How to Insure Mount Rushmore

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

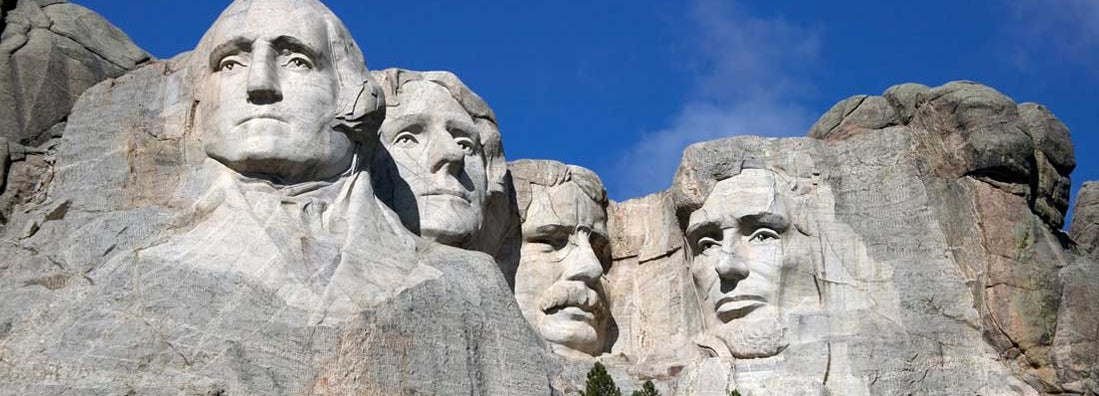

All things need to be protected, even larger-than-life monuments like Mount Rushmore. Such a colossal structure requires coverage that’s equally colossal — and sturdy. There are all kinds of risks that need protecting for a national park and monument like this, and here’s what an independent insurance agent would keep in mind when trying to find the right coverage for all aspects of Mount Rushmore.

What Does It Take to Insure Mount Rushmore?

When taking on a landmark of such massive scale and importance, it’s easy to wonder where you’d even start when attempting to insure it. To begin with, you’d need to consider all the potential risks to Mount Rushmore, including:

- Property damage risks: For example, if one of the presidents’ heads got damaged by a tourist, vandal, or natural disaster, it would be considered a property damage risk.

- Worker/employee risks: There are tons of workers on deck at Mount Rushmore, from rangers to tour guides to gift shop cashiers, and more. They all need protection from illness and injury on the job.

- Business risks: Mount Rushmore is a national monument, but it’s also a profitable business that generates income from tourists and its gift shops and eateries. This income needs to be protected against numerous risks including theft and unexpected business interruptions.

- Liability risks: If a tourist got injured or suffered from lost or damaged personal property while on the premises, they could sue. Mount Rushmore also needs protection from a legal standpoint.

Once all risk areas have been identified, an independent insurance agent would then consider the types of coverage that would protect against all potential hazards.

How Large Are the Heads of Mount Rushmore?

At its core, Mount Rushmore is essentially one massive work of art. From an insurance perspective, it’d be considered in terms of how much property would need to be covered from a size and value standpoint. To better gauge how much property is at risk and would need protection and just how valuable the memorial is, check out these quick stats about Mount Rushmore:

- The memorial covers 2 square miles.

- The national park spans 1,278.45 acres.

- The monument draws more than 2 million visitors annually.

- The mountain itself stands at an elevation of 5,725 feet.

- George Washington’s nose is 21 feet long.

- Each presidents’ head is about 60 feet tall.

- Each of the presidents’ eyes are about 11 feet wide.

- Each of the presidents’ mouths are about 18 feet wide.

- Work on the memorial began in 1927.

- It took 14 years to complete the memorial.

- It cost nearly $1 million to sculpt the memorial.

When working with a property of such massive scale, coverage must be considered for every square inch. If you were to insure Mount Rushmore, you’d have to start by contemplating all possible risks to each area, both inside and out.

Coverage for Mount Rushmore’s Priceless Property

The most obvious property aspect to cover when it comes to Mount Rushmore is the actual monument itself. A business insurance policy would include the necessary property damage coverage for the national monument, to protect against disasters such as:

- Vandalism

- Lightning

- Wind and hail

- Accidental damage

- Fire

- Theft

- Sinkhole collapse

- Most explosions

- Aircraft/vehicle damage (if operated by a third party)

- Riot/civil commotion

Property coverage for a widely loved monument would provide serious, important protection. A business insurance policy would not cover natural erosion of the monument over time, however. It’s up to the groundskeepers to maintain the presidents’ heads as much as possible.

Coverage for Mount Rushmore’s Liabilities

Whether it’s tourists or staff, Mount Rushmore is always surrounded by bodies — other than the giant heads of former presidents. As a result, the national monument is a huge liability risk at all times, and needs adequate protection from a legal standpoint. Liability coverage included in a business insurance policy protects against third parties suing over injuries or personal property damage. Coverage pays for legal fees, fines, and restitution.

Possible incidents at Mount Rushmore that would require liability coverage include:

- A tourist tripping over a rock and accidentally injuring themselves.

- A tourist becoming ill from food purchased at one of the park’s eateries.

- A tourist’s personal property getting damaged or stolen while on the premises.

A special type of liability coverage may be required to protect visitors to Mount Rushmore, known as:

- Premises liability: Coverage would protect against costs associated with third-party injuries and property damage sustained on Mount Rushmore’s premises. Common injuries include slips and falls.

Though many folks think of visiting Mount Rushmore as a leisurely activity, there are still plenty of possible risks in doing so. That’s why considering protection from a legal standpoint is so important. Reimbursement for legal fees could help the national monument remain open and operational following costly lawsuits.

Coverage for Mount Rushmore’s Employees

Mount Rushmore is home to all kinds of workers, from groundskeepers to tour guides to eatery and gift shop workers who need protection too. As far as legal concerns, the employees of Mount Rushmore would be covered under the business insurance policy’s liability section, but employees need coverage in other ways too.

Employees of Mount Rushmore would most likely require the following add-on coverages:

- Crime insurance: This insurance would cover instances of employee theft from the premises. Employees may steal money directly from cash registers at the national monument, or they may steal property or inventory.

- Workers’ compensation: In the event any of Mount Rushmore’s employees became ill, got injured, or died from a work-related incident, this aspect of the insurance would cover the financial ramifications. Coverage is mandatory in South Dakota.

- Employee practices liability: This coverage would take care of legal fees in the event Mount Rushmore’s employees were involved in harassment cases against coworkers or members of the public.

With so many workers on the grounds at all times, multiple forms of employee coverage would be necessary to adequately protect Mount Rushmore’s staff and to protect the national monument from staff-related incidents.

Business Coverage Concerns for Mount Rushmore

While Mount Rushmore has obvious physical property in need of protection, it also has plenty of virtual property in the form of electronic data which needs coverage too. A good cyber liability insurance policy would be necessary to protect Mount Rushmore against cyberattacks and data breaches.

Cyber liability coverage would protect Mount Rushmore in the following ways:

- Lost income: Cyber liability policies help to recover stolen funds due to cyberattacks and data breaches, and also provide reimbursement in the event business operations are temporarily suspended.

- Costs due to damaged reputation: A cyberattack or data breach impacting Mt. Rushmore could potentially wind up in the media and deter future guests. Cyber liability insurance would provide important public relations protection to help keep the media as quiet as possible.

- Legal expenses: In the event any personal or sensitive information from Mount Rushmore was stolen and sold to third parties such as tourists’ credit card information, lawsuits could arise. Cyber liability coverage pays for things like attorney, court, and settlement fees.

- Hired professionals: More than likely in the event of a serious data breach or cyberattack, the staff of Mount Rushmore wouldn’t hesitate to call on a professional programmer or other computer expert to help them repair the damage. A cyber liability policy would cover fees for hiring professional help to fix computer systems and patch holes in security.

Since cybercrime is always on the rise, it would be imperative to protect Mount Rushmore, like any other business, from a virtual perspective as well as a physical one. Cyber liability policies help protect business of all kinds to protect sensitive data that’s stored electronically.

Additional Business Coverage Needs for Mount Rushmore

Though Mount Rushmore is certainly one of a kind, it still has plenty of common concerns that relate to most all businesses. The following types of coverage would likely be purchased as add-ons to a business insurance policy for Mount Rushmore:

- Boiler & machinery: Also known as "equipment insurance," coverage applies to electric equipment in the building (e.g., AC units and boilers) that breaks down due to power surges, etc.

- Business income: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Utility services: Covers losses due to halted production resulting from an extended power outage. Prolonged power outages can lead to spoiled food or other supplies. Coverage can also be applied to the replacement or repair of products and machinery as well as income lost due to suspended operations.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of employees. This aspect would apply to Mount Rushmore’s eateries.

Just as they would with any other business owner, an independent insurance agent would help to identify all potential risk areas needing coverage for Mount Rushmore. The above list may not be extensive in all the kinds of coverage a national monument would require from a business perspective.

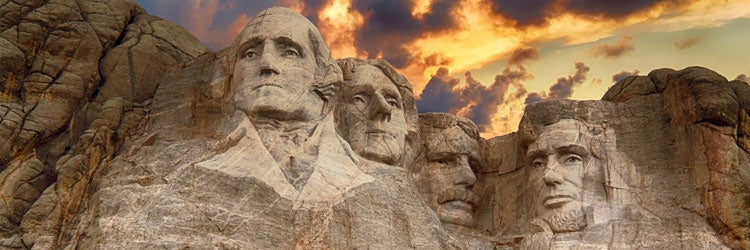

What if Something Happens to George Washington’s Nose?

Perhaps the most prominent features of Mount Rushmore are the presidents’ noses. Since they literally stick out, they are most vulnerable to many potentially destructive elements. Fortunately, the property coverage aspect of a business insurance policy would protect all features of the presidents’ faces from many perils such as vandalism, many natural disasters, explosions, and damage due to impact from an aircraft.

Which President’s Head Is Worth the Most?

The monument of Mount Rushmore as a whole would be classified as one giant piece of artwork from an insurance perspective. As such, all of the presidents’ heads would be insured together under a single insurance policy.

As for which head is the most valuable, while it’s not really possible to place a specific dollar value on each individual president’s head, it can be determined purely from a size perspective that Abraham Lincoln would be the most expensive to replace or repair. While George Washington’s head stands at 60 feet tall, Abraham Lincoln’s is slightly taller, making it the largest of the group.

An insurer would therefore consider Lincoln as being the largest section of the property to protect. Insurance payouts for repairs to Lincoln’s head versus the others would likely cost the most since there is more surface area at risk.

How an Independent Insurance Agent Would Help

If you were to actually insure Mount Rushmore, your first stop would be to call up an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in this type of insurance, deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

You Can’t Actually Insure Mount Rushmore, But…

We may not be able to insure a national monument like Mount Rushmore, but we can insure that — whatever "that" is for you. Whether it’s a gift shop or eatery in need of business insurance, a team of workers that need protection, property coverage or liability concerns, our independent agents are here for you. Start by finding an independent insurance agent in your community here.

nps.gov