How to Calculate Car Depreciation

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

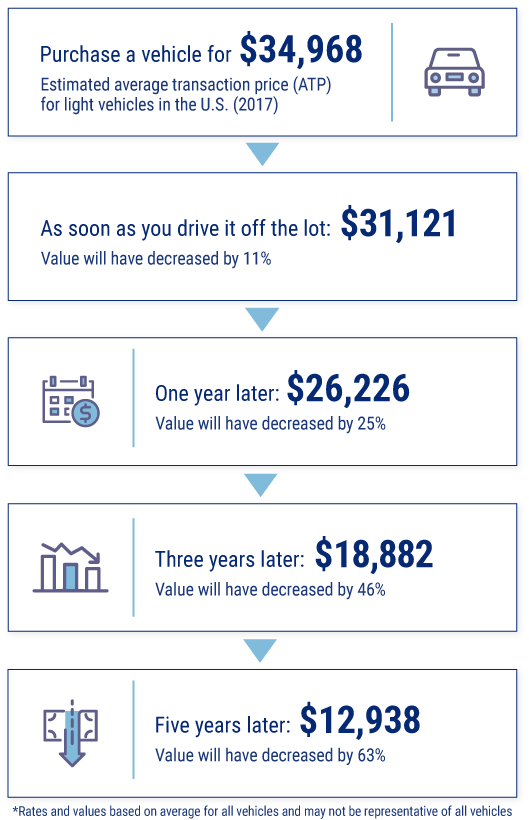

Though some folks may consider buying a car to be a great investment, the reality is you'll likely start to lose money at a significant rate right after purchase. Why? Car depreciation is a real factor that basically refers to your car beginning to lose value the moment you drive it off the lot. Even if you planned to resell your car a day after purchase, odds are you'd already take a noticeable loss.

Whatever your car's beginning or end value, it needs to be insured with the proper protection. An independent insurance agent can help you get set up with an affordable car insurance policy in your area. But first, let's take a closer look at car depreciation and why you need to be aware of it.

How Much Does a Car Depreciate?

Car depreciation refers to the natural process of a vehicle losing its resale value from the moment it's driven off the dealership's lot. The amount your specific car will depreciate over time depends on a number of factors, so it can be hard to predict the exact number. However, within just the first year of purchase, vehicles can be expected to depreciate between 20% and 35%, which is already a significant difference. Potential depreciation is just one thing you need to remember when buying your first car.

How to Calculate Your Car’s Depreciation

Considering that the percentage of depreciation experienced by vehicles each year can reach between 20% and 35%, you can follow a basic formula to calculate how much your car may depreciate in that timeframe. So if your car costs $40,000 at the time of purchase, within only 12 months, its value could fall to $32,000 or even as low as $26,000. Pricier cars are not immune to depreciation, either. If you purchased a $100,000 vehicle and it depreciated 25% within a year, it would retain only $75,000 of its value 12 months later.

Factors Affecting Car Depreciation

Many factors influence the rate of car depreciation, including the vehicle's total mileage, age, make and model, market demand, and overall condition. Car depreciation rates are not standard but tend to follow a formula to be calculated, such as the one detailed in the above section. Further, cars that depreciate the most are older vehicles with less market demand and higher mileage. Basically, the more likely the majority of prospective buyers would be to purchase your car at present, the less it's likely to have depreciated. Here's a breakdown of the specific factors that influence car depreciation.

Vehicle Type

SUVs and pickup trucks are sold more frequently than many other types of vehicles and, therefore, tend to depreciate less than less-frequently purchased vehicles, like luxury sedans.

Vehicle Make and Model

Again, luxury sedans, like BMWs, tend to depreciate faster than many other vehicles. The make and model of your vehicle significantly impact its depreciation rate. Trends indicate that Toyota and Jeep brands tend to depreciate less quickly overall.

Vehicle Age

The older a car is, the more its depreciation increases, and even accelerates. Older vehicles are more likely to require maintenance or upgrades and retain a much lower resale value.

Vehicle Mileage

Similar to age, the higher a vehicle's mileage, the more likely it is to need repairs. Therefore, cars with higher mileage also experience higher depreciation rates.

Vehicle Condition

Cars that have been poorly maintained or even neglected experience much more significant depreciation rates than those that have only accumulated normal wear and tear over time.

Vehicle Reputation

Certain foreign vehicles and others with a reputation for requiring more expensive maintenance tend to depreciate much more quickly than others. If a vehicle costs more, it tends to depreciate faster overall.

Car Depreciation Rates over Time

After the first year, vehicles tend to depreciate about an additional 15% each year going forward until they reach four or five years old. But if you're still asking, "How much does a car depreciate per year, really?" keep in mind that many factors will affect a specific vehicle's depreciation rates. The annual depreciation on a car is determined by the vehicle's age, make and model, condition, and more. So, if your vehicle lost 20% of its value the first year and is now three years old, you can predict it will have already lost about 50% of its value (i.e., 20% + 15% + 15%).

Frequently Asked Questions about Car Depreciation

A new car is expected to depreciate between 20% and 35% within its first year of ownership. The car begins to depreciate the moment it's driven off the dealership's lot.

It's estimated that a new car loses between 9% and 11% of its value immediately after being driven off the lot. Considering that a new $30,000 car could lose about $3,000 in value right after being driven off the lot, that's significant depreciation already.

There are several reasons, but the two most prominent are reliability and popularity. Cars that are in better shape and maintain a better reputation over time will have a much lower depreciation rate than those in terrible condition and with poor reputations, such as having a reputation for requiring frequent or expensive repairs.

It’s impossible to stop depreciation entirely, but there are steps you can take to slow it down:

- Buy used (e.g., three to five years old): If you buy used, the depreciation rate has already slowed after the four- or five-year mark.

- Keep your vehicle a while: Once a car hits 10 years old, deprecation is no longer a factor.

- Maintain the value: Keep your service records up to date and repair any damage quickly.

- Buy wisely: Choose a popular color and options that will add value.

- Low mileage: Keep your mileage down as much as you can to help increase resale value.

Final Thoughts on Car Depreciation

This breakdown of car depreciation rates and how they're calculated has perhaps gotten you interested in purchasing a brand-new car with an excellent reputation. On the other hand, some of the information about car depreciation may have swayed you toward buying a used vehicle. Either way, we hope we've provided a detailed breakdown of car depreciation for your reference.

If you still have questions, you can find out more by contacting an independent insurance agent in your area for an affordable car insurance policy.

http://www.jdpower.com/press-releases/2016-us-vehicle-dependability-study-vds

https://www.ramseysolutions.com/saving/car-depreciation#:~:text=So%2C%20as%20you%20research%20different,you%20drive%20off%20the%20lot.