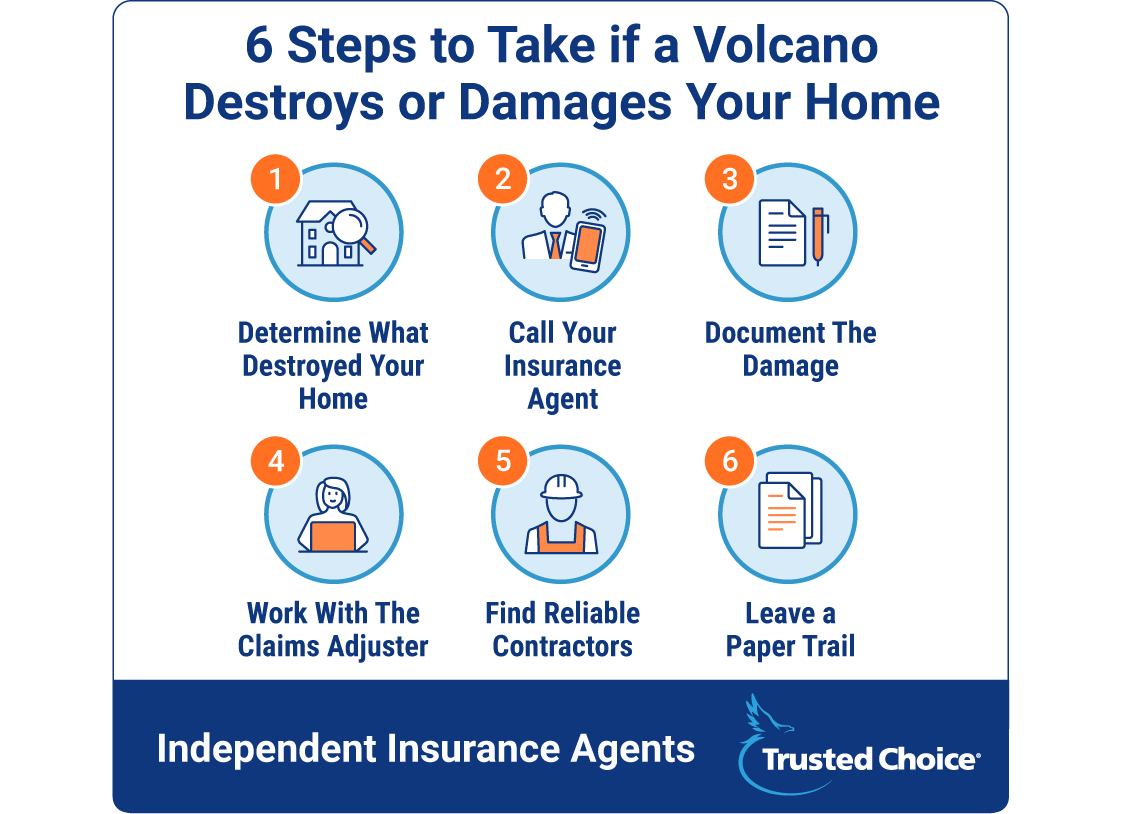

6 Steps To Take If a Volcano Destroys Or Damages Your Home

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Unless you live in Hawaii, you’re probably not thinking about a volcano ruining your home. But did you know that scientists believe there are about 169 active volcanoes in the U.S.?

Volcanoes erupt all the time and fortunately most people and their homes aren’t affected. But a volcanic eruption can result in more than just lava flow and an explosion. The following is a list of deaths due to volcanic eruption incidents worldwide from 1500 to 2017.

| PDC* | Incidents | Fatalities |

| Tsunami | 102 | 56,822 |

| Lahars | 23 | 49,938 |

| Secondary lahars | 72 | 6,377 |

| Tephra | 41 | 4,315 |

| Avalanche | 52 | 3,525 |

| Quiescent gas | 9 | 1,698 |

| Lava flows | 50 | 659 |

| Gas | 25 | 585 |

| Ballistics | 16 | 367 |

| Hydrothermal | 7 | 62 |

| Lightning | 4 | 9 |

*PDC: pyroclastic density currents; includes pyroclastic flows, surges, and blasts

As you can see, a volcano can spearhead a variety of hazardous events. And should your home get damaged or destroyed by any of these things, you’ll need to file an insurance claim. But how do you go about doing that? We spoke with insurance expert, Paul Martin, to learn the exact steps to take if a volcano should damage or destroy your home.

Step 1. Determine What Destroyed Your Home

Wait, didn’t a volcano just destroy my home? Yes, it did, but the unique thing about a volcano causing damage is that it can happen in multiple ways. If a volcano erupts, a home can be damaged by the blast of the eruption or the lava flow.

This is important to know because explosion damage and lava flow damage usually fall under two different insurance policies and may determine your next step.

Step 2. Call Your Insurance Agent

No matter what caused the damage to your home, one of your first steps in the event of any catastrophic damage to your home is to call your insurance agent. If you don’t have an insurance agent, call your insurance company directly.

Your agent will immediately contact your insurance company and the claim process can begin. You can use this time to educate yourself on the timeline and process of filing a claim. Some questions you can ask your agent or insurance company include:

- What is the next step I should take?

- How long will it take for me to hear from the insurance company?

- How long will the claim process take?

- Is there any information I should start gathering now?

Step 3. Document the Damage

If you’re able to access your home, you can immediately begin to take photos and videos of the aftermath of the volcano. Try to document as much as possible without injuring yourself or making more of a mess of your home.

After a volcano, it’s likely you may not be able to access your home. You can still start to write down a list of all of your possessions that you can think of for when your insurance provides you with the Proof of Loss.

A Proof of Loss is a document provided by your insurance company that asks you to list all of your possessions. Don’t feel like you need to remember absolutely everything, you can always add items as they come to mind.

Step 4. Work with the Claims Adjuster

In the wake of a volcanic eruption, it’s likely your insurance company was preparing for the damage. That means they’ll have claim adjusters ready to chat with you about your next step.

You should hear from an adjuster within a couple weeks but in the event that the volcano caused a lot of damage, it could take longer.

If your home is no longer livable your adjuster will ask where you’re living. Your homeowners insurance will cover any temporary living while the volcanic eruption is being investigated.

Any information that your claim adjuster requests should be completed as quickly as possible.

The sooner you can provide your adjuster with the information they need the faster they can move through the next steps of the claim.

Step 5. Find Reliable Contractors

Once the adjuster is done assessing the damage and the area is safe, you’ll get the go-ahead to start repairing the damage to your home. This could be anything from fixing a few problems to a complete rebuild.

At this point you’ll start working with different contractors that you can choose yourself or take suggestions from your insurance company.

Unfortunately, it’s common for fraudulent contractors to contact people who have recently been through a catastrophe. Be cautious to only work with licensed contractors. When working with contractors be sure to ask for all the details, costs, and materials for the work you need.

Step 6. Leave a Paper Trail

When a volcano flows through a populated area, it leaves a mess. Messes can take a lot of time and people to clean up. It's important to know your insurance rights. One of the best ways to assure you're not getting taken advantage of is to keep a paper trail of the following things:

- Dates, times, and conversations with your agent

- Dates, times, and conversations with the insurance company

- Dates, times, and conversations with adjusters

- Conversations with contractors

- Price of materials from contractors

- Receipts from any damage you prepare

- Receipts from hotels or other lodging

- Receipts from a rental car

Your independent insurance agent can help you understand what type of coverage you have and how the process should be handled so you can assure you’re being treated fairly by your insurance company.

Moving Forward

Going through the repair or rebuild process can take anywhere from months to years depending on the damage.

Having your home damaged or destroyed from a volcano can be an emotional event. From the first day you speak to your insurance agent, ask questions so you understand the process and timing of filing a claim. Get a good understanding of your policy and what it pays in a situation like this so you know your insurance is working as it should.

Keeping a professional attitude and being cooperative will make the claim process more bearable for all involved. If you believe your insurance company is treating you unfairly, get your insurance agent involved. They’re there to have your back and help you begin the process of rebuilding, repairing, and restarting your life in your home.

6 Steps to Take if a Volcano Destroys or Damages Your Home

If you're one of the unlucky ones, you can follow these six quick steps to start getting your life and your home back on track after a volcano.

statista.com