West Virginia Barber Shop Insurance

And what you need to know

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

In West Virginia, there are roughly 113,410 small businesses in existence. If you fall into that category, you'll have all the responsibility that owning an operation entails. Fortunately, West Virginia business insurance will have options that protect your barber shop from the unknowns.

A West Virginia independent insurance agent does the shopping for you at zero cost, making it super easy. They have a network of carriers so that you're presented with the best coverage at a fair price. Connect with a local expert to start saving in minutes.

What Is Barber Shop Insurance?

Consider using a professional if you're searching for coverage that makes sense to your West Virginia barber shop. There are several policies that may be necessary for your business to obtain.

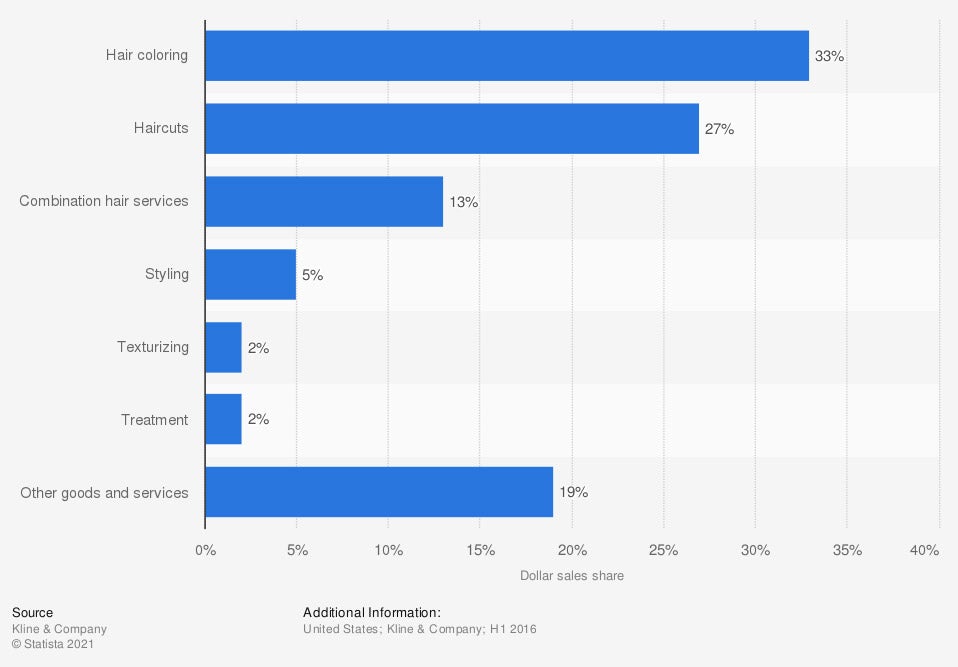

Revenue of barber shops in the US in recent years (in million US dollars)

If your barber shop is pulling in revenue, then you'll want to protect it. There are a few different ways you can create a foundation of coverages that save you from paying out of pocket for a loss.

What Does Barber Shop Insurance Cover in West Virginia?

When a claim occurs, you'll be at a loss without the right coverage in place beforehand. In West Virginia, $1,699,944,000 in commercial insurance claims alone were paid in one recent year. Take a peek at these common policy coverages for your barber shop.

General liability insurance: Pays for bodily injury or property damage claims where you and your employees are responsible.

Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

Commercial property insurance: Pays for building, equipment, and inventory damage from a covered loss.

Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

Workers' compensation insurance: Pays for an employee's medical expenses resulting from an injury or illness on the job.

Errors and omissions insurance: Pays for negligence, personal injury, and consulting lawsuits of a client.

How Much Is Barber Shop Insurance in West Virginia?

The way your barber shop insurance is calculated has a lot to do with how you run your business. Insurance companies use several risk factors when determining your premiums which makes each one unique. Look at what carriers use when quoting your West Virginia barber shop insurance.

- Prior claims reported

- Number of years in the industry

- If you have employees

- If you have safety practices

- The value of property owned

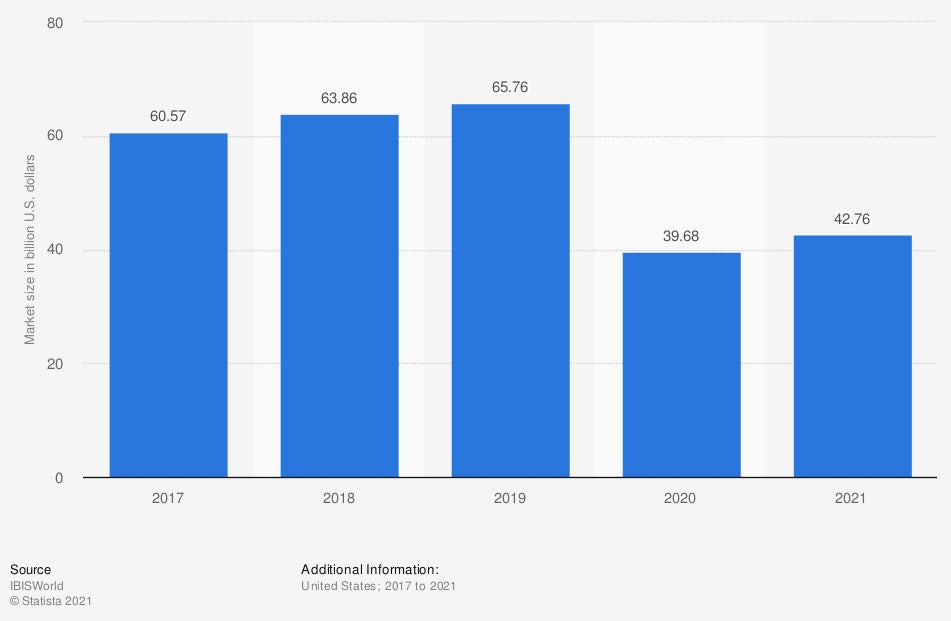

Industry revenue of hair care and esthetic services in the US in recent years (in billion US Dollars)

Haircare services are always needed as long as humans have hair. This means your barber shop could be in high demand, depending on where you're located.

Will My West Virginia Location Impact My Rates?

Where you decide to lay down roots will have a lot to do with the premiums you pay for protection. In West Virginia, your barber shop's location will impact your insurance pricing due to local factors. Take a look at what could play a role in your rates based on your territory.

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

How an Independent Insurance Agent Can Help in West Virginia

West Virginia business insurance can make or break your company. If you're the proud owner of a barber shop, you'll need specific policies to be fully insured. Fortunately, a trained professional can help review your coverage for free.

A West Virginia independent insurance agent will do the shopping through highly rated carriers at no cost to you. They'll compare policies and premiums, so you're protected. Connect with a local expert on trustedchoice.com for tailored quotes in minutes.

https://www.statista.com/forecasts/409860/united-states-barber-shops-revenue-forecast-naics-812111

https://www.statista.com/forecasts/1014390/hair-care-and-esthetic-services-revenue-in-the-us

http://www.city-data.com/city/West-Virginia.html