Iowa Restaurant Insurance

It's coverage for more than just corn.

When you think of Iowa’s must popular foods, you probably think about:

- Pork-based dishes (Iowa produces the most pork in the country, after all)

- Maid-Rite sandwiches

- Burgers

- Corn

- Blue Bunny ice cream (Le Mars is the ice cream capital of the world)

Even though these are the most popular dishes, every restaurant – even those serving the same types of foods – will have different types of restaurant insurance. But no matter what insurance you need, an independent insurance agent will always be there to help you along the way. This includes basic coverage issues and the risks that drive coverage, too.

Use our independent insurance agents to find the best insurance plan in your area. You tell us what you’re looking for, and our technology will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Risks in Restaurant Insurance in Iowa

Insurance coverage will differ due to various factors, including:

- Foods

- Cooking styles

- Buildings

- Equipment in the kitchen

- Personal, movable property, like tables and chairs

- Special property, like the sign

- Staff (or lack thereof)

Your Iowa Restaurant Needs 3 Basic Types of Insurance

You’re going to need three types of insurance for your restaurant, regardless of what you serve, how you prepare it, and a number of other factors. These three types of insurance are:

- Property

- Liability

- Employee

Each has general coverage and more specific policy options depending upon your unique restaurant and needs.

Property Insurance for Your Iowa Restaurant

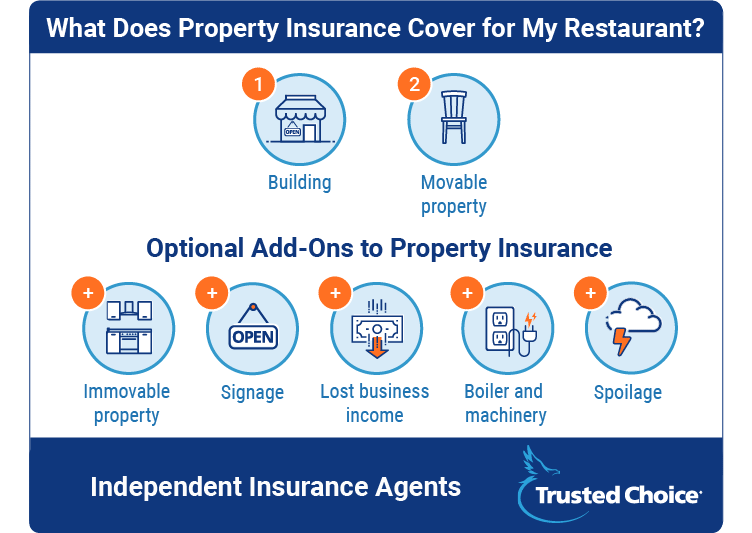

General property insurance coverage will pay for the replacement value of:

- Your building

- Movable property inside the building, like furniture, décor, and other personal possessions

That being said, you’ll have immovable property, too. Think about your kitchen equipment: It’s bolted down to the floor. This isn’t typically covered under a general property policy like your furniture or other personal possessions would be. The best thing you can do to evaluate what additional coverage you’ll need for this immovable property is to talk to your independent insurance agent.

In addition to the building and movable and immovable property inside it, there are other types of specialty property coverage that you should be aware of. The most popular of the specialized policy choices include:

- Your sign (and drive-through sign): Restaurant signs cost tens of thousands of dollars. Some of the most expensive signs can even top $100,000! Drive-through signs aren’t typically as expensive, but can be valuable, too. Neither of these signs is covered under your general property policy, so it’s important to get specialty coverage if yours is worth a lot.

- Lost business income: Kitchen fires, natural disasters, and other issues happen. When you have a covered loss and are shut down, lost business income coverage means you can pay employees and other expenses to keep the restaurant afloat.

- Damage due to equipment (machinery): If your electrical or HVAC system fails, it might cause damage. Machinery coverage means any damage caused by the failure of the machine is covered, although the cost of the machine itself is not.

- Spoilage: Food spoils if a refrigerator or freezer fails. This is particularly problematic in the Midwest, where a lot of restaurants rely on frozen food. If you lose some or all of your food because of a refrigeration issue, this coverage will keep you protected.

Commercial General Liability Insurance for Your Iowa Restaurant

Commercial general liability coverage is good for two types of issues that may arise in your Iowa restaurant:

- An accident that a customer has on the premises of your restaurant

- An illness that a customer suffers because of food you serve

You’ll typically need liability insurance if a customer slips and falls (say on a wet floor). You’ll also need liability insurance if you prepare food incorrectly and it causes illness.

It’s important to note that general liability insurance only covers these two issues. Two types of specialty liability coverage you’ll want to consider are:

- Liquor-related accidents

- Directors and officers liability

Most restaurants serve, brew, or distill alcohol in some way. If yours does, you’ll need a liquor liability policy to cover property damage and bodily injury that may result from an alcohol-related accident. This will apply if you overserve a customer and they get into an accident after leaving the restaurant. Standard liquor liability has a $1 million policy limit, but if you serve a lot of alcohol, you may want to increase coverage.

Directors and officers liability is a much more specialized type of policy. It kicks in if there isn’t an injury or damage, per se, but stockholders, a city, or employees allege that the directors or officers have made a poor corporate decision. This is more applicable if you’re operating an Iowa restaurant on a large scale and are afraid that this kind of issue is going to arise.

Employee Insurance for Your Iowa Restaurant

Employee insurance for your Iowa restaurant is twofold and includes:

- Workers' compensation

- Employment practices liability insurance

Workers' compensation is required by law in Iowa. It will cover expenses if an employee is injured and has to pay:

- Medical bills

- Rehabilitation costs

Workers' compensation will also pay lost wages to employees while they recover. Generally speaking, the cost of workers' compensation coverage will hinge on (1) your payroll (per $100); and (2) the risk classifications for employees in your restaurant. The higher the risk – such as if you serve a lot of deep fried food and employees are around hot oil – the higher the cost of your workers' compensation coverage.

The other type of employee-related insurance that you may choose to get is employment practices liability insurance. This insurance will cover lawsuits brought for workplace problems like:

- Bad behavior

- Sexual harassment

- Discrimination

- Hostile work environment

If you’re ever sued, this coverage will pay for the cost of litigation by defending the restaurant and officers, too.

Certain Features of Your Iowa Restaurant May Affect Insurance Costs

Restaurants in Iowa have a lot of unique features, and few are exactly alike. Here, we're talking about whether a restaurant decides solely to do carry-out and has no wait staff. We’re also talking about situations where a restaurant has a buffet, drive-through window, or any number of other features.

Let’s examine some of the most common features and how (or if) they’ll affect your coverage or costs:

- Carry-out vs. staffed: The difference between these two options is how much workers' compensation you’ll pay. After all, if you have a carry-out restaurant, you’ll require fewer employees.

- Drive-throughs: A drive through doesn’t affect your insurance at all. The only way it possibly could is if you have an expensive sign and want additional property coverage.

- Buffets: Underwriters typically dislike buffets. That's because there's food that sits out and is exposed to the public. This might increase your liability costs and, because a buffet is typically immovable property, you might need more property coverage for that, too.

- Delivery: Delivery vehicles are covered under your liability policy. This means that if drivers use their own vehicles for delivery, you might pay more because there is a risk that the vehicles are in poor condition. You can always purchase vehicles for your delivery drivers to use: this typically reduces the cost of your liability coverage.

Keep in mind that these are just a few of the many factors that may affect your insurance costs. However, as some of the most common features of most restaurants, they’re the ones that are likely to affect your coverage the most.

Why Operating a Restaurant in Iowa Could Change Insurance Coverage Needs

Insurance coverage doesn’t change much from state to state. However, coverage needs and costs do change depending on the:

- Food you serve

- How you cook it

As we mentioned above, Midwest food is typically frozen and flown in. This means it’s important for almost every restaurant to get spoilage coverage in case there is a refrigeration problem. After all, you could lose some or all of your food, and that would cost your restaurant a fortune.

Based on the types of dishes that are the most popular in the Iowa, you may also need to pay additional workers' compensation coverage as well. Deep fried foods mean hot oil in the kitchen, which increases the risks to employees in a big way.

These are just some of the issues that might arise, all of which you’ll want to keep in mind when you’re talking to an independent insurance agent about coverage for your Iowa restaurant.

How Much Is Insurance Coverage Going to Cost in Iowa?

It’s impossible to provide a hard and fast rule about insurance costs. However, we can break down how the costs balance out and a broad range of factors that may affect insurance costs for you.

Generally speaking, insurance coverage for your Iowa restaurant is going to break down into two separate expenses:

- Property and liability

- Workers' compensation

Workers compensation coverage is charged separately because it’s calculated differently. There are two factors that affect cost: (1) Payroll (per $100); and (2) risk classification (how dangerous it is for employees in the kitchen).

Property and liability coverage can cost as little as $1,000 annually or as much as $100,000 or more. It depends on all of the factors we’ve mentioned above. As an example, if you’re operating a corner hotdog stand, are the only employee, and don’t have much risk, you’ll be on the low end.

DID YOU KNOW?

If you’re operating a multi-location restaurant that has significant risk in food preparation, lots of employees, and valuable personal property inside, you’ll pay more.

Speaking of valuable personal property: You’ll need to get it appraised to ensure that you aren’t shorted on its replacement value. This often comes into play with paintings or other décor that may have a higher resale value than what the materials themselves are worth.

Get Your Iowa Restaurant Covered with an Independent Insurance Agent’s Help

Remember, you’ll need general insurance coverage for:

- Property

- Liability

- Employee

That being said, you’ll also need to consider all of the specialty policies and coverage that comes with operating an Iowa restaurant. Your independent insurance agent will evaluate all of your options with a range of carriers to ensure you’re paying the best price, for the best coverage – guaranteed.