Rio Rancho Bonds

If you are a business owner or a contractor in Rio Rancho, New Mexico, you should be familiar with business bonds and how they work. These bonds may be mandated by the state for licensing purposes, required by clients before they will hire you, or purchased by your company to cover against losses related to employee dishonesty.

Whether you are looking to purchase surety bonds or fidelity bonds, a local independent insurance agent can help. These agents can shop around to find the best and most affordable bonds for your Rio Rancho business. Find an insurance agent near you to learn more.

What Are Business Bonds?

There are two types of business bonds that company owners in the Rio Rancho area should be familiar with.

- Surety bonds, which are designed to protect your clients.

- Fidelity bonds, which are designed to protect your business.

You can learn more about each of these types of business bonds by reading below. You can also contact an independent insurance agent in Rio Rancho for answers to any questions you may have.

What Is a Surety Bond?

Surety bonds are required in order for certain businesses to be licensed to operate in New Mexico. Surety bonds can also protect and reimburse your customers in the event that your company fails to meet its contractual obligations. These bonds serve as a guarantee, but do not relieve your business of any financial obligations.

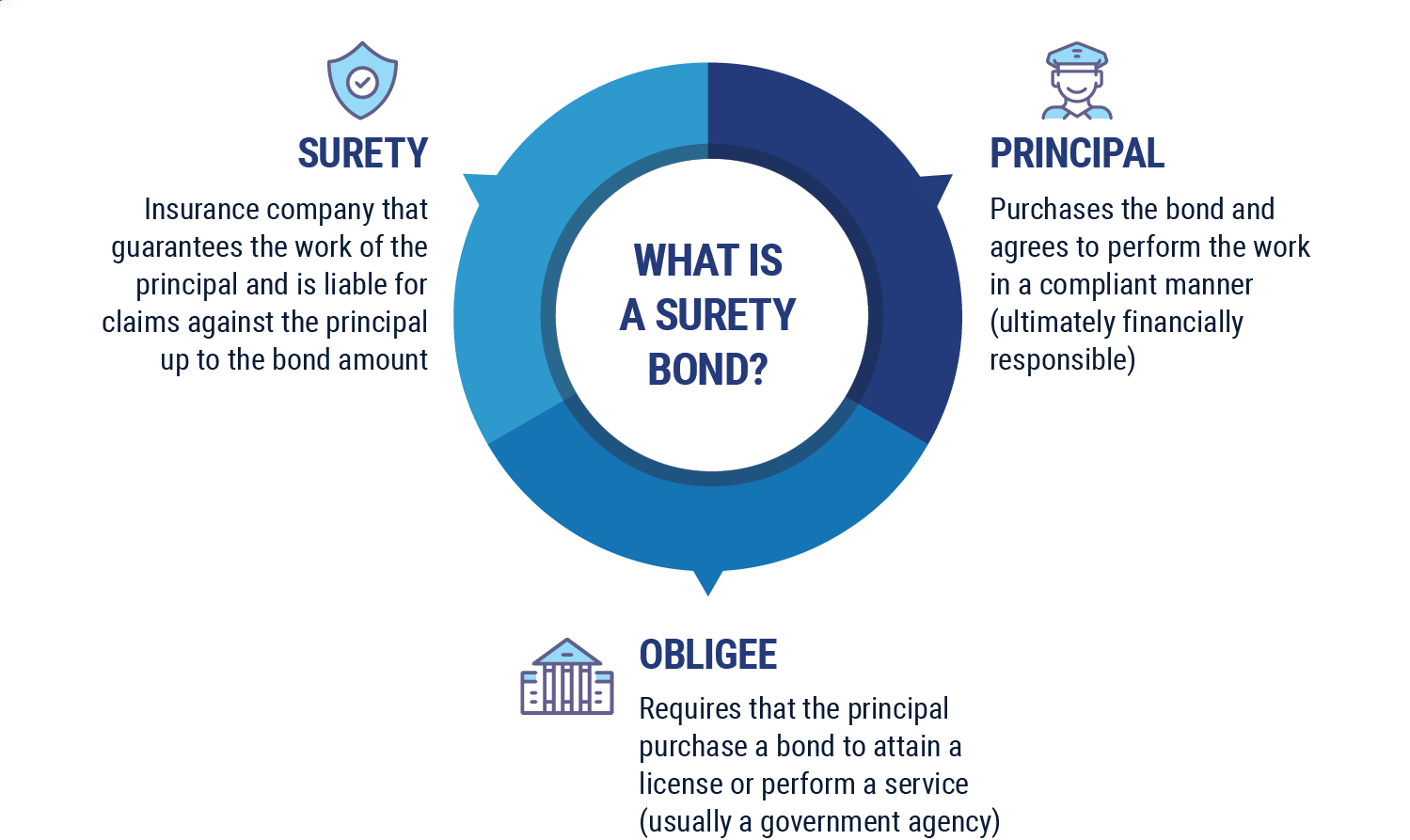

A surety bond can best be described as an agreement between three parties:

- The principal: This would be you, as the bondholder.

- The obligee: This would be your client.

- The surety: This is the company providing the bond.

If the principal doesn't act in accordance with the terms established by the bond, the surety will provide the obligee with financial compensation in an amount appropriate to satisfactorily complete the job. The principal would then be obligated to reimburse the surety for their losses.

Keep in mind that a surety bond company merely guarantees compensatory payment to your clients. It does not relieve your business of any financial responsibilities.

What Kinds of Rio Rancho Businesses Should Purchase Surety Bonds?

The state of New Mexico requires certain kinds of businesses to post surety bonds before they can be licensed to operate in this state. In Rio Rancho, the following must post surety bonds:

- Appraisal management companies

- Construction contractors

- Independent insurance adjusters

- Private investigators and detectives

- Notaries

- Motor vehicle dealerships and dismantlers

Additionally, if you are a contractor (particularly in the construction industry), you may be required by your clients to a post surety bond in the amount of your contractual obligation. That way, if your company fails to complete the job, the surety will provide your client with the funds necessary for another contractor to do the work.

If the surety needs to pay out on your behalf, your business will then be expected to pay this money back to the surety. You can expect the surety to take legal action if necessary to collect it. Do not view surety bonds as an insurance product.

How Much Do Surety Bonds Cost in Rio Rancho?

For a general idea of what a bond might cost, you can expect to pay anywhere from 1% to 15% of the total bond amount. So posting a $50,000 bond can cost anywhere from $500 to $7,500. The actual cost of your surety bond will vary according to factors such as:

- The amount of the bond you are purchasing

- The type of bond you are purchasing

- Your company’s financial standing

- How long your company has been in business

It may be difficult or impossible for a new company in weak financial condition to secure a high-value surety bond, such as for a large construction project. These companies must often work their way up to being able to take on these large contracts.

Learn more and get bond quotes from competing sureties by contacting a local independent insurance agent in Rio Rancho.

What Is a Fidelity Bond?

Sadly, not all employees are honest. Fidelity bonds are designed to protect your business against losses caused by your workers’ dishonest and illegal actions. That is why fidelity bonds are considered a form of crime insurance.

Examples of covered acts include if an employee steals or embezzles from your company or if an employee steals from or defrauds a customer and your company must pay restitution. Employees who have committed crimes in the past will most likely not be eligible to be covered by the bond.

What Kinds of Rio Rancho Businesses Buy Fidelity Bonds?

The kinds of Rio Rancho businesses that may find it beneficial to invest in fidelity bonds include those that:

- Require fidelity bonds in order to acquire a business license

- Operate in the financial sector, such as banks and credit unions

- Have employees who handle large financial transactions

- Have employees who have access to your customers’ personal data

- Have employees who have access to your customers’ assets

In order to be bonded, workers need to pass a background check. When you advertise that your employees are bonded, your customers know that your company has carefully screened and vetted the people they will be dealing with. This can improve your chances of winning contracts.

If you are not sure whether a fidelity bond is right for your business, you can ask an independent insurance agent in Rio Rancho for advice.

How Much Do Fidelity Bonds Cost in Rio Rancho?

The cost to bond your employees with a fidelity bond can vary according to a few factors, including:

- The amount of the bond

- The number of employees you have

- The types of jobs your workers do

- The ways your company reduces the likelihood of employee theft

Talk to an independent insurance agent in Rio Rancho to find out how much it will cost to purchase a fidelity bond for your business.

Why Work with an Independent Insurance Agent in Rio Rancho, NM?

If you need a business bond for your company, you can turn to an independent insurance agent in Rio Rancho for help. These agents can answer your bond-related questions and can assist you with finding suitable surety or fidelity bonds at affordable prices.

Contact an insurance agent near you to start reviewing customized rates for bonds for your Rio Rancho business.