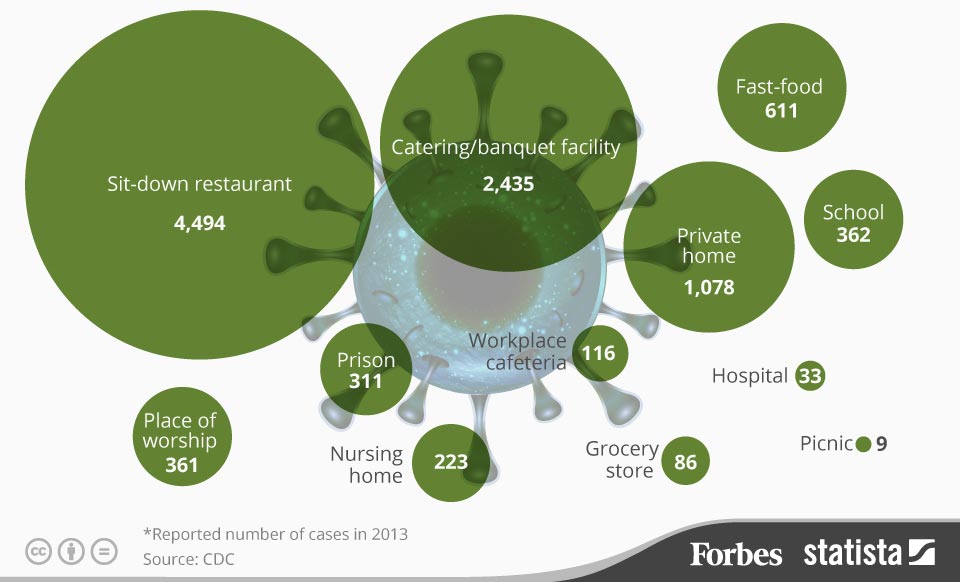

Number of Illnesses from Foodborne Disease Outbreaks in Selected US Locations

This image depicts reported cases of foodborne disease outbreaks in the US in the year 2013 alone. Outbreaks that occurred at private homes came in third place overall with 1,078 reported incidents. The most common location illness outbreaks occurred was in sit-down restaurants with 4,494 cases reported, followed by catering and banquet facilities with a total of 2,435 cases reported.

Clearly, incidents of illness outbreaks occur at private homes fairly often. Fortunately, your independent insurance agent can ensure you’re protected against these disasters and more through the right coverage.

What Kind of Insurance Will Help Protect Me or Get Me Back on My Feet after an Incident?

Your homeowners insurance policy will help protect you in the event you are sued due to a third party’s illness after attending a BBQ on your property. Instances of food poisoning and communicable disease transfer are a covered peril under standard homeowners insurance. Even if you’re accused of negligence and end up being held liable for the incident, your homeowners insurance will help protect you through the liability coverage section of the policy.

Liability Coverage for Homeowners

If a third party gets sick during or after a visit to your property due to a covered peril and you get sued, the liability coverage provided by your homeowners insurance policy will help protect you. Whether or not you end up being held liable in court, you’ll still be relying on your liability coverage to pay for legal fees.

Liability coverage protects homeowners in the following ways:

- Payment of legal fees: Liability coverage reimburses homeowners for court and attorney fees, as well as any settlements they’re ordered to pay in the event they are held responsible for an incident such as someone getting sick from food at their BBQ.

- Medical payments: Liability coverage also takes care of fees associated with treating any third party illness that requires medical attention stemming from events on a homeowner's property due to a covered peril, like food poisoning.

Lawsuits are enough of a hassle in the first place, and whether or not you’re held responsible for an incident like guests becoming sick due to your summer event, liability coverage seriously helps to take care of the financial repercussions.

Umbrella Coverage for Homeowners

Depending on your specific home and other factors, you may want to consider adding umbrella coverage to help extend your liability coverage’s limits. Umbrella insurance is essentially excess liability coverage that stacks on top of the underlying liability coverage provided by your homeowners policy. Umbrella insurance policies typically come with limits of $1 million in coverage.

While a guest getting sick after attending your BBQ may not require excess liability or umbrella coverage, there are many common lawsuits that could easily become extremely costly. The most common lawsuits filed against homeowners other than sick BBQ guests include the following:

- Dog bites: Even injuries caused by a family pet can cost an average of $30,000 in claim settlements.

- Accidents: Third party injuries on your property, such as slips on icy sidewalks or falls down unsteady stairwells, happen frequently and can be costly in terms of medical treatments.

- Fallen trees: If a tree on your property falls and causes damage to your neighbor’s home, the resulting financial damages could easily reach into the ten-thousands.

- Hired help injuries: In the event a domestic worker, such as a maid or gardener, is injured on your property due to your failure to maintain a safe premises, the resulting lawsuit and medical payments required could get expensive, fast.

- Intoxicated guests: When you throw a party and it gets a little out of hand, you as the homeowner are still held responsible for any property damage or bodily injuries an intoxicated guest causes to others.

While you may not be too worried about sick BBQ guests, it’s important to consider all the common legal risks to homeowners that could warrant an umbrella insurance policy.

Other Common Home Insurance Claims

BBQ illness outbreaks aren’t a concern for all homeowners, but knowing other risks that homeowners face on a daily basis can seriously help when working with your independent insurance agent to get all the coverage you may need. Check out these stats regarding common home insurance claims.

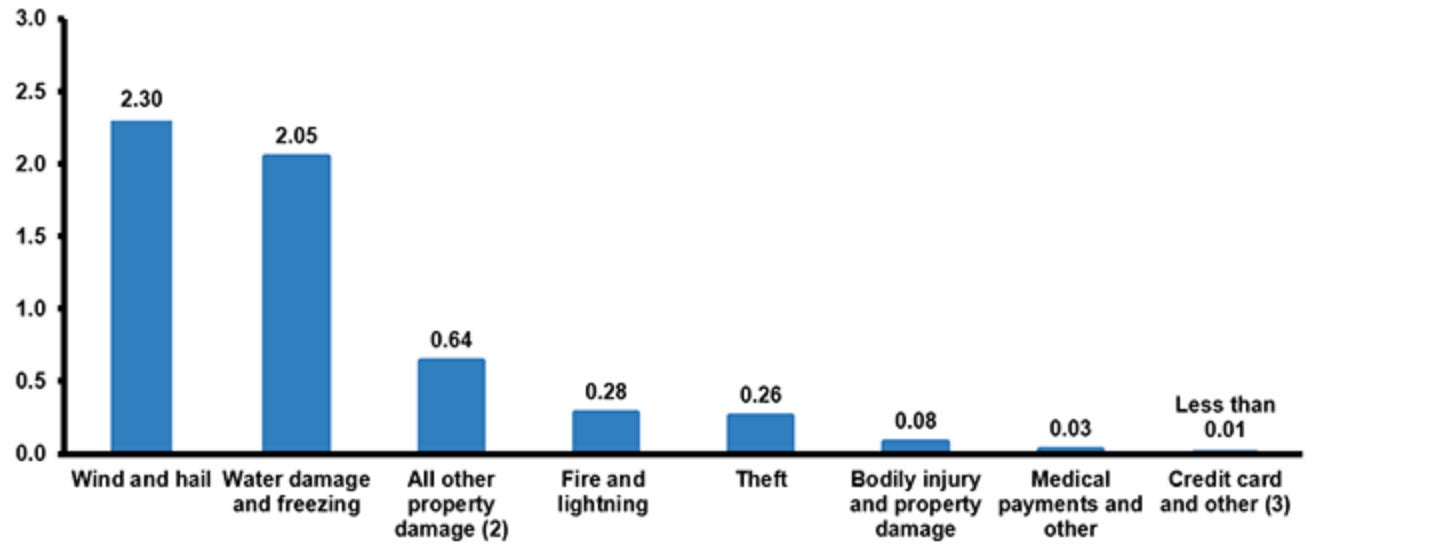

Homeowners Losses Ranked by Claims Frequency, 2014 to 2018

(Weighted average, 2014 to 2018)

(1) Claims per 100 house years (policies). For homeowners multiple peril policies (HO-2, HO-3, HO-5, and HE-7 for North Carolina). Excludes tenants and condominium owners policies. Excludes Alaska, Texas, and Puerto Rico.

(2) Includes vandalism and malicious mischief.

(3) Includes coverage for unauthorized use of various cards, forgery, counterfeit money, and losses not otherwise classified.

Source: ISO®, a Verisk Analytics® business.

The most commonly submitted claims by homeowners in the 2014 to 2018 period were due to wind and hail damage. Following those disasters were claims made due to water damage and freezing. Property damage, fire and lightning, and theft were also commonly reported, as were bodily injury claims, theft, medical payments, and credit card misuse.

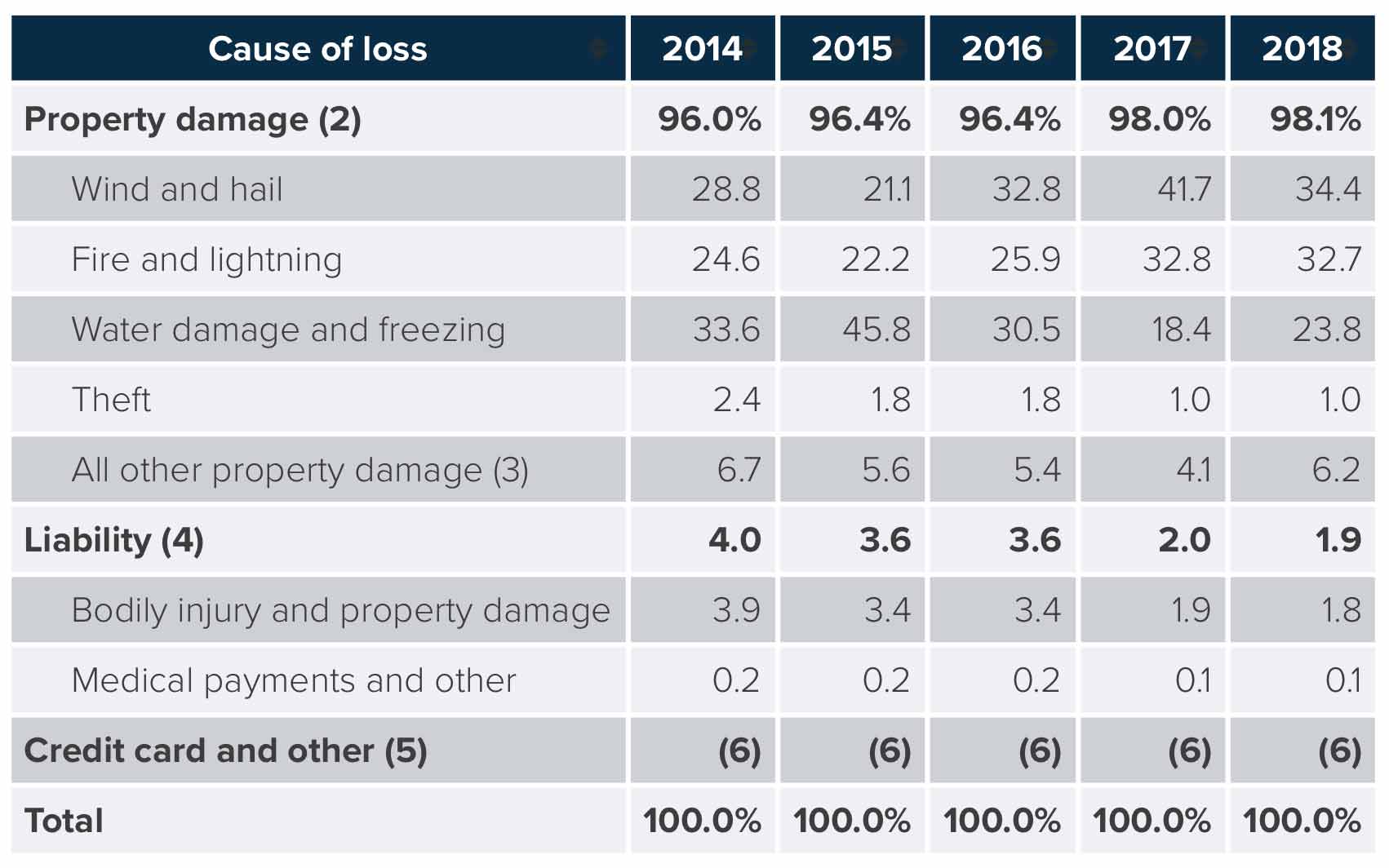

Homeowners Insurance Losses by Cause, 2014-2018

(1) For homeowners multiple peril policies (HO-2, HO-3, HO-5, and HE-7 for North Carolina). Excludes tenants and condominium owners policies. Excludes Alaska, Texas, and Puerto Rico.

(2) First party, i.e., covers damage to policyholder's own property.

(3) Includes vandalism and malicious mischief.

(4) Payments to others for which policyholder is responsible.

(5) Includes coverage for unauthorized use of various cards, forgery, counterfeit money, and losses not otherwise classified.

(6) Less than 0.1 percent.

Source: ISO®, a Verisk Analytics® business.

Property damage claims were by far the most frequently reported claims for home insurance between 2014 and 2018, with water damage and freezing specifically accounting for 33.6% of all claims in 2014. In 2018, wind and hail claims took the top spot for frequency, accounting for 34.4% of all home claims reported that year. Liability related claims account for less than 4% of total claims each year during the observed period.

Do I Need Extra Endorsements to Protect Me?

In the case of an illness stemming from your summer BBQ, no, you shouldn’t need any extra endorsements to protect you. Your homeowners insurance will provide significant coverage for these incidents. However, there are certain scenarios when you may want to purchase additional coverage to help protect yourself from common incidents affecting homeowners.

Homeowners often purchase the following coverages in addition to home insurance:

- Home-based business endorsements: While standard homeowners policies protect against third party injuries on your property, you’re not protected if you run a business out of your home. You’ll need to add this endorsement if you have a home office or studio in order to ensure you have adequate liability coverage.

- Personal property endorsements: Standard homeowners policies place limits on expensive personal property items like jewelry and electronics. If you’re worried about these items getting stolen, lost, damaged, or destroyed, it’s a good idea to purchase endorsements for specific pieces you’d like to increase coverage limits for.

- Sewer backup endorsements: Homeowners insurance protects you against a lot of things, but typically sewage backup isn’t one of them. While this incident would be messy enough in the first place, not having coverage would really be a nightmare. Talk with your independent insurance agent about adding a sewer backup endorsement to your coverage.

- Flood insurance: Many natural disasters are covered under standard homeowners insurance policies, but floods aren’t one of them. If you live in an area prone to flooding, you’ll want to purchase a flood insurance policy to protect your home against damage or destruction due to flood waters.

- Earthquake insurance: Also known as earth movement policies, this coverage protects homeowners against home damage due to earthquakes, mudslides, and other related natural events. Standard homeowners policies do not provide coverage for these types of disasters.

Your independent insurance agent can help you address any remaining coverage concerns you may have. They’ll make sure you get set up with all the protection you could possibly need against many different kinds of unforeseen disasters.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting third parties against slips on an icy sidewalk and all other strange incidents, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org