How to Start a Bar

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’ve decided the time is now to share your creative mixed drinks and tasty beer with the world, so you’re opening your own bar. We admire your ambition, but it takes a bit more than just impressive glass-flipping skills and tiny umbrellas to get a successful bar up and running. You’ll need to plan right from the start to keep the profits flowing along with your tap.

When the time comes to open up shop, having business insurance for your bar is the key to maintaining smooth operations. All businesses come with risks (even the fun ones), so you’ll need to obtain protection during your preparation phase. Our independent insurance agents are here to help get you set up with the right coverage for your specific needs. But first, let’s talk about bars.

All about the Bar Industry

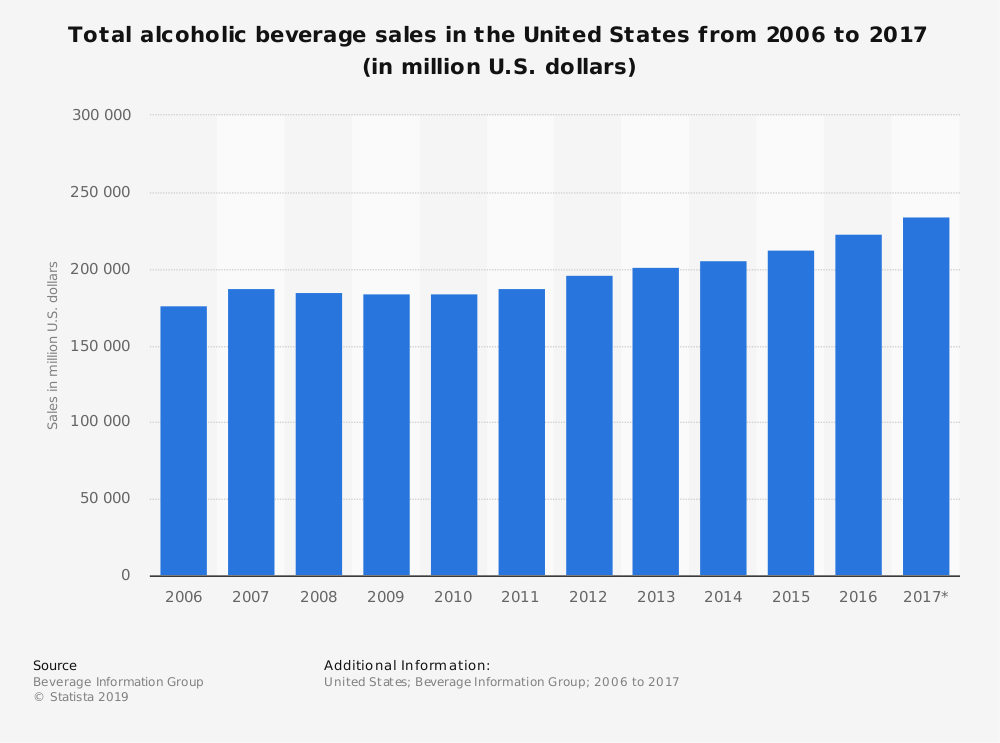

There’s no question that bars are in hot demand in the US, and it looks like they will be for the foreseeable future. Since 2010, revenue in the alcohol industry has risen nearly $500,000. The alcoholic drink market revenue totaled $1,056,901 in 2010, and has skyrocketed to more than $1.5 million in 2019. People are clearly crazy for cocktails.

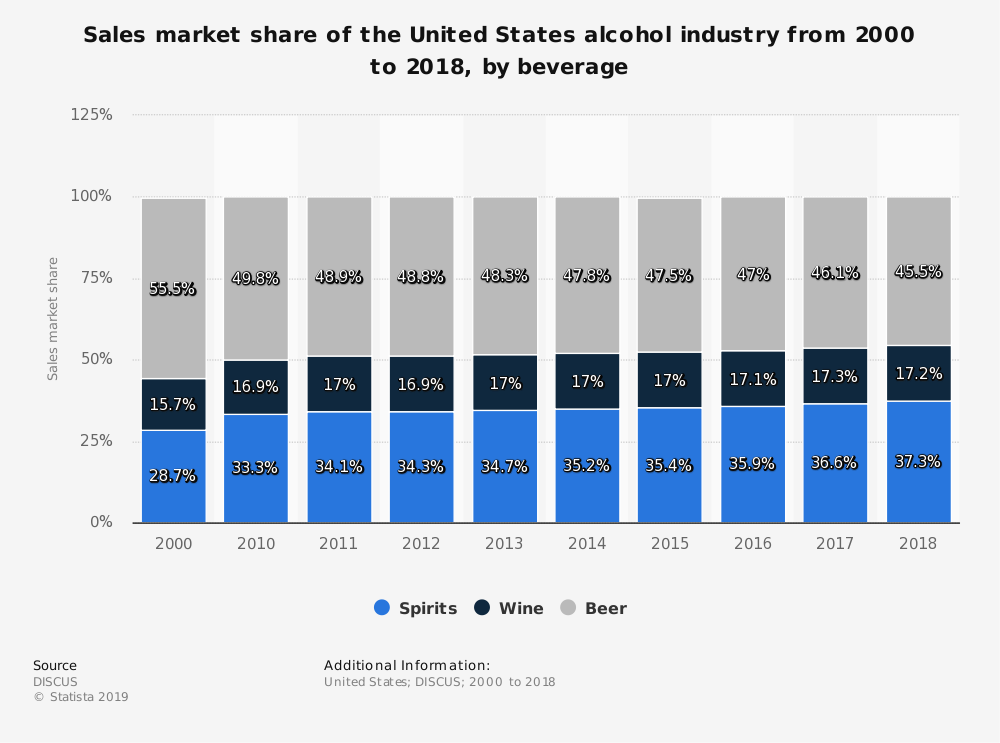

Interestingly, there seems to slightly more demand for spirits over beer as time rolls on. In 2010, beer made up 55.5% of the alcohol industry sales market share, compared to spirits (28.7%) and wine (15.7%). In 2018, however, beer fell to just 45.5% of the sales market share — a 10% decrease. The sales market share for spirits increased to 37.3% in 2018, and wine increased to 17.2%. Might be handy to keep these figures in mind when planning your menu.

How to Start a Bar

Your passion for starting a new business is a great motivator, but it’s far from all you need to bring that dream to reality. Of course your vision will be specific and unique (as it should be), but we’ll take a look at some general steps to starting a bar:

- Step One: Planning. No successful business can begin without a solid plan—we’re willing to bet on that. First up, you’ll need to determine all kinds of stuff like your start-up costs, target market, business name, the products and services you’ll offer, and how long it’ll take you to break even and start turning a profit. You’ll also need to decide what kind of business you want to be (i.e., if you want to work out of a strip mall or stand-alone space, etc.). Lastly, you’ll need to scout out a location, and actually purchase or rent said property, once you’ve found it.

- Step Two: Legal stuff. Next, you’ll decide what kind of business entity you want to be (e.g., LLC, partnership, etc.), and then go through the proper channels for making it legal by registering with the government. You’ll also need to register for taxes and obtain any required permits and licenses.

- Step Three: Money stuff. This phase involves opening a business bank account so you can accurately monitor your business’s financial performance, and it will also make your life a heck of a lot easier when it comes time to file your annual taxes. Then, it’s time to obtain your start-up costs and determine how much you’ll be charging customers/clients for any goods and services your business will offer.

- Step Four: Define and build your brand. What will your business stand for? How do you want the world to perceive it? These are just a couple of questions you’ll answer in order to define your brand. A solid, unique branding of your business will help it stand out from the competition. Once the nitty-gritty has been figured out, it’s time to get to work building that brand. This generally involves designing business cards, building a website, and establishing a social media presence. If you’re clueless when it comes to Twitter or any of the other platforms, you can always hire (or beg) someone to take care of that aspect for you.

- Step Five: Build your team. You’ve made all kinds of progress, and now it’s time to find people to actually do the work. Determine what kind of team you need, the different roles you need to fill and how many positions there are in each, and then go about hiring your staff/employees/minions. You can advertise online, in your local newspaper, or go the old-school word-of-mouth route. Once you’ve got a solid team established, it’s time to get them trained.

- Step Six: Iron out the details. For your bar business, this could involve purchasing alcohol and glasses, ordering supplies needed for your kitchen or dine-in area (if applicable), crafting your menu, designing creative signage, perfecting your mixed drink recipes and then sharing them with the appropriate staff, etc. Basically, any of the specifics needed to make your bar come to life will fall into this step.

- Step Seven: Get coverage. The final step, and perhaps the most important, is to obtain the proper coverage. You’ll need business insurance to protect not only your bar, but also your employees—and yourself. Business insurance is the pièce de résistance that’ll keep your bar pouring those mouthwatering beverages for eager customers for years to come.

What Is Bar Insurance?

Boiled down, bar insurance is a classy cocktail of an insurance package designed to meet the specific needs of bar owners. All the coverage offered by a basic small business insurance plan as well as policy options tailored for the unique needs of bars are rolled into one.

A bar insurance package simplifies the process of obtaining all necessary coverages for bar owners while eliminating confusion and stress. Basically, it’s the best way to go.

What Does Bar Insurance Cover?

A bar insurance policy is typically the easiest option when it comes to knocking out your extensive list of coverage needs all together in one tidy package. These policies offer the basics of business insurance coverage, including most of the liability insurance you’ll need, plus specific coverages tailored to your unique niche.

Here are several bar insurance coverage options:

- General liability: This coverage protects you against property damage or injury claims made by a third party.

- Workers' compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Depending on the type of work being performed, this coverage is often mandatory in most states.

- Property insurance: Covers loss of or damage to your physical property, including your office space, and often the inventory inside it. Protected mishaps include fires, storms, and more.

- Cyber risk & privacy liability: Covers the loss/theft of customers’ sensitive data, including credit card numbers and more. This coverage can also save your business in the event a deposit or money transfer is intercepted by cybercriminals.

- Employment practices liability: Covers fees for lawyers and other financial ramifications if any of your employees are involved in harassment cases against coworkers or customers.

- Boiler & machinery: Also known as "equipment insurance," it covers electric equipment in the building (e.g., AC units and boilers) that breaks down due to power surges, etc. Property insurance may cover this stuff, but not always.

- Utility services: In the event that production is halted due to an extended power outage and food spoils as a result, this coverage will take care of the financial losses. This aspect of the insurance can also be applied to the replacement or repair of your products and machinery as well as income lost due to suspended operations.

- Liquor liability: The quintessential insurance component for bars, liquor liability coverage is an absolute must, since most patrons who enter your establishment plan on drinking. General liability will not protect you if your employees overserve a customer who ends up with a DUI or other alcohol-related charge.

Your bar insurance package will be assembled by selecting the coverages that work for your unique business from a big list of available options. Coverage applies to everything from lost business revenue to potential legal/court fees and beyond.

Who Needs Bar Insurance?

Whatever the size or proof scale of your bar, if you’re selling drinks (or bar snacks) to the public and paying employees, you’ll need protection. Bar operation comes with a set of unique risks, both obvious and hidden, so coverage is essential if you own or operate any of the following:

- Sports bar

- Specialty bar

- Pub or Irish pub

- College bar

- Hotel bar

- Nightclub

- Music lounge bar

- Cocktail bar

Bar insurance will cover all aspects of your business, regardless of the specific type you own. It’s always important to have protection for your workers, your equipment, your inventory and your property, but protection against potential lawsuits is also crucial. Bars of all shapes and sizes can be sued, so don’t risk not having coverage.

How Much Does Bar Insurance Cost?

Truthfully, it depends. On quite a few things. But whether you’re a retro nostalgia bar in a big city or a pub in your hometown, bar owners pay about $3,000 to $5,000 annually for combined liability coverage, workers’ comp, and more. However, for a little hole-in-the-wall dive bar in the middle of nowhere, figures will most likely be lower.

Of course, it’s hard to offer an average figure, since each bar is unique. But really, it all depends on a number of factors, like:

- The type of bar: This includes more than just if you’re serving cutesy cocktails with fancy names or strictly beer. The kind of equipment your bar uses will affect the risk involved in operations. Obviously, more danger means more money for insurance. Also, if your bar doubles as a venue for live music or other entertainment, you’re likely to need more coverage.

- The location of the bar: Larger cities tend to have higher costs for insurance, but it goes beyond that. Depending on where you are in the country, your location may be subject to various weather-related risks. Bars along the Atlantic Coast, for example, may have premiums up to 20% higher due to risk of hurricane damage.

- The number of employees: The more you've got, the more workers comp you’ll need. Simple as that.

- How much business you generate: Premiums are calculated based on business projections for the upcoming year. If your workload doubles, so will your premium, most likely.

Top 5 Business Insurance Claims

From potential injuries to property damage and lawsuits, business insurance is definitely a must-have. In order to keep all operations running smoothly, you’ll need to consider not only the risks unique to your trade, but also those that apply to all kinds of businesses. Here’s a quick look at the most common business insurance claims across the board:

- Theft/Burglary: Whether they’re after money, merchandise, your company vehicles or anything else, thieves and burglars commonly target businesses. Anything you have that could be stolen is worth protecting—before ever opening your doors to the public.

- Weather-related damage: Windstorms and hailstorms create the type of weather damage most often reported by businesses across the map. Whether it’s shattered windows, broken signage, destroyed products or anything else, Mother Nature can wreak havoc when she gets angry. Plan for disasters before they happen, and secure coverage up front.

- Fire Damage: Another common/costly claim is fire damage. Be it destruction caused by natural wildfires or resulting from employee negligence (such as with a kitchen fire), these disasters can be devastating. Fire damage can result in lost property, inventory, and even revenue, especially if your business is forced to close. Also, fires are obviously a huge hazard for your workers and customers alike. Take as many proactive measures as possible, such as installing sprinkler systems and extinguishers.

- Employee Injury: Even the most well-trained employees on record run the risk of getting injured on the job, regardless of the line of work they’re in. Employees may be injured while carrying out daily tasks, due to the negligence of a coworker, while making service deliveries, or in a myriad of other ways. Protecting your workers with workers’ comp is crucial, not to mention mandatory in most states.

- Customer Injury: Of course, your business’s customers are also at risk of injury while on your property. Slips and falls are some of the most commonly reported business insurance claims, but customers can also be injured due to unsafely stocked shelves, employee negligence, faulty products, and much more.

Top 5 Business Insurance Discounts

Owners of businesses of every size, color, and flavor love scoring discounts however they can. And fortunately, there are some discounts out there to help obtain a significantly lower premium, like:

- The safety discount: Insurance companies love working with clients who put safety first. Put practices in place to keep your employees, equipment, and physical office space as safe as possible, and you're likely to be rewarded by your insurance company. Installing sprinkler systems and burglar alarms are just a couple of examples of easy ways to score this discount.

- The quality discount: Establishing a track record of quality goods, services, and customer interactions will not only keep your business running strong, but also help reduce your insurance costs. Essentially, keeping your clients happy is the key to keeping your insurance company happy, and they just might slash your premium as a thank-you in return.

- The low claims history discount: Along the same lines as maintaining a safe and efficient business, having a low claims record is another way to seriously please your insurance company—and over time they’ll probably reward you for it. Plus, if you ever need to switch insurance policies or companies, having a low or even squeaky-clean claims record will definitely help you land a lower premium.

- The professionalism discount: Sometimes insurance companies send out inspectors to observe your business during a typical day of operation. If your equipment is clean and well-maintained, your employees are following necessary safety protocols, and your customers/clients seem happy, you’ll get a good report. A favorable evaluation could reward you with a reduced premium.

- The bundle discount: Purchasing multiple types of insurance with the same company is a tried and true way to save money—but so is purchasing specialty insurance packages. These packages, made up of multiple policies tailored to a specific kind of business, are designed to save you money, and just generally make life easier. And since they exist, you might as well take advantage.

How to Find the Best Bar Insurance

In order to get the protection you need (and deserve), you’ll want to work with a trusted expert. Independent insurance agents will not only know where to find the best coverage and price, but also help to make sense of the fine print.

Consider your business’s unique needs, then connect with an agent to help you take it from there. Have a list of your specific concerns and desires handy before you reach out, to help the process run even more smoothly.

Compare Bar Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From business insurance packages to special add-on policies, our expert independent insurance agents will help you determine which types of coverage make the most sense for you and your new business.

Our independent insurance agents stay on top of the insurance industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help walk you through the claims process and make sure you are getting the benefits you’re entitled to. Now that’s thinking ahead.

Statista