Ohio Restaurant Insurance

Because buckeyes need coverage, too.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’ve dazzled the family with your cooking at gatherings for years. Your coworkers beg you to bring food to the potluck. But it’s time you showed more than just Deb from accounting what you’re made of. You’re going to open a restaurant in Ohio, and that means you’re about to open yourself up to a whole lot of risk. But you don’t have to navigate this road alone! You’ve got an independent insurance agent at the ready who knows the ins and outs of covering your restaurant, no matter what you’re serving up. So whether you know a thing or two about restaurant insurance or you’re here to learn, you’ll have a good idea of what you’re in for.

What Is Restaurant Insurance?

Restaurant insurance is coverage that protects every aspect of your restaurant, from property to risks (to customers and employees alike) and more. Not only are you selling food, but you'll also have customers on the property where there could be wet floors and other dangers. The best thing you can do is get yourself an independent insurance agent to help you work through all of the coverage you need (with none of the guesswork).

Property Coverage for Your Ohio Restaurant

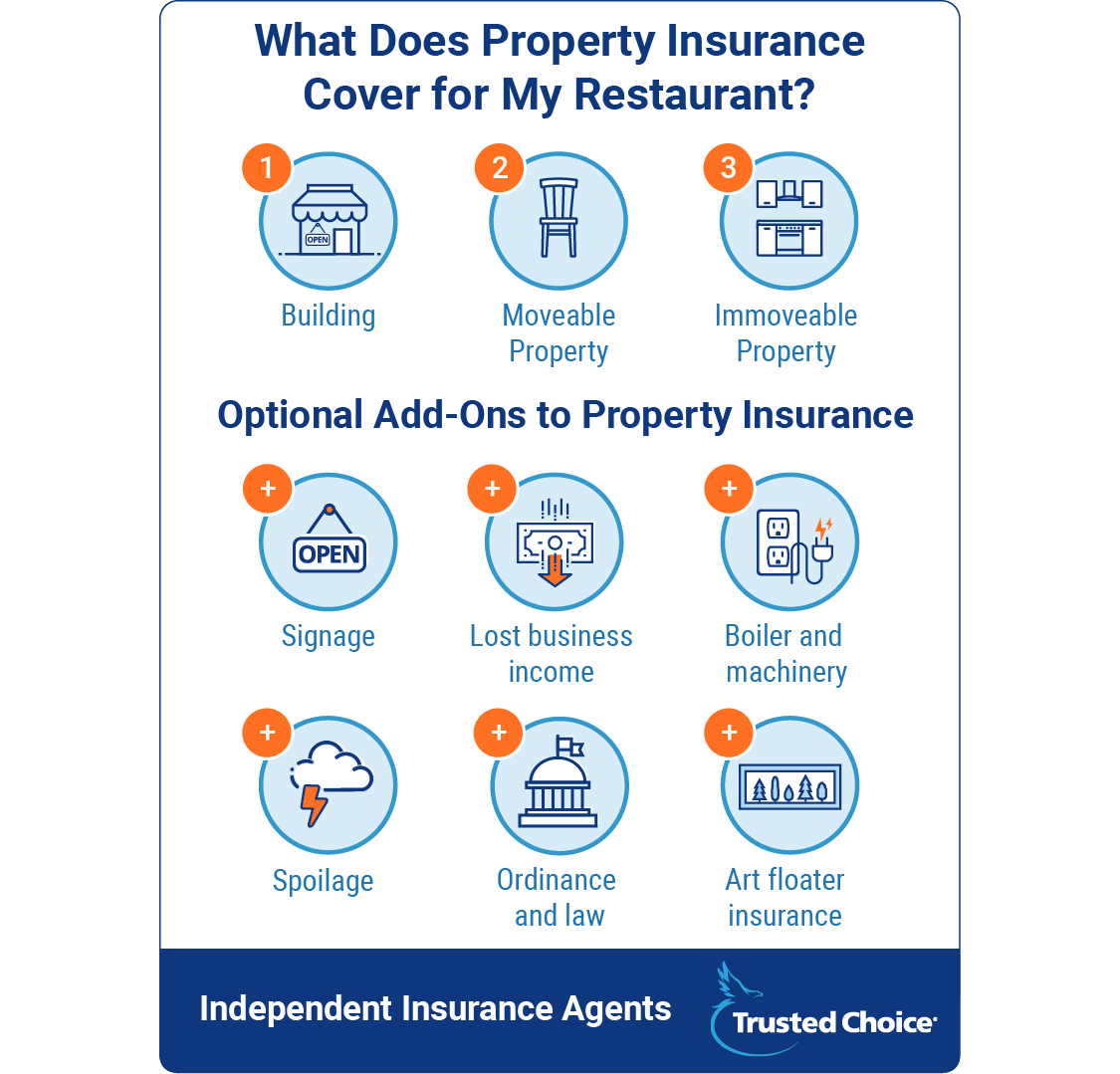

First things first: You have a building. That’s property. And you have stuff in that building, which is also property. But general property insurance doesn’t cover everything inside your building. It covers things you can move, like tables and chairs. You’re a smart cookie, so you probably realize that this means immovable property is treated differently. Immovable means it’s bolted down to the restaurant. This is stuff like your kitchen equipment. It could also be built-in furniture, like a bar or cabinetry. Your independent agent will be able to tell you how much additional coverage you will need for immovable property.

Keep in mind that property coverage costs can fluctuate based on other factors, too. The type of kitchen equipment you have will heavily influence property coverage. The reason is that the more dangerous the equipment, the more likely there could be a kitchen fire or other (potentially devastating) issue. Then, if you sit down and really brainstorm, you’ll realize that you’ve got other property, too. For example, your sign. Signs can cost a lot of money. Like, $100,000 a lot of money. Then, if you have a drive-thru, you've got another sign. Weather, bad/distracted drivers, and vandals could all destroy your sign. And general property insurance isn’t going to pay for either of those signs. But if you buy specialty coverage, it will.

Another thing that you may not think of as property but that is property is your food. Just think about all of the food you keep in your restaurant, especially in a Midwest state like Ohio that is landlocked. If your refrigeration goes on the fritz, all of your food goes to waste. Spoilage coverage pays for the cost of the food you have to throw away. There are lots of other specialty property policies. These might include:

- Lost business income: This pays your expenses and employee salaries if you’re shut down because there was a kitchen fire, tornado, or other disaster.

- Equipment (boiler and machinery) coverage: If your electric panel malfunctions and damages the wiring, this would cover the cost to repair the wiring (but not the panel itself).

- Art floater insurance: If you have pricey paintings or other obscure things worth a lot of money that aren’t obvious to the naked eye, get them appraised. If you don’t, your property insurance isn’t going to hold these things near and dear and pay out for them like you would want them to. However, this specialty policy will keep you covered if you suffer a loss - due to theft or destruction - and need to replace your property.

- Ordinance and law: State codes mandate a lot of what you need to do with your restaurant. Ordinance and law coverage also applies if you need to rebuild your restaurant, or if you're building the restaurant itself from the ground up. Other relevant factors include handicapped-compliant features, fire safety equipment, and emergency exits.

Liability Coverage for Your Ohio Restaurant

Liability means risk. Risk happens as soon as you open your doors to the public. But that’s what insurance is for. Your general liability insurance covers customer-related food illnesses and slips, trips, and falls. This would also cover anything that happens in the parking lot – because it snows in Ohio, after all. This really just covers the basic of the basic, and every restaurant needs it. Another policy most restaurants need is liquor liability. If you sell, distill, or brew alcohol, or basically touch alcohol in any shape or form, you need liquor liability. It pays out if an intoxicated customer gets into an accident. It pays for property damage and bodily injury. And, because these types of accidents are often deadly, the policy limit is something you should discuss with your independent insurance agent.

Note that this coverage is more important for smaller restaurants. Chains have stricter rules in place to limit liability and prevent mishaps. Communicable disease coverage is another type of liability insurance you should consider for your Ohio restaurant. Wrongfully prepared food isn't the only thing that can make customers sick. This coverage protects you if employees transmit any illnesses to customers because of poor hygiene.

One other type of liability coverage to mention on the grander scale of things is directors and officers liability. It kicks in when your company is sued by stockholders (if you’re public), employees, or cities (yes, cities), for what any of those parties view as a poor business decision. Sometimes it’s obvious when you need this coverage, and sometimes it isn’t. And, you guessed it: Your independent agent can help with this, too.

Ohio Dram Shop Laws

The Ohio dram shop laws give first and third parties the right to sue your restaurant because of an alcohol-related accident. Ohio law allows a person injured by an intoxicated individual to seek damages against a restaurant if:

- The injuries occurred on the restaurant's property and were caused by the restaurant's negligence

- The injuries occurred off the restaurant's property and the restaurant knowingly sold alcohol to a noticeably intoxicated person or someone under the age of 21

This is why liquor liability coverage is so important. Whether you sold alcohol to a minor, or sold to someone who was noticeably intoxicated, your restaurant is on the line. These suits can be pricey, too. That's why when it comes to liquor liability coverage, you will want to talk things over in detail with your independent agent.

Workers' Comp Insurance for Your Ohio Restaurant

You need employees to keep your restaurant going. You legally need workers' compensation coverage if you want to open the restaurant in the first place. Workers' compensation is a pretty simple concept. It pays for medical expenses, lost wages, and rehabilitation costs if an employee is hurt at work.

Then there’s the optional employment practices liability insurance. This isn’t insurance coverage for your employees, it’s protection against lawsuits that employees might bring against your restaurant and/or its officers. Even if you’re running a smaller place, the cost of defending against workplace harassment or discrimination lawsuit can add up fast. While you may never need it, you'll sleep better at night knowing you have it.

How Much Does Ohio Restaurant Insurance Cost?

Features are always thought of as a good thing. The more features, the better. And that isn’t to say that restaurant features aren’t a good thing – they are. But some can affect how much insurance coverage you need, and that’s need-to-know info. A drive-thru hardly affects coverage at all. The pavement typically isn't covered in your general property policy, and the sign needs coverage, too. Buffets are similar. Some underwriters hate buffets with a passion and might bump the cost of your policy up for that reason. While it’s not a reason to cut out your buffet, it is a reason to give the side-eye to your underwriter as they walk through your new place.

Other features do affect coverage in obvious ways, like carry-out vs. dine-in. If you have a solely carry-out restaurant, you won’t need the same liability coverage or workers' compensation insurance that a dine-in restaurant does. The reason is obvious: You won’t have customers staying on your property for hours at a time and you won’t need as many employees. Then there’s delivery.

Offering delivery services affects your liability coverage. Plus you have a very important choice to make. Do you purchase vehicles or do you cover your employees’ cars? We’ve all seen the standard delivery car – and it ain’t always a beautiful sight. This can mean you pay more for coverage for an older car with more risk rather than just purchasing your own reliable vehicles. If you're operating a food truck, you'll also need this coverage. The choice is yours, but choose wisely.

That’s All Great. So, What Do I Owe?

You probably came to this article looking for some sort of an idea about how much restaurant insurance in Ohio is going to cost you. We aren’t going to disappoint. Well, not completely anyway. First things first: how you pay your restaurant insurance. There are going to be two costs:

- Workers' compensation

- Property and liability

Workers' compensation is priced separately because it’s priced differently. It’s calculated per $100 of payroll and by risk classification. The more dangerous your restaurant, the more you pay. Tough, but fair, if we do say so ourselves. Then there’s property and liability. This is where things can really take a huge turn when it comes to pricing. On the low end, you could pay just $10,000 annually. But unless you’re looking to start a corner hotdog or taco stand, keep dreaming. This is realistic if you’re going to own minimal to no property and have fewer employees than you can count on one hand.

That being said, some kind of cart or food truck is one of the safest and least expensive types of restaurants you can start. On the extremely high end of things, property and liability can cost upwards of $100,000 annually or more. Before you panic, this is most likely for a multi-location chain restaurant that packs in property, employees and customer risk, and all sorts of other hidden catastrophes. A simple rule of thumb is that the bigger, more complex, and more dangerous the restaurant, the more your annual insurance premium is going to cost.

Your Independent Insurance Agent Knows Ohio Restaurant Insurance

You might know everything about your future Ohio restaurant, but you don’t know insurance like our independent insurance agents know insurance. Independent agents are great because you'll get the coverage you need at the best possible deal. You don't have to do any of the shopping, either. Just sit back, and your agent will make sure that all the "i's" are dotted and the "t's" are crossed.

Step aside and let our agents take the lead to guarantee you get what you need, don’t pay for what you don’t need, and can afford the insurance along with everything else you need to get your restaurant dream off the ground.