Best Group Short Term Disability Insurance

(Don’t let a short-term disability cause a long-term problem)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You sit at work wishing the clock clicked faster, but have you thought about what it would mean if you were out of work for an extended period? At first thought, getting away from the grind sounds like a welcome gift.

But no work means no income, and if you’re faced with an injury or illness that makes you unable to do your job, how do you pay your bills?

The answer is through disability insurance. When it comes to having a back-up plan if you become unable to work, independent insurance agents can help you understand group short-term disability insurance and what it can do for you.

What Is Group Short-Term Disability Insurance?

Group short-term disability insurance is an insurance policy offered by your employer that will pay a portion of your income should you become injured or ill and not capable of performing your job.

The short term means that the benefits are only available for a short amount of time, determined in your policy. The group means that the insurance is offered through your employer vs. purchasing the insurance plan yourself.

Short Term Disability at a Glance

- Benefits cover a shorter amount of time, usually 2-26 weeks.

- You cannot perform your own occupation.

- Includes pregnancy and birth.

- Lower monthly premiums.

- Shorter waiting period (called elimination period).

- Suffering from less serious injury or illness.

- Ends if you lose your job while out on disability.

- Cannot receive short-term disability and workers' compensation.

Can I Purchase Group Short-Term Disability Insurance Myself?

No. You can purchase individual short-term disability insurance if your employer does not offer a group plan, but you cannot purchase group short-term disability insurance.

Offering disability insurance allows an employer to provide a more comprehensive and attractive benefits package. In addition, most companies will pay for a portion or the whole premium for disability insurance for their employees. If your employer offers group short-term disability insurance, you should accept it unless the benefits do not fit your needs.

How Does Group Short-Term Disability Insurance Work?

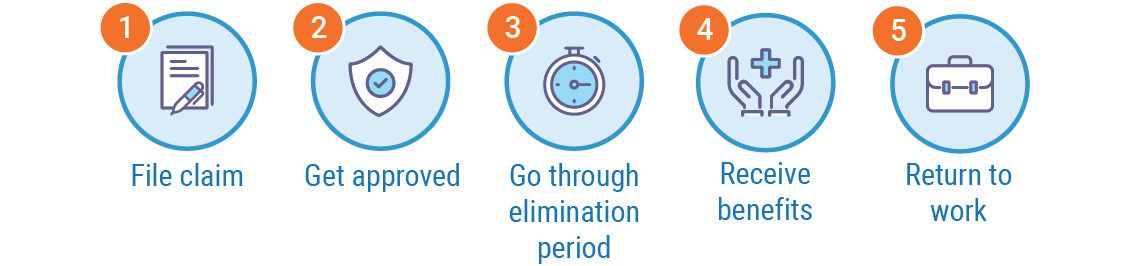

If you’ve accepted the group short-term disability insurance offered by your work and find yourself injured or ill due to something that isn’t work-related, you would follow these steps.

- File a claim with the insurance company.

- The company determines whether you meet their criteria for disability.

- If you are determined to be disabled and not capable of performing your job, you’ll be placed in a short elimination period. The elimination period is a small amount of time, usually no more than two weeks, before your benefits are available.

- Begin receiving weekly benefits for a set amount of time.

Group short-term disability insurance pays a portion of your income. Usually, this is around 60%, and the benefits are paid weekly. The amount of time you can receive payments is determined by your policy and disability. However, most short-term policies pay out for three to six months, but some policies will pay out for up to two years.

What Is the Difference Between Disability Insurance and Workers’ Comp?

At first glance, it may seem like disability insurance overlaps with workers' compensation, but the two are very different.

- Workers' compensation: Provides coverage for work-related injuries or illness. This means your injury or illness must be directly tied to your work, whether it happens at work or is a result of your work environment.

- Disability insurance: Provides coverage for when you’re injured or fall ill outside of work, on your personal time, but are unable to return to work as a result of your disability.

Most common short-term disability claims

- Childbirth

- Recovery from surgery

- Sickness that requires frequent treatment

Examples of most common short-term disabilities

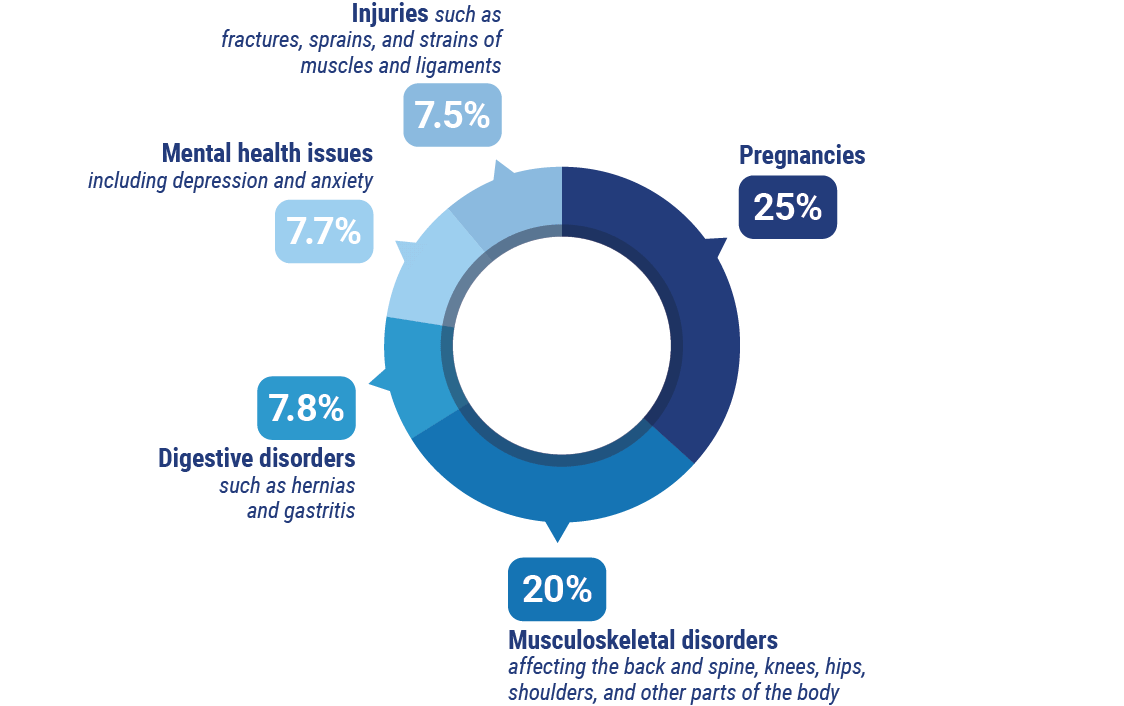

- Pregnancies (25%)

- Musculoskeletal disorders affecting the back and spine, knees, hips, shoulders, and other parts of the body (20%)

- Digestive disorders, such as hernias and gastritis (7.8%)

- Mental health issues including depression and anxiety (7.7%)

- Injuries such as fractures, sprains, and strains of the muscles and ligaments (7.5%)

Even though they cover different scenarios, both disability insurance and workers’ compensation can help protect you should you be in a situation where you’re unable to earn your income.

How to Choose the Best Group Short-Term Disability Insurance

When it comes to group disability insurance, you don’t get to choose between agencies. Your company will either offer disability insurance or not and you can accept it or not.

With that said, you will get to choose whether you want short-term, long-term, or both. Determining whether group short-term disability insurance is a good option for you depends on your lifestyle. You can ask yourself the following questions to help determine if a group short-term disability plan will benefit you.

- If you were to fall ill or get injured and not be able to work, how many months could you afford to be out of work on your savings?

- How risky do you live?

- What are the odds of getting injured or ill outside of work?

- Do you plan on getting pregnant?

- What percentage of your income do you spend on your bills?

Why Independent Insurance Agents?

Disability insurance policies can be complex, and determining whether to accept group insurance or find your own plan can be time-consuming and frustrating. An independent insurance agent's role is to simplify the process.

They’ll make sure you get the right coverage that meets your unique needs. Not only that, they’ll break down all the jargon and explain the nitty-gritty, so you understand exactly what you're getting.

And in the unfortunate event that you need to file a claim, you won’t be alone. Your agent will be right there to help guide you through every last step so you can keep paying for your life. How great is that?

https://www.iii.org/article/what-are-types-disability-insurance

https://www.goodfinancialcents.com/insurance-quotes/disability/best-companies/

https://oneamerica.com/newsroom/news-releases/harris-oneamerica-disability-insurance-survey