Anesthesiologist Insurance

(And how to avoid getting sued)

Becoming an anesthesiologist is quite an accomplishment. Protecting your hard work with a professional liability policy is a wise step. As an anesthesiologist, you may not plan on harming a patient.

However, professional liability insurance, aka medical malpractice insurance, is for accidents. It's for those unplanned, unfortunate events that could happen to any anesthesiologist at any time.

There's no person better to go over the cold hard facts of professional liability insurance than an independent insurance agent. They have the goods when it comes to protecting your business practices and they're not afraid to use 'em.

What Is Professional Liability Insurance?

Professional liability insurance is also known as medical malpractice insurance. This policy will cover a professional, consultant or doctor for claims of alleged negligence or omissions that have resulted in injury or even death while under the professional's care.

For an anesthesiologist, think a patient going down for a deep sleep and not waking up. It's happened and will continue to happen as long as each person is different and their bodies react different ways to different treatment. Medical malpractice claims are a real possibility and one that should be protected with insurance.

Should You or Your Healthcare Facility Pay?

Who foots the bill and is responsible for obtaining the professional liability policy on you depends on where you work. A lot of larger hospitals and healthcare facilities will add you to their group malpractice policy. They may even pay for the premium as part of your perks for being employed with them.

The downside to that is you can't take the policy with you if you leave. That means you may have a gap in coverage for a some time if you aren't proactive about obtaining a new policy beforehand.

This can cause problems with your licensing and future malpractice insurance policies. The best option is usually to get a policy on yourself for yourself because you're the one who's responsible if the worst should happen.

An independent insurance agent is the best resource when it comes to finding really good malpractice insurance at a low premium.

How to Know If Your Professional Liability Coverage Is Enough

You got the degree, you have the job, you're accomplished. Now what about insuring it? Here is an example of what a typical medical malpractice insurance, aka a professional liability policy, may look like:

Medical malpractice insurance limits:

The "per occurrence limit" portion affords you up to, in this scenario, $1,000,000 to cover a claim. The "aggregate limit" is the total amount paid out for the policy term, which is typically one year.

In this case, the aggregate limit is $3,000,000. That means that if you had 3 different claims come up during your 12-month policy term totaling $1,000,000 for each claim, you would have $3,000,000 in claims for that policy term and would have enough coverage.

Knowing if coverage is enough should be discussed with your independent insurance agent. They can go over your specific risk factors and what-ifs and together you can make a good decision.

What Is a Claims-Made Professional Liability Policy?

A claims-made policy will provide professional liability coverage or medical malpractice coverage for a claim as long as you meet the following rules:

- You are insured when the claim is made. But you may be saying, "What happens if I no longer need the policy and a claim is made after the fact?" Great question, and the answer is what's known as a tail policy or coverage. A tail policy will protect you after your claims-made policy is long gone and make sure that if you get sued after the fact, you still have coverage for the past.

- You have continually renewed the policy from the time the incident occurred until the time the claim is made. This means no gaps in coverage for the entire time you were a practicing anesthesiologist.

Let's say you were insured on a claims-made policy from 2016 to 2017 and one of your former patients that was treated in 2016 is suing you in 2019 for a related injury received under your care during 2016.

Since you had coverage the entire time you were practicing without any gaps and purchased a tail policy, you are covered for this claim. Boom, and that's what good coverage can do.

That's also what a knowledegable independent insurance agent can do. Making sure you have the right trusted advisor in your corner is key.

How Likely Are Anesthesiologists to Be Sued?

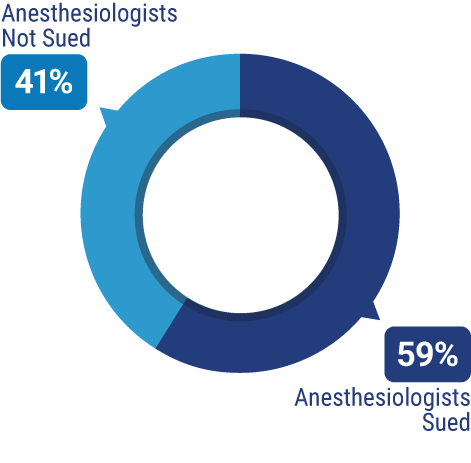

The numbers don't lie, and they aren't that pretty when it comes to medical malpractice lawsuits against anesthesiologists. According to a past study, 59% of anesthesiologists will be sued during their careers.

Fifty-nine percent. That's over half, and that means that you have more than a 50-50 chance of coming into a lawsuit at some point in your lifetime.

Anesthesiologists Sued in the US

Having the proper medical malpractice insurance, aka a professional liability policy, in place is key. And your independent insurance agent can make sure that happens.

Is Your Employer-Provided Professional Liability Insurance Enough?

Well, that is entirely impossible to know without seeing first-hand. However, a little word of advice would be to have your independent insurance agent look over their policy to make sure.

Most of the time, an employer-provided policy is going to protect the employer more than the actual professional or healthcare provider, and this can be a big problem if a claim gets large enough.

What's the Cost of a Professional Liability Policy?

For an anesthesiologist, the cost of a medical malpractice insurance, aka a professional liability policy, is somewhere between premiums for a realtor's professional liability policy and a brain surgeon's professional liability. The risk is somewhere in the middle, and the premiums are based on experience, loss history, and coverage limits.

It's best to check with your independent insurance agent for your specific pricing because everybody's different.

Benefits of an Independent Insurance Agent

The benefits of an independent insurance agent are many. Probably the one that matters most is that they have your back. An agent will scour the market, finding you the best professional liability policy at the best rates. They work for you and they like it.

Making sure you are prepared for anything that comes your way in your profession is just plain good sense, and an independent insurance agent will get you there.

Medscape Malpractice Report 2015. (January 22nd, 2016). https://www.medscape.com/features/slideshow/malpractice-report-2015/anesthesiology#page=5