What Happens If You DON'T File a Claim after a Car Accident?

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Car accidents are stressful in numerous ways. Worse, the thought of reporting the accident to your insurance company and possibly facing higher rates afterwards can easily add to this stress.

While it might be tempting to not report a claim to your insurance company after a car accident, that can end up coming back to bite you in the long run. Here's a closer look at why you really do need to file a claim after a car accident.

Can You Just Decide NOT to Report an Accident?

According to insurance expert Jeffrey Green, auto insurance policies require you to report any accident you're involved in. To avoid violating the terms of your policy, it's safest to just report an accident to your insurance company right away, regardless of the severity. An independent insurance agent can advise you on the right steps to take going forward.

But If the Other Driver Involved Reports It, Are You in Trouble?

Green added that not reporting an accident can cause problems in the future if the other party decided to file a claim. If your insurance company finds out that you failed to report an accident you were involved in, it could refuse to pay for any damage you discover on your vehicle later on. Worse yet, the insurance company could also invalidate your coverage altogether.

Car Accident Stats for the US

Just how common are car accidents? They may happen much more frequently than you'd expect. Of course, it's always important to practice safe driving while on the road, but in case of an accident, you should still be prepared to contact your insurance company and the police ASAP.

Here are some recent car accident stats for the US

- An total of 3 million people are injured in car accidents annually.

- Around 2 million drivers suffer permanent injuries after car accidents annually.

- More than 90 people lose their lives in fatal crashes daily.

- Failure to wear a seat belt can make you 30 times more likely to be ejected from the vehicle in an accident.

- Seat belts reduce the risk of death in an accident by 45%, and serious injury by 50%.

DID YOU KNOW?

An average of 6 million car accidents occur annually.

No matter how safe you are on the road, there are others who aren't. From texting and distracted driving to harsh weather conditions, accidents unfortunately do happen frequently. That's why it's so important to be familiar with when and why you need to report these accidents to your insurance company.

Are There Other Consequences of Not Reporting an Accident?

In many states, it is required that you not only report an accident to your insurance company, but also to the police. Not reporting an accident to police in these states can result in fines, misdemeanor charges, or even felony charges. To avoid paying fines or facing other legal consequences on top of the possibility of losing your auto insurance, be sure to always report an accident ASAP.

How Soon Do You Have to Report the Accident to Your Insurance?

Different insurance companies have different requirements about how soon you need to file a claim after a car accident. Most insurance companies, however, expect that you'll file a claim immediately after the accident. Some companies may give you 24 hours to report an accident, while others might allow slightly longer time frames.

In general, sooner is always better to file accident claims to your auto insurance and to report the accident to the police. If you're unsure of your state's specific laws for reporting accidents or your insurance company's guidelines for how long you have to file a claim, an independent insurance agent can help resolve any confusion. They can also file claims with your insurance company for you after an accident.

Where Can I Get Car Insurance?

It's crucial to be equipped with car insurance to protect you in case of accidents and many other threats to you and your vehicle while on the road. Here's a look at some of the current top-rated places to get coverage in the country.

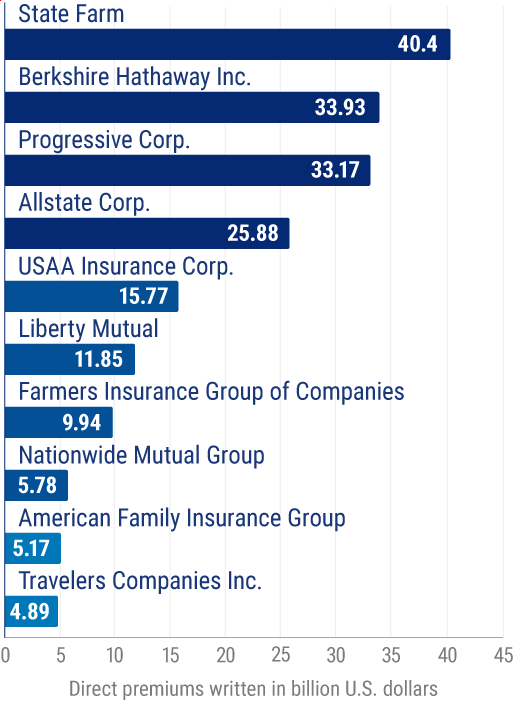

Leading writers of private passenger auto insurance in the US, by direct premiums written

State Farm currently holds the title as the top-performing auto insurance company, with $40.4 billion in direct premiums written. Second-highest is Berkshire Hathaway Inc., with $33.93 billion,followed by Progressive, with $33.17 billion.

An independent insurance agent can help you decide if car insurance from one of these companies is right for you. If not, they'll help you find a policy from the carrier that best meets your needs.

Here’s How an Independent Insurance Agent Would Help

When it comes to helping drivers report car accidents to their insurance companies, no one’s better equipped than an independent insurance agent. These agents search through multiple carriers to find providers that specialize in car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

stats - https://www.statista.com/statistics/186513/top-writers-of-us-private-passenger-auto-insurance-by-premiums-written/

stats - https://www.driverknowledge.com/car-accident-statistics/

https://www.keatingfirmlaw.com/post/if-you-don-t-report-an-accident