Understanding Home Insurance Claims

Learn how to decide when filing a home insurance claim is worth it, how to file, and more.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Your home is much more than a place to hang your hat. It's where you store your personal belongings and even host company on occasion. If a disaster occurred that resulted in property damage or injury, you might have to file a claim through your homeowners insurance. But there are some instances when filing a claim just isn't worth it.

Fortunately, an independent insurance agent can help you determine when it would be beneficial to file a home insurance claim. They can also file claims for you directly. But first, here's a breakdown of the home insurance claims process and when it makes sense to file to get you started.

Steps for Filing a Homeowners Insurance Claim

Whether your home was vandalized, damaged by a storm, or something else, you might need to file a home insurance claim. Here's what to do if a disaster happens to your home.

Follow these simple steps to file a home insurance claim:

- Contact your independent insurance agent: When you decide to file a homeowners insurance claim, you’ll start by contacting your agent. They can help guide you through the process, outline the actions your insurance company will take next, and answer any questions you may have.

- Assess and document the damage: Take photos and videos of the damage and write down what’s been destroyed or stolen. If the damage is structural, use caution when shuffling through your home.

- Report crimes to the police: If you’ve been burglarized, let the police know when it happened and what was stolen.

- Fill out the claim forms: If you decide to file a claim, you’ll need to provide a list of everything that was lost or damaged to your insurance company.

- Prepare for an adjuster to come: Schedule a visit with an insurance adjuster, then don’t move or touch anything until they can assess the damage in person.

An independent insurance agent can also file claims for you and provide you with an ETA of when your insurance company will finish each step of the claims process.

Is Filing a Claim Worth It?

Really, no one can answer this question except for you, and it comes down to each specific scenario, as well as personal preference. Filing a home insurance claim can be time-consuming, and there's always a possibility that your claim will be denied. While your independent insurance agent can help advise on whether it makes sense to file a claim after an incident, there are ways to break this answer down even further.

How Do I Know If the Damage Will Be Covered?

First, check your policy documents. If you’re still unsure, you can begin the claims process anyway. For example, many types of flood damage are not covered by home insurance, but if your basement sustains significant water damage that wasn't caused by natural flooding, the incident may be covered.

For example, if your hot water heater leaks and damages your floors or a sump pump fails, and your policy includes sewer backup coverage, you may be able to receive compensation. If the damage isn't covered, your insurance company will let you know. In many cases, it can be worth filing a claim to find out. Your independent insurance agent can also advise on whether your policy is likely to cover a specific incident.

How Does the Deductible Work?

Every home insurance policy has a deductible. Some deductibles are in dollar amounts (typically $500 or $1,000), while others are percentage-based according to the value of your home (i.e., the deductible for a $200,000 home with a 1% deductible would be $2,000).

The deductible is the amount you have to pay out of pocket per claim before receiving reimbursement from your insurance company. Therefore, if you have a $500 deductible and your house sustains $10,000 worth of damage, your insurance company may reimburse you up to $9,500 if your claim is approved.

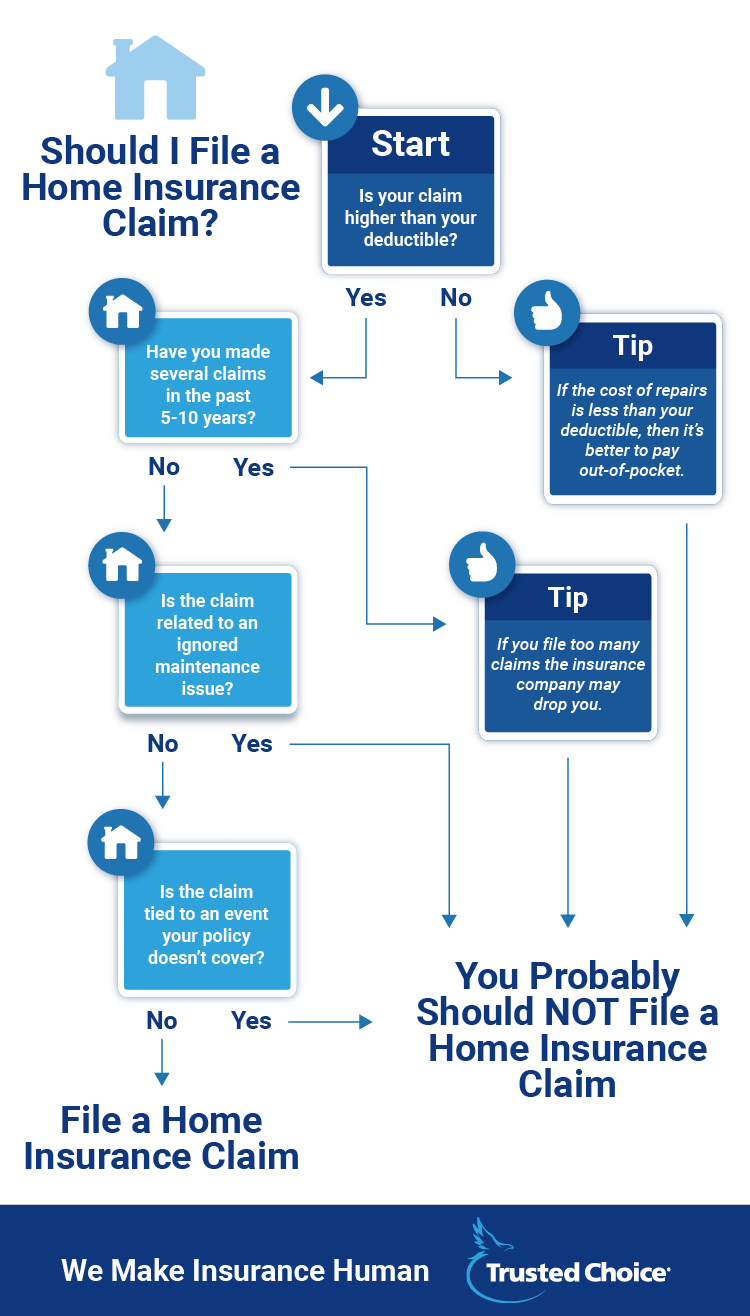

When to File a Homeowners Insurance Claim

The decision of when to file a homeowners insurance claim doesn’t have to be a difficult one. Keeping these four major determining factors in mind can greatly help to simplify your decision if you’re ever on the fence.

File a home insurance claim if one of the following applies:

- The loss exceeds your predetermined amount: Some homeowners automatically file claims for any damage that will exceed their deductible, no matter how small the amount. It’s up to you to decide what amount will be your baseline for filing a claim. Consider how much money you’d be willing to pay out of pocket for various incidents and how much your deductible would have to be exceeded to justify going through the claims process for you.

- The incident could become a liability claim: Any incident that could turn into a liability claim should be reported to your insurance company immediately. Insurance contracts typically state that it’s the policyholder’s duty to report liability incidents, such as injuries, ASAP. It’s best to go ahead and file even if the claim seems minor because the sooner you report an incident, the better chance your insurance company will have at defending you.

- There’s property damage you can’t fully assess: It’s not always possible to assess the extent of property damage at first glance. Damage may be much more extensive (and costly) than you’re able to determine upfront. Until a professional inspection has been done, it’s impossible to know the full extent of the damage or the cost of repairs. It’s best to file this type of property damage as a claim so you can get the right amount of reimbursement for necessary repairs.

- The damage is too costly for you to fully cover yourself: In the event of a particularly expensive incident, it’s wise to file a claim to try to secure some financial reimbursement from your insurance company. It’s also helpful to file a claim for larger incidents because the insurance company will arrange for a professional evaluation of the extent of the damage.

While it’s not possible to list every potential scenario in which an insurance claim should be filed, having these examples may provide a good springboard for you to make your decision. In short, if the damage, theft, or incident was significant, you should file a claim right away. But if only a partially broken bike was stolen, you may not want to file a claim.

The value of your bike is probably insignificant compared to the risk of having your premiums increase. So, after any incident, try to weigh the possible risk of a premium increase against the out-of-pocket replacement cost to decide whether it’s worth the claim. Your independent insurance agent can also help you to determine when filing a claim is appropriate.

When Not To File a Home Insurance Claim

Filing home insurance claims comes with the risk of not only a denial from your home insurance company but also of your insurer increasing your policy's premiums or even potentially canceling your policy entirely. But if there is significant damage to your home where the cost to repair or replace your property will drastically outweigh your deductible, you'll likely want to file a claim anyway.

Here are a few examples of when you would not want to file a claim:

- If your claim is not much more than your deductible: The payout won’t be worth the potential increase in premium.

- If you’ve made several claims in the past 5 to 10 years: This could cause your insurance company to drop you.

- If the claim is for something your insurance doesn’t cover: If you try to file a claim for something your home insurance policy excludes, it will be denied automatically.

- If the damage is related to poor maintenance: Insurance companies consider routine home maintenance to be the homeowner's responsibility, so coverage is not provided by your policy.

Again, your independent insurance agent can help you decide if filing a home insurance claim is worth it based on your specific scenario.

How Long Does It Take to File a Claim?

The short answer is that it depends. Your insurance company is probably required to send you claims forms within 30 days after you file, but it can take much longer than that for the claim to be resolved and for you to get reimbursed. Insurance companies often have 10 to 30 days to accept a claim receipt and up to an additional 40 days to decide whether they’ll accept or reject the claim. If a claim is accepted, the insurance company may take several weeks or even months to pay out the claim amount.

Patience is key during the claims process. Some claims can take up to a year or more to be fully resolved. Be sure to stay in touch with your independent insurance agent throughout the process. Let them know any status updates as they happen so they can stay informed if your agent is not directly handling the claim for you.

How Long Will It Take to Get Reimbursed?

The timing of when you will receive reimbursement for your claim ultimately depends on your insurance company and the extent of the damage. In some cases, the insurance adjuster can write you a check immediately after assessing the damage. In many cases, however, it may not be nearly as fast.

When Will an Adjuster Come to My Home?

This depends on a few factors, like the insurance company, the location of your home, and the extent of the damage. If a wildfire or hurricane causes widespread damage in your area, it may take a while for an adjuster to visit your home. But if it's an isolated event, like an accident in the kitchen that led to a fire, your adjuster may be able to visit more quickly.

How Do I Know the Claims Adjuster's Estimate Is Fair?

For contents claims, you can do a bit of homework in advance by looking up the replacement costs of your lost or destroyed property. If your policy includes replacement cost coverage, your insurer may accept the estimated value of your property. However, if you have actual cash value coverage, your adjuster will estimate the depreciated value of your property.

For property damage to your home's structure or dwelling, it can be wise to get a couple of professional repair estimates done before your adjuster arrives. If possible, you may want to have a trustworthy contractor at your home at the same time, just in case the adjuster’s estimates are considerably different from the amount you were quoted. The contractor and adjuster can often work together to come to an agreement.

How Much Will My Homeowners Insurance Cover If I File a Claim?

So you’ve filed a claim, and it’s been accepted by your insurance company. Now, you’re likely to be wondering just how much your insurance company will cover. After paying your deductible, you’ll be responsible for paying any amount exceeding your homeowners insurance policy’s limit for whatever category the incident falls under, such as personal property or dwelling coverage (i.e., if something happens to the home’s structure).

A standard homeowners policy has a deductible that’s typically a flat value amount, such as $3,000, $5,000, or $10,000. If a covered incident falls under the personal property category of coverage, you might have to exceed $3,000, for example, in stolen or damaged personal property, before getting reimbursed. Your reimbursement amount will be determined by your specific policy and if it includes coverage for the property’s full replacement value or if depreciation is factored in.

If the incident falls under the other structures coverage category, the limit is often 10% of your dwelling coverage limit. So if you’ve got a $300,000 home, your other structures coverage may be limited to $30,000. You’ll still have to exceed your deductible amount before the insurance company’s reimbursement will kick in.

What If I Don't Agree with My Insurance Company's Compensation?

If you don't think you were compensated fairly by your home insurance company for your claim, you can file an appeal. This is often a process completed by submitting a formal written document to your insurance company. Your independent insurance agent can help you through this process.

What If My Home Is Burglarized?

Your first step is to ensure that you and your family are safe and then call the police. When the police arrive, they will complete a report with all the important information about the incident. This report is necessary if you file a home insurance claim and will help expedite the process. Be sure also to create a detailed list of any stolen, lost, or damaged items, including their estimated values, and have that ready when contacting your insurance company.

If My Home Was Damaged, Can I Start Repairs Right Away?

If a natural disaster caused significant damage to your home, you may be tempted to begin repairs right away. However, doing so can mask much of the damage and make it more difficult for an insurance adjuster to estimate the repair costs fairly.

Temporary fixes that could help prevent any further damage are wise to proceed with right away, but it’s best to wait until after the insurance adjuster has visited your property to make permanent repairs. Be sure to save all receipts from repairs that you make yourself before filing a home insurance claim, too.

Preemptive Measures Before Claim Time Comes

If your entire house burned down unexpectedly, chances are you wouldn’t remember every item of value inside. Being organized and having purchase records and receipts on hand can help make the claim process much easier. There are a few simple things you can do to be prepared:

- Make a video of your house that shows your belongings.

- Make a note of anything of particular value and how much it costs at the time of purchase.

- Keep receipts from any furniture and home décor purchases.

- Know the specific models of any appliances and electronics.

- Keep records and receipts from any home upgrades.

- Have a list of all your possessions and how much they’re worth.

- Understand your home insurance policy and what it covers.

Taking a few simple action steps in advance can greatly help streamline the process of filing a claim should you ever need to.

What If My Home Is Uninhabitable During the Claim Process?

If a hailstorm wipes out half your roof, you won’t be able to stay in your home during the claim process. If you’re displaced from your home, keep track of your extra living expenses. These can include:

- Hotel rooms

- Takeout meals

- Laundromat fees

- Extra gas to commute to work

- Loss of rental income if you were renting out a room in your house

- Boarding for your pets

Your home insurance policy should include coverage for loss of use or additional living expenses, so be sure to keep track of any financial burden that comes with leaving your house temporarily. Keep in mind that the disaster must be covered by your home insurance to receive reimbursement for the loss of use of your home. It’s wise to verify with your insurance company exactly what's included in your loss of use coverage before booking a room at an expensive hotel.

Damage Homeowners Insurance Won’t Cover

Not everything is covered by a basic homeowners insurance policy. In fact, certain disasters are excluded by home insurance coverage, such as:

- Flood damage caused by natural sources (e.g., hurricanes)

- General wear and tear of the home

- Insect damage and infestation

- Damage from earthquakes

- Malicious or intentional acts against others

- Business-related losses (unless you purchased an endorsement)

If you live in an area where any of these situations is a potential threat, you can always add the proper coverage to your insurance. Your independent insurance agent can help you add flood insurance, earthquake insurance, or home-based business insurance if you need it.

The Benefits of Working with an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you. They'll shop and compare quotes and present you with only the best options for home insurance.

https://www.iii.org/article/how-to-file-a-homeowners-claim/

https://www.iii.org/article/understanding-the-insurance-claims-payment-process/