How to Prepare for Flash Flooding in Tennessee

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Flash floods come on quickly, and if you're unprepared, you can end up with not only property damage, but a hefty insurance claim as well. Reviewing your flood insurance before a flash flood ever hits can help you be familiar with how your coverage can work for you after these disasters.

A Tennessee independent insurance agent can also get you equipped with the right flood insurance and other coverage necessary to be ready for a flash flood. But first, here's a deep dive into how to prepare for flash flooding in Tennessee.

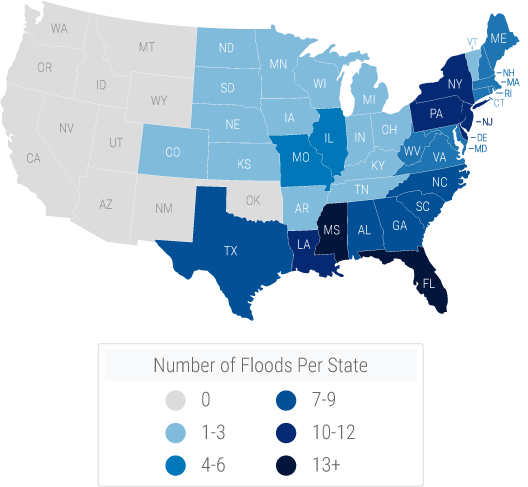

Why Does Tennessee See More Floods than Other States?

Tennessee is home to more water than most other states in the country. The state is also prone to heavy rains and harsh winter weather that can lead to runoff. When these events happen, the state's natural bodies of water can overfill and flood.

The Mississippi River is one of the most famous major bodies of water in the state. There are many tributaries and smaller rivers that jet off from the "Mighty Mississippi" which can lead to backups and overflow after heavy rains or melting snow and ice. This overflow can quickly spread throughout cities and towns, leading to flash flooding.

How to Prepare for Tennessee Floods

While flash flooding can't always be anticipated ahead of time, there are steps you can take to prepare for these events, including:

- Know the risk of flooding in your area: It's not enough to know that Tennessee is home to many bodies of water. Take it one step further and locate your city or town on FEMA's flood map. The higher your area's risk of flooding, the more you need to stay on the offense against these disasters.

- Familiarize yourself with evacuation routes: If severe flooding hits, you might be ordered to evacuate the city. Take some time to learn the best routes for yourself before a flood happens so you won't have to stress about figuring it out during a crisis.

- Gather supplies: Prepare medications and food for an emergency, and ensure that all of your important documents and personal property are off the ground and out of harm's way. Some folks choose to store important paperwork in waterproof safes to protect them against potential floods.

- Pack for safety: Have an emergency kit prepared in advance, full of essential items like insulated blankets, flashlights, radios, extra batteries, etc. Keep this kit in a place where it's easy to grab when you need it.

- Set up a sump pump: These tools are set up in a home's basement to detect excess water. If an accumulation or flood is detected, the sump pump can begin pumping excess water away from your property through a discharge line.

- Review your insurance coverage: Know that your home insurance won't cover damage to your property caused by natural floodwaters. If you're not equipped with a flood insurance policy, you could be out of luck after a flash flood or other flooding event.

It's not always possible to be fully prepared for a flood event, but you can take these steps to better ensure your family and your property's safety if one happens in your area. You can also head to ready.gov to get comprehensive planning documents and other helpful resources to connect you to the help you need after an unexpected natural disaster like a flash flood.

What Does Flood Insurance Cover?

Flood insurance is designed to protect your property against damage caused by natural floodwaters, not against damage from leaking plumbing or clogged toilets. Flood insurance is used to:

- Reimburse for structural damage: The structure of your home, as well as its electrical and plumbing systems, built-in appliances, and installed carpeting, are protected against flood damage by flood insurance.

- Reimbursement for contents damage: The personal property stored in your home, sheds, and storage units, also referred to as contents, is also protected by flood insurance against loss, damage, and destruction due to natural floodwaters.

When reimbursing for property damage, your flood insurance will take into account any depreciation in value of the damaged items or structures. Ask your Tennessee independent insurance agent about getting set up with flood insurance ASAP to be as ready as possible for flash flooding.

How Much Does Flood Insurance Cost?

Like many other forms of insurance, the cost of a flood policy depends on many factors, including:

- Your home or property's elevation

- Your area's flooding history

- Your designated flood zone

- Your location

- How much coverage you purchase

The lower your home or property's risk of flooding, the less expensive your flood insurance will be. Flood insurance rates in Tennessee have recently decreased since 2021's Risk Rating 2.0 system implemented by FEMA. The average annual flood insurance premium in the state decreased from $920 last year to $815 this year.

Can I Buy Flood Insurance at Any Time in Tennessee?

While you can buy a flood insurance policy at any time, just keep in mind that it takes 30 days for coverage to become active. That means that if you buy a policy today and it floods tomorrow or two weeks from now, your flood insurance won't be in effect yet. If you live in Tennessee, it's relevant to consider adding a flood insurance policy ASAP, due to the state's increased risk of flood event catastrophes.

Why Choose a Tennessee Independent Insurance Agent?

Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you'll know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best flood insurance coverage, accessibility, and competitive pricing while working for you.